Resources

About Us

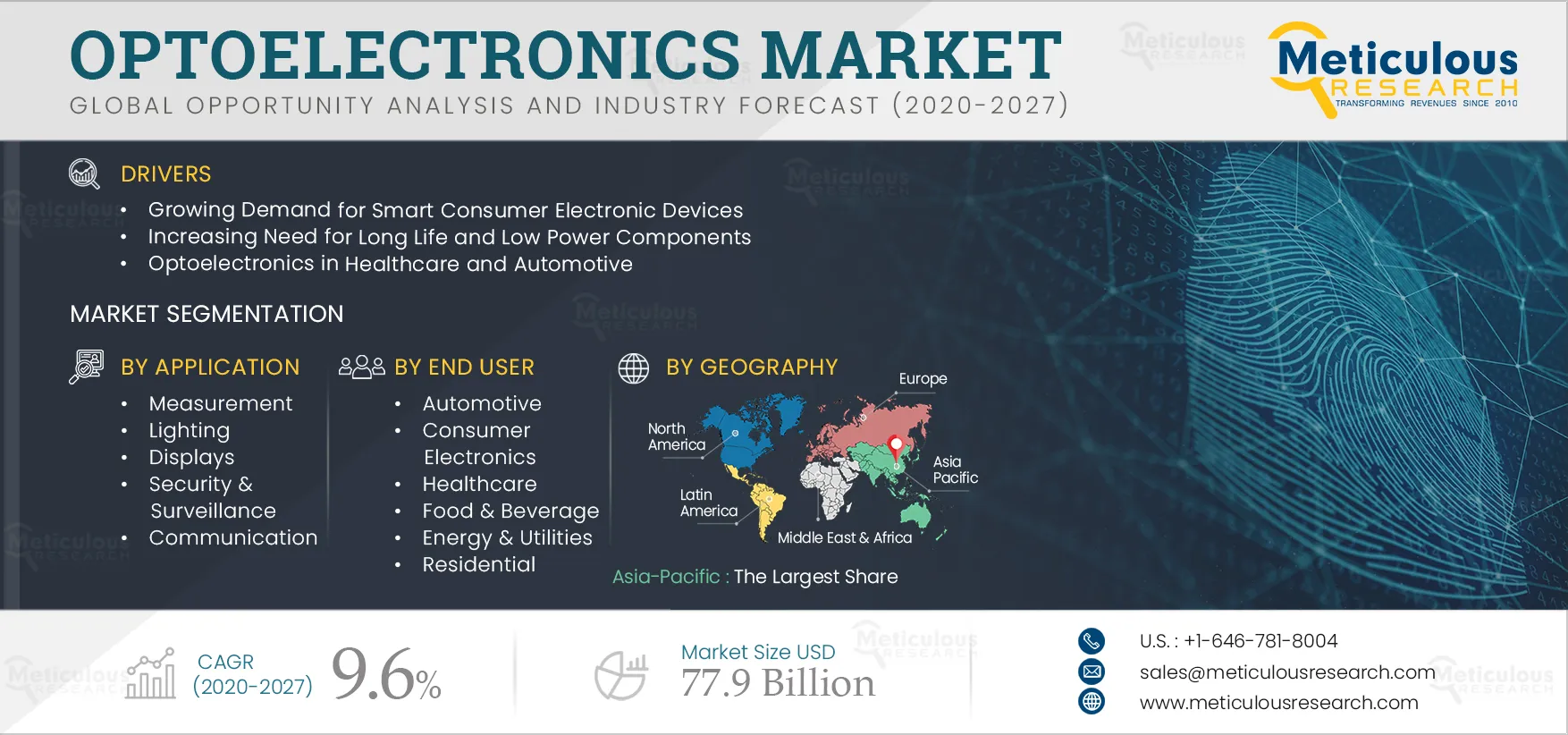

Optoelectronics Market by Device (LEDs, Sensors), Device Material (Gallium Nitride, Indium Phosphide), Application (Measurement, Communication, Lighting), End User (Consumer Electronics, Healthcare), and Geography - Forecast to 2027

Report ID: MRSE - 104457 Pages: 308 Jun-2021 Formats*: PDF Category: Semiconductor and Electronics Delivery: 2 to 4 Hours Download Free Sample ReportThe Optoelectronics Market is expected to grow at a CAGR of 9.6% from 2020 to 2027 to reach $ 77.9 billion by 2027 from $ 41.2 billion in 2020. The market is growing rapidly due to the increasing demand for optical solutions in the healthcare and automotive industry verticals, growing demand for smart consumer electronics devices, and increasing need for durable and low power consuming components. However, high initial costs associated with manufacturing and fabrication are expected to hamper the market growth. The market is expected to witness immense growth opportunities from the proliferation of IIoT applications, advancements in Li-Fi technology, and innovations in optoelectronic devices.

Increasing Demand for Optical Solutions in the Healthcare and Automotive Industries Is Driving the Growth of the Optoelectronics Market

Optoelectronics is a critical part of several advanced technologies. Healthcare and automotive are the prominent industries that have started adopting optoelectronics in recent years. The use of optical sensors for biosensing applications in the healthcare industry allows for monitoring the heart rate and the functioning of other vital organs in a human body. Thus, the use of non-intrusive, inexpensive sensors across advanced healthcare applications has led to a paradigm change in consumer wellness. Moreover, the growing demand for automotive lighting for interior and exterior applications and head-up display units is expected to propel the demand for optoelectronic components such as LEDs and display panels.

The sudden outbreak of the COVID-19 pandemic had a significant impact on public health as well as businesses. To stop the spread of the virus, governments worldwide imposed lockdowns, consequently shutting down on-premise business processes and manufacturing operations and disrupting supply chains and production schedules. This scenario led to a demand-supply gap of components required in residential and healthcare applications. The demand for optoelectronics witnessed a dip due to the shutdown of consumer electronics, automobile, industrial, and other manufacturing facilities across the globe. Moreover, Asia-Pacific being the hub of semiconductor manufacturing and China, the epicenter of the virus outbreak, led to huge losses during the first and second quarters of 2020. However, the market is expected to gain traction in 2021, with manufacturing facilities resuming operations at full capacity to meet the growing demand for optoelectronic components across various industry verticals.

Click here to: Get Free Request Sample Copy of this report

In 2020, the Sensors Segment Accounted for the Largest Share of the Optoelectronics Market

Based on device, the optoelectronics market has been segmented into LEDs, sensors, infrared components, optocouplers, photovoltaic cells, displays, and others such as optical fiber, solid-state relays, and laser diodes. The sensors segment is further divided into phototransistors, photodiodes, photo relays, image sensors, optical sensors, and UV sensors. The large market share of the sensors segment is attributed to the high adoption of various sensors such as photodiodes, image sensors, and optical sensors across various industry verticals. The use of optical sensors in the textile industry offers improved safety; CMOS image sensors are used in cameras, spectroscopy, and LiDAR systems; and plasmonic color sensors are used for LED monitoring and colorimetry, among other applications. Thus, the adoption of various sensors across a wide application area contributes to the sensors segment’s highest share among devices in the optoelectronics market.

In 2020, the Gallium Nitride Segment Commanded the Largest Share amongst Device Materials in the Optoelectronics Market

Based on device material, the optoelectronics market has been segmented into gallium nitride, gallium arsenide, gallium phosphide, silicon germanium, silicon carbide, and indium phosphide. Gallium nitride (GaN) is a binary III/V direct bandgap semiconductor that is ideal for high-power transistors capable of operating at high temperatures. The ability to withstand high temperatures and voltages makes gallium nitride ideal for imaging and sensing applications. GaN is used in LEDs, power devices, RF components, lasers, and photonics applications. Thus, the need for enhanced efficiency, minimized power consumption, and lower system costs contributes to the GaN segment’s largest share among other device materials in the optoelectronics market.

In 2020, the Measurement Segment Accounted for the Largest Share of the Optoelectronics Market

Based on application, the optoelectronics market has been segmented into lighting, security & surveillance, communication, measurement, displays, and other applications such as infotainment, spectrometry, and scanning. An OMS detects light and uses this detection to estimate the 3D positioning of a marker via time-of-flight triangulation. OMSs are based on fixed cameras and can therefore acquire data only within a restricted area. Optoelectronics measurement systems are more accurate than other systems owing to which optical measurement systems are used for process monitoring and control across various industries and in machine vision and other applications, thereby contributing to the segment’s largest market share.

In 2020, the Consumer Electronics Segment Accounted for the Largest Share amongst End Users in the Optoelectronics Market

Based on end user, the optoelectronics market has been segmented into automotive, consumer electronics, aerospace & defense, IT & telecommunication, healthcare, food & beverage, energy & utilities, residential, industrial, commercial, and others, such as media & entertainment, retail, and government. The largest market share of the consumer electronics segment is attributed to the growing adoption of optoelectronic components in the manufacture of consumer electronics and advancements in electronic devices such as smartphones, high-end cameras, smart television displays, LED projectors, organic LEDs, and flexible 3-D displays.

In 2020, Asia-Pacific Commanded the Largest Share of the Optoelectronics Market

In 2020, Asia-Pacific accounted for the largest share of the optoelectronics market, followed by North America and Europe. Asia-Pacific is the hub of semiconductor component manufacturing, and the region houses the majority of key players operating in the optoelectronics market such as Renesas, Rohm Co., Ltd, Hamamatsu Photonics K.K., Samsung Electronics Co., Ltd., Sony Corporation, Panasonic Corporation, and Sharp Corporation along with other small regional players. Furthermore, growth in the healthcare, consumer electronics, and automotive industries is further expected to propel the demand for optoelectronic components in the region. China, Japan, South Korea, and India are the major market contributors in the region.

Key Players

The report includes a competitive landscape derived from an extensive assessment of the key strategic developments by leading market participants in the industry over the past three-four years. The key players operating in the optoelectronics market are Rohm Co., Ltd (Japan), Renesas (Japan), Vishay Intertechnology, Inc. (U.S.), Hamamatsu Photonics K.K. (Japan), Osram Licht AG (Germany), ON Semiconductor (U.S.), Cree, Inc. (U.S.), TT Electronics (U.K.), Samsung Electronics Co., Ltd. (South Korea), Sony Corporation (Japan), Panasonic Corporation (Japan), General Electric Company (U.S.), Sharp Corporation (Japan), Broadcom (U.S.), and Texas Instruments (U.S.).

Scope of the Report

Optoelectronics Market, by Device

Optoelectronics Market, by Device Material

Optoelectronics Market, by Application

Optoelectronics Market, by End User

Optoelectronics Market, by Geography

Key Questions Answered in the Report

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates