Resources

About Us

Data Mining Tools Market Size, Share, Forecast & Trends Size - By Component, Deployment (Cloud, On-Premise), By Organization Size (Large Enterprises, Small & Medium Enterprises), By End-user Vertical (BFSI, Healthcare, Retail, IT & Telecom) - Global Forecast to 2035

Report ID: MRICT - 1041556 Pages: 220 Aug-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportData Mining Tools Market Expands Rapidly Driven by AI Integration, Cloud Adoption, and Growing Demand for Predictive Analytics

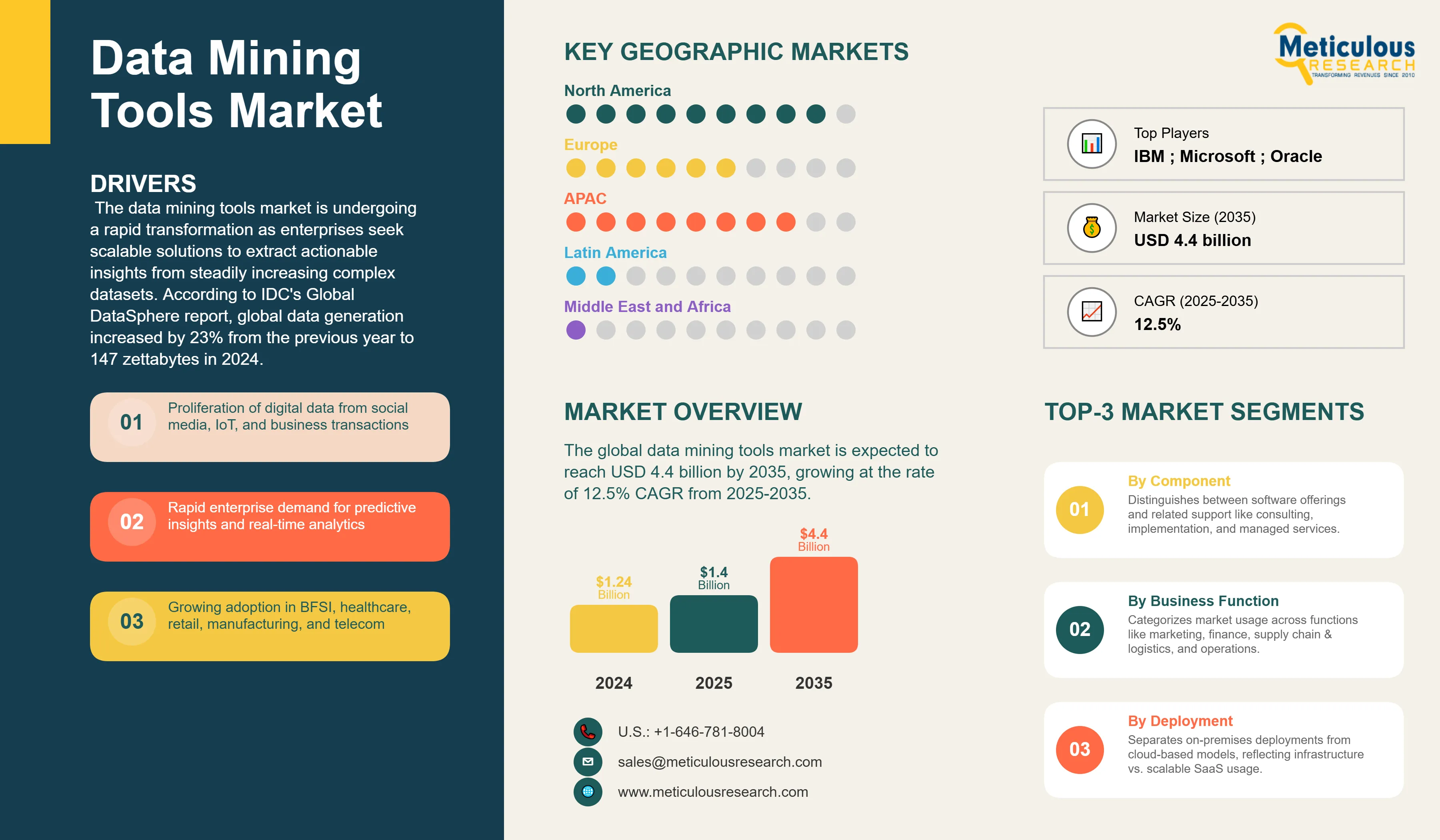

The global data mining tools market size was estimated to be USD 1.4 billion in 2025 and is expected to reach USD 4.4 billion by 2035, growing at the rate of 12.5% CAGR from 2025-2035.

The data mining tools market is undergoing a rapid transformation as enterprises seek scalable solutions to extract actionable insights from steadily increasing complex datasets. According to IDC's Global DataSphere report, global data generation increased by 23% from the previous year to 147 zettabytes in 2024. This growth was fueled by IoT, cloud computing, and digital transactions. Advanced data mining platforms are being implemented by organizations to automate the process of pattern recognition, anomaly detection, and predictive modeling for both structured and unstructured data. The demand for integrated mining tools that facilitate real-time analytics and model training has been further exacerbated by the emergence of generative AI and large language models. Enterprises are also prioritizing tools that include governance, explainability, and compliance features to comply with the changing data privacy regulations. Mining tools are transitioning from niche analytics utilities to core infrastructure components in digital transformation strategies as data becomes a strategic asset.

Click here to: Get Free Sample Pages of this Report

The competitive landscape is distinguished by cloud-native platforms, including Microsoft Azure Machine Learning and Google Cloud's Vertex AI, as well as established players like IBM, SAS, RapidMiner, and KNIME. In 2024, IBM enhanced its Watson Studio capabilities to facilitate the automated deployment of models and data preparation across hybrid environments. New connectors for Snowflake and Databricks were introduced by KNIME, which facilitates the seamless integration of enterprise data lakes. Low-code interfaces, real-time analytics, and support for open-source frameworks such as Python and R are the methods by which vendors are distinguishing themselves. Product roadmaps and market positioning are being influenced by strategic partnerships with cloud providers and AI startups.

Recent Developments

IBM Watson Studio Enhances Automation in Data Preparation, Feature Engineering, and Model Selection for Low-Code, Scalable Analytics

IBM released updates to Watson Studio in Q1 2024 that automate data wrangling, feature engineering, and model selection. IBM's internal benchmarks indicate that the improvements decrease manual preprocessing time by as much as 40%. The platform now facilitates hybrid cloud deployment, allowing enterprises to execute mining workflows in both on-premise and cloud environments. These updates are indicative of the increasing demand for low-code, scalable analytics solutions.

KNIME Advances Enterprise Integration with Native Connectors for Snowflake and Databricks, Adding Python Support and Improved Visualization

In 2024, KNIME enhanced its integration capabilities by introducing native connectors for Snowflake and Databricks, which enable users to construct mining workflows directly on cloud data warehouses. The update enhances the performance of large-scale analytics and facilitates real-time data access. Additionally, KNIME implemented Python scripting support and improved visualization tools to cater to data scientists and business analysts in the finance, retail, and healthcare sectors.

Key Market Drivers

Key Market Restraints

Base CAGR: XX%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Surging Global Data Creation Fuels Demand for Scalable and Automated Data Mining Platforms |

Rapid scaling needs for data handling |

Ubiquitous automated data mining |

▲ + 9.5% |

|

2. Artificial Intelligence Transforms Data Mining into Predictive Intelligence with Real-Time Analytics Capabilities |

Increased adoption of predictive tools |

Seamless predictive intelligence integration |

▲ + 8.7% |

|

|

3. Cloud Infrastructure Accelerates Mining Tool Deployment, Enabling Real-Time Analytics and Collaboration |

Wider cloud-based deployments |

Global real-time analytics collaboration |

▲ + 7.9% |

|

|

Restraints |

1. High Technical Skill Requirements Limit Adoption of Data Mining Tools by Non-Technical Business Users |

Training gaps slow tool adoption |

Broader user-friendly tools |

▼ −3.0% |

|

2. Poor Data Quality Impairs Mining Outcomes, Necessitating Investment in Data Cleaning and Validation |

Investment in data cleansing |

Standardized data quality management |

▼ −2.5% |

|

|

Opportunities |

1. AI and machine learning integration for advanced pattern detection and automation |

Early AI automation pilots |

Full AI-driven automation |

▲ + 8.2% |

|

2. Expansion in emerging markets via cloud and mobile-first deployments |

Cloud expansion in emerging regions |

Mature cloud/mobile market penetration |

▲ + 7.5% |

|

|

Trends |

1. Cloud-native and edge data mining solutions for on-demand, real-time analytics |

Growth of cloud and edge analytics |

Pervasive cloud-edge hybrid solutions |

▲ + 6.8% |

|

2. Automated analytics, low-code/no-code mining platforms |

Rise of citizen data scientists |

Mainstream low-code/no-code adoption |

▲ +6.3% |

|

|

Challenges |

1. Scalability and performance issues with petabyte-scale datasets |

Performance bottlenecks at scale |

Optimized petabyte-scale processing |

▼ −3.5% |

|

2. Integration with legacy IT and multi-cloud architecture |

Legacy system integration delays |

Unified multi-cloud environments |

▼ −2.8% |

North America Leads in AI-Driven Cloud Analytics Adoption, Powered by Enterprise Digitization and Industry-Specific Innovations

Enterprise digitization, cloud infrastructure, and AI integration continue to propel North America as the largest market for data mining tools, accounting for USD 580 million in 2025. In 2024, Flexera reported that over 68% of U.S. enterprises utilized cloud-based analytics platforms. IBM, Microsoft, and Google are among the prominent vendors in the region, providing integrated mining solutions for a variety of industries. Financial services, healthcare, and retail are among the industries that are among the most advanced in their utilization of mining tools for the purposes of customer segmentation, fraud detection, and patient analytics.

Asia-Pacific’s Rapid Growth in Data Mining Tools Driven by Mobile Data Expansion and Government Digital Transformation Initiatives

The Asia-Pacific region is becoming a high-growth market for data mining tools, expanding at 14.2% CAGR, driven by government-led AI initiatives, mobile penetration, and digital transformation. Ericsson's Mobility Report indicates that mobile data traffic in the region increased by 35% in 2024. In order to enhance financial forecasting, optimize logistics, and analyze consumer behavior, enterprises in China, India, and Southeast Asia are implementing mining platforms. A national AI infrastructure plan was initiated by the Ministry of Industry and Information Technology of China in 2024 to encourage the adoption of mining tools by enterprises. Localized solutions are being provided by regional vendors, which include native language support and mobile-first interfaces.

U.S. Dominates Global Data Mining Innovation with AI Integration, Enterprise-Scale Deployments, and Strategic Government Investments

The United States is the global leader in the adoption and innovation of data mining tools, and was valued at USD 505 million in 2025. According to Deloitte, in 2024, more than 70% of Fortune 500 companies employed AI-enhanced mining platforms for strategic decision-making. In order to satisfy compliance and performance requirements, enterprises are allocating resources to GPU acceleration, hybrid cloud deployments, and explainable AI. The Department of Energy has initiated a USD 100 million initiative to utilize data mining for energy optimization and climate modeling. The U.S. market is characterized by a skilled workforce, a robust vendor presence, and regulatory clarity.

China Accelerates Data Mining Adoption with National AI Infrastructure Programs and Digitally Governed Enterprise Solutions

China is expanding the adoption of data mining at a rapid pace, and is set to grow at 15.2% CAGR, by leveraging government-backed AI infrastructure and enterprise digitization. The Ministry of Industry and Information Technology initiated a USD 1.5 billion program in 2024 to provide assistance to AI and analytics platforms in the manufacturing, healthcare, and logistics sectors. Leading technology companies, including Alibaba and Baidu, are incorporating mining tools into their cloud services and retail platforms. The demand for real-time analytics and predictive modeling is being driven by the country's emphasis on digital governance and smart cities. Local vendors are creating Mandarin-language platforms that accommodate domestic data standards.

Germany Emphasizes Industrial Analytics, Sustainability, and GDPR Compliance in Mining Tool Deployments Across Sectors

Germany is expected to hold 19% market share in Europe region in 2024. The country is implementing data mining tools with an emphasis on sustainability, compliance, and industrial automation. Siemens and Bosch increased their utilization of mining platforms in 2024 to enhance manufacturing workflows and decrease energy consumption. AI projects that employ mining tools for climate modelling and vocational training analytics were funded by the German Federal Ministry of Education and Research. Enterprises continue to prioritize GDPR compliance by implementing platforms that facilitate data governance and auditability.

Predictive Analytics Drives Enterprise Operational Optimization, Risk Assessment, and Forecasting with Measurable ROI Gains

The data mining tools market is dominated by predictive analytics, growing at 11.8% CAGR, which is employed in a variety of industries for operational optimization, risk assessment, and forecasting. According to a report published by MIT Sloan in 2024, over 65% of enterprises implemented predictive models for fraud detection, inventory planning, and sales forecasting. Regression, classification, and time-series analysis are all supported by mining platforms, which facilitates real-time decision-making. The segment is expanding as a result of its integration with business intelligence tools and measurable ROI.

Text Mining Accelerates Unstructured Data Analysis for Sentiment Insights, Customer Service, and Compliance Across Industries such as BFSI

The BFSI industry accounted for 28% market share in 2025, leading the global market. The necessity to analyze unstructured data from emails, social media, and customer feedback has resulted in the rapid expansion of text mining as a market segment. According to Harvard Business Review, in 2024, over 58% of enterprises implemented text mining tools to enhance sentiment analysis and customer service. Natural language processing, entity recognition, and topic modeling are now supported by platforms, which facilitate the acquisition of more profound insights from qualitative data. The segment is experiencing growth in the retail, healthcare, and legal sectors, where document analysis is essential.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 1.4 billion |

|

Revenue forecast in 2035 |

USD 4.4 billion |

|

CAGR (2025-2035) |

12.5% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Component, Deployment (Cloud, On-Premise), By Organization Size (Large Enterprises, Small & Medium Enterprises), By End-user Vertical (BFSI, Healthcare, Retail, IT & Telecom), Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

IBM Corporation; Microsoft Corporation; Oracle Corporation; SAS Institute, Inc.; SAP SE; Intel Corporation; Altair Engineering Inc.; KNIME; Teradata; The MathWorks, Inc.; Alteryx, Inc.; RapidMiner, Inc.; H2O.ai; Minitab LLC; Dataiku; Splunk Inc.; BlueGranite Inc.; Sisense; Qlik; Orange (AI/data mining platform); Weka |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

The Data Mining Tools Market size is estimated to be USD 1.4 billion in 2025 and grow at a CAGR of 12.5% to reach USD 4.4 billion by 2035.

In 2024, the Data Mining Tools Market size was estimated at USD 1.2 billion, with projections to reach USD 1.4 billion in 2025.

IBM Corporation, Microsoft Corporation, Oracle Corporation, SAS Institute, Inc., SAP SE, Intel Corporation, Altair Engineering Inc., KNIME, Teradata, The MathWorks, Inc., Alteryx, Inc., RapidMiner, Inc., H2O.ai, and Minitab LLC among others are the major companies operating in the Data Mining Tools Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

The BFSI industry accounted for 28% market share in 2025, leading the global market.

Published Date: Jan-2025

Published Date: Oct-2024

Published Date: Jul-2024

Published Date: May-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates