Resources

About Us

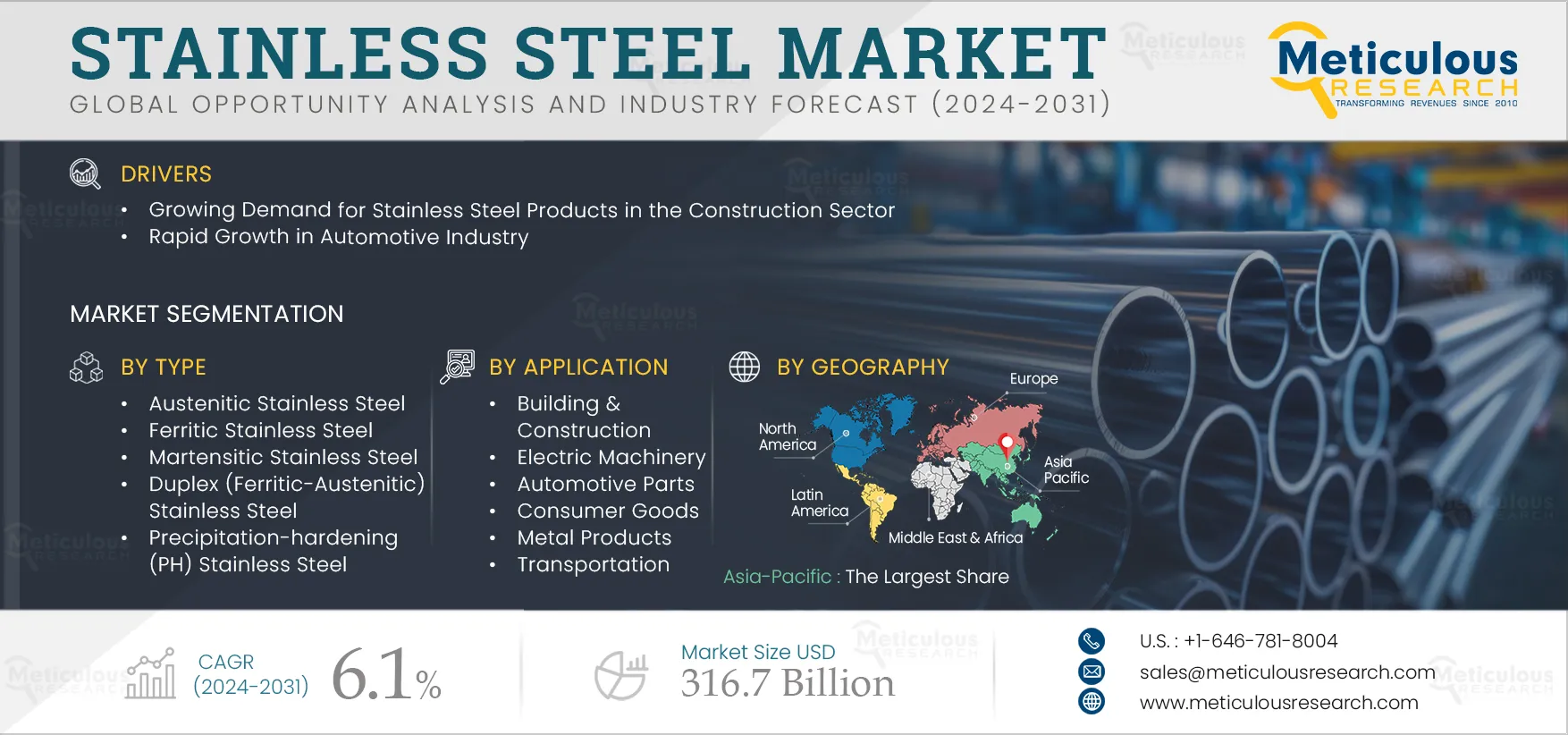

Stainless Steel Market Size, Share, Forecast, & Trends Analysis by Product (Flat, Long), Type (Austenitic Stainless Steels, Ferritic Stainless Steels, Martensitic Stainless Steels) and Applications (Metal Products, Electric Machinery) and Geography—Global Forecast to 2032

Report ID: MRCHM - 1041322 Pages: 250 Sep-2024 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of the stainless steel market is primarily driven by increasing demand for stainless steel products in the building and construction sector, as well as rapid expansion in the automotive industry. Additionally, the rising adoption of stainless steel products in the consumer goods sector and a growing emphasis on sustainability are expected to create further growth opportunities for market players.

The growing demand for stainless steel products in the building and construction sector is driving substantial market growth. Stainless steel is highly sought after for its durability and longevity, making it an ideal material for applications where structural integrity and corrosion resistance are critical. It can endure harsh weather conditions, resist corrosion and abrasion, and ensure that buildings maintain their structural integrity over time. Additionally, stainless steel's modern, sleek appearance is favored by architects and designers for both exterior and interior applications. Its clean lines, reflective surfaces, and versatility in finishes enhance the aesthetic appeal of buildings. As urbanization and infrastructure development continue to expand globally, the demand for stainless steel products in the building and construction sector is anticipated to grow even further, driven by its superior properties, sustainability benefits, design flexibility, and contribution to the durability and visual appeal of contemporary structures.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Stainless steel has high recyclability, with the industry actively encouraging the collection and processing of scrap stainless steel to reduce reliance on virgin materials. This practice minimizes waste generation associated with stainless steel production. Recycling stainless steel is notably more energy-efficient than producing it from raw materials, leading to lower greenhouse gas emissions, conservation of natural resources such as iron ore and chromium, and reduced landfill waste. Additionally, there is a rising trend toward sustainable practices within the stainless steel industry, with manufacturers increasingly incorporating recycling and sustainability principles into their operations.

Additionally, regulatory frameworks and voluntary certifications are fostering sustainable practices in stainless steel production and recycling. Standards like ISO 14001 (Environmental Management Systems) and industry-specific certifications advocate for responsible environmental stewardship and guide manufacturers to adopt sustainable operations. By effectively recycling stainless steel and embracing sustainable practices, stakeholders play a crucial role in environmental conservation, resource efficiency, and long-term sustainability within the materials sector.

Based on product, the stainless steel market is segmented into the flat and long. In 2025, the flat segment is expected to account for a larger share of over 60.0% of this market. Several key factors drive the segment’s significant market share. There is an increasing demand for flat products in mechanical engineering and a growing use of cold-rolled flat products in various industrial applications. The advantages of flat stainless steel products, such as their strength, durability, aesthetic appeal, recyclability, versatility, and longevity, also contribute to the growth of this segment. Moreover, this segment is expected to grow at a higher CAGR during the forecast period.

Based on type, the stainless steel market is segmented into austenitic stainless steels, ferritic stainless steels, martensitic stainless steels, duplex (ferritic-austenitic) stainless steels, and precipitation-hardening stainless steels. In 2025, the austenitic stainless steel segment is expected to account for the largest share of over 46.0% of this market. The segment’s significant market share can be attributed to several factors, such as urban development and infrastructure projects driving demand for austenitic stainless steel in the construction sector.

Additionally, the growing emphasis on sustainability and the increasing use of austenitic stainless steels in automotive exhaust systems, fuel tanks, and structural components are contributing to this growth. Furthermore, the benefits of austenitic stainless steels—including corrosion resistance, hygiene, ease of cleaning, low maintenance, aesthetic appeal, and sustainability are supporting this segment’s growth.

However, the duplex (ferritic-austenitic) stainless steel segment is estimated to record the highest CAGR during the forecast period. The growing demand for duplex stainless steels in renewable energy projects, such as wind turbines and solar power plants, along with the increasing need for these materials in chemical processing plants—encompassing reactors, heat exchangers, and storage tanks—is anticipated to drive the growth of this segment.

Based on application, the stainless steel market is segmented into building & construction, mechanical engineering and heavy industry, electric machinery, automotive parts, consumer goods, metal products, transportation, and other applications. In 2025, the metal products segment is expected to account for the largest share of over 34.3% of this market. The large market share of this segment is attributed to several factors. These include the increasing demand for lightweight and corrosion-resistant materials in automotive manufacturing, a growing emphasis on sustainable materials, and a rising need for customized stainless steel solutions tailored to specific applications and industries. Additionally, the demand is driven by the need for materials with excellent mechanical properties, such as high strength, toughness, and ductility. Moreover, this segment is expected to register the highest CAGR during the forecast period.

Based on geography, the stainless steel market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Asia-Pacific is expected to account for the largest share of over 66.0% of this market. The presence of major stainless steel producers such as Nippon Steel Corporation (Japan), Jindal Stainless Limited (India), JFE Steel Corporation (Japan), Baosteel Co., Ltd. (China), and POSCO (South Korea) is expected to significantly contribute to the high revenue share of this region. In addition, leading industry players are making strategic investments to support market growth. For example, in May 2025, Jindal Stainless Limited (India) announced a comprehensive investment strategy valued at approximately INR 5,400 crores (USD 64.5 million) aimed at achieving global leadership in stainless steel. This strategy includes establishing a joint venture to develop and operate a stainless steel melt shop in Indonesia with an annual production capacity of 1.2 million tons per annum. In addition, the company is investing around INR 1,900 crores (USD 22.7 million) to expand its downstream lines in Jaipur and Odisha to enhance its melting capacity. Furthermore, Jindal Stainless will acquire a 54% equity stake in Chromeni Steels Private Limited, which owns a 0.6 MTPA cold rolling mill in Mundra, Gujarat, through a structured indirect acquisition deal.

Additionally, the rapid expansion of the automotive industry, the increasing demand for stainless steel in the building and construction sectors, and the heightened focus on sustainability are driving the demand for stainless steel in the region. Furthermore, Asia-Pacific is projected to experience the highest compound annual growth rate (CAGR) of 7.5% during the forecast period. This robust growth is attributed to the advancement of regional economies and accelerated infrastructure development, particularly in Japan, South Korea, and India.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the stainless steel market are Acerinox, S.A. (Spain), Aperam S.A. (Luxembourg), Jindal Stainless Limited (India), Nippon Steel Corporation (Japan), Outokumpu (Finland), Acciai Speciali Terni S.p.A. (Italy), JFE Steel Corporation (Japan), POSCO (South Korea), Thyssenkrupp Materials Services GmbH (Germany), Yieh Corp. (Taiwan), Baosteel Co., Ltd. (China), Tsingshan Steel Pipe Co., Ltd. (China), ArcelorMittal S.A. (Luxembourg), Tsingshan Holdings Group (China), and Tata Steel Ltd. (India).

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

6.1% |

|

Market Size (Value) |

$316.7 Billion by 2032 |

|

CAGR (Volume) |

5.8% |

|

Market Size (Volume) |

$117.1 Million Ton by 2032 |

|

Segments Covered |

By Product

By Type

By Application

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, U.K., France, Italy, Spain, Austria, Belgium, Netherlands, Sweden, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Singapore, Australia & New Zealand and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America) and the Middle East & Africa (UAE, Israel, Rest of the Middle East & Africa) |

|

Key Companies Profiled |

Acerinox, S.A. (Spain), Aperam S.A. (Luxembourg), Jindal Stainless Limited. (India), Nippon Steel Corporation (Japan), Outokumpu (Finland), Acciai Speciali Terni S.p.A. (Italy), JFE Steel Corporation (Japan), POSCO (South Korea), Thyssenkrupp Materials Services GmbH (Germany), Yieh Corp. (Taiwan), Baosteel Co., Ltd. (China), Tsingshan Steel Pipe Co., Ltd. (China), ArcelorMittal S.A. (Luxembourg), Tsingshan Holdings Group (China), and Tata Steel Ltd. (India) |

The stainless steel market study focuses on market assessment and opportunity analysis based on the sales of stainless steel products across various countries, regions, and market segments. The study includes a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years

The stainless steel market is expected to reach $316.7 billion by 2032, at a CAGR of 6.1% from 2025 to 2032.

Based on volume, the stainless steel market is projected to reach $117.1 million tons by 2032, at a CAGR of 5.8% during the forecast period from 2025 to 2032.

In 2025, the metal products segment is expected to account for a larger share of over 34.3% of the stainless steel market. This segment's large market share is attributed to the rising demand for lightweight and corrosion-resistant materials in automotive manufacturing, the increasing focus on sustainable materials, the growing demand for customized stainless steel solutions tailored to specific applications and industries, and the rising need for excellent mechanical properties, including high strength, toughness, and ductility.

The growth of the stainless steel market is primarily driven by the growing demand for stainless steel products in the building & construction sector and rapid growth in the automotive industry. Moreover, the rising adoption of stainless steel products in the consumer goods sector and growing emphasis on sustainability are expected to generate growth opportunities for the players operating in this market.

The key players operating in the stainless steel market include Acerinox, S.A. (Spain), Aperam S.A. (Luxembourg), Jindal Stainless Limited (India), Nippon Steel Corporation (Japan), Outokumpu (Finland), Acciai Speciali Terni S.p.A. (Italy), JFE Steel Corporation (Japan), POSCO (South Korea), Thyssenkrupp Materials Services GmbH (Germany), Yieh Corp. (Taiwan), Baosteel Co., Ltd. (China), Tsingshan Steel Pipe Co., Ltd. (China), ArcelorMittal S.A. (Luxembourg), Tsingshan Holdings Group (China), and Tata Steel Ltd. (India).

At present, Asia-Pacific dominates the stainless steel market. Moreover, Japan, China, India, and South Korea are expected to witness strong growth in the demand for stainless steel products in the coming years.

Published Date: Sep-2024

Published Date: Aug-2024

Published Date: Jun-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates