Resources

About Us

ESG Data Management Platforms Market by Offering (Hardware, Software, Services), Application (Environmental, Social, Governance, Supply Chain), Deployment Mode (Cloud, On-Premises, Hybrid), End-User Industry & Geography – Global Forecast 2025-2032

Report ID: MRICT - 1041482 Pages: 235 May-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThis comprehensive market research report analyzes the dynamic ESG data management platforms market, evaluating how providers are addressing evolving regulatory requirements, technological advancements, and growing corporate sustainability commitments across various industries and regions. The report provides a strategic analysis of market dynamics, growth projections till 2032, and competitive positioning across global and regional/country-level markets.

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

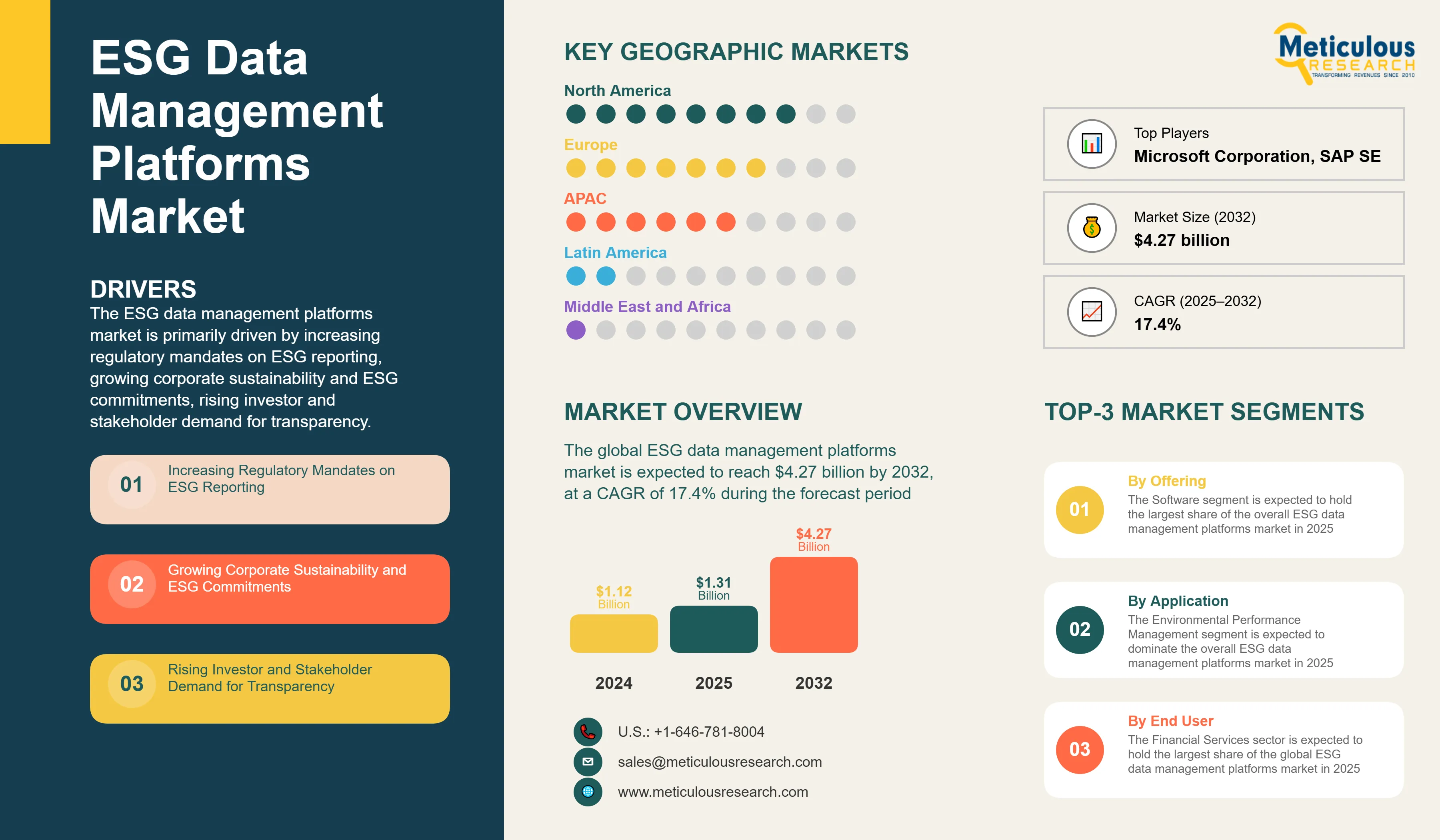

The ESG data management platforms market is primarily driven by increasing regulatory mandates on ESG reporting, growing corporate sustainability and ESG commitments, rising investor and stakeholder demand for transparency, and advances in data analytics, AI, and cloud technologies. Cloud-based ESG data management platforms are reshaping the industry, while real-time ESG data monitoring and reporting is gaining significant traction. Additionally, increasing focus on Scope 3 emissions and supply chain ESG data, growing importance of ESG data assurance and verification, and integration of AI and machine learning for ESG insights are further driving market growth, especially in North America and Europe.

Key Challenges

Despite significant growth potential, the overall ESG data management platforms market faces challenges including data privacy and security concerns, complexity in integrating diverse data sources, and lack of standardized ESG metrics and reporting frameworks. Additionally, ensuring data quality and consistency, managing large volumes of unstructured ESG data, aligning ESG data across multiple reporting standards, and navigating regional regulatory variations present significant barriers, potentially slowing down market adoption in different regions across the globe.

Growth Opportunities

The ESG data management platforms market offers several high-growth opportunities. Adoption of AI and machine learning for advanced ESG insights is driving innovation across various segments. Another major opportunity lies in expansion in emerging markets as sustainability regulations continue to develop globally. Additionally, integration of ESG data with financial and operational systems is creating new revenue streams for platform providers. Mobile ESG data collection solutions and blockchain for ESG data verification further expand the growth landscape for both established software companies and innovative startups.

Market Segmentation Highlights

By Offering

The Software segment is expected to hold the largest share of the overall ESG data management platforms market in 2025, due to the critical role of specialized applications in collecting, analyzing, and reporting ESG data. ESG Data Collection and Integration Software leads this segment, as organizations prioritize solutions that can aggregate data from diverse sources. The Services segment follows closely, particularly in ESG Consulting and Advisory Services where expertise is needed to navigate complex reporting frameworks. However, the Hardware segment, especially IoT Devices for Real-Time Data Capture, is expected to grow at the fastest CAGR during the forecast period, driven by increasing demand for automated and continuous environmental monitoring.

By Application

The Environmental Performance Management segment is expected to dominate the overall ESG data management platforms market in 2025, primarily due to the pressing need for carbon accounting and emissions reduction tracking as organizations work toward net-zero commitments. This application area benefits from more mature measurement methodologies and regulatory focus. The Governance and Compliance Management segment follows closely, leveraging increased board-level focus on ESG oversight. However, the Supply Chain ESG Data Management segment is expected to grow at the fastest CAGR through 2032, driven by mounting pressure for organizations to understand and report on Scope 3 emissions and supplier sustainability practices.

By Deployment Mode

The Cloud-Based segment is expected to hold the largest share of the overall ESG data management platforms market in 2025, as organizations increasingly prioritize scalability, accessibility, and integration capabilities for their ESG data solutions. The Hybrid deployment model follows, offering flexibility for organizations with specific data sovereignty or security requirements. However, the On-Premises segment remains important for highly regulated industries with strict data governance policies, though growing at a slower rate than cloud alternatives.

By Organization Size

The Large Enterprises segment is expected to hold the largest share of the overall ESG data management platforms market in 2025, primarily due to greater regulatory pressure, more complex reporting requirements, and larger budgets for comprehensive solutions. However, the Small and Medium Enterprises (SMEs) segment is expected to grow at the fastest rate during the forecast period, driven by increasing supply chain requirements from larger partners, more accessible SaaS offerings, and growing recognition of ESG as a competitive differentiator.

By End-User Industry

The Financial Services sector is expected to hold the largest share of the global ESG data management platforms market in 2025, driven by stringent regulatory requirements, investment screening needs, and leadership in sustainable finance initiatives. Energy and Utilities follows closely, particularly focused on environmental monitoring and emissions reduction tracking. However, the Manufacturing sector is expected to experience the fastest growth rate during the forecast period, driven by increasing focus on sustainable production, circular economy initiatives, and supply chain transparency requirements.

By Geography

The North America region is expected to hold the largest share of the global ESG data management platforms market in 2025, driven by stringent regulatory environments, advanced technology adoption, and corporate leadership in sustainability initiatives. Europe follows as the second-largest market, bolstered by the EU's comprehensive sustainability regulatory framework, particularly CSRD and SFDR requirements. However, the Asia-Pacific region is witnessing the fastest growth rate during the forecast period, primarily driven by rapidly evolving sustainability regulations in China, Japan, and India, increasing foreign investor pressure, and growing corporate sustainability commitments among regional market leaders.

Competitive Landscape

The global ESG data management platforms market features a diverse competitive landscape with established enterprise software providers, specialized ESG solution providers, sustainability consulting firms expanding into technology, and innovative startups pursuing varied approaches to ESG data collection, analysis, and reporting.

The broader provider landscape is categorized into industry leaders, market differentiators, and emerging players, with each group employing distinctive strategies to maintain competitive advantage. Leading providers are focusing on comprehensive platform capabilities while specialized players deliver deep expertise in specific ESG domains or industry verticals.

The key players operating in the global ESG data management platforms market are Microsoft Corporation, SAP SE, International Business Machines Corporation (IBM), Salesforce, Inc., Workiva Inc., Enablon (a Wolters Kluwer business), Sphera Solutions, Inc., Diligent Corporation, Persefoni, Inc., FigBytes Inc., Sweep (Sweep SAS), EcoVadis SAS, Novata, Inc., Siemens, Schneider Electric, UL 360, Emex, Greenstone, Isometrix, and Position Green among others

|

Particulars |

Details |

|

Number of Pages |

235 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

17.4% |

|

Market Size (Value) in 2025 |

USD 1.31 billion |

|

Market Size (Value) in 2032 |

USD 4.27 billion |

|

Segments Covered |

|

|

Countries Covered |

North America (United States of America, Canada, Mexico), Europe (Germany, United Kingdom, France, Nordics, Rest of Europe), Asia-Pacific (China, India, Japan, Australia, Rest of Asia-Pacific), Latin America (Brazil, Rest of Latin America), Middle East & Africa (United Arab Emirates, Kingdom of Saudi Arabia, Rest of Middle East & Africa) |

|

Key Companies |

Microsoft Corporation, SAP SE, International Business Machines Corporation (IBM), Salesforce, Inc., Workiva Inc., Enablon (a Wolters Kluwer business), Sphera Solutions, Inc., Diligent Corporation, Persefoni, Inc., FigBytes Inc., Sweep (Sweep SAS), EcoVadis SAS, Novata, Inc., Siemens, Schneider Electric, UL 360, Emex, Greenstone, Isometrix, Position Green |

The global ESG data management platforms market was valued at $1.12 billion in 2024. This market is expected to reach $4.27 billion by 2032 from an estimated $1.31 billion in 2025, at a CAGR of 17.4% during the forecast period of 2025–2032.

The global ESG data management platforms market is expected to grow at a CAGR of 17.4% during the forecast period of 2025–2032.

The global ESG data management platforms market is expected to reach $4.27 billion by 2032 from an estimated $1.31 billion in 2025, at a CAGR of 17.4% during the forecast period of 2025–2032.

The key companies operating in this market include Microsoft Corporation, SAP SE, International Business Machines Corporation (IBM), Salesforce, Inc., Workiva Inc., Enablon (a Wolters Kluwer business), Sphera Solutions, Inc., Diligent Corporation, Persefoni, Inc., FigBytes Inc., Sweep (Sweep SAS), EcoVadis SAS, Novata, Inc., Siemens, Schneider Electric, UL 360, Emex, Greenstone, Isometrix, and Position Green.

Major trends shaping the market include cloud-based ESG data management platforms, real-time ESG data monitoring and reporting, increasing focus on Scope 3 emissions and supply chain ESG data, growing importance of ESG data assurance and verification, and integration of AI and machine learning for ESG insights.

• In 2025, the Software segment is expected to dominate the overall ESG data management platforms market by offering

• Based on application, the Environmental Performance Management segment is expected to hold the largest share of the overall ESG data management platforms market in 2025

• Based on deployment mode, the Cloud-Based segment is expected to hold the largest share of the global ESG data management platforms market in 2025

• Based on organization size, Large Enterprises are expected to hold the largest share of the market in 2025

• Based on end-user industry, Financial Services is expected to hold the largest share of the market in 2025

North America is expected to hold the largest share of the global ESG data management platforms market in 2025, driven by stringent regulatory environments, advanced technology adoption, and corporate leadership in sustainability initiatives. However, Asia-Pacific is witnessing the fastest growth during the forecast period.

The growth of this market is driven by increasing regulatory mandates on ESG reporting, growing corporate sustainability and ESG commitments, rising investor and stakeholder demand for transparency, and advances in data analytics, AI, and cloud technologies.

Published Date: Aug-2025

Published Date: Jan-2025

Published Date: Oct-2024

Published Date: Jul-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates