Resources

About Us

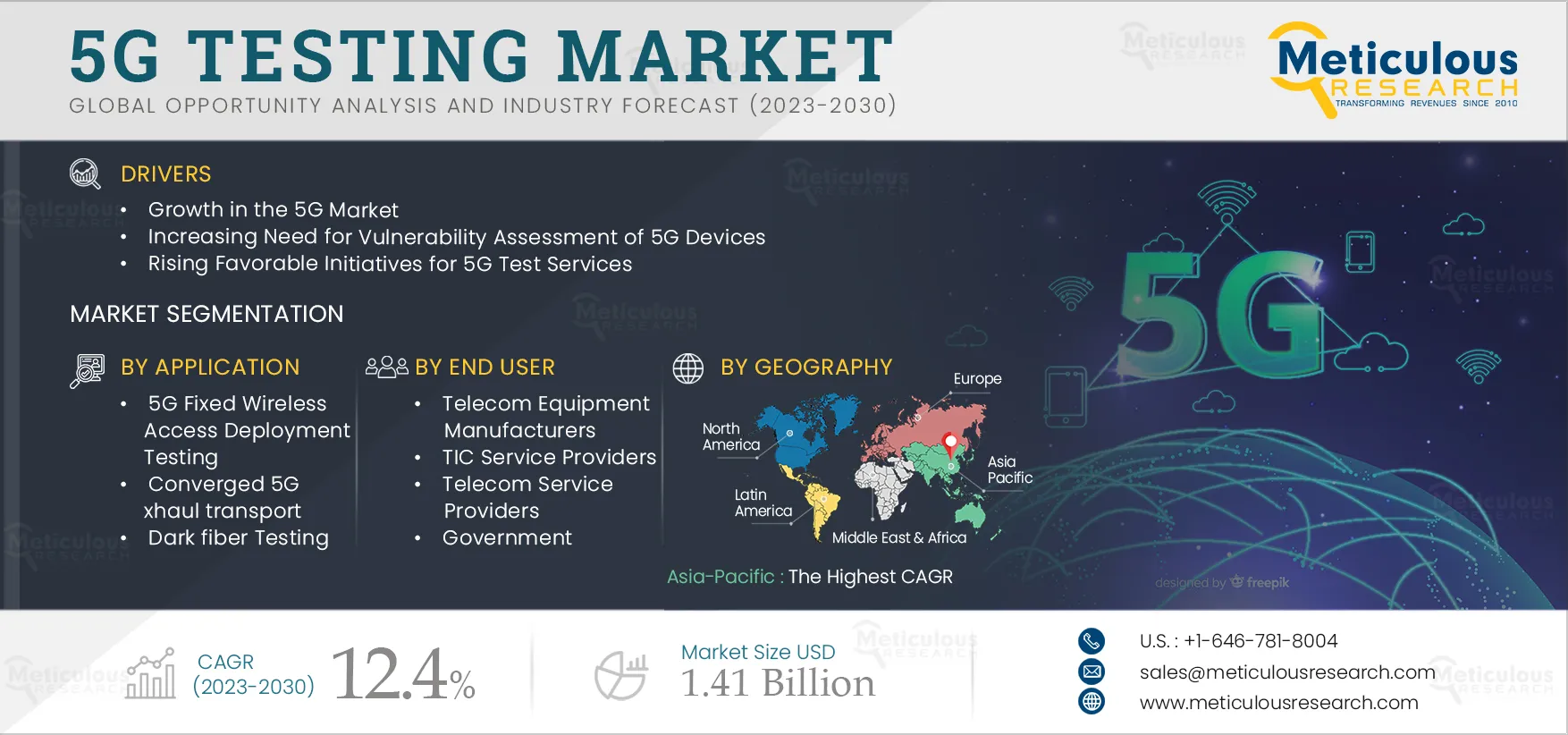

5G Testing Market by Offering (Equipment, Outsourced Services), Application (5G Fixed Wireless Access Deployment Testing, Converged 5G xhaul Transport, 5G Small Cell Testing, Dark fiber Testing), End User, and Geography - Global Forecast to 2032

Report ID: MRICT - 104798 Pages: 300 Jan-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe 5G Testing Market is projected to reach $1.41 billion by 2032, at a CAGR of 12.4% from 2025 to 2032. The growth of this market is attributed to the expanding 5G market, the increasing need for vulnerability assessment of 5G devices, and favorable initiatives for 5G test services. Furthermore, the 5G standardization and applications focused on enhanced mobile broadband (eMBB) and technological innovations for innovative tests and measurement solutions are expected to create significant opportunities for this market. However, the shortage of skilled labor resources for 5G testing poses challenges to this market's growth.

The global 5G testing market is segmented based on offering, application, end user, and geography. The study also evaluates industry competitors and analyses the regional and country-level markets.

In recent years, 5G technology has recorded strong growth in developed countries, such as the U.S., Germany, Canada, and others. According to GSM Association, in February 2022, a new wave of 5G rollouts in large economies with modest income levels (such as Brazil, Indonesia, and India) could encourage the mass production of 5G devices that are more accessible to lower-income people. It might also encourage creating brand new 5G business and consumer applications in developing regions, given that most 5G applications and use cases have been concentrated on more developed markets. This encourages 5G uptake and creates an opportunity for cutting-edge services based on the technology.

Click here to: Get Free Sample Copy of this report

5G technology is associated with security and connectivity-related concerns such as privacy violations, faster data extraction, poor network, etc. Such security concerns have encouraged the government of several countries to undertake initiatives for 5G testing services. For instance, in August 2020, the Department of Defense (U.S.) invested USD 600 million in 5G experimentation and testing at five U.S. military test sites, representing the largest full-scale 5G tests for dual-use applications globally. This investment aimed to rapidly field a scalable, resilient, and secure 5G network to provide a test bed for experimentation with a 5G-enabled Augmented Reality/Virtual Reality (AR/VR) capability for mission planning, distributed training, and operational use.

Moreover, in January 2025, the Department of Telecommunications (DoT) announced launching an independent quality of service (QoS) test for 5G. The ministry received many complaints about poor call connectivity from 5G users and conveyed the issue to two telecom service providers (TSPs) currently rolling out 5G services, Reliance Jio Infocomm Ltd. (India) and Bharti Airtel Limited (India). Such initiatives are expected to drive the growth of the 5G testing market in the coming years.

Based on Offering, the Outsourced Services Segment is Projected to Register the Highest CAGR During the Forecast Period

Based on offering, the global 5G testing market is segmented into equipment, software, and outsourced services. The outsourced services segment is expected to grow at the highest CAGR during the forecast period. The growth in 5G devices and the affordability of testing services are the major factors driving the growth of this segment. End-to-end 5G test services play a vital role in the development, deployment, and operational excellence of emerging 5G networks. Further, the growing adoption of 5G devices is surging demand for verifying the network's lightning-fast download speeds, super low latency, and expansive coverage density.

Based on Application, the 5G Fixed Wireless Access Deployment Testing Segment is Projected to Register the Highest CAGR During the Forecast Period

Based on application, the global 5G testing market is segmented into 5G fixed wireless access deployment testing, converged 5G xhaul transport, 5G small cell testing, dark fiber testing and other applications. The 5G fixed wireless access deployment testing segment is expected to grow at the highest CAGR during the forecast period. The segment's growth is attributed to the growing demand for low-power and strong internet connectivity. As a result, various market players are pushing new developments to provide high-bandwidth connectivity. For instance, in August 2022, 1&1 AG, a German telecommunication company, demonstrated Open RAN-based 5G FWA tests with friendly users under real conditions. Also, in October 2022, Nokia Corporation (Finland) signed an agreement with NBN Co limited. (Australia) to supply 5G fixed wireless access (FWA) mmWave Customer Premises Equipment (CPE) to upgrade NBN’s fixed wireless network. The companies aim jointly to provide high-speed internet to residents and businesses across Australia. Such developments are expected to drive the growth of the segment during the forecast period.

Based on End User, the Telecom Equipment Manufacturers Segment is Projected to Account for the Largest Share of the 5G Testing Market

Based on end user, the global 5G testing market is segmented into telecom equipment manufacturers, TIC service providers, telecom service providers, government, and other end users. In 2025, the telecom equipment manufacturers segment is expected to account for the largest share of the 5G testing market. The large share of this segment is attributed to the increase in the deployment of 5G networks and long-term evolution, such as LTE networks, across the globe. Telecommunications equipment manufacturers use 5G testing equipment to access multiplexers, transmission lines, base transceiver stations, and others. Test equipment facilitates instrument management, repair technology, maintenance, calibration, and deployment of telecom networks. It also ensures that the products adhere to international standards. Manufacturers ensure that broadband service providers deliver a high-quality experience to their users and effective service management via technologies such as Voice over Internet Protocol (VoIP) and Internet Protocol TV (IPTV).

Asia-Pacific is Slated to Register the Highest CAGR During the Forecast Period

Based on geography, the global 5G testing market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The Asia-Pacific is expected to grow at the highest CAGR during the forecast period. Major market players in China, Japan, and South Korea are focusing on deploying 5G network infrastructure for media and entertainment, transportation and logistics, healthcare, and manufacturing, among other industry verticals. These investments are estimated to propel the growth of the Asia-Pacific market over the forecast period. Furthermore, rapidly escalating demand for smartphones and higher internet speeds have resulted in vigorously manufacturing 5G-enabled smartphones across the region. This is expected to surge the demand for test equipment as well.

Key Players

The key players profiled in the global 5G testing market study include ANRITSU CORPORATION (Japan), Artiza Networks, Inc. (Japan), EXFO Inc. (Canada), PCTEL, Inc. (U.S.), Intertek Group plc (U.K.), Keysight Technologies, Inc. (U.S.), MACOM Technologies Solutions Holdings, Inc. (U.S.), Rohde & Schwarz GmbH & Co. KG (Germany), Teradyne Inc. (U.S.), VIAVI Solutions Inc. (U.S.), Telefonaktiebolaget LM Ericsson (Sweden), Trex Enterprises Corporation. (U.S.), Siklu Communications, Ltd. (Israel), GL communications Inc. (U.S.) and Innowireless Co., Ltd. (South Korea).

Scope of the Report:

5G Testing Market, by Offering

5G Testing Market, by Application

5G Testing Market, by End User

5G Testing Market, by Geography

Key Questions Answered in the Report:

The global 5G testing market is segmented based on offering, application, end user, and geography. The study also evaluates industry competitors and analyses the regional and country-level markets.

The global 5G testing market is projected to reach $1.41 billion by 2032, at a CAGR of 12.4% from 2025 to 2032.

Based on offering, in 2025, the equipment segment is expected to account for the largest share of the 5G testing market.

Based on end user, in 2025, the telecom equipment manufacturers segment is expected to account for the largest share of the global 5G testing market.

The growth of this market is attributed to the expansion in the 5G market, the increasing need for vulnerability assessment of 5G devices, and favorable initiatives for 5G test services. Furthermore, the 5G standardization and applications focused on enhanced mobile broadband (eMBB) and technological innovations for innovative test and measurement solutions are expected to create significant opportunities for this market.

The key players profiled in the global 5G testing market study include ANRITSU CORPORATION (Japan), Artiza Networks, Inc. (Japan), EXFO Inc. (Canada), PCTEL, Inc. (U.S.), Intertek Group plc (U.K.), Keysight Technologies, Inc. (U.S.), MACOM Technologies Solutions Holdings, Inc. (U.S.), Rohde & Schwarz GmbH & Co. KG (Germany), Teradyne Inc. (U.S.), VIAVI Solutions Inc. (U.S.), Telefonaktiebolaget LM Ericsson (Sweden), Trex Enterprises Corporation. (U.S.), Siklu Communications, Ltd. (Israel), GL communications Inc. (U.S.) and Innowireless Co., Ltd. (South Korea).

The Asia-Pacific is expected to grow at the highest CAGR during the forecast period. Major market players in China, Japan, and South Korea are focusing on deploying 5G network infrastructure for the media and entertainment, transportation and logistics, healthcare, manufacturing, among other industry verticals. These investments are estimated to propel the growth of the Asia-Pacific market over the forecast period. Furthermore, rapidly escalating demand for smartphones and higher internet speeds have resulted in vigorously manufacturing 5G-enabled smartphones across the region. This is expected to surge the demand for test equipment as well.

Published Date: Jan-2025

Published Date: Sep-2024

Published Date: Jan-2023

Published Date: Oct-2022

Published Date: Aug-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates