Resources

About Us

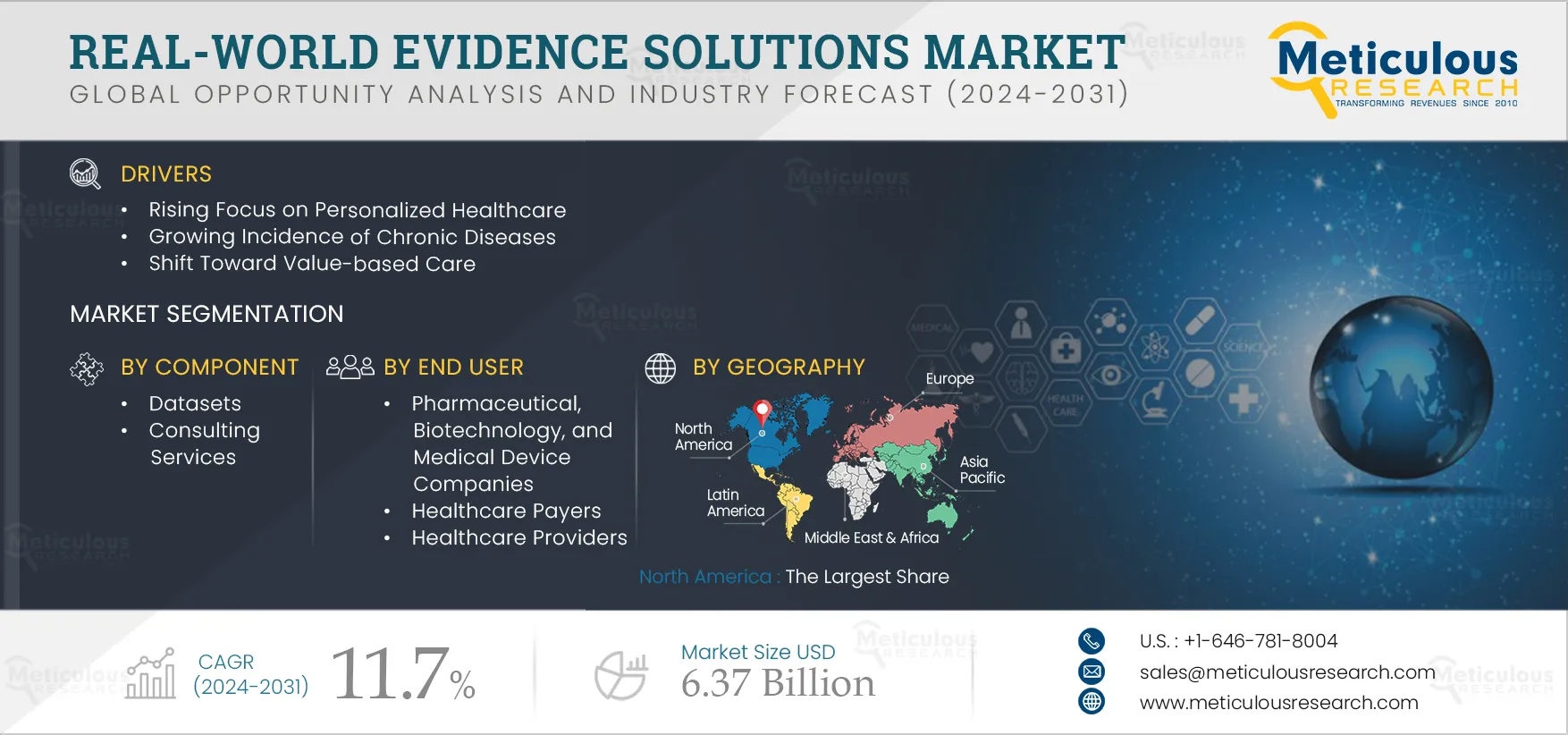

Real-world Evidence (RWE) Solutions Market Size, Share, Forecast, & Trends Analysis by Component (Datasets [Clinical, Claims, Pharmacy], Services) Application (Market Access, Drug Development & Approvals, PMS), and End User - Global Forecast to 2031

Report ID: MRHC - 104253 Pages: 254 Aug-2024 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of the real-world evidence solutions market is driven by the rising incidence of chronic diseases, delays in drug development and the consequent increase in development costs, the rising focus on personalized healthcare, a shift toward value-based care, and the growing adoption of real-world evidence solutions in drug development and commercialization. Furthermore, emerging economies and an increasing focus on end-to-end RWE services are expected to offer significant growth opportunities for players operating in the real-world evidence solutions market.

Personalized medicine is one of the emerging approaches to improve disease treatment and prevention, considering individuals’ variability in genes, environment, and lifestyles. However, this approach can be challenging, as designing an effective treatment plan for a medically complex patient requires a thorough analysis of a large volume of data. Providers may face difficulties due to limited resources, which can hinder their ability to extract and utilize valuable information effectively. The use of real-world evidence accelerates the transition to precision medicine.

It enables researchers to extend beyond the limitations of traditional clinical trials by utilizing real-world data gathered during patients' routine clinical care. This real-world information allows researchers to identify which medications are best suited for individual patients, leading to more personalized therapies and improved outcomes. The increasing approvals for personalized medicines are expected to increase the demand for real-world evidence solutions. According to the Personalized Medicine Coalition (PMC), in the U.S. in 2022, 34% of FDA-approved medicines were classified as personalized medicine, up from 25% in 2019.

Click here to: Get Free Sample Pages of this Report

With the shift towards personalized healthcare and the emergence of rare diseases, healthcare, and research organizations are facing challenges such as high costs and lengthy timelines for delivering medicines to patients as the development of new pharmaceutical entities is time-consuming, extremely costly, and of high-risk with fewer chances of successful outcomes. For instance, it is estimated that the average cost of drug development ranges from USD 43.4 million to USD 4.2 billion (Source: WHO 2022 report). Pharmaceutical companies are also confronting rising clinical trial costs and are seeking ways to reduce these expenses to expedite drug development. Real-world evidence (RWE) solutions offer a promising approach by simplifying access, alleviating burdens, and providing deeper insights into the real-world use of medicines. The growing use of real-world data helps to accelerate drug development, streamline approvals, and lower overall costs.

Enhancements in data management and data integration have improved the speed & quality of drug discovery and clinical trials. Artificial intelligence (AI) is employed in real-world data (RWD) to enhance data anomaly detection, standardization, and quality checking at the pre-processing stage. AI is expected to provide pharmaceutical and biotech companies with the ability to increase meaningful RWE output, decrease the time required to derive valuable insights and maximize the use of available data sources. RWE technology platforms that offer advanced data processing, analysis, and outcomes present an unparalleled opportunity to leverage these computing advancements. When integrated into a comprehensive RWE strategy, AI innovations can enhance drug development, improve patient treatment, access, and drive new business opportunities. AI-driven analytics and automation provide access to crucial insights from historical clinical trial data and real-world evidence (RWE), expanding end-to-end clinical trial capabilities.

Enhancements in data management and integration have improved the speed & quality of drug discovery and clinical trials. Artificial intelligence (AI) enhances real-world data (RWD) by improving anomaly detection, standardization, and quality checking during pre-processing. AI is expected to boost meaningful RWE output, shorten insight generation time, and optimize data use for pharma and biotech companies. RWE platforms with advanced AI-driven data processing and analysis provide a unique opportunity to leverage these technologies. As part of a comprehensive RWE strategy, AI can accelerate drug development, enhance patient treatment, access, and create new business opportunities. AI-integrated analytics also offer critical insights from historical clinical trial data and RWE, expanding clinical trial capabilities.

The healthcare industry has witnessed tremendous change in the last few years, with a shift toward value-based care in developed economies spurred by healthcare organizations’ efforts to reduce costs, improve outcomes, and enhance returns on investment. Various organizations are focusing on population health and driving improved outcomes through value-based care delivery models. Companies must possess strong evidence lifecycle management capabilities to prove and articulate their value propositions. An end-to-end approach to leveraging data, evidence, and knowledge assets of a life sciences organization enables insight-driven decision-making from R&D through commercialization. To leverage the opportunities offered by RWD and RWE, various players are providing end-to-end and late-phase services, such as study planning, protocol development, and clinical study management & reporting. The key players offering end-to-end RWE services are Medstreaming (U.S.), Oracle Corporation (U.S.), SAS Institute Inc. (U.S.), Sciformix Corporation (U.S.), and PAREXEL International Corporation (U.S.).

Based on offering, the global real-world evidence (RWE) solutions market is segmented into datasets and consulting & analytics. In 2024, the datasets segment is expected to account for the largest share of 53% of real-world evidence (RWE) solutions. Real-world data (RWD) are collected from diverse sources related to patient outcomes in real-world settings. This data is often used in retrospective studies to generate real-world evidence (RWE). RWE offers valuable insights into unmet needs, as well as the clinical and economic impacts on patients and healthcare systems. It helps determine outcomes based on larger data samples, reduces costs, and enhances the efficiency of clinical trials. The shift towards personalized medicine, which increasingly relies on extensive datasets to identify patient subgroups and tailor treatments, further drives the demand for larger datasets. This approach is particularly beneficial for diseases like cancer, thus contributing significantly to the growth of this segment.

However, the consulting & analytics segment is estimated to register the highest CAGR of 15.2% during the forecast period. Consulting services encompass observational or prospective studies that involve the primary collection of data from individuals over time as their characteristics evolve. Analytic services include online platforms and software that generate real-world evidence (RWE). As data complexity grows, the demand for consulting and analytics services is rising. Technological advancements, such as wearables, electronic health records, and mobile applications, are driving an increase in data volume. Consequently, there is a growing need for consulting and analytics services to clean, manage, and analyze this data effectively.

Based on application, the global real-world evidence (RWE) solutions market is segmented into drug development & approvals, medical device development & approvals, market access & reimbursement/coverage decisions, post-market surveillance, and clinical & regulatory decision-making. In 2024, the market access & reimbursement/coverage decisions segment is expected to account for the largest share of 53.4% of the real-world evidence (RWE) solutions market. Real-world evidence (RWE) offers payers valuable insights into how treatments perform in everyday settings, aiding their decisions on medication coverage and reimbursement, which drives adoption. Monitoring drug safety and effectiveness is crucial for sustaining market access. RWE solutions assess pharmaceutical products' performance across diverse patient populations, considering real-world factors such as adherence, comorbidities, and concomitant medications, thereby reducing the risk of drug trial failures. Additionally, the FDA utilizes RWE to evaluate and monitor the post-market safety of approved drugs, contributing significantly to the growth of this segment.

Based on end user, the global real-world evidence (RWE) solutions market is segmented into pharmaceutical, biotechnology, and medical device companies, healthcare payers, healthcare providers, and other end users. In 2024, the pharmaceutical, biotechnology, and medical device companies’ segment is expected to account for the largest share of 39.1% of the real-world evidence (RWE) solutions market. This segment’s large market share is attributed to the increasing importance of RWE studies in drug development & approvals and the growing need to avoid drug recalls and assess drug performance in real-world settings. According to the Congressional Budget Office, the average cost of drug development ranges from USD 1 billion to over USD 2 billion, depending on the type of drug. These high costs present significant technical, regulatory, and economic challenges for pharmaceutical R&D pipelines. Consequently, pharmaceutical companies leverage RWE solutions to assess real-world data (RWD) and understand the potential risks and benefits of drugs, thereby optimizing drug design and development.

Based on geography, the global real-world evidence solutions market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, North America is expected to account for the largest share of 48.9% of the real-world evidence (RWE) solutions market. Several factors, including the rising prevalence of chronic diseases, stringent drug approval regulations, the availability of electronic datasets, advancements in the healthcare industry, and the growing volume of big data in healthcare, drive the significant market share in this region. Additionally, supportive government initiatives for deploying RWE solutions further bolster this market share.

In August 2023, the U.S. FDA released a report titled "Considerations for the Use of Real-World Data and Real-World Evidence to Support Regulatory Decision-Making for Drug and Biological Products." This report outlines the FDA's framework for incorporating RWE solutions into regulatory decision-making processes.

However, Asia-Pacific is slated to register the highest growth rate of 11.2% during the forecast period. Countries like Japan and Taiwan have started integrating real-world evidence (RWE) into their healthcare systems through initiatives such as Japan's "Rational Medicine" program. This effort aims to make the Japanese healthcare system more patient-centric and evidence-based, driving market growth in the region. Additionally, supportive government initiatives in these countries are further fueling market expansion.

The report offers a competitive analysis based on an extensive assessment of the product portfolios and geographic presence of leading market players and the key growth strategies adopted by them over the past three to four years. Some of the key players operating in the real-world evidence solutions market are IQVIA Holdings Inc. (U.S.), Elevance Health, Inc. (U.S.), ICON plc (Ireland), Clinigen Group plc (U.K.), Cognizant Technology Solutions Corporation (U.S.), Revvity, Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Thermo Fisher Scientific Inc. (U.S.), Oracle Corporation (U.S.), SAS Institute Inc. (U.S.), Parexel International Corporation (U.S.), and HealthVerity, Inc. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

254 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR |

11.7% |

|

Market Size |

USD 6.37 Billion by 2031 |

|

Segments Covered |

By Component

By Application

By End User

|

|

Countries Covered |

North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, Switzerland, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Taiwan, Singapore, Australia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa |

|

Key Companies |

IQVIA Holdings Inc. (U.S.), Elevance Health, Inc. (U.S.), ICON plc (Ireland), Clinigen Group plc (U.K.), Cognizant Technology Solutions Corporation (U.S.), Revvity, Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Thermo Fisher Scientific Inc. (U.S.), Oracle Corporation (U.S.), SAS Institute Inc. (U.S.), Parexel International Corporation (U.S.), and HealthVerity, Inc. (U.S.) |

The global real-world evidence solutions market is expected to reach $6.37 Billion by 2031, at a CAGR of 11.7% from 2024 to 2031.

The real-world evidence solutions market study focuses on market assessment and opportunity analysis through the sales of real-world evidence solutions across different regions and countries across different market segments. This study is also focused on competitive analysis for RWE solutions based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

In 2024, the datasets segment is projected to hold the largest share of the global real-world evidence (RWE) solutions market. The increasing demand for insights into epidemiology, compliance, adherence, and costs within real-world settings drives this significant market share. Additionally, the growing volume of medical data generated by hospitals, the rising reliance of outcome-based studies on real-world data (RWD), and the heightened demand for drug safety information among healthcare payers, regulatory bodies, and providers contribute to this segment's dominance.

The growth of the real-world evidence solutions market is driven by the growing incidence of chronic diseases, delays in drug development and the consequent increase in development costs, the rising focus on personalized healthcare, a shift toward value-based care, and the growing adoption of real-world evidence solutions in drug development and commercialization. Furthermore, emerging economies and a rising focus on end-to-end RWE services are expected to offer significant growth opportunities for players operating in the real-world evidence solutions market.

The key players operating in the real-world evidence solutions market are global IQVIA Holdings Inc. (U.S.), Elevance Health, Inc. (U.S.), ICON plc (Ireland), Clinigen Group plc (U.K.), Cognizant Technology Solutions Corporation (U.S.), Revvity, Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Thermo Fisher Scientific Inc. (U.S.), Oracle Corporation (U.S.), SAS Institute Inc. (U.S.), Parexel International Corporation (U.S.), and HealthVerity, Inc. (U.S.).

Asia-Pacific is projected to register the highest CAGR of 11.2% during the forecast period. Countries like Japan and Taiwan have begun incorporating real-world evidence into their healthcare systems owing to the “Rational Medicine” initiative, which is driving market growth in the region. The initiative aims to make the Japanese healthcare system more patient-centric and evidence-based.

Published Date: May-2025

Published Date: Jan-2025

Published Date: Jun-2024

Published Date: Dec-2022

Published Date: Oct-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates