Resources

About Us

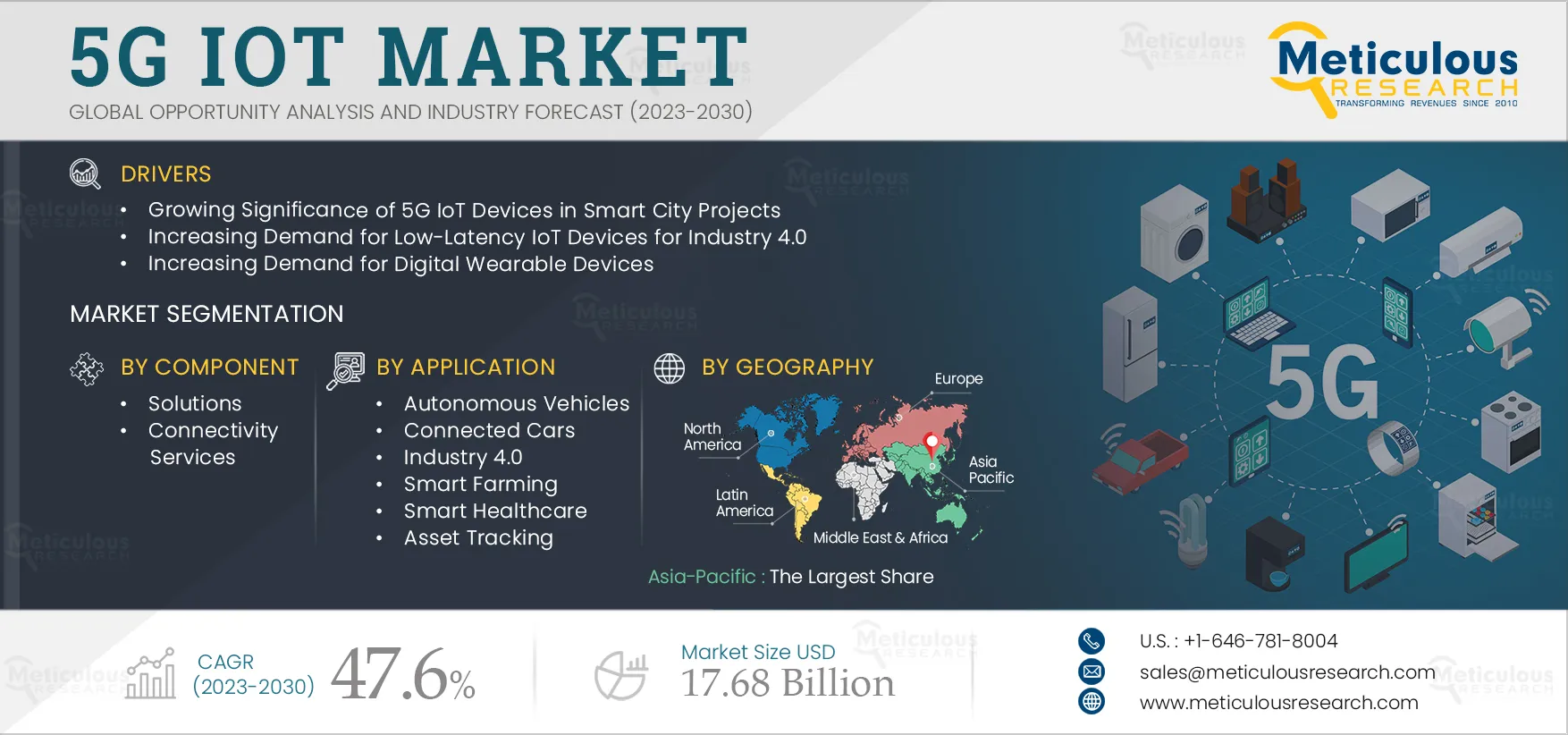

5G IoT Market by Component (Solutions, Connectivity Services), Architecture (5G NR Standalone, 5G NR Non-standalone), Application (Autonomous Vehicles, Security & Surveillance), End User, & Geography - Global Forecast to 2030

Report ID: MRICT - 104752 Pages: 324 Jan-2023 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe 5G IoT Market is projected to reach $17.68 billion by 2030, at a CAGR of 47.6% from 2023 to 2030. The growth of the 5G IoT market is attributed to the growing significance of IoT devices in smart city projects, increasing demand for low-latency IoT devices for Industrial 4.0 applications, and increasing demand for digital wearable devices. However, the global availability of the 5G network may restrain the market’s growth.

Moreover, the use of 5G IoT in self-driving vehicles and the high potential for 5G IoT in connected healthcare offer significant opportunities for the growth of the global 5G IoT market. However, high costs for 5G IoT network installation and security & data privacy concerns may hinder the market's growth.

Industry 4.0, also known as the “Fourth Industrial Revolution,” focuses on transforming the industrial management system and business process using advanced technologies, including AI, IoT, edge computing, 5G, and robotics. IoT technologies offer smart manufacturing machinery, AI-powered automation, and advanced analytics to improve production and quality and reduce downtime in the manufacturing industry. More than 70 billion connected devices are expected to be functioning worldwide by 2025, many of them in use in industrial applications. However, IoT devices rely on cellular networks that can create high latency due to vast data transfer, which slows the processing rate. Manufacturers are incorporating low-latency IoT devices with 5G technology to resolve this issue. These smart connected devices help increase product functionality, generate additional value for customers, and provide manufacturers with data needed to better manage complex production cycles. Several manufacturing industries are adopting advanced technologies, including IoT technology, to enhance product quality and equipment reliability. Some of the developments in the market using IoT technologies are as follows:

In 2021, ABB (Switzerland) launched a new GoFa CRB 15000, a higher payload cobot, to support the growing demand for a collaborative robot capable of handling heavier payloads.

Such developments, along with increasing demand for high bandwidth, higher throughput speeds, low latency, and low-cost wireless networks, are driving the market growth.

Click here to: Get Free Sample Copy of this report

Based on component, the global 5G IoT market is segmented into solutions and connectivity services. In 2022, the solutions segment accounted for the larger share of 84.7% of the global 5G IoT market. The large market share of this segment is mainly attributed to the increasing demand for cloud-based solutions, the proliferation of wireless technologies in industry operations, and the increasing demand to enhance network capacity and coverage area.

Based on application, the global 5G IoT market is segmented into autonomous vehicles, connected cars, industry 4.0, smart energy & utilities, smart farming, security & surveillance, smart healthcare, asset tracking, smart logistics & supply chains, smart consumer electronics, and other applications. The autonomous vehicles segment registered the highest CAGR of 75.1% during the forecast period. The growth of this segment is attributed to the rising government initiatives and investments in self-driving vehicles, the adoption of advanced automotive solutions, and the need for a reduction in traffic congestion.

Based on end user, the global 5G IoT market is segmented into B2B end users (business-to-business) and B2C end users (business-to-consumer). In 2022, the B2B end users segment accounted for the larger share of 70.7% of the global 5G IoT market. The large market share of this segment is mainly attributed to the to the increasing demand for connected services, real-time machine monitoring, enhanced automation for improved productivity and quality, and the need for predicting performance to improve efficiency.

Based on geography, the market is broadly segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2022, Asia-Pacific accounted for the largest share of 46.7% of the global 5G IoT market. The large market share of this segment is attributed to the increasing investments in 5G IoT devices, rising deployments of 5G IoT solutions, and increasing collaborations for deploying smart solutions across the region. Also, this region is expected to register the highest CAGR during the forecast period.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by major market players in the last three to four years. The key players profiled in the global 5G IoT market study are Telefonaktiebolaget LM Ericsson (Sweden), Nokia Corporation (Finland), Qualcomm Incorporated (U.S.), AT&T Inc. (U.S.), Vodafone Limited (U.K.), SK Telecom Co., Ltd. (South Korea), Samsung Electronics Co., Ltd. (South Korea), NEC Corporation (Japan), Telit (U.K.), Cisco Systems, Inc. (U.S.), Intel Corporation (U.S.), ZTE Corporation (China), IBM Corporation (U.S.), Thales Group (France), Sierra Wireless, Inc. (Canada), T‑Mobile US, Inc. (U.S.), Verizon Communications Inc. (U.S.), Juniper Networks Inc. (U.S.), and Huawei Technologies Co., Ltd. (China).

Key Growth Strategies

Partnerships, collaborations, and agreements were the most preferred growth strategies adopted by leading market players, accounting for a share of 52.2%. Telefonaktiebolaget LM Ericsson (Sweden), Nokia Corporation (Finland), Qualcomm Incorporated (U.S.), AT&T Inc. (U.S.), Vodafone Limited (U.K.), SK Telecom Co., Ltd. (South Korea), Samsung Electronics Co., Ltd. (South Korea), NEC Corporation (Japan), Telit (U.K.), Cisco Systems, Inc. (U.S.), Intel Corporation (U.S.), ZTE Corporation (China), IBM Corporation (U.S.), Thales Group (France), Sierra Wireless, Inc. (Canada), Verizon Communications Inc. (U.S.), Juniper Networks Inc. (U.S.), and Huawei Technologies Co., Ltd. (China) were some of the leading companies that adopted these strategies.

Product launches & enhancements accounted for a 38.3% share of the total strategic developments from key players between 2019–2022. The leading players that actively launched products and enhanced their existing ones were Telefonaktiebolaget LM Ericsson (Sweden), Nokia Corporation (Finland), Qualcomm Incorporated (U.S.), AT&T Inc. (U.S.), Vodafone Limited (U.K.), SK Telecom Co., Ltd. (South Korea), Telit (U.K.), Cisco Systems, Inc. (U.S.), Intel Corporation (U.S.), ZTE Corporation (China), IBM Corporation (U.S.), Thales Group (France), Sierra Wireless, Inc. (Canada), T‑Mobile US, Inc. (U.S.), Verizon Communications Inc. (U.S.), and Huawei Technologies Co., Ltd. (China).

Expansions accounted for a 7.8% share of the total strategic developments from key players between 2019–2022. The leading players focused on expansions were AT&T Inc. (U.S.), Vodafone Limited (U.K.), Samsung Electronics Co., Ltd. (South Korea), Thales Group (France), T‑Mobile US, Inc. (U.S.), Verizon Communications Inc. (U.S.), and Huawei Technologies Co., Ltd. (China).

Mergers & acquisitions accounted for a 1.7% share of the total strategic developments from key players between 2019–2022. The leading players focused on mergers & acquisitions were Samsung Electronics Co., Ltd. (South Korea) and IBM Corporation (U.S.).

Report Summary:

|

Particular |

Details |

|

Number of Pages |

325 |

|

Format |

|

|

Forecast Period |

2023-2030 |

|

Base Year |

2022 |

|

CAGR |

47.6% |

|

Estimated Market Size (Value) |

$17.68 billion by 2030 |

|

Segments Covered |

By Component

By Device Range

By Architecture

By Application

By End User

By Geography

|

Key questions answered in the report:

The global 5G IoT market is projected to reach $17.68 billion by 2030, at a CAGR of 47.6% during the forecast period.

The growth of this market is attributed to the growing significance of 5G IoT devices in smart city projects, increasing demand for low-latency IoT devices for Industrial 4.0, and increasing demand for digital wearable devices. In addition, the use of 5G IoT in self-driving vehicles and the high potential for 5G IoT in connected healthcare are expected to offer prominent opportunities for the growth of the market.

The key players operating in the global 5G IoT market are Telefonaktiebolaget LM Ericsson (Sweden), Nokia Corporation (Finland), Qualcomm Incorporated (U.S.), AT&T Inc. (U.S.), Vodafone Limited (U.K.), SK Telecom Co., Ltd. (South Korea), Samsung Electronics Co., Ltd. (South Korea), NEC Corporation (Japan), Telit (U.K.), Cisco Systems, Inc. (U.S.), Intel Corporation (U.S.), ZTE Corporation (China), IBM Corporation (U.S.), Thales Group (France), Sierra Wireless, Inc. (Canada), T?Mobile US, Inc. (U.S.), Verizon Communications Inc. (U.S.), Juniper Networks Inc. (U.S.), and Huawei Technologies Co., Ltd. (China).

Asia-Pacific dominates the global 5G IoT market and is expected to grow at the highest CAGR over the coming years.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jul-2024

Published Date: Jul-2024

Published Date: Aug-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates