Resources

About Us

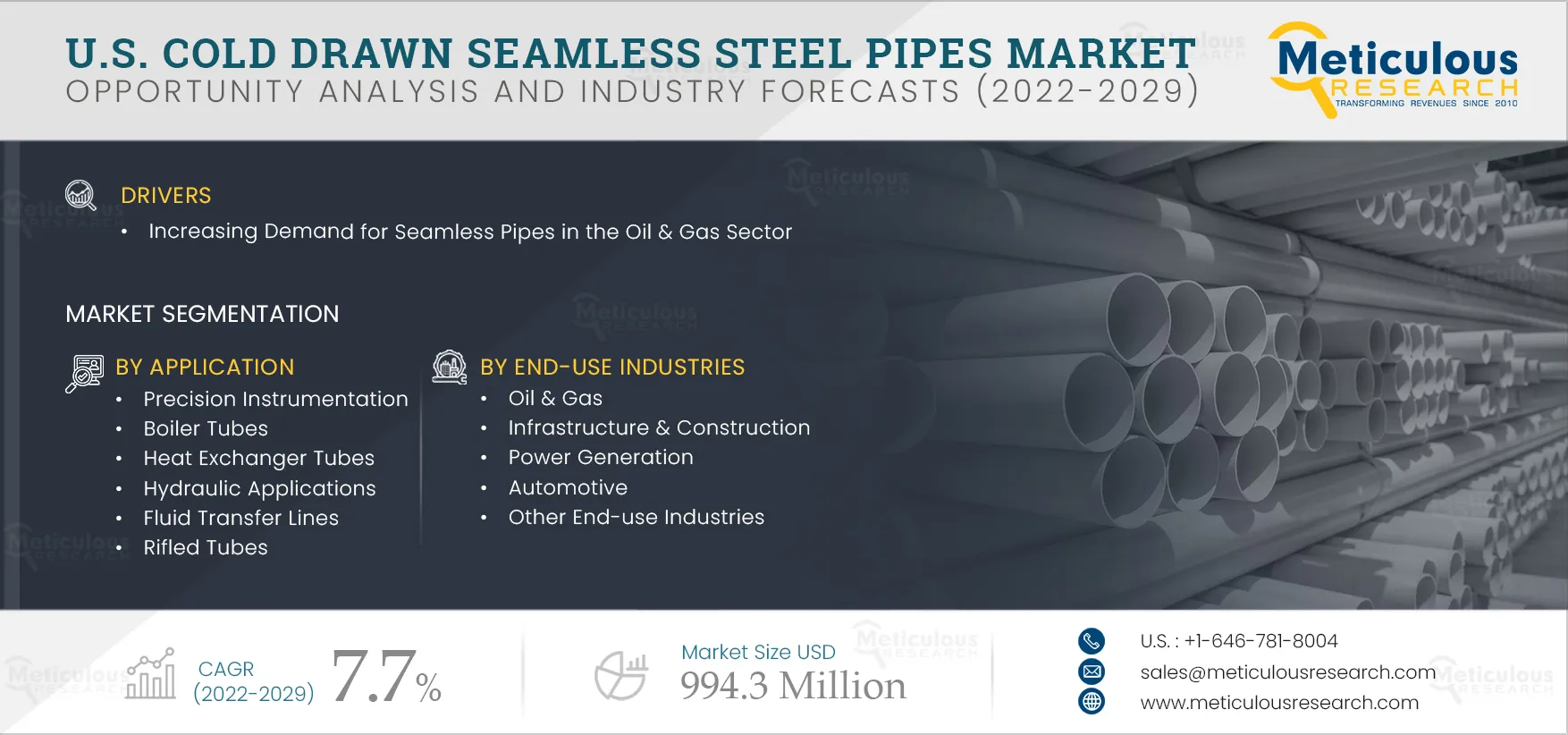

U.S. Cold Drawn Seamless Steel Pipes Market By Standard (ASTM A179, ASTM A106, ASTM A511/A511M, ASTM A213), Product Type (MS Seamless Steel Pipes), Production Process, Application, and End-use Industry - Forecasts to 2029

Report ID: MRCHM - 104583 Pages: 90 May-2022 Formats*: PDF Category: Chemicals and Materials Delivery: 2 to 4 Hours Download Free Sample ReportThe U.S. Cold Drawn Seamless Steel Pipes Market is expected to reach $994.3 million, at a CAGR of 7.7% during the forecast period 2022–2029. The increasing demand for seamless pipes in the oil & gas sector is the key factor driving the growth of the U.S. cold drawn seamless steel pipes market. However, the volatile raw material prices and lower demand in saturated markets are expected to restrain the growth of this market.

Increased offshore spending and new oilfield discoveries are expected to create significant growth opportunities for the players operating in the U.S. cold drawn seamless steel pipes market. Trade protectionism and the introduction of new substitutes pose serious challenges to the growth of this market.

The outbreak of the COVID-19 pandemic severely affected numerous businesses across the globe. Several industries were negatively impacted due to the disruption of supply chains and workforce limitations caused by the nationwide lockdowns. Closure of factories and trade restrictions also added to the existing challenges, severely impacting various industries. Manufacturing plants were shut down, affecting production, which led to a significant demand-supply gap. Infrastructure & construction industries in the U.S. witnessed acute labor shortages, suspension & cancellation of projects, and disrupted supply and logistics.

According to a national survey conducted by the Associated General Contractors of America in October 2020, of 1,077 respondents, 840 (78%) contractors confirmed project delays or disruptions, which reduced the demand for steel pipes in the construction industry. Furthermore, according to the U.S. Energy Information Administration’s (EIA’s) Monthly Energy Review, in 2020, total energy consumption in the U.S. fell to 93 quadrillion British thermal units (quads), a 7% decline from 2019. This decline in electricity demand affected the growth of the power generation industry.

Thus, the COVID-19 pandemic negatively impacted the U.S. cold drawn seamless steel pipes market due to diminished demand from the end-use industries. However, supportive government policies helped the U.S. steel industry recover from the significant economic and production losses. For instance, in March 2022, the U.S. and Japan agreed to expand coordination involving trade remedies and customs matters, monitor bilateral steel & aluminum trade, cooperate on addressing non-market excess capacity & carbon intensity in these sectors, and review their arrangement annually.

Click here to: Get Free Request Sample Copy of this report

Increasing Demand for Seamless Pipes in the Oil & Gas Sector to Drive the Growth of the U.S. Cold Drawn Seamless Steel Pipes Market

The U.S. is one of the leading producers and consumers of oil & gas globally. According to data from the U.S. EIA, as of March 2022, crude oil production in the U.S. stood at 11.7 million barrels/day. As per data from the U.S. EIA (2021), in 2020, the U.S. accounted for 20% of the total oil produced globally, whereas, in 2019, the country accounted for 20% of global oil consumption. The U.S. has moved from a distant third place in crude oil production to becoming the number one producer in less than a decade while also remaining the number one consumer of petroleum. The U.S. is also the leading producer, importer, and exporter of refined petroleum products. In addition, the country’s share in global natural gas production is higher than any other country. The U.S. is also likely to become one of the top three exporters of liquefied natural gas in the future.

The high growth of the oil & gas sector in the U.S. drives the demand for cold drawn seamless steel pipes due to their widening applications, including pumps, barrels, plungers, and bearing races. The International Energy Agency (IEA) estimates that by 2024, the U.S. will surpass Russia and move closer to Saudi Arabia in terms of oil export. The IEA also estimates that under the stated policies, 85% of the increase in global oil production over the next decade will come from the U.S. The growth in the oil & gas sector is expected to boost the demand for seamless steel pipes, driving the cold drawn seamless steel pipes market in the U.S.

ASTM A335 to Dominate the U.S. Cold Drawn Seamless Steel Pipes Market throughout 2029

Based on standard, the market is segmented into ASTM A179, ASTM A106, ASTM A511/A511M, ASTM A213, ASTM A192, ASTM A209, ASTM A210, ASTM A333, ASTM A335, ASTM A53, and other standards. In 2022, the ASTM A335 segment is estimated to account for the largest share of the U.S. cold drawn seamless steel pipes market. The large market share of this segment is attributed to the increasing need for seamless ferritic alloy steel pipes for high-temperature services; its characteristics include higher strength, resistance, elasticity, and hardenability.

MS Seamless Steel Pipes to Dominate the U.S. Cold Drawn Seamless Steel Pipes Market Throughout 2029

Based on product type, the market is segmented into MS seamless steel pipes, hydraulic MS seamless pipes, ERW square & rectangular hollow section pipes, and honed tubes. In 2022, the MS seamless steel pipes segment is estimated to account for the largest share of the U.S. cold drawn seamless steel pipes market. The large market share of this segment is attributed to its increasing use in the construction industry due to its high strength & pressure-bearing capability and growing use in the manufacturing of structural & mechanical parts, including oil drill pipes, automobile transmission shafts, bicycle frames, and steel scaffolding.

Cross-roll Piercing & Pilger Rolling Segment to Dominate the U.S. Cold Drawn Seamless Steel Pipes Market during the Forecast Period

Based on production process, the market is segmented into cross-roll piercing & pilger rolling, multi-stand plug mill, and continuous mandrel rolling. In 2022, the cross-roll piercing & pilger rolling segment is estimated to account for the largest share of the U.S. cold drawn seamless steel pipes market. The large market share of this segment is driven by the simplicity of the process, including multi-stand plug mill and continuous mandrel rolling, and the need to identify the formation of cavity and zone at ductile fracture. Also, the rise in the need for a high-quality surface finish with maximum productivity, and its advantages, including uniform macrostructure and microstructure in the cross-cut section of the forged part, are driving the growth of this segment.

Boiler Tubes Segment Projected to Grow at Highest CAGR During Forecast Period

Based on application, the market is segmented into precision instrumentation, boiler tubes, heat exchanger tubes, hydraulic applications, fluid transfer lines, rifled tubes, bearing pipes, mining applications, automotive applications, and general engineering applications. In 2022, the boiler tubes segment is slated to register the highest CAGR during the forecast period. The high growth of this segment is driven by the growing demand for boiler tubes from end-use industries, including oil & gas and power generation, and the increasing need for boiler tubes in steam boilers, fossil fuel plants, industrial processing plants, and electric power plants.

Oil & Gas Sector to Dominate the U.S. Cold Drawn Seamless Steel Pipes Market During Forecast Period

Based on end-use industry, the market is segmented into oil & gas, infrastructure & construction, power generation, automotive, and other end-use industries. In 2022, the oil & gas sector is estimated to account for the largest share of the U.S. cold drawn seamless steel pipes market. The large market share of this segment is attributed to the increasing government initiatives & investments and the rising need for upstream operations, including onshore & offshore drilling, general plumbing applications, and midstream operations in the oil & gas industry.

Key Players

The major players operating in this market are ArcelorMittal North America Holdings LLC (U.S.), U. S. Steel Tubular Products Inc. (U.S.), Chicago Tube and Iron Company (U.S.), American Piping Products Inc. (U.S.), Bison Stainless Tube, LLC (U.S.), Penn Stainless Products, Inc. (U.S.), Bri-steel Manufacturing (Canada), Michigan Seamless Tube, LLC. (U.S.), U.S. Metals, Inc. (U.S.), and Industrial Tube and Steel Corporation (U.S.).

Scope of the Report:

U.S. Cold Drawn Seamless Steel Pipes Market, by Standard

U.S. Cold Drawn Seamless Steel Pipes Market, by Product Type

U.S. Cold Drawn Seamless Steel Pipes Market, by Production Process

U.S. Cold Drawn Seamless Steel Pipes Market, by Application

U.S. Cold Drawn Seamless Steel Pipes Market, by End-use Industries

Key questions answered in the report:

Published Date: Sep-2024

Published Date: Sep-2024

Published Date: Aug-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates