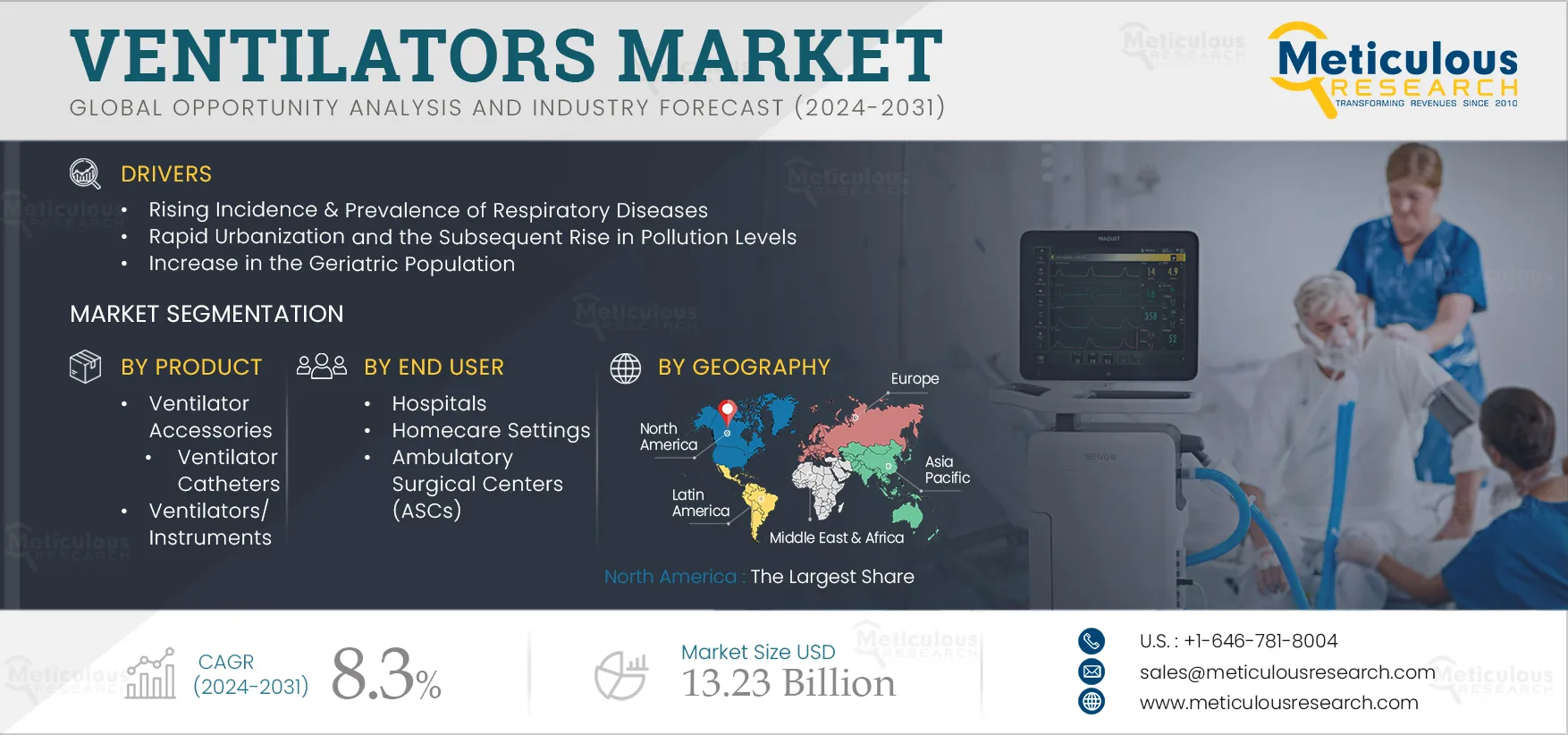

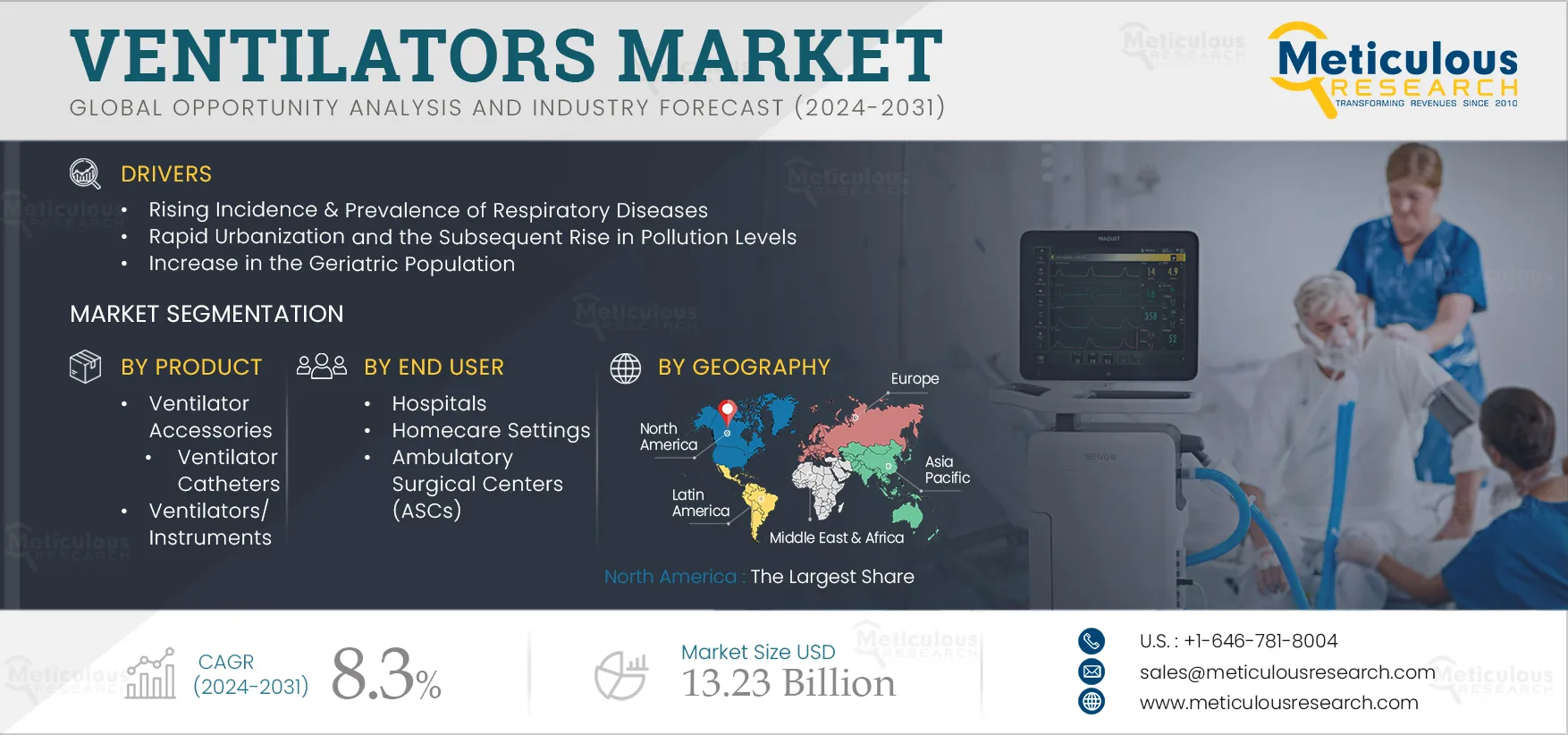

Ventilators Market Size & Forecast

The Ventilators Market is projected to reach $13.23 billion by 2031, at a CAGR of 8.3% from 2024 to 2031. Ventilators, also known as breathing machines or respirators, are medical devices primarily used in hospitals to provide patients with oxygen when they are unable to breathe on their own. They deliver oxygen into the lungs and remove carbon dioxide from the body.

The growth of the ventilators market is driven by factors such as the increasing number of intensive care units (ICUs) and ICU beds, the rising incidence & prevalence of respiratory diseases, rapid urbanization coupled with rising pollution levels, the growth in the geriatric population, and the rising incidence of preterm births. However, the high costs of ventilators and the high preference for alternative oxygenation therapies restrain the market’s growth.

The increasing demand for homecare therapeutic devices and emerging economies in Asia-Pacific and Latin America are expected to create market growth opportunities. However, the adverse effects of ventilators on neonates and difficulties in maintaining component supply chains pose challenges to the market’s growth.

Increasing Number of Intensive Care Units (ICU) and ICU Beds Fueling the Demand for Ventilators

The intensive care unit (ICU) is a specialized facility where critically ill patients receive intensive medical care. The strength of healthcare systems globally is often assessed based on the availability of hospital beds and critical care beds, including those in the ICU. This availability determines the accessibility of healthcare services for the population. Currently, access to healthcare services, particularly intensive care, varies significantly worldwide. The number of ICU beds per 10,000 population differs across regions. For example, in Europe, ICU bed numbers range from 0.42 per 10,000 population in Portugal to 2.92 per 10,000 population in Germany, with an average of 1.15 ICU beds per 10,000 population across Europe. Globally, the U.S. has the highest number of ICU beds, with 3.42 beds per 10,000 population—nearly ten times that of China (0.36) and three times that of Italy (1.25).

Equipment utilized in ICUs ranges from basic tools like blood pressure monitors to highly specialized machinery such as dialysis machines. Key components of critical care infrastructure include ventilators, infusion pumps, IV pole mounts, bedside electronic and manual patient monitoring devices, resuscitation equipment, and various catheters and intubation devices. Therefore, a rise in the overall number of ICU beds subsequently increases demand for associated devices like ventilators.

Growing Demand for Home Care Therapeutic Devices Driving the Market’s Growth

The rising elderly population, the rise in life expectancy, and changing family structures towards nuclear families have increased the global demand for home care services. Additionally, government initiatives aimed at reducing healthcare costs by transitioning certain treatments to non-hospital settings have further fueled the growth of the home care therapy market. As a result, there has been a substantial increase in the demand for home care devices. Moreover, advancements in technology have redirected attention towards alternative treatment approaches, like home healthcare, which are both cost-effective and efficient.

Amid the heightened demand for ventilators prompted by the outbreak of the COVID-19 pandemic, the U.S. FDA implemented a reinforcement policy in March 2020 to increase the availability of ventilators and respiratory devices, including their accessories. The FDA categorized ventilators based on their suitability for facility or home use. According to regulations outlined in 21 CFR 868.5895, ventilators supporting continuous ventilation with minimal assistance can be utilized in home settings. These regulatory measures are expected to foster the expansion of the ventilator market for home care therapies, presenting growth opportunities for companies operating in this market.

Click here to: Get Free Sample Pages of this Report

Key Findings of the Ventilators Market Study:

The Ventilator Accessories Segment is Expected to Account for the Largest Share of the Market in 2024

Among the products studied in this report, in 2024, the ventilator accessories segment is expected to account for the largest share of the market. The large market share of this segment can be attributed to the rising awareness regarding hospital hygiene practices and the extensive utilization of ventilator accessories such as catheters, masks, endotracheal tubes, sensors, nebulizers, humidifiers, oxygen and CO2 measurement devices, circuit sets, and valve sets. The high demand for these accessories has prompted market players to expand their product offerings. For example, in May 2021, Olympus Corporation (Japan) obtained 510(k) clearance for its Airway Mobilescopes, including the MAF-TM2, MAF-GM2, and MAF-DM2 models, designed for a range of upper and lower airway management procedures. These flexible mobile scopes feature a video camera at the tip, facilitating enhanced visualization during procedures. Anesthesiologists and pulmonologists can utilize these devices to deliver critical and intensive care.

The Intensive Care Ventilators Segment is Expected to Account for the Largest Share of the Market in 2024

Based on mobility, in 2024, the intensive care ventilators segment is expected to account for the largest share of the market. The large market share of this segment can be attributed to the increasing installation of ventilators in ICUs, the availability of reimbursements for ventilation solutions and respiratory treatment procedures, the growing number of patient admissions in CCUs due to the increasing population afflicted with chronic and respiratory infectious diseases, and the rising incidence of preterm births worldwide.

The Invasive Ventilators Segment is Expected to Account for the Largest Share of the Market in 2024

Among the interfaces studied in this report, in 2024, the invasive ventilators segment is expected to account for the largest share of the market. The large market share of this segment can be attributed to the widespread utilization of invasive ventilators in ICUs for patients with chronic respiratory and infectious diseases, neurological disorders, and sleep disorders.

The Adult & Pediatric Segment is Expected to Account for the Largest Share of the Market in 2024

Among the age groups studied in this report, the adult & pediatric segment is expected to account for the largest share of the market. The large market share of this segment can be attributed to the high adoption of ventilation support among the elderly population, their increased vulnerability to chronic and infectious diseases such as COPD and lung infections, and the rising consumption of tobacco. Furthermore, the market growth is bolstered by the increasing hospital admissions worldwide. For example, according to the American Hospital Association (AHA), in 2022, a total of 33,679,935 admissions were recorded across all U.S. hospitals. Similarly, National Health Service (NHS) England recorded approximately 237,951 adult critical care admissions in 2022. These high admission rates necessitate the utilization of critical care equipment like ventilators, thereby contributing to the market’s growth.

The Volume Mode Ventilation Segment is Expected to Account for the Largest Share of the Market in 2024

Among the modes studied in this report, in 2024, the volume mode ventilation segment is expected to account for the largest share of the market. The large market share of this segment can be attributed to the widespread adoption of volume-controlled ventilators in intensive care units due to their advantages, including precise minute ventilation and consistent tidal volume delivery. Volume Controlled Ventilation (VCV) has traditionally been a standard mode of controlled ventilation in anesthesia. In VCV, a predetermined tidal volume is administered at a fixed rate, particularly when the patient exhibits no spontaneous breathing. Some of the companies that provide volume mode ventilators are GE HealthCare Technologies, Inc. (U.S.), Hamilton Company (U.S.), Medtronic plc (Ireland), and Drägerwerk AG & Co. KGaA (Germany).

The Hospitals Segment is Expected to Account for the Largest Share of the Market in 2024

Among the end users studied in this report, in 2024, the hospitals segment is expected to account for the largest share of the market. The large market share of this segment can be attributed to the considerable number of patients afflicted with respiratory illnesses, the presence of skilled medical practitioners in hospitals, and the accessibility to advanced healthcare facilities equipped with state-of-the-art medical devices such as ventilators.

North America: Largest Regional Market

In 2024, North America is expected to account for the largest share of the market. North America’s significant market share can be attributed to its well-established healthcare infrastructure, the rising prevalence of chronic and infectious diseases, the presence of major market players, and the high adoption of technologically advanced medical equipment.

Ventilators Market: Competitive Analysis

The key players profiled in the ventilators market report are Schiller AG (Switzerland), Hamilton Medical AG (Switzerland), Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies, Inc. (U.S.), Medtronic plc (Ireland), Getinge AB (Sweden), ResMed Inc. (U.S.), Zoll Medical Corporation (U.S.), Drägerwerk AG & Co. KGaA (Germany), Fisher & Paykel Healthcare Limited (New Zealand), and VYAIRE MEDICAL, INC. (U.S.).

The report includes a competitive landscape based on an extensive assessment of the market based on product, mobility, interface, age group, mode, and end user. The report also provides insights into the presence of major market players and their key growth strategies in the last three to four years.

Report Summary:

|

Particular

|

Details

|

|

Page No

|

~220

|

|

Format

|

PDF

|

|

Forecast Period

|

2024-2031

|

|

Base Year

|

2023

|

|

CAGR

|

8.3%

|

|

Market Size (Value)

|

$13.23 billion by 2031

|

|

Segments Covered

|

By Product

- Ventilator Accessories

- Ventilator Catheters

- Endotracheal Tubes

- Ventilator Masks

- Other Ventilator Accessories

(Note: Other accessories primarily include interfaces, sensors, nebulizers, oxygen & CO2 measurement devices, circuit sets, and valve sets)

- Ventilator/Instrument

By Mobility

- Intensive Care Ventilators

- Portable Ventilators

By Interface

- Invasive Ventilators

- Non-invasive Ventilators

By Age Group

- Adult & Pediatric

- Neonatal & Infant

By Mode

- Volume Mode Ventilation

- Dual/Combined Mode Ventilation

- Pressure Mode Ventilation

- Other Ventilation Modes

(Note: Other ventilation modes primarily include Synchronized Intermittent-mandatory Ventilation, Assist-Control Ventilation, Continuous Positive Airway Pressure (CPAP) Mode, Bilevel Positive Airway Pressure (BIPAP), Airway Pressure Release Ventilation, and High-Frequency Oscillatory Ventilation)

By End User

- Hospitals

- Homecare Settings

- Ambulatory Surgical Centers (ASCs)

- Other End Users

(Note: Other end users primarily include emergency medical services/transport [ambulance services or paramedic services], nursing care centers, and military centers)

|

|

Countries Covered

|

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Switzerland, Belgium, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, Indonesia, Singapore, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and Middle East & Africa (U.A.E., Saudi Arabia, South Africa, and Rest of Middle East & Africa).

|

|

Key Companies

|

Schiller AG (Switzerland), Hamilton Medical AG (Switzerland), Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies, Inc. (U.S.), Medtronic plc (Ireland), Getinge AB (Sweden), ResMed Inc. (U.S.), Zoll Medical Corporation (U.S.), Drägerwerk AG & Co. KGaA (Germany), Fisher & Paykel Healthcare Limited (New Zealand), and VYAIRE MEDICAL, INC. (U.S.)

|

Key questions answered in the report: