Resources

About Us

Active Speaker Market Size, Share, Forecast & Trends by Type (Wired and Wireless) Technology (Analog active speakers and Digital Signal Processing (DSP)) Application, and Application - Global Forecast to 2035

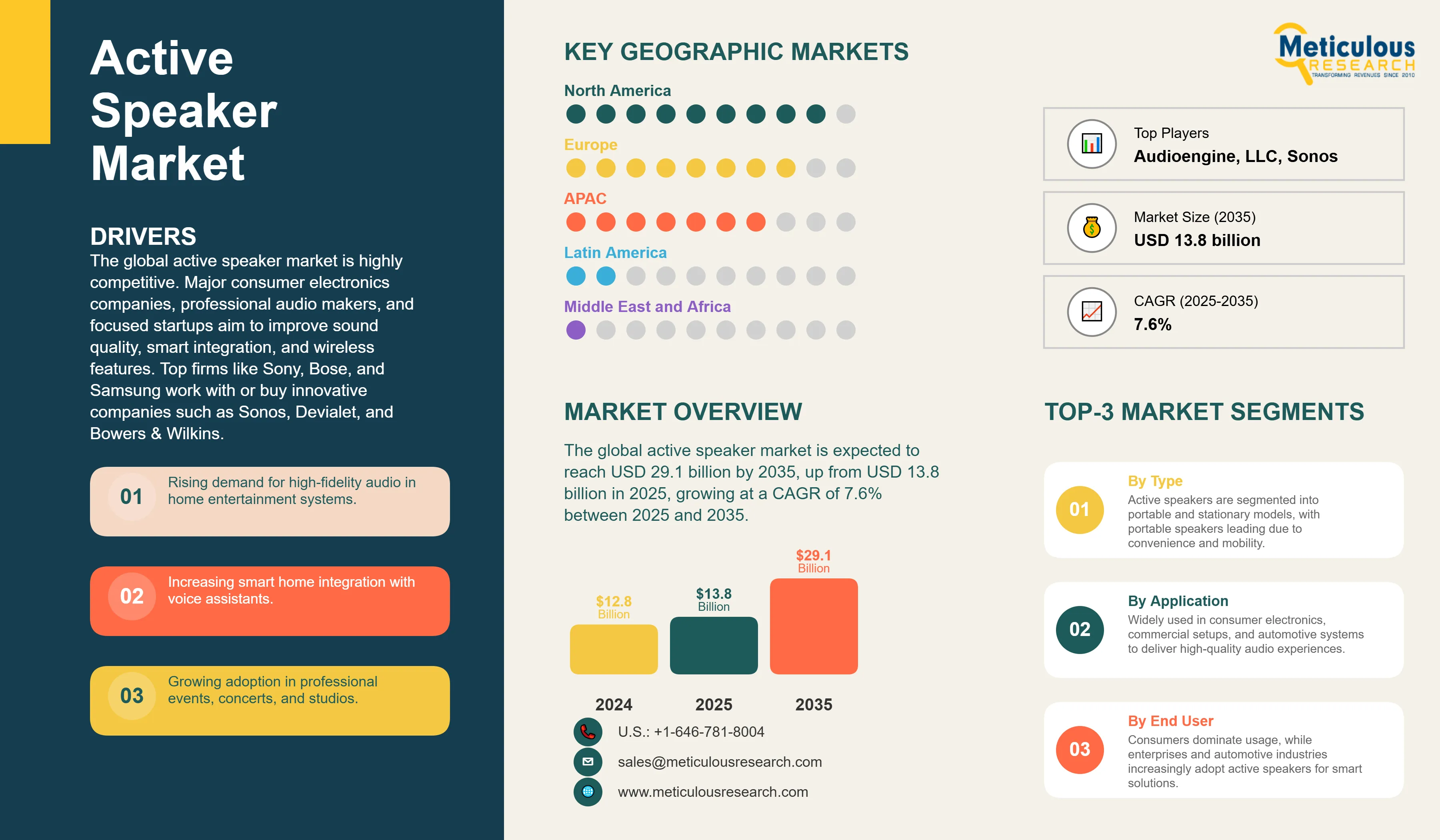

Report ID: MRSE - 1041569 Pages: 189 Aug-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe global active speaker market was valued at USD 12.8 billion in 2024. The market is expected to reach USD 29.1 billion by 2035, up from USD 13.8 billion in 2025, growing at a CAGR of 7.6% between 2025 and 2035.

The growing popularity of wireless and Bluetooth-enabled active speakers is driving the overall active speaker market as consumers seek more convenient and flexible audio solutions.

Competitive Scenario of the Global Active Speaker Market

The global active speaker market is highly competitive. Major consumer electronics companies, professional audio makers, and focused startups aim to improve sound quality, smart integration, and wireless features. Top firms like Sony, Bose, and Samsung work with or buy innovative companies such as Sonos, Devialet, and Bowers & Wilkins. They incorporate new technologies like AI-driven sound optimization, voice control, and seamless connectivity into their products. This blend of established and new players is driving ongoing market growth and innovation in 2025 and beyond.

Click here to: Get Free Sample Pages of this Report

WiiM Debuts the “WiiM Sound” Smart Active Speaker

In June 2025, WiiM presented the first smart speaker the WiiM Sound, designed to appeal to audiophiles with an orientation towards the Apple HomePod. It has power output of 100W with a 4 inch woofer and two dual balanced radiator tweeters, a 1.8 inch touchscreen, and the ability to offer 10-band equalization expounding, with 24 user presets. It features connectivity such as Wi-Fi 6E, Bluetooth 5.3, Ethernet, and supports Chromecast, Spotify Connect, TIDAL Connect, DLNA and Alexa Cast services.

SmartBadge Introduced to Enhance School Safety

In July 2024, FiiO released the SP5- a set of desktop speakers that are inclined to the needs of the audiophiles and audio professionals. There are standouts such as three-band equalized shelf EQ on the rear to acoustically tune rooms (particularly when near walls), separate 120 watts power supply per speaker to minimize cross-channel interference, and four-channel amp to drive a Rohacell woofer (60 watts) and a tweeter (20 watts).

Key Market Drivers

Key Market Restraints

Table: Key Factors Impacting Global Active Speaker Market (2025–2035)

Base CAGR: 7.6%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Rising Demand for Smart & Connected Audio Systems |

Increased sales of Wi-Fi/Bluetooth-enabled active speakers in home entertainment and offices |

Integration with broader IoT ecosystems, becoming core smart-home control hubs |

▲ +2.5% |

|

2. Growth in Professional Event & Studio Applications |

Higher adoption in concerts, conferences, and broadcasting studios |

Advanced AI-driven audio calibration and automation for large-scale events |

▲ +2.2% |

|

|

3. Advancements in Wireless & Streaming Technologies |

Faster adoption due to Wi-Fi 6, Bluetooth 5.3, and multi-room sync features |

Universal compatibility with immersive audio formats and streaming platforms |

▲ +1.9% |

|

|

Restraints |

2. Competition from Passive Speakers & Soundbars |

Some consumers prefer more flexible or cheaper alternatives |

Market share narrows to niche and premium segments |

▼ −1.3% |

|

3. Limited Awareness in Developing Regions |

Slower market penetration in rural and emerging markets |

Increasing brand outreach and localized marketing to expand adoption |

▼ −1.1% |

|

|

Opportunities |

1. Portable Outdoor & Travel-Friendly Active Speakers |

Surge in compact, battery-powered models with weather resistance |

Integration with solar charging and AI-powered outdoor sound optimization |

▲ +2.0% |

|

2. AI-Driven Personalization |

AI-based EQ and room-tuning features gain popularity |

Fully autonomous sound systems that adapt in real-time to user habits |

▲ +1.7% |

|

|

Trends |

1. Immersive & Spatial Audio Integration |

Early adoption of Dolby Atmos/DTS:X-enabled active speakers |

Spatial audio becomes a standard feature in mid- and high-range products |

▲ +1.5% |

|

Challenges |

1. Latency & Sync Issues in Multi-Room Setups |

Affects user experience in high-end wireless systems |

Breakthroughs in low-latency protocols eliminate sync problems |

▼ −1.0% |

Regional Analysis

North America Leads the Global Active Speaker Market

In 2025, North America leads the global smart and active speakers. This growth comes from strong adoption of smart home technologies and high consumer demand for quality audio products. The U.S. accounted for a major share of North America’s market. This is supported by a solid retail and e-commerce network and the presence of major brands like Bose, Sonos, and JBL. Smart home access in North America exceeded 40% of households, with millions of smart speakers actively in use. Products like the Sonos Era 300, which features Dolby Atmos and smart assistant integration, have become very popular. This aligns with the region's preference for quality, high-functionality audio devices. These trends reflect consumer interest in voice-controlled smart systems and multi-room audio experiences in North America.

Asia Pacific Registers Strong Growth Momentum for Active Speakers Market

The fastest growing market in active speaker market is Asia pacific, which is driven by rapid urbanization, growing disposable incomes, and fast growing usage of smart consumer electronics. The growth in demand and increased penetration of middle-income populations who are technology literate fans are contributing to growing demand of both higher end and affordable active speakers in countries like China, Japan, and India. To illustrate, Sony SRS-XV900 has had wide market reception in countries such as Japan and India due to its amazing bass, portability, and wires-free connectivity during home entertainment and out-of-door events.

Country-level Analysis

Innovation and Premium Product Adoption in the U.S. to Drive the Active Speakers Market in the U.S.

The U.S. dominates the active speaker market with high expenditure on home entertainment systems by consumers on the low end and quick uptake of smart home products. The availability of top-level manufacturers like Bose, Sonos, and JBL supports market development, as well as the popularity of streaming service that promotes the use of high-quality sound systems. For instance, the Bose Home Speaker 500 is highly adopted in U.S households due to its high-quality sound, accompanied with its use of Alexa and stylish model.

China’s Growing Consumer Market and Smart Audio Accessibility

China's active speaker market is growing quickly. This growth is fueled by higher incomes, more people moving to cities, and widespread use of e-commerce. Local companies like Xiaomi lead the way with affordable and feature-packed products like the Xiaomi Mi Smart Speaker. This speaker is well-liked for its low price and compatibility with smart home devices. The market enjoys a large group of consumers ready to embrace smart audio technology, thanks to the strong rise in smart home use and digital services.

Germany’s Renowned High-End Audio Engineering

Germany is a key player in the high-end active speaker market, driven by a strong audiophile culture and a rich tradition of precision audio engineering. Consumers prioritize quality and craftsmanship. Premium brands like ELAC receive praise for products like the Navis ARF-51, which is known for its detailed sound tuning, elegant design, and impressive driver technology. This highlights Germany’s continued leadership in advanced audio solutions and high-performance speaker systems.

Segmental Analysis

By Application, Household Segment Dominated the Market with 50-60% in 2025.

The household segment registered the largest revenue share of around 50-60% of the active speaker market. The increasing penetration of smart-home ecosystem and wireless connectivity-related technologies like Wi-Fi and Bluetooth has been enabling active speakers to gain high popularity in residential settings.

The major contributors encompass popularity of voice assisted technology, multi room audio features, and the space-saving sizes that could fit into a living room, a kitchen or a home office. Products such as, Sonos One, JBL Link, and Bose Home Speaker 500 are characteristic of this direction, with built-in amplifiers, streaming, and AI sound enhancement. According to the surveys, more than 60% of active speakers’ users in the developed territories prefer to use it at home because it provides convenience, ease of setup and delivery of better audio performance.

Dominance of Digital Signal Processing (DSP) Technology Driving Active Speaker Market Growth

Based on technology, the Digital Signal Processing (DSP) market segment holds around 50-60% share of the overall market, as it offered better quality of audio, minimized distortion, and ensure accurate sound optimization across various environments. DSP provides real-time processing capabilities with the ability to enhance sound, decrease noise, adjust the equalization, and calibrate the room providing high audio quality in diverse settings. Bose, Yamaha and JBL, and other large-scale manufacturers use DSP to tailor output of the sounded material to the positioning of the speakers and the acoustics of the area, improving usability to residential and business purposes.

The active speaker market is witnessing the emergence of new technologies, most notably AI-driven DSP (Digital Signal Processing) engines that automatically adjust sound characteristics based on the type of content whether it's music, movies, or voice. In parallel, the integration of multichannel audio hardware is enhancing the home theater experience by delivering immersive surround sound. Among premium active speakers, the use of advanced DSP remains a key differentiator, enabling manufacturers to design more compact yet powerful systems without compromising audio quality. For instance, the JBL Professional PRX900 series provides advanced DSP 20 user presets, EQ controls and real time performance monitoring, among others features, thus making it very popular with event organizers and other audio experts in search of that combination of freedom-of-power and clarity.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 13.8 billion |

|

Revenue forecast in 2035 |

USD 29.1 billion |

|

CAGR (2025-2035) |

7.6% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Type (Wired and Wireless), Technology (Analog active speakers and Digital Signal Processing (DSP)), Distribution Channel, Application, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

Sony Group Corporation, Audioengine, LLC, Beijing Edifier Technology Company, Ltd., Creative Technology Ltd., Bose Corporation, Sennheiser electronic GmbH & Co. KG, LOUD Audio, LLC, Pyle Audio, Inc., Yamaha Corporation, VOXX International Corporation, Logitech International S.A., Gibson Brands, Inc., Sonos, Inc., QSC, LLC, and Bosch Security Systems among others |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

Market Segmentation

The active speaker market size is estimated to be USD 13.8 billion in 2025 and grow at a CAGR of 7.6% to reach USD 29.1 billion by 2035.

In 2024, the active speaker market size was estimated at USD 12.8 billion, with projections to reach USD 13.8 billion in 2025.

The leading companies operating in the global active speaker market are Sony Group Corporation, Audioengine, LLC, Beijing Edifier Technology Company, Ltd., Creative Technology Ltd., Bose Corporation, Sennheiser electronic GmbH & Co. KG, LOUD Audio, LLC, Pyle Audio, Inc., Yamaha Corporation, VOXX International Corporation, Logitech International S.A., Gibson Brands, Inc., Sonos, Inc., QSC, LLC, Bosch Security Systems, GP Acoustics Group, Zound Industries AB, Bang & Olufsen A/S, Bowers & Wilkins Group Ltd., Dynaudio A/S, LG Electronics Inc., Samsung Electronics Co., Ltd., Audio-Technica Corporation.

The North America region is projected to grow at the highest CAGR over the forecast period (2025-2035), driven by digital transformation and technological autonomy initiatives.

By Application, in 2025, household account for the largest market share in the active speaker market, with consumer electronics being the leading end-user segment.

Published Date: Sep-2024

Published Date: Jul-2021

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates