Resources

About Us

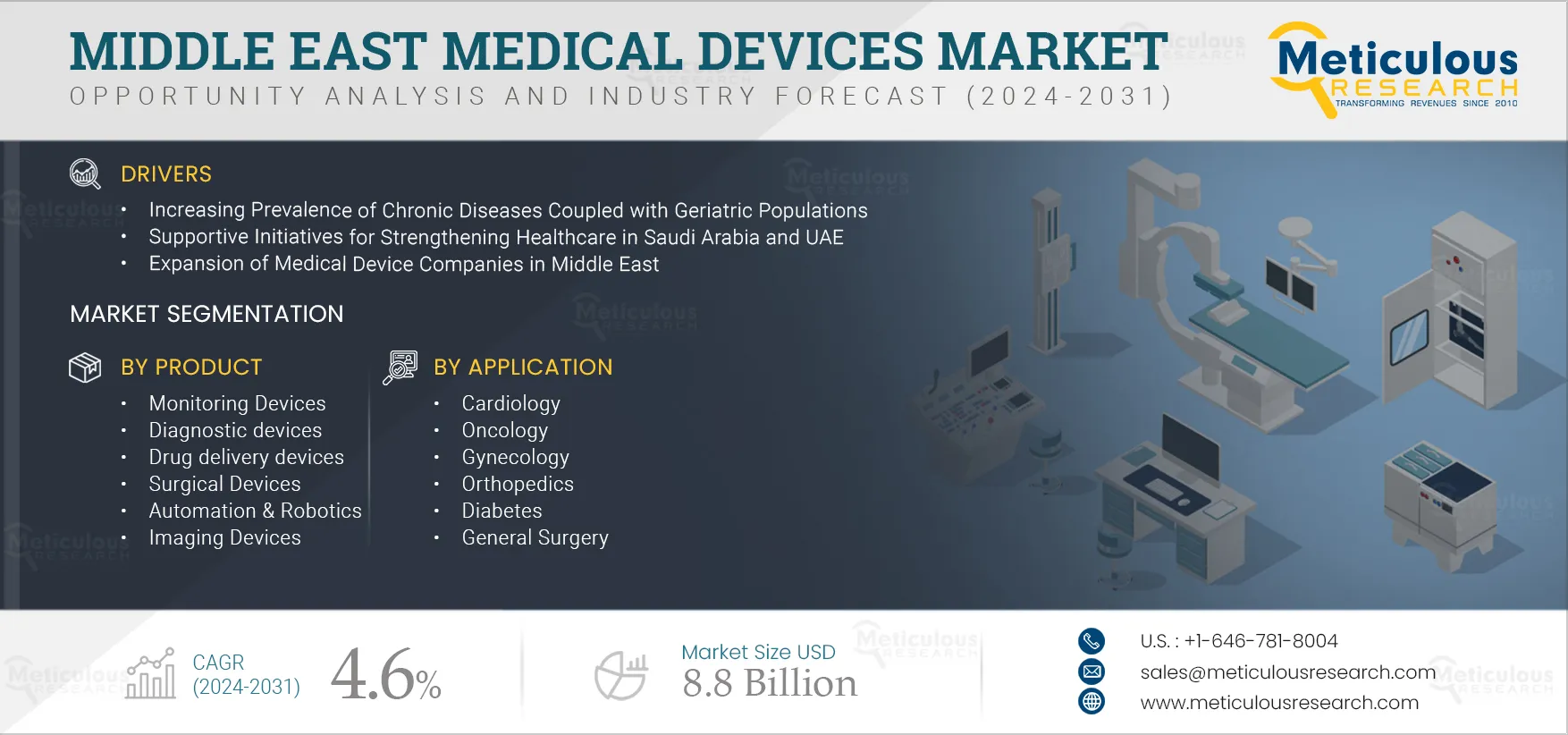

Middle East Medical Devices Market Size, Share, Forecast, & Trends Analysis by Product (IVD, Monitoring, Imaging, Drug Delivery, Surgical, Bioimplant, Stimulation) Risk Type, Application (Cardiology, General Surgery, Orthopedic) End User - Forecast to 2032

Report ID: MRHC - 1041418 Pages: 280 Nov-2024 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market is driven by the increasing prevalence of chronic diseases coupled with geriatric populations, supportive initiatives for strengthening healthcare in Saudi Arabia and UAE, and the expansion of medical device companies in the Middle East & Middle East. Furthermore, expanding healthcare services in the Middle East and emerging medical tourism in Middle Eastern countries are expected to generate growth opportunities for the stakeholders in this market.

Key Findings in the Middle East Medical Devices Market

Click here to: Get Free Sample Copy of this report

The growing global burden of the geriatric population is contributing to an increase in chronic diseases such as cancer, diabetes, kidney disorders, stroke, and heart disease. According to the National Institute of Health (NIH), chronic diseases were a major public health issue in 2021, with Oman reporting 185.75 deaths per 100,000 population due to these conditions. The rising prevalence of chronic diseases is attributed to factors such as tobacco use, physical inactivity, alcohol consumption, unhealthy diets, air pollution, genetics, and viruses. Cancer, in particular, has become one of the most costly diseases worldwide, significantly impacting individuals' lives globally. For example, according to GLOBOCAN, 28,113 new cancer cases were diagnosed in Saudi Arabia in 2022, and this number is expected to rise to 39,900 by 2032.

The geriatric population is more vulnerable to a range of chronic diseases, including hearing loss, chronic obstructive pulmonary disease (COPD), diabetes, dementia, joint pain, osteoarthritis, and refractive errors. According to the Telecommunications and Digital Government Regulatory Authority (TDRA), in 2021, 11.8% of the UAE's population was affected by diabetes. Medical devices play a crucial role in treating chronic conditions and supporting surgeries. As the prevalence of chronic diseases rises alongside the growing geriatric population, the demand for medical devices in the Middle East is expected to increase, driving market growth.

In recent years, new medical devices with advanced features and greater efficiency have been introduced to the market, surpassing conventional devices. Ongoing research and development in medical devices have resulted in improved communication, enhanced patient care and safety, better access to medical records, more accurate diagnostics and treatment, and streamlined medical administration—all while reducing hospital costs. For example, in February 2025, Zylox-Tonbridge Medical Technology Co., Ltd. (China) received marketing approval from the Ministry of Health and Prevention in the United Arab Emirates for five medical devices, including the ZENFluxion Drug-coated PTA Balloon Catheter, ZENFlow HP PTA Balloon Catheter, ZENFlow PTA Balloon Catheter, ZENFlex Peripheral Stent System, and ZENFLEX Pro Peripheral Drug-eluting Stent System.

In addition, in December 2022, the government of Saudi Arabia collaborated with Medtronic plc (U.S.) to launch a ventilator for the intensive care unit (ICU). Therefore, technological advancements in medical devices are driving the medical device market.

Numerous medical device companies are aiming for partnerships and collaborations to innovate offerings and improve accessibility to medical treatments in the region. For instance, in June 2025, The Department of Health in Abu Dhabi partnered with Novartis AG (Switzerland) and AstraZeneca PLC (U.K). This partnership aims for two primary areas, which are advancing clinical genomics research for real-world data and generating evidence for research on radioligand therapy for cancer patients.

Thus, increasing partnerships and collaborations by the Medical Devices companies creates a growth opportunity for the market.

The rise in surgical procedures can be attributed to the increasing number of injuries, accidental cases, and chronic diseases. Many surgeries treat various injuries or diseases, such as cardiology, gastrointestinal surgery, orthopedic surgery, nephrology, neurology, and other general surgeries.

World Heart Federation (WHF), cardiovascular disease is the number one cause of death in the Middle East and North Middle East region. About 1.4 million deaths are caused due to cardiovascular disease every year in the Middle East and the northern Middle East region.

In July 2024, The Ministry of Health (MOH) provided a statement that there were around 170,000 non-critical surgeries performed in various surgical specialties. According to the Ministry of Health (MOH), In 2024, there were about 177,744 surgeries carried out in hospitals where general surgery topped the list with 21%, gynecology with 13%, and eye surgery with 13% all around Saudi Arabia’s region. In September 2025, Saudi Arabia’s hospital performed the world’s first fully robotic-assisted heart transplant surgery on a 16-year-old patient. According to the World Health Organization (WHO), In 2022, in Saudi Arabia, there were 28,113 new cases of cancer and there were 13,399 new casualties. Thus, an increasing number of surgical procedures is expected to create an opportunity for market growth.

Based on products, the Middle East medical devices market is segmented into monitoring devices, diagnostic devices, drug delivery devices, surgical devices, bio implants & stimulation devices, automation & robotics, imaging devices, and other devices. In 2025, the monitoring devices segment is estimated to account for the largest share of the Middle East medical devices market.

The large market share of this segment is attributed to the increasing demand for medical devices for surgical procedures in the Middle East, technological advancements in medical devices, and increasing healthcare expenditure. For instance, the United Arab Emirates Ministry of Finance (UAEMF) announced a budget for 2024-2026 of 4.8 billion (7.6% of the total general budget) for healthcare and community protection.

The report includes a competitive landscape based on an extensive assessment of the key strategic developments that led market participants to adopt over the past years. The key players profiled in the global biopharmaceutical processing equipment and consumables market report are Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies Inc. (U.S), Abbott Laboratories (U.S.), Smith+Nephew. (U.K.), Coloplast Corp. (Denmark), Saudi Mais CO. (Saudi Arabia), Zimmer Biomet. (U.S), Siemens Healthineers AG (Germany), F. Hoffmann-La Roche Ltd. (Switzerland), Becton, Dickinson and Company. (U.S), Olympus Corporation (Japan), Johnson & Johnson Services, Inc. (U.S.), Novartis AG (Switzerland), and Cardinal Health. (U.S.).

|

Particulars |

Details |

|

Number of Pages |

280 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

4.6% |

|

Market Size (Value) |

USD 8.8 Billion by 2032 |

|

Segments Covered |

By Product

By Risk Type

By Application

By End User

|

|

Countries Covered |

Saudi Arabia, United Arab Emirates, Kuwait, Qatar, Bahrain, Egypt, Israel, Oman, Turkey, Jordan, Lebanon and the Rest of the Middle East |

|

Key Companies |

Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies Inc. (U.S), Abbott Laboratories (U.S.), Smith+Nephew. (U.K.), Coloplast Corp. (Denmark), Saudi Mais CO. (Saudi Arabia), Zimmer Biomet (U.S), Siemens Healthineers AG (Germany), F. Hoffmann-La Roche Ltd. (Switzerland), Becton, Dickinson and Company. (U.S), Olympus Corporation (Japan), Johnson & Johnson Services, Inc. (U.S.), and Cardinal Health. (U.S.) |

The Middle East Medical Devices market size was valued at $6 billion in 2024.

The market is projected to grow from $6.4 billion in 2025 to $8.8 billion by 2032.

The Middle East medical devices market analysis indicates significant growth, reaching $8.8 billion by 2032 at a compound annual growth rate (CAGR) of 4.6% from 2025 to 2032.

The key companies operating in this market include Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), GE HealthCare Technologies Inc. (U.S), Abbott Laboratories (U.S.), Smith+Nephew. (U.K.), Coloplast Corp. (Denmark), Saudi Mais CO. (Saudi Arabia), Zimmer Biomet. (U.S), Siemens Healthineers AG (Germany), F. Hoffmann-La Roche Ltd. (Switzerland), Becton, Dickinson and Company. (U.S), Olympus Corporation (Japan), Johnson & Johnson Services, Inc. (U.S.), Novartis AG (Switzerland), and Cardinal Health. (U.S.).

A prominent market trend in Middle Eastern medical devices is the rising investments by key players, the integration of AI and robotics in medical devices, and the increasing adoption of wearable devices.

By country, Saudi Arabia holds the largest Middle Eastern medical devices market share in 2025. However, the United Arab Emirates is expected to witness the fastest growth, driven by technological advancements in medical devices, rising awareness for early disease diagnosing and treating, and partnerships & collaborations for medical devices.

The primary drivers of the Middle East medical devices market are the increasing prevalence of chronic diseases coupled with geriatric populations, supportive initiatives for strengthening healthcare in Saudi Arabia and the UAE, and the expansion of medical device companies in the Middle East.

Published Date: Oct-2025

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Nov-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates