Resources

About Us

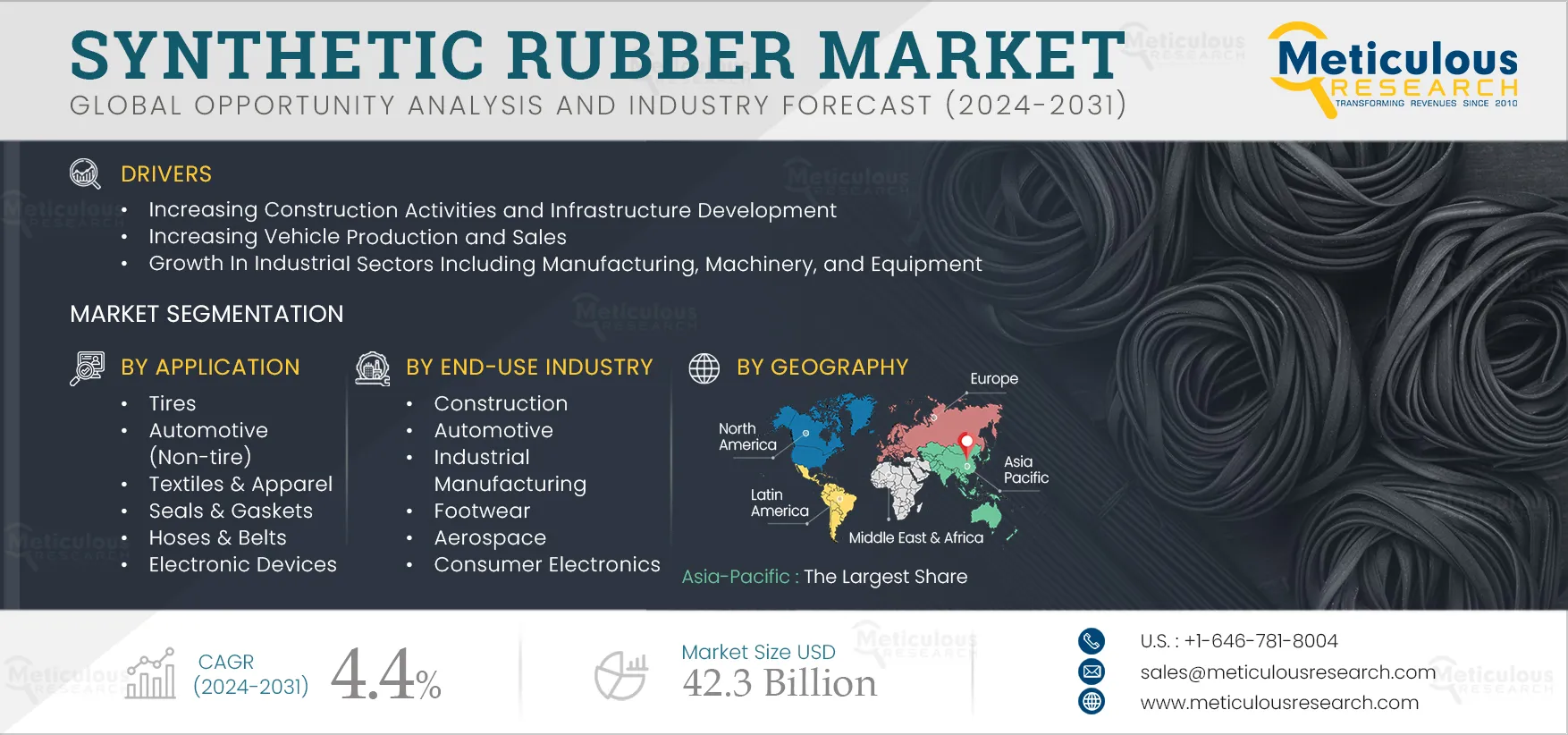

Synthetic Rubber Market Size, Share, Forecast, & Trends Analysis by Type (SBR, EPDM, BR, SBC, IIR, NBR, IR, CR), Application (Tires, Textiles & Apparel, Electronic, Packaging), Industry (Construction, Automotive, Industrial) - Global Forecast to 2032

Report ID: MRCHM - 1041165 Pages: 180 May-2024 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportThe Synthetic Rubber Market is expected to reach $42.3 billion by 2032, at a CAGR of 4.4% from 2025 to 2032.The growth of this market is driven by increasing construction activities and infrastructure development, increasing vehicle production and sales, and growth in industrial sectors, including manufacturing, machinery, and equipment. Additionally, the growing demand for eco-friendly synthetic rubber alternatives is expected to create market growth opportunities. However, issues related to waste disposal, pollution, and carbon emissions may restrain the growth of this market. However, stringent environmental regulations, quality standards, and compliance policies by governments pose a major challenge for the players operating in this market.

Additionally, the increasing demand for high-performance synthetic rubber materials is a key market trend.

The automotive sector is a major consumer of synthetic rubber, with tires alone representing a substantial portion of the market. Synthetic rubber plays a pivotal role in vehicle manufacturing. It is used to manufacture various automotive components such as seals, gaskets, hoses, belts, and vibration isolators and is primarily used in tire production. According to the World Economic Forum (Switzerland), the global sales of electric cars will increase by 60.0% in 2022, exceeding 10 million for the first time, as per the Net Zero Emissions (NZE) by 2050 scenario. In 2032, electric car fleets are expected to account for nearly 60.0% of new car sales, with a volume of 300 million units. As a result, the rise of electric vehicles is a key driver in increasing vehicle production and sales, thereby supporting the demand for synthetic rubber in the coming years.

Synthetic rubber plays a crucial role in various industrial sectors for a wide range of applications due to its favorable properties such as durability, resilience, and chemical resistance. It is used in the production of hoses, belts, seals, gaskets, O-rings, and vibration-dampening components. Also, it is used for components such as bushings, seals, gaskets, and conveyor belts to ensure optimal performance and longevity. According to the National Institute of Standards and Technology (NIST)(U.S.), in 2022, the U.S. manufacturing contributed more than $2.3 trillion to the U.S. GDP amounting to 11.4 % of total U.S. GDP, measured in chained 2012 dollars. According to the India Brand Equity Foundation (India) report 2025, manufacturing exports have registered the highest annual exports of $447.46 billion with 6.03% growth during 2024 surpassing the previous year (2022) record exports of $422 billion. This growth underscores the importance of synthetic rubber in supporting industrial activities and meeting the demand for various rubber components in manufacturing processes and equipment. All such factors, along with increasing demand for manufactured goods, Industry 4.0, and infrastructure development are supporting the demand for synthetic rubber during the forecast period.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

The growing need for superior properties and diverse applications across various industries, including automotive, aerospace, construction, and industrial manufacturing, is driving the demand for high-performance synthetic rubber materials. It refers to advanced rubber formulations that offer enhanced characteristics, such as durability, abrasion resistance, weather resistance, chemical resistance, and thermal stability compared to conventional rubber compounds. Companies are focusing on high-performance synthetic rubber materials to meet stringent requirements and address demanding operating conditions in their applications in automotive tires, seals, gaskets, hoses, conveyor belts, adhesives, and specialty industrial products. Increasing advancements in rubber technology, evolving industry standards and regulations, and growing emphasis on product quality and durability are further supporting innovation and investment in the synthetic rubber market during the forecast period.

Eco-friendly synthetic rubber alternatives refer to rubber compounds that are manufactured through processes that minimize environmental impact and carbon footprint or use sustainable and renewable resources. These alternatives offer several benefits, including reduced dependence on fossil fuels, lower greenhouse gas emissions, and improved energy efficiency during manufacturing. Companies are focusing on eco-friendly synthetic rubber alternatives to address concerns regarding environmental pollution, resource depletion, and carbon emissions associated with traditional rubber production methods. In June 2024, Continental AG (Germany) launched a series of tire “UltraContact NXT” with up to 65% renewable, recycled and mass balance certified materials. It combines a high share of sustainable materials with maximum safety and performance. Such initiative demonstrates the industry's focus on developing eco-friendly synthetic rubber alternatives and meet the growing demand for sustainable products. All such factors along with the increasing environmental awareness and sustainability initiatives across industries are creating significant growth opportunities for the market growth.

Based on type, the synthetic rubber market is broadly segmented into styrene butadiene rubber (SBR), polybutadiene rubber (BR), styrene block copolymer (SBC), ethylene propylene diene rubber (EPDM), butyl rubber (IIR), acrylonitrile-butadiene rubber (NBR), isoprene rubber (IR), chloroprene rubber (CR), and other types. In 2025, the styrene butadiene rubber (SBR) segment is expected to account for the largest share of above 29.0% of the synthetic rubber market. The large market share of this segment is attributed to the increasing demand for tires, the growing use of SBR in tire manufacturing due to its high abrasion resistance and good aging properties, and the growing shift toward green tire technologies that incorporate higher proportions of bio-based and recycled materials including SBR.

However, the ethylene propylene diene rubber (EPDM) segment is projected to record the highest CAGR during the forecast period of 2025–2032. This growth is driven by the increasing use of EPDM in construction applications, automotive seals, gaskets, weatherstripping, and hoses due to its high weather resistance and durability; growing focus on renewable energy sources as EPDM is used in seals & gaskets for renewable energy technologies.

Based on application, the synthetic rubber market is broadly segmented into tires, automotive (non-tire), footwear components, textiles & apparel, seals & gaskets, hoses & belts, electronic devices, lubrications, packaging, and other applications. In 2025, the tires segment is expected to account for the largest share of above 72.0% of the synthetic rubber market. The large market share of this segment is attributed to the expansion of the automotive industry, driven by increasing vehicle production and sales globally, increasing vehicle maintenance, rising demand for tires, and growing need for tire replacement due to wear and tear.

However, the electronic devices segment is projected to witness the highest growth rate during the forecast period of 2025–2032. This growth is driven by the growth of the consumer electronics market, the growing popularity of wearable devices such as smartwatches, fitness trackers, and earbuds, the expansion of telecommunication infrastructure, including the deployment of 5G networks and increased connectivity, and the increasing use of synthetic rubber in various electronic components such as keypads, gaskets, vibration dampening materials, and seals.

Based on end-use industry, the global synthetic rubber market is broadly segmented into construction, automotive, industrial manufacturing, footwear, aerospace, consumer electronics, and other end-use Industries. In 2025, the automotive segment is expected to account for the largest share of above 76.0% of the synthetic rubber market. The large market share of this segment can be attributed to the growth of the automotive industry, the growing use of synthetic rubber in automotive applications such as tires, seals, gaskets, automotive interiors, exteriors, and chassis systems, and increasing demand for high-performance synthetic rubber materials with enhanced properties.

However, the consumer electronics segment is projected to record the highest CAGR during the forecast period of 2025–2032. This growth is driven by the continuous technological advancement in the consumer electronics industry, the growing popularity of wearable devices, the expansion of telecommunication infrastructure, the growing demand for water- and dust-resistant devices, and the proliferation of IoT devices, including smart home appliances, connected wearables, and industrial sensors.

Based on geography, the global synthetic rubber market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2025, Asia-Pacific is expected to account for the largest share of above 54.0% of the synthetic rubber market, followed by Europe, North America, Latin America, and the Middle East & Africa. Asia-Pacific's significant market share can be attributed to several key factors, including the increasing demand for synthetic rubber in various industries, including automotive, construction, manufacturing, and consumer goods, increasing urbanization and infrastructure development, increasing government initiatives and policies promoting industrial growth, and growing automotive and consumer electronics industry in countries including China, Japan, South Korea, and India. The region is also slated to register the highest growth rate of above 6.0% during the forecast period.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years. Some of the key players operating in the synthetic rubber market are China Petrochemical Corporation (a subsidiary of Sinopec Corp.) (China), ERIKS N.V.(Netherlands), The Dow Chemical Company (U.S), Exxon Mobil Corporation (U.S.), Kumho Petrochemical Co., Ltd. (KKPC) (South Korea), Zeon Corporation (Japan), Nizhnekamskneftekhim (NKNK) (Russian), Mitsui Chemicals, Inc. (Japan), JSR Corporation (Japan), SABIC (Saudi Arabia), Denka Company Limited (Japan), Asahi Kasei Corporation (Japan), Indian Synthetic Rubber Private Limited (India), Apcotex (India), Reliance Industries Limited (India), Trinseo PLC (U.S.), TSRC Corporation (Taiwan), Michelin Group (France), and LANXESS (Germany).

In January 2025, Michelin Group (France), IFP Energies nouvelles (IFPEN) (France), and Axens (France) unveiled an industrial-scale demonstrator for producing bio-based butadiene, a key ingredient in synthetic rubber production. The demonstrator was built within the framework of the BioButterfly project, which aims to develop and commercialize butadiene from ethanol derived from biomass (plants) to replace butadiene from petrochemicals.

In May 2024, ARLANXEO (Netherlands) announced to build of a rubber production plant in Jubail, Saudi Arabia, with an annual capacity of 140,000 metric tons. This plant will be part of the USD 11 billion Amiral complex planned by Saudi Aramco and Total Energies to produce two elastomers, including ultra-high cis polybutadiene (NdBR) and lithium butadiene rubber (LiBR).

|

Particulars |

Details |

|

Number of Pages |

180 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

4.4% |

|

Market Size (Value) |

USD 42.3 Billion by 2032 |

|

Segments Covered |

By Type

By Application

By End-use Industry

|

|

Countries Covered |

Europe (Germany, U.K., Italy, France, Spain, Russia, Netherlands, and Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Thailand, Singapore, and Rest of Asia-Pacific), North America (U.S., Canada), Latin America (Brazil, Argentina, Mexico, and Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of the Middle East & Africa) |

|

Key Companies |

China Petrochemical Corporation (a subsidiary of Sinopec Corp.) (China), ERIKS N.V.(Netherlands), The Dow Chemical Company (U.S), Exxon Mobil Corporation (U.S.), Kumho Petrochemical Co., Ltd. (KKPC) (South Korea), Zeon Corporation (Japan), Nizhnekamskneftekhim (NKNK) (Russian), Mitsui Chemicals, Inc. (Japan), JSR Corporation (Japan), SABIC (Saudi Arabia), Denka Company Limited (Japan), Asahi Kasei Corporation (Japan), Indian Synthetic Rubber Private Limited (India), Apcotex (India), Reliance Industries Limited (India), Trinseo PLC (U.S.), TSRC Corporation (Taiwan), Michelin Group (France), and LANXESS (Germany). |

The Synthetic Rubber Market refers to the global industry that produces and sells rubber materials manufactured through chemical processes, often derived from petroleum byproducts. These rubber materials are used in various industries like automotive, construction, electronics, and industrial manufacturing due to their properties such as elasticity, durability, and resistance to heat, chemicals, and wear.

As of the latest projections, the Synthetic Rubber Market is expected to reach $42.3 billion by 2032.

The market is projected to grow at a CAGR of 4.4% from 2025 to 2032, driven by increasing demand from industries like automotive, construction, and consumer electronics, along with innovations in eco-friendly synthetic rubber alternatives.

The current market size is projected to grow steadily, reaching approximately $42.3 billion by 2032.

The global outlook remains positive, with Asia-Pacific leading in market share (over 54% in 2025) due to its expanding automotive and industrial sectors. North America and Europe also hold significant shares but the highest growth rate is expected in the Asia-Pacific region.

The market is expected to grow at a CAGR of 4.4% from 2025 to 2032, reaching $42.3 billion by 2032.

The market is projected to grow at a 4.4% CAGR from 2025 to 2032.

Asia-Pacific holds the largest share of the Synthetic Rubber Market, accounting for over 54% of the global market in 2025, driven by its robust automotive, construction, and manufacturing industries.

Published Date: Sep-2024

Published Date: May-2024

Published Date: Nov-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates