Resources

About Us

Ultrasonic Testing Market by Offering (Equipment, Services, and Software), by Technology (Conventional Ultrasonic Testing, Phased Array Ultrasonic Testing, Time-of-Flight Diffraction, Automated Ultrasonic Testing, Guided Wave Ultrasonic Testing, Full Matrix Capture/Total Focusing Method), Application, End-use Industry— Global Forecast to 2036

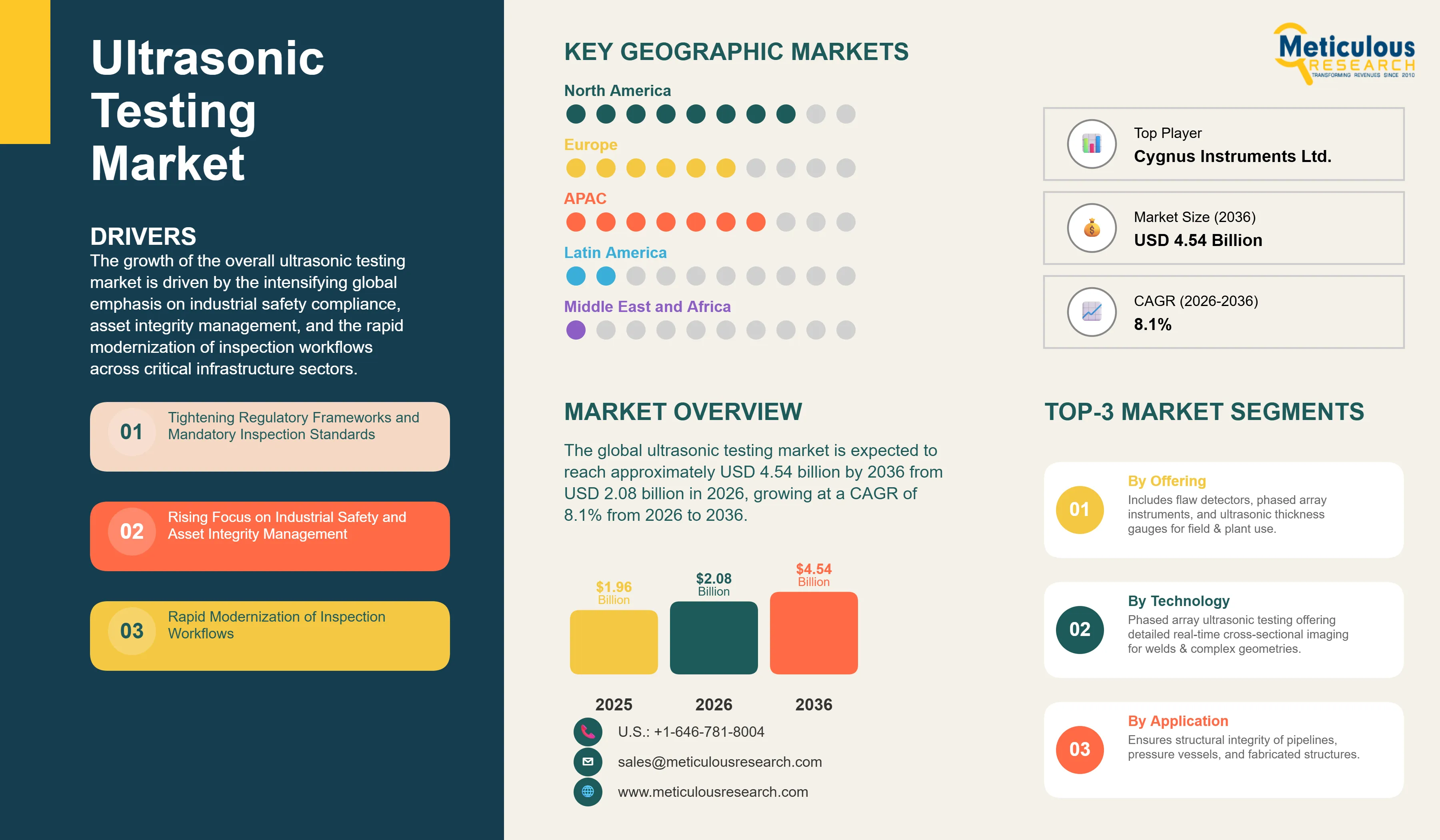

Report ID: MRSE - 1041797 Pages: 294 Feb-2026 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe global ultrasonic testing market was valued at USD 1.96 billion in 2025. The market is expected to reach approximately USD 4.54 billion by 2036 from USD 2.08 billion in 2026, growing at a CAGR of 8.1% from 2026 to 2036. The growth of the overall ultrasonic testing market is driven by the intensifying global emphasis on industrial safety compliance, asset integrity management, and the rapid modernization of inspection workflows across critical infrastructure sectors. As asset operators across oil & gas, aerospace, and power generation seek to integrate greater precision and speed into their quality assurance programs, ultrasonic testing technology has emerged as an indispensable tool for detecting structural defects, measuring material thickness, and ensuring the long-term reliability of high-value assets. The accelerating adoption of phased array techniques, the integration of artificial intelligence for real-time defect classification, and the expanding use of robotic and automated scanning systems continue to fuel significant growth across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Ultrasonic testing is a well-established non-destructive testing (NDT) method that uses high-frequency sound waves to inspect materials, components, and structures for internal flaws, dimensional variations, and material degradation without causing damage to the test object. The technique works by transmitting ultrasonic pulses into a material through a transducer and analyzing the reflected or transmitted energy to identify discontinuities, measure thickness, or assess material properties. The market encompasses a broad spectrum of instruments, inspection services, and analytical software, ranging from handheld portable flaw detectors used in field maintenance to fully automated multi-axis scanning systems deployed in high-throughput manufacturing environments.

The market is defined by rapid technology evolution, including the widespread shift toward phased array ultrasonic testing (PAUT), which uses multiple piezoelectric elements to electronically steer and focus sound beams, enabling detailed cross-sectional imaging of welds, forgings, and composite components. The time-of-flight diffraction (TOFD) technique, which uses the diffraction of ultrasonic signals at defect tips, is gaining significant adoption in pressure vessel and pipeline weld inspection due to its high sensitivity to planar defects. Guided wave ultrasonic testing, which propagates low-frequency waves along extended pipe lengths from a single sensor ring, is transforming corrosion monitoring in buried and insulated pipelines. The full matrix capture (FMC) and total focusing method (TFM), representing the latest frontier in ultrasonic imaging, are now being commercialized by leading equipment manufacturers for applications requiring maximum defect characterization accuracy, including nuclear and aerospace inspection.

These systems are increasingly integrated with artificial intelligence and machine learning engines that automate defect recognition, reduce operator dependency, and dramatically improve inspection throughput. The rise of robotic and semi-automated ultrasonic scanning solutions — including crawlers, drones, and collaborative robots — is enabling inspections in previously inaccessible or hazardous environments. Cloud-based data platforms now allow inspection teams to stream, store, and analyze ultrasonic data remotely, supporting distributed asset management across multiple geographies. The ability to deliver high-precision, audit-ready inspection records while minimizing asset downtime has made advanced ultrasonic testing a preferred choice across industries where structural failure carries significant safety, operational, and regulatory consequences.

Regulatory authorities worldwide continue to tighten inspection mandates. The U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA) revised its high-consequence pipeline inspection intervals in 2024, requiring ultrasonic surveys every seven years rather than every ten, directly driving incremental equipment and service demand. API RP 1160, Third Edition, published in January 2025, reinforced performance-validation benchmarks for ultrasonic inspection tools. Similar regulatory tightening is taking place in Europe under the Pressure Equipment Directive (PED) and in Asia-Pacific as industrial safety enforcement intensifies.

Proliferation of AI-Augmented Inspection Platforms and Automated Defect Recognition

Inspection professionals across industries are rapidly embracing AI-driven ultrasonic testing platforms that move well beyond manual waveform interpretation, fundamentally changing how defect data is collected, processed, and acted upon. Waygate Technologies' InspectionWorks platform and Evident Corporation's Olympus Scientific Cloud now offer application programming interfaces (APIs) that allow ultrasonic datasets to be fed directly into enterprise asset management systems and digital twin environments, enabling continuous, data-driven maintenance planning. Machine learning classifiers embedded in modern phased array flaw detectors are reducing defect interpretation time significantly while improving defect hit rates to approximately 96% in controlled trials — a breakthrough that makes high-volume inspection economically viable for asset operators managing thousands of inspection points. These advancements are making advanced ultrasonic inspection practical and cost-effective for everything from single-site facility managers to multinational pipeline operators seeking real-time asset integrity visibility across distributed infrastructure networks.

Expansion of Robotic and Automated Scanning Solutions for Hazardous and Complex Environments

Innovation in automated and robotic ultrasonic scanning is rapidly reshaping how inspections are conducted in confined, elevated, or otherwise hazardous environments that were previously dependent on manual access and scaffolding. Equipment manufacturers such as Eddyfi Technologies and MISTRAS Group are now deploying magnetic crawler robots and remotely operated inspection vehicles equipped with phased array probes and high-resolution encoders, capable of scanning large surface areas on pressure vessels, storage tanks, and offshore structures with minimal human exposure. Drone-mounted ultrasonic transducers are advancing into bridge deck and wind turbine blade inspection, enabled by improvements in contact force control and signal fidelity at low adhesion. Semi-automated inline scanning systems integrated directly into manufacturing lines at electric vehicle battery plants are enabling 100% inspection of electrode stacks and welded battery housings at production-line speeds, addressing a critical quality assurance bottleneck as EV manufacturing scales rapidly. By combining the precision of advanced phased array imaging with the operational flexibility of robotic deployment, these integrated systems are compressing inspection timelines, reducing labor costs, and delivering significantly more consistent and repeatable inspection outcomes than manual methods.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 4.54 Billion |

|

Market Size in 2026 |

USD 2.08 Billion |

|

Market Size in 2025 |

USD 1.96 Billion |

|

Market Growth Rate (2026–2036) |

CAGR of 8.1% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Offering, Technology, Application, End-use Industry, and Geography |

|

Geographies Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Tightening Regulatory Frameworks and Mandatory Inspection Standards

A key driver of the ultrasonic testing market is the steady tightening of government and industry-body inspection mandates across high-consequence sectors. Regulations governing the integrity of oil and gas pipelines, nuclear plant components, pressure vessels, and aerospace structures are becoming more prescriptive in terms of inspection frequency, technique qualification, and data traceability requirements. The PHMSA's revised pipeline inspection rule, API RP 1160 Third Edition, and nuclear inspection standards enforced by bodies such as the U.S. Nuclear Regulatory Commission and the International Atomic Energy Agency are directly driving recurring demand for advanced ultrasonic inspection equipment and qualified inspection services. In Europe, the Pressure Equipment Directive and EN standards for weld testing are pushing industrial operators to adopt qualified phased array and TOFD systems to satisfy conformity requirements. This regulatory environment creates a sustained, non-discretionary baseline of demand for ultrasonic inspection that remains relatively insulated from short-term industrial downturns, providing a stable foundation for equipment manufacturers, service providers, and software developers operating in the market.

Opportunity: Expansion of EV Manufacturing and Advanced Composite Inspection Requirements

The rapid global growth of electric vehicle production and the associated manufacturing of lithium-ion battery cells, modules, and packs is opening an entirely new and fast-expanding end-use domain for ultrasonic testing. EV battery manufacturers require high-throughput, non-contact or minimal-contact inspection of electrode layers, weld joints in battery housings, and separator integrity to prevent manufacturing defects that could result in thermal runaway events and significant safety and warranty liabilities. Inline automated ultrasonic scanning systems that can inspect battery cells at production-line speed are being rapidly developed and deployed by equipment manufacturers including Waygate Technologies and Evident Corporation. Simultaneously, the growing use of carbon fiber-reinforced polymer (CFRP) composites in aerospace, wind energy, and high-performance automotive applications is generating strong demand for advanced ultrasonic imaging techniques such as TFM and immersion scanning that can reliably characterize delamination, porosity, and fiber waviness in anisotropic composite structures. These adjacent growth applications are expected to represent some of the highest-value incremental opportunities for ultrasonic testing equipment and software vendors through 2036.

Why Does the Equipment Segment Lead the Market?

The equipment segment accounts for the largest share of the overall ultrasonic testing market in 2026. This is primarily due to the high capital expenditure associated with the procurement of phased array flaw detectors, ultrasonic thickness gauges, TOFD systems, and specialized transducer arrays across a broad base of end-user industries including oil & gas, aerospace, power generation, and manufacturing. Flaw detectors, particularly portable phased array instruments, represent the single largest product category within the equipment segment, with leading products such as Waygate Technologies' Krautkrämer USM 100, Evident Corporation's OmniScan X3, and Eddyfi Technologies' Capture-based instruments driving volume across field inspection programs globally. The ongoing shift from conventional single-element flaw detectors to multi-group phased array systems that support simultaneous PAUT and TOFD acquisition in a single pass is accelerating average selling price growth within the equipment segment. The services segment, however, is projected to grow at a healthy CAGR during the forecast period, reflecting the increasing trend among asset operators to outsource inspection activities to certified third-party service providers who can deliver qualified inspection data along with regulatory compliance documentation.

How Does Phased Array Ultrasonic Testing (PAUT) Dominate?

Based on technology, the phased array ultrasonic testing (PAUT) segment holds the largest share of the overall market in 2026. This is primarily due to its ability to produce detailed, real-time cross-sectional images of internal structures by electronically steering ultrasonic beams at multiple angles without physically moving the probe, dramatically reducing scan times and improving defect detection probability on complex geometries such as nozzle welds, curved surfaces, and dissimilar metal joints. PAUT has become the de facto standard for weld inspection in oil & gas pipeline construction, power plant pressure component inspection, and aerospace maintenance, displacing conventional multi-angle manual ultrasonic scanning in a growing proportion of code-qualified applications. The full matrix capture and total focusing method (FMC/TFM) segment is expected to witness the fastest growth during the forecast period, as this technique delivers superior spatial resolution and quantitative defect sizing accuracy that is increasingly required for fitness-for-service assessments in nuclear, aerospace, and critical pressure equipment inspection programs.

Why Does the Oil & Gas Segment Lead the Market?

The oil & gas segment commands the largest share of the global ultrasonic testing market in 2026. This dominance is driven by the extensive network of aging pipelines, refineries, offshore platforms, pressure vessels, and storage tanks that require continuous integrity monitoring and periodic statutory inspection under both regulatory mandate and industry codes such as API 570, API 653, and API 580. Ultrasonic testing is the primary technique for corrosion mapping of pipe walls and vessel shells, weld inspection during new pipeline construction, and crack sizing in high-consequence areas subject to stress corrosion cracking and fatigue loading. The prevalence of guided wave ultrasonic testing for screening long pipeline runs from a single sensor attachment point, combined with the use of robotic crawlers for in-line inspection of operating pipelines, underlines the scale and technical diversity of ultrasonic inspection within the oil & gas segment. The aerospace & defense segment is poised for the fastest growth through 2036, fueled by the intensification of composite material inspection requirements on next-generation commercial aircraft and by increased defense spending on maintenance, repair, and overhaul (MRO) of military aviation assets globally.

How is North America Maintaining Dominance in the Global Ultrasonic Testing Market?

North America holds the largest share of the global ultrasonic testing market in 2026. The region's leadership is primarily attributed to its mature and well-regulated NDT ecosystem, which encompasses an extensive pipeline and refinery infrastructure subject to recurring federal inspection mandates, a world-leading aerospace manufacturing and MRO sector, and a large installed base of nuclear power plants requiring rigorous in-service inspection programs. The United States alone accounts for a disproportionately large share of global ultrasonic testing expenditure, reflecting the breadth and density of regulated industrial assets and the presence of leading inspection equipment manufacturers and service providers including Waygate Technologies, MISTRAS Group, and Innerspec Technologies. Canada contributes meaningfully through its oil sands and heavy crude pipeline infrastructure in Alberta, which demands high volumes of automated ultrasonic inspection. The PHMSA's mandate tightening pipeline inspection intervals in high-consequence areas, finalized in 2024, is expected to sustain above-average demand for advanced ultrasonic inspection systems and services in North America through the forecast period.

Which Factors Support Asia-Pacific and Europe Market Growth?

Asia-Pacific is the fastest-growing regional market for ultrasonic testing during the forecast period. This growth is driven by the rapid expansion of manufacturing, energy, and infrastructure sectors across China, India, South Korea, and Southeast Asia, all of which are investing heavily in quality assurance and asset integrity programs as industrial output scales. China's continuing expansion of nuclear power generation capacity, large-scale natural gas pipeline network development, and the rapid growth of domestic aerospace manufacturing are creating significant incremental demand for advanced phased array and TOFD inspection systems. India's expanding refining and petrochemical sector and its ambitious infrastructure development agenda are similarly driving adoption of automated ultrasonic inspection technologies.

In Europe, the leadership in engineering quality standards and the push for decarbonization across the energy sector are driving sustained demand for high-reliability ultrasonic inspection solutions. Countries such as Germany, France, the United Kingdom, and the Netherlands are at the forefront of adopting advanced digital inspection workflows that integrate ultrasonic data with cloud-based asset management platforms and predictive maintenance programs. Europe's significant offshore wind energy build-out is creating new inspection requirements for marine and subsea structural components, further diversifying the regional demand base.

Companies such as Waygate Technologies (a Baker Hughes business), Evident Corporation, Eddyfi Technologies Inc., and MISTRAS Group, Inc. lead the global ultrasonic testing market with comprehensive portfolios spanning advanced phased array instruments, automated scanning systems, inspection services, and data analytics platforms for large-scale industrial applications. Meanwhile, players including Sonatest Ltd., NDT Global GmbH & Co. KG, Cygnus Instruments Ltd., Sonotron NDT Ltd., and Innerspec Technologies, Inc. focus on specialized instrumentation, guided wave inspection, and niche applications targeting specific industry segments such as marine, nuclear, and heavy manufacturing. Emerging innovators and integrated players such as Screening Eagle Technologies (formerly Proceq), Zetec, Inc. (acquired by Eddyfi Technologies), Testia (an Airbus Group company), YXLON International GmbH, and Karl Deutsch Prüf- und Messgerätebau GmbH & Co. KG are strengthening the market through innovations in portable phased array instruments, composite inspection systems, and AI-driven data analysis software. Wabtec Corporation, following its acquisition of Evident Corporation's Inspection Technologies Division in July 2025, is positioned as a significant new force in the ultrasonic testing equipment space.

The global ultrasonic testing market is expected to grow from USD 2.08 billion in 2026 to USD 4.54 billion by 2036.

The global ultrasonic testing market is projected to grow at a CAGR of 8.1% from 2026 to 2036.

The equipment segment is expected to dominate the market in 2026 due to high capital procurement of phased array and TOFD instruments across oil & gas, aerospace, and power generation sectors. However, the services segment is projected to grow at a healthy CAGR during the forecast period, driven by increasing outsourcing of inspection activities and demand for certified inspection services with integrated compliance documentation.

Phased array ultrasonic testing (PAUT) is expected to lead the market in 2026 owing to its superior scan coverage, defect imaging capability, and established qualification under international inspection codes. The full matrix capture / total focusing method (FMC/TFM) segment is projected to register the fastest CAGR during the forecast period, driven by growing adoption in nuclear, aerospace, and fitness-for-service inspection programs requiring maximum defect characterization accuracy.

AI integration is transforming ultrasonic inspection by enabling automated defect recognition, reducing reliance on highly skilled manual interpreters, and dramatically accelerating inspection throughput. Machine learning classifiers embedded in modern phased array flaw detectors are improving defect detection rates to approximately 96% while reducing interpretation time by half compared to manual review. Cloud-based platforms from providers such as Waygate Technologies and Evident Corporation are enabling remote, continuous access to inspection data across distributed asset portfolios, supporting predictive maintenance programs and digital twin environments that transform inspection findings into actionable operational intelligence.

North America holds the largest share of the global ultrasonic testing market in 2026. This is primarily attributed to its mature regulatory environment, large pipeline and aerospace asset base, and the presence of leading inspection equipment manufacturers and service providers.

Leading companies include Waygate Technologies (Baker Hughes), Evident Corporation, Eddyfi Technologies Inc., MISTRAS Group, Inc., Sonatest Ltd., NDT Global GmbH & Co. KG, and Cygnus Instruments Ltd.

Published Date: Jan-2026

Published Date: Jan-2025

Published Date: Nov-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates