Resources

About Us

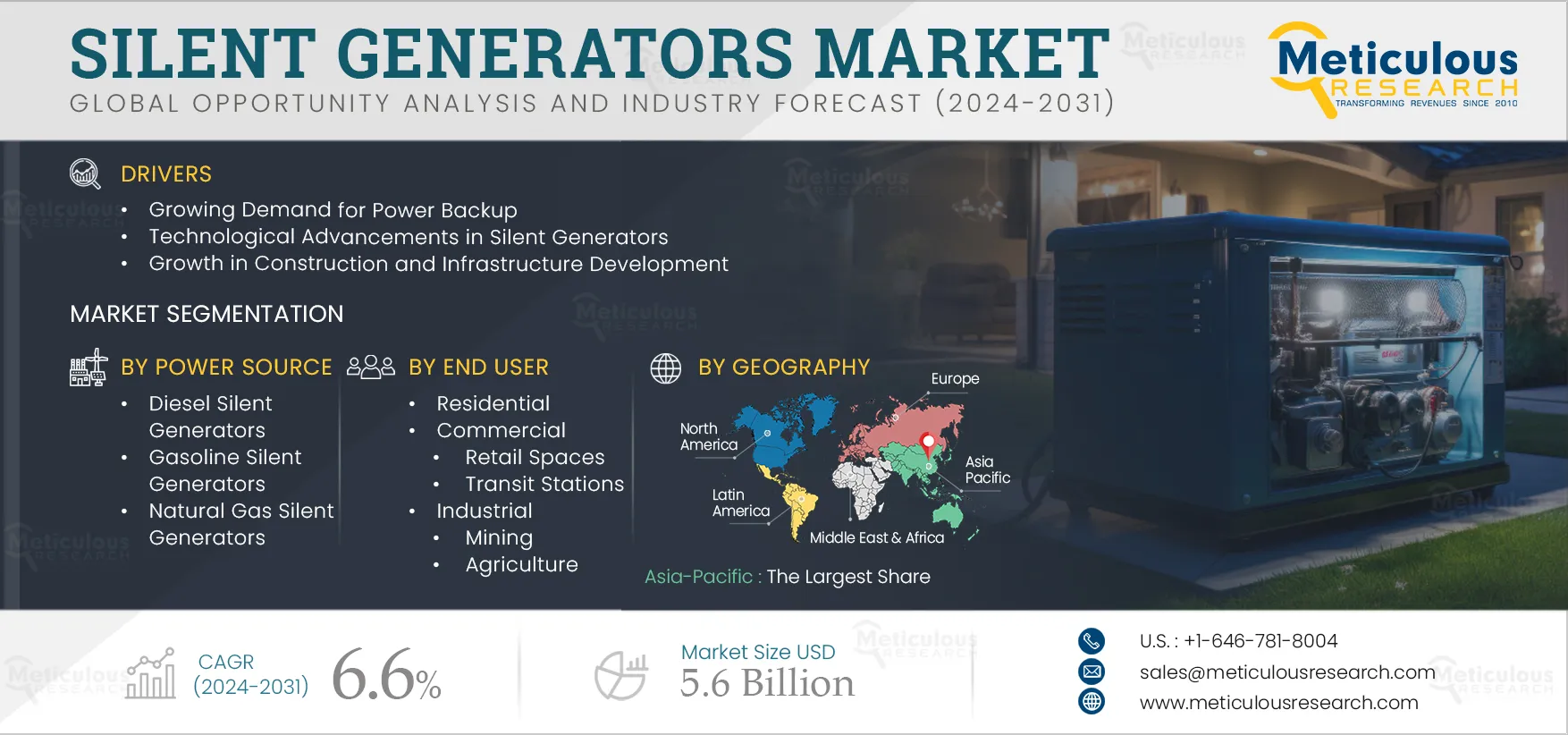

Silent Generators Market Size, Share, Forecast, & Trends Analysis by Portability (Portable and Non-portable), Sound Level, Power Source (Diesel, Gasoline, Natural Gas), Phase, Single Phase, Three Phase), Power Output, and End User (Residential, Commercial) - Global Forecast to 2032

Report ID: MRSE - 1041182 Pages: 250 May-2024 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe Silent Generators Market is expected to reach $5.6 billion by 2032, at a CAGR of 6.6% from 2025–2032. The expansion of the silent generators market is propelled by increasing requirements for power backup, continuous technological enhancements in silent generator technologies, and the surge in construction and infrastructure projects. Additionally, the emphasis on green initiatives and sustainable practices, alongside the rising adoption of distributed power generation methods, are anticipated to present substantial growth prospects for stakeholders within the silent generators market.

The growing demand for power backup solutions is a key driver behind the expansion of the silent generators market. Silent generators are versatile and can be used in a wide range of applications, including residential homes, hospitals, schools, offices, outdoor events, construction sites, and remote locations. The growing demand for backup power across these diverse sectors drives the need for silent generators that can provide reliable and quiet operation. Traditional generators are known for their noise pollution, which can be disruptive and annoying, especially in residential areas or places where noise restrictions are enforced. The demand for silent generators stems from the desire to mitigate this noise pollution while still maintaining reliable backup power.

Moreover, technological advancements have led to the development of quieter and more efficient generator models. Manufacturers are constantly innovating to improve the performance, fuel efficiency, and noise levels of silent generators, making them more attractive to consumers seeking reliable backup power solutions. Such factors drive the market during the forecast period.

Technological advancements in silent generators have led to significant improvements in efficiency, noise reduction, and overall performance. Manufacturers have developed innovative sound-dampening technologies to reduce noise emissions from generators. This includes the use of advanced materials and designs to minimize vibration and sound transmission, as well as the incorporation of sound-absorbing panels and enclosures.

Various silent generator OEMs launched silent generators equipped with advanced monitoring and control systems that allow users to remotely monitor the generator's status, performance, and fuel levels. This enables proactive maintenance and troubleshooting, ensuring reliable operation and minimizing downtime.

Digital control systems and smart features, such as automatic start/stop functionality, load management, and self-diagnostic capabilities, enhance the usability and efficiency of silent generators. These features help optimize performance, reduce fuel consumption, and extend the lifespan of the generator. For instance, in June 2022, Honda Power Sports & Products, a business unit of American Honda Motor Co., Inc., (U.S.), launched an all-new Honda EU3200i, the newest generator in the Honda Super Quiet EU Series lineup. The high-output Honda EU3200i delivers more power and more convenience than the Honda EU3000i Handi generator in a compact, space-saving, portable package with quick and easy two-step starting, remote smartphone monitoring and control, exceptional fuel efficiency, long run times, simplified maintenance, and additional features. Such factors drive the market during the forecast period.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Distributed power generation involves generating electricity closer to the point of use, often using small-scale generators like silent generators. This approach enhances resilience by decentralizing the power grid and reducing reliance on centralized power plants. Silent generators play a crucial role in providing backup power during grid outages or in areas with unreliable grid infrastructure, ensuring continuity of operations for critical facilities and essential services. In remote or off-grid locations where access to the main power grid is limited or non-existent, distributed power generation using silent generators becomes essential. These generators can provide a reliable and independent power source for off-grid communities, remote construction sites, telecommunications towers, and other isolated facilities.

Moreover, distributed power generation enhances energy security by diversifying the sources of electricity supply. Renewable energy-powered silent generators contribute to a more resilient and sustainable energy infrastructure. They can be integrated into microgrid systems to provide reliable backup power and support renewable energy integration, reducing dependence on fossil fuels and mitigating the impacts of power outages and fuel shortages. Such factors provide lucrative growth opportunities in the development of the market.

Stringent government regulations are being implemented for silent generators, primarily to address two main concerns: noise pollution and air pollution. These regulations typically set noise emission limits for generators depending on their power output and intended use. These limits aim to ensure generators operate within acceptable noise levels in residential, commercial, and industrial areas. Diesel engine-powered silent generators emit pollutants like nitrogen oxides, carbon monoxide (CO), nitrogen oxides (NOx), and particulate matter (PM). Governments also set maximum permissible noise levels for generators, especially in residential and sensitive areas. These limits are often measured in decibels (dB) and vary depending on the time of day and the location.

Moreover, installing and operating a generator may require obtaining permits from local authorities. These permits ensure that generators are installed correctly and operated in compliance with relevant regulations. Such factors create challenges in the development of the market.

Based on portability, the global silent generators market is segmented into portable and non-portable. In 2025, the non-portable segment is expected to account for the larger share of above 60.0% of the global silent generators market. The growth of this segment is attributed to rising demand for flexible power solutions, increasingly stringent noise regulations imposed by governments and local authorities, and urbanization and infrastructure development. Advancements in generator technology have led to the development of quieter and more efficient non-portable generators. These innovations, such as soundproof enclosures and mufflers, enhance the appeal of non-portable silent generators to various industries. Non-portable silent generators are also known for their reliability and durability, making them a preferred choice for applications where continuous power supply is critical. Industries such as healthcare, telecommunications, and manufacturing rely on these generators to maintain operations during power outages.

However, the portable segment is projected to register the highest CAGR during the forecast period. The growth of this segment can be attributed to the rising demand for portable silent generators fueled by outdoor recreational activities such as camping, tailgating, and boating, rising mobile business operations, increasing usage of portable silent generators with recreational vehicles (RVs), and boating to power appliances, electronics, and climate control systems while traveling or moored at remote locations.

Based on sound level, the global silent generators market is segmented into low-noise generators and ultra-silent generators. In 2025, the low-noise generators segment is expected to account for the larger share of above 60.0% of the global silent generators market. The growth of this segment is attributed to various factors, such as increasingly stringent noise regulations imposed by governments and local authorities that drive the demand for low-noise generators. Low-noise generators are essential for emergency preparedness, providing a reliable power source during blackouts, natural disasters, and other emergencies. Homeowners, businesses, hospitals, and government agencies rely on these generators to maintain essential services without causing noise disturbances.

However, the ultra-silent generators segment is projected to register the highest CAGR during the forecast period. The growth of this segment can be attributed to various factors, as ultra-silent generators are essential for applications where noise disturbance must be minimized to ensure optimal conditions. These applications include healthcare facilities, laboratories, recording studios, film sets, and residential neighborhoods where noise levels must be kept exceptionally low.

Based on power source, the global silent generators market is segmented into diesel silent generators, gasoline silent generators, and natural gas silent generators. In 2025, the diesel silent generators segment is expected to account for the largest share of above 65.0% of the global silent generators market. The growth of this segment is attributed to various factors, as diesel generators are known for their high-power output and robust performance, making them suitable for both standby and prime power applications. Industries, businesses, and residential users often require reliable power sources capable of handling heavy loads, and diesel generators fulfill this need effectively. Moreover, diesel generators are renowned for their durability and reliability, with rugged designs that can withstand harsh operating conditions and heavy-duty use. This reliability is particularly valuable in critical applications such as hospitals, data centers, telecommunications facilities, and industrial operations.

However, the natural gas silent generators segment is projected to register the highest CAGR during the forecast period. The availability of natural gas silent generators attracts a diverse customer base, including environmentally conscious users, residential customers, commercial establishments, and industrial facilities, and by offering silent generators powered by natural gas, manufacturers can cater to the needs and preferences of a broader range of customers across various sectors and applications. Natural gas generators offer economic benefits such as lower fuel costs, reduced maintenance expenses, and longer service intervals compared to diesel generators. These cost savings appeal to budget-conscious customers and businesses seeking to optimize operational efficiency, driving demand for natural gas silent generators and fuelling market growth.

Based on phase, the global silent generators market is segmented into single-phase silent generators, three-phase silent generators, split-phase silent generators, and multi-phase silent generators. In 2025, the single-phase silent generators segment is expected to account for the largest share of above 32.0% of the global silent generators market. Single-phase silent generators are well-suited for residential use, small businesses, and other applications with relatively low power requirements. As the residential and small business sectors increasingly recognize the importance of reliable backup power, the demand for single-phase silent generators grows, expanding the overall market.

Single-phase silent generators are preferred in urban and noise-sensitive environments where noise pollution must be minimized to comply with regulations and maintain peace. The silent operation of these generators makes them suitable for residential neighborhoods, urban areas, and commercial districts, driving demand in these markets.

Additionally, the single-phase silent generators segment is projected to register the highest CAGR during the forecast period.

Based on power output, the global silent generators market is segmented into less than 10 kW, 10 kW to 20 kW, and more than 20 kW. In 2025, the 10 kW to 20 kW segment is expected to account for the largest share of the global silent generators market. 10 kW to 20 kW silent generators are well-suited for residential use, small businesses, and other applications with moderate power requirements. As homeowners and small businesses recognize the importance of reliable backup power, the demand for these generators grows, expanding the overall market.

10 kW to 20 kW silent generators are used in various commercial and industrial applications, including construction sites, small manufacturing facilities, telecommunications towers, and temporary events. These generators provide reliable backup power and support operations without causing noise disturbances, driving market growth in commercial and industrial segments.

Additionally, the 10 kW to 20 kW segment is projected to register the highest CAGR during the forecast period.

Based on end user, the global silent generators market is segmented into residential, commercial, and industrial. Further, the commercial market is segmented into corporate offices, retail spaces, hospital & healthcare centers, educational institutes, transit stations, parks & stadiums, and other commercial applications.

In 2025, the commercial segment is expected to account for the largest share of above 55.0% of the global silent generators market. Silent generators are extensively used in commercial spaces to ensure uninterrupted power supply while minimizing noise disruptions. Retail stores, supermarkets, and shopping malls rely on silent generators to maintain essential operations during power outages. These generators power cash registers, lighting, security systems, and refrigeration units, ensuring smooth business operations and preventing revenue loss.

Moreover, data centers, server rooms, and IT facilities require uninterrupted power to prevent data loss, system downtime, and business disruption. Silent generators provide backup power for servers, networking equipment, cooling systems, and security systems, ensuring continuous operation and data integrity. Such factors help to drive the growth of silent generators in commercial during the forecast period.

Additionally, the commercial segment is projected to register the highest CAGR during the forecast period.

In 2025, Asia-Pacific is expected to account for the largest share of above 40.0% of the global silent generators market. Asia-Pacific is a hub for industrial activities, including manufacturing, construction, and infrastructure development. Silent generators are widely used in industrial applications to provide backup power for critical equipment, machinery, and production processes, ensuring minimal disruption and maintaining productivity levels during power outages. With ongoing construction projects and infrastructure development initiatives across the region, there is a rising demand for silent generators on construction sites to power tools, machinery, lighting, and temporary facilities. Silent generators enable construction activities to proceed smoothly, even in remote or noise-sensitive areas. Various key players in this market launched various initiatives in the development of the market, which are as follows:

Moreover, the market in Asia-Pacific is projected to register the highest CAGR of 7.5% during the forecast period.

The report offers a competitive analysis based on an extensive assessment of the product portfolios and geographic presence of leading market players and the key growth strategies adopted by them over the past 3–4 years. Some of the key players operating in the silent generators market are Cummins Inc. (U.S.), Rolls-Royce plc (U.K.), Atlas Copco AB (Sweden), Generac Holdings Inc. (U.S.), Honda Motor Co., Ltd. (Japan), Mahindra Powerol Business (India), Kirloskar Oil Engines Limited (India), Greaves Cotton Limited (India), Huu Toan Group Co., Ltd (Vietnam), Jakson Group (India), Jiangxi Vigorous New Energy Technology Co., Ltd. (China), Kingway Group (China), Constant Power Solutions Ltd (U.K.), Kubota Corporation (Japan), and TAFE Motors and Tractors Limited (India).

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR |

6.6% |

|

Market Size |

USD 5.6 Billion by 2032 |

|

Segments Covered |

By Portability

By Sound Level

By Power Source

By Phase

By Power Output

By End User

|

|

Countries Covered |

Europe (Germany, U.K., France, Italy, Spain, Netherlands, Switzerland, Sweden, Denmark, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia & New Zealand, Indonesia, Thailand, Vietnam, Malaysia, Singapore, and Rest of Asia- Pacific), North America (U.S., Canada), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (UAE, Israel, and Rest of Middle East & Africa) |

|

Key Companies |

Cummins Inc. (U.S.), Rolls-Royce plc (U.K.), Atlas Copco AB (Sweden), Generac Holdings Inc. (U.S.), Honda Motor Co., Ltd. (Japan), Mahindra Powerol Business (India), Kirloskar Oil Engines Limited (India), Greaves Cotton Limited (India), Huu Toan Group Co., Ltd (Vietnam), Jakson Group (India), Jiangxi Vigorous New Energy Technology Co., Ltd. (China), Kingway Group (China), Constant Power Solutions Ltd (U.K.), Kubota Corporation (Japan), and TAFE Motors and Tractors Limited (India) |

The global silent generators market is expected to reach $5.6 billion by 2032, at a CAGR of 6.6% from 2025–2032.

The silent generators market study focuses on market assessment and opportunity analysis through the sales of silent generators across different regions and countries across different market segmentations. This study is also focused on competitive analysis for silent generators based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

In 2025, the non-portable segment is expected to account for the larger share of above 60.0% of the global silent generators market. The growth of this segment is attributed to rising demand for flexible power solutions, increasingly stringent noise regulations imposed by governments and local authorities, and urbanization and infrastructure development. Advancements in generator technology have led to the development of quieter and more efficient non-portable generators. These innovations, such as soundproof enclosures and mufflers, enhance the appeal of non-portable silent generators to various industries.

The commercial segment is projected to register the highest CAGR during the forecast period. Silent generators are extensively used in commercial spaces to ensure uninterrupted power supply while minimizing noise disruptions. Retail stores, supermarkets, and shopping malls rely on silent generators to maintain essential operations during power outages. These generators power cash registers, lighting, security systems, and refrigeration units, ensuring smooth business operations and preventing revenue loss.

The growth of the silent generators market is driven by the growing demand for power backup, technological advancements in silent generators, and growth in construction and infrastructure development. Furthermore, green initiatives, sustainable practices, and a growing trend towards distributed power generation are expected to offer significant growth opportunities for players operating in the silent generators market.

The key players operating in the global silent generators market include Cummins Inc. (U.S.), Rolls-Royce plc (U.K.), Atlas Copco AB (Sweden), Generac Holdings Inc. (U.S.), Honda Motor Co., Ltd. (Japan), Mahindra Powerol Business (India), Kirloskar Oil Engines Limited (India), Greaves Cotton Limited (India), Huu Toan Group Co., Ltd (Vietnam), Jakson Group (India), Jiangxi Vigorous New Energy Technology Co., Ltd. (China), Kingway Group (China), Constant Power Solutions Ltd (U.K.), Kubota Corporation (Japan), and TAFE Motors and Tractors Limited (India).

The Asia-Pacific is projected to register the highest CAGR of 7.5% during the forecast period. The Asia-Pacific region serves as a bustling center for industrial endeavors, encompassing manufacturing, construction, and infrastructure development. Silent generators play a pivotal role in industrial settings, providing backup power for vital equipment, machinery, and production processes. This ensures minimal disruption and sustains productivity levels during power outages.

Given the ongoing surge in construction projects and infrastructure development initiatives throughout the region, there is a notable uptick in demand for silent generators on construction sites. These generators power essential tools, machinery, lighting, and temporary facilities, facilitating seamless operations amidst varying conditions.

Published Date: Apr-2023

Published Date: Dec-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates