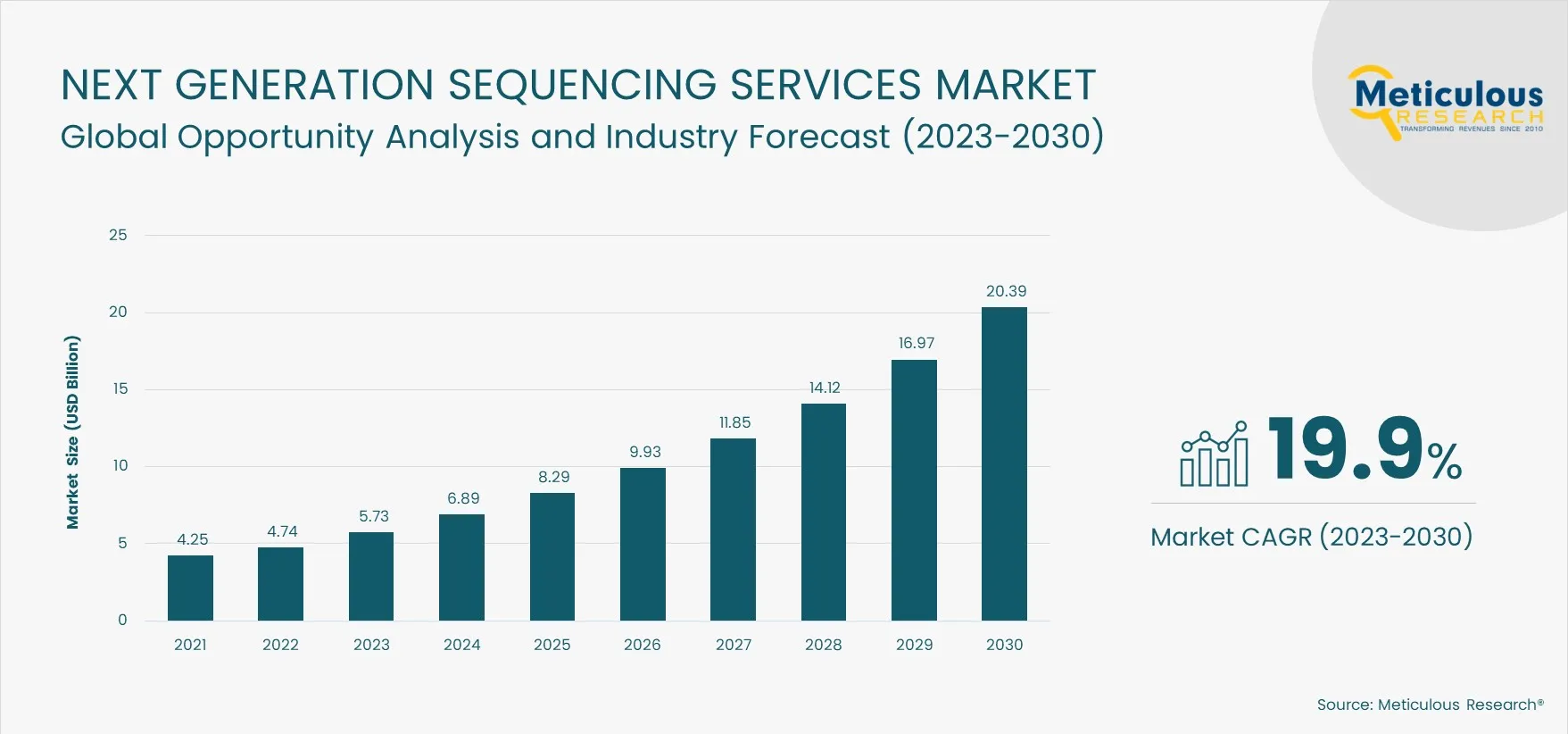

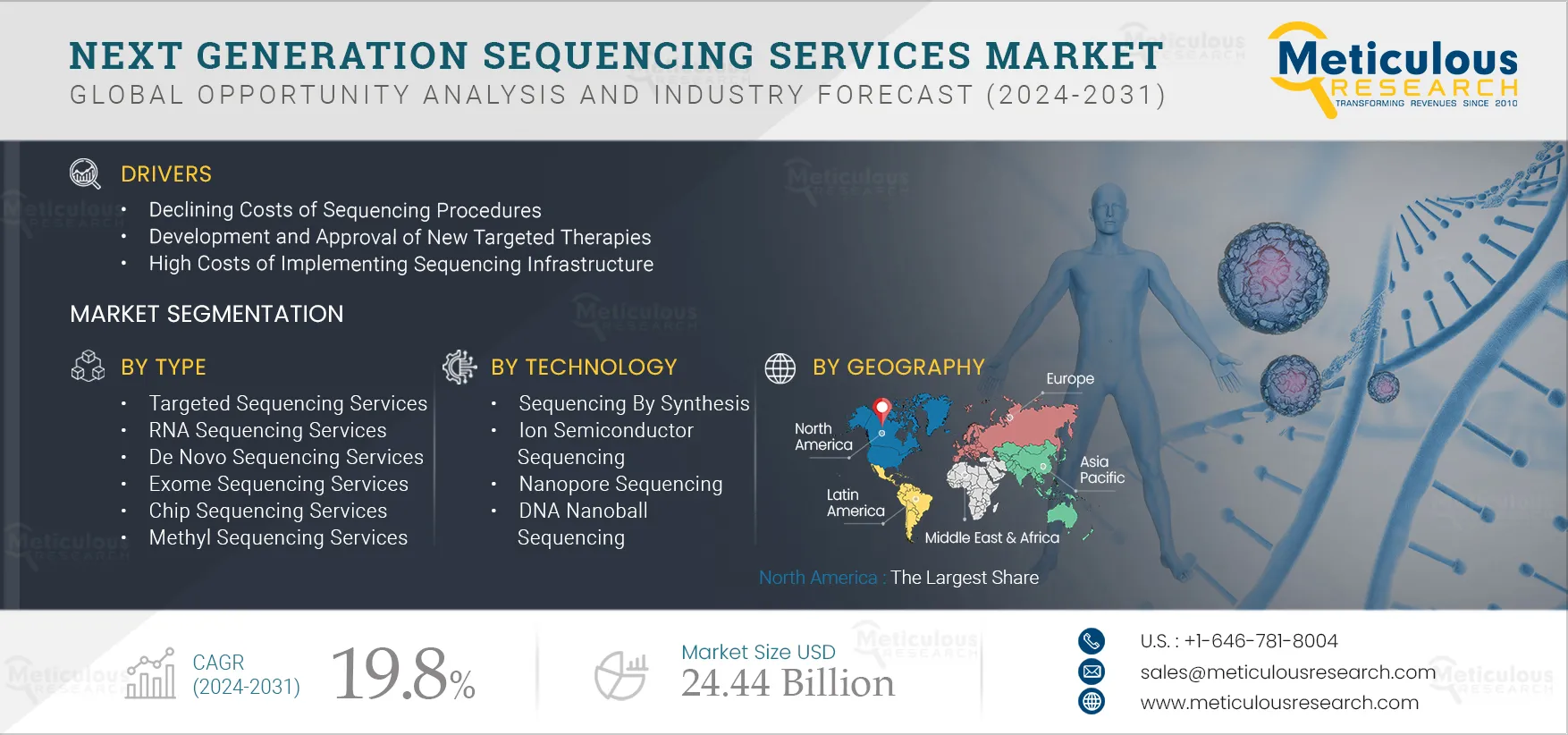

The Next Generation Sequencing Services Market is expected to grow at a CAGR of 19.9% from 2023 to 2030 to reach $20.39 billion by 2030. The growth of this market is mainly driven by the declining costs of sequencing procedures, the development & approval of new targeted therapies, the rising prevalence of cancer, partnerships between NGS service providers & pharmaceutical companies, the high cost of implementing sequencing infrastructure, and technological advancements in NGS. However, the availability of alternative technologies, the lack of skilled professionals for sample preparation & analysis, and the low chances of positive actionable mutations for precision medicine are factors restraining the growth of the NGS services market.

Furthermore, the increasing applications of NGS in cancer & agri-genomics research and advancements in sequencing data analytics are expected to generate market growth opportunities. However, regulatory & standardization concerns in diagnostic testing, the installation of in-house NGS facilities in large hospitals & research institutes, and the ethical issues & costs related to non-invasive prenatal genetic testing are major challenges for the stakeholders in this market.

Decreasing Costs of Sequencing to Drive the Market Growth

Recent advancements in genomics research have substantially reduced the costs of genome sequencing procedures. In the past few years, the availability of advanced NGS technologies has lowered sequencing costs and significantly reduced the time required for DNA sequencing. According to the National Human Genome Research Institute (NHGRI), the cost of sequencing a human genome decreased from USD 29,092 in 2010 to USD 562 in 2021.

As the cost of sequencing is declining, the adoption of NGS services has increased rapidly. NGS has enabled the discovery of genetically targeted drugs and blood tests that can detect cancer at early stages. It has also enabled diagnosis for people with rare diseases. The declining cost of sequencing has increased its adoption in clinical applications. Thus, the declining sequencing costs are expected to drive the growth of the NGS services market.

Installation of In-house NGS Systems to Hinder Market Growth

The advantages of NGS and the plummeting costs of NGS procedures have led to the installation of in-house NGS systems. Various large hospital chains and academic & research institutes are increasingly setting up in-house NGS facilities for their sequencing needs. These in-house facilities help healthcare professionals by reducing turnaround times for test results, enabling them to effectively plan personalized treatments for their patients. These in-house facilities help researchers improve research efficiency by reducing turnaround times and retaining sample quality. They also help organizations improve their revenue channels, adversely affecting the revenues of core NGS service providers.

Thus, the increasing installation of in-house sequencing platforms and facilities among large-scale hospitals and academic & research institutes may hamper the revenues of NGS service providers, affecting the growth of the NGS services market.

Key Findings in the Next Generation Sequencing Services Market Study:

In 2023, the Targeted Sequencing Services Segment is Expected to Account for the Largest Share of the NGS Services Market

Based on type, the global NGS services market is segmented into targeted sequencing services, whole genome sequencing services, RNA sequencing services, exome sequencing services, de novo sequencing services, ChIP sequencing services, methyl sequencing services, and other NGS services. The targeted sequencing services segment is expected to account for the largest share of the NGS services market in 2023. The large share of this segment is attributed to the increased use of targeted sequencing in precision medicine, its higher cost efficiency compared to other sequencing services, the increased number of clinical applications for diagnosing diseases and monitoring patient health, its rapid turnaround time, and its growing importance in cancer research and drug discovery.

The Nanopore Sequencing Segment is Expected to Grow at the Highest CAGR During the Forecast Period of 2023–2030

Based on technology, the global NGS services market is segmented into sequencing by synthesis (SBS), ion semiconductor sequencing (IOS), single-molecule real-time sequencing (SMRT), nanopore sequencing, and DNA nanoball sequencing. The nanopore sequencing segment is expected to grow at the highest CAGR during the forecast period. The benefits offered by nanopore sequencing technology, such as inexpensive sample preparation, label-free ultra-long reads, high throughput, and lower material requirements compared to other sequencing technologies, drive the growth of this segment.

The Clinical Applications Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Based on application, the global NGS services market is segmented into research applications and clinical applications. The clinical applications segment is expected to grow at the highest CAGR during the forecast period of 2023 to 2030. The growth of this segment is attributed to factors such as the growing adoption of next generation sequencing for oncology applications, the increasing demand for precision medicine in cancer therapy, and the rising need for specific cancer gene-targeting diagnostic tests.

Click here to: Get Free Sample Pages of this Report

In 2023, the Hospitals & Clinics Segment is Estimated to Account for the Largest Share of the Global NGS Services Market

Based on end user, the global NGS services market is segmented into hospitals & clinics, pharmaceutical & biotechnology companies, academic institutes & research centers, and other end users. In 2023, the hospitals & clinics segment is estimated to account for the largest share of the global NGS services market. The large share of this segment is attributed to factors such as high capital requirements for building in-house NGS capabilities in hospitals & clinics, the rising prevalence of cancer and other chronic diseases, the growing demand for advanced medical treatments, and the rising number of biomarker-based therapies.

In 2023, North America is Estimated to Account for the Largest Share of the Global NGS Services Market

Based on region, the NGS services market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, North America is estimated to account for the largest share of the global NGS services market. The large share of North America in the NGS services market is primarily attributed to the presence of leading NGS service providers in the region, favorable government initiatives for genomics research, growing applications of NGS-based research, declining cost of sequencing coupled with the rising awareness of NGS, increasing research investments by pharmaceutical and biopharmaceutical companies, increasing cancer prevalence, and favorable reimbursement scenario in the region.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments that market participants adopted over the past four years. The key players profiled in the global next generation sequencing services market report include Illumina, Inc. (U.S.), QIAGEN N.V. (Netherlands), PerkinElmer, Inc. (U.S.), Eurofins Scientific S.E. (Luxembourg), Macrogen, Inc. (South Korea), LGC Limited (U.K.), GENEWIZ, Inc. (U.S.), Beijing Genomics Institute (China), MedGenome, Inc. (U.S.), DNA Link, Inc. (South Korea), Novogene Co., Ltd. (China), CD Genomics (U.S.), SeqLL, Inc. (U.S.), Otogenetics Corporation (U.S.), Foundation Medicine, Inc. (U.S.), Quest Diagnostics Incorporated (U.S.), and Invitae Corporation (U.S.).

Scope of the Report

Next Generation Sequencing Services Market Assessment, by Type

- Targeted Sequencing Services

- RNA Sequencing Services

- De Novo Sequencing Services

- Exome Sequencing Services

- Chip Sequencing Services

- Whole Genome Sequencing Services

- Methyl Sequencing Services

- Other Services

Next Generation Sequencing Services Market Assessment, by Technology

- Sequencing By Synthesis

- Ion Semiconductor Sequencing

- Single-molecule Real-time Sequencing

- Nanopore Sequencing

- DNA Nanoball Sequencing

Next generation Sequencing Services Market Assessment, by Application

- Research Applications

- Drug Discovery

- Agriculture & Animal Research

- Other Research Applications

- Clinical Applications

- Reproductive Health Diagnosis

- Oncology

- Infectious Diseases

- Other Clinical Applications

(Note: Other research applications include food microbiology, microbiota analysis in the beverage industry, and environmental studies, and other clinical applications include the detection of genetic aberrations in neurological disorders, rare diseases, metabolic and immune disorders, and food-borne illnesses)

Next Generation Sequencing Services Market Assessment, by End User

- Hospitals & Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Academic Institutes & Research Centers

- Other End Users

Next Generation Sequencing Services Market Assessment, by Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe (RoE)

- Asia-Pacific (APAC)

- China

- Japan

- China

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America

- Middle East & Africa

Key questions answered in the report: