Resources

About Us

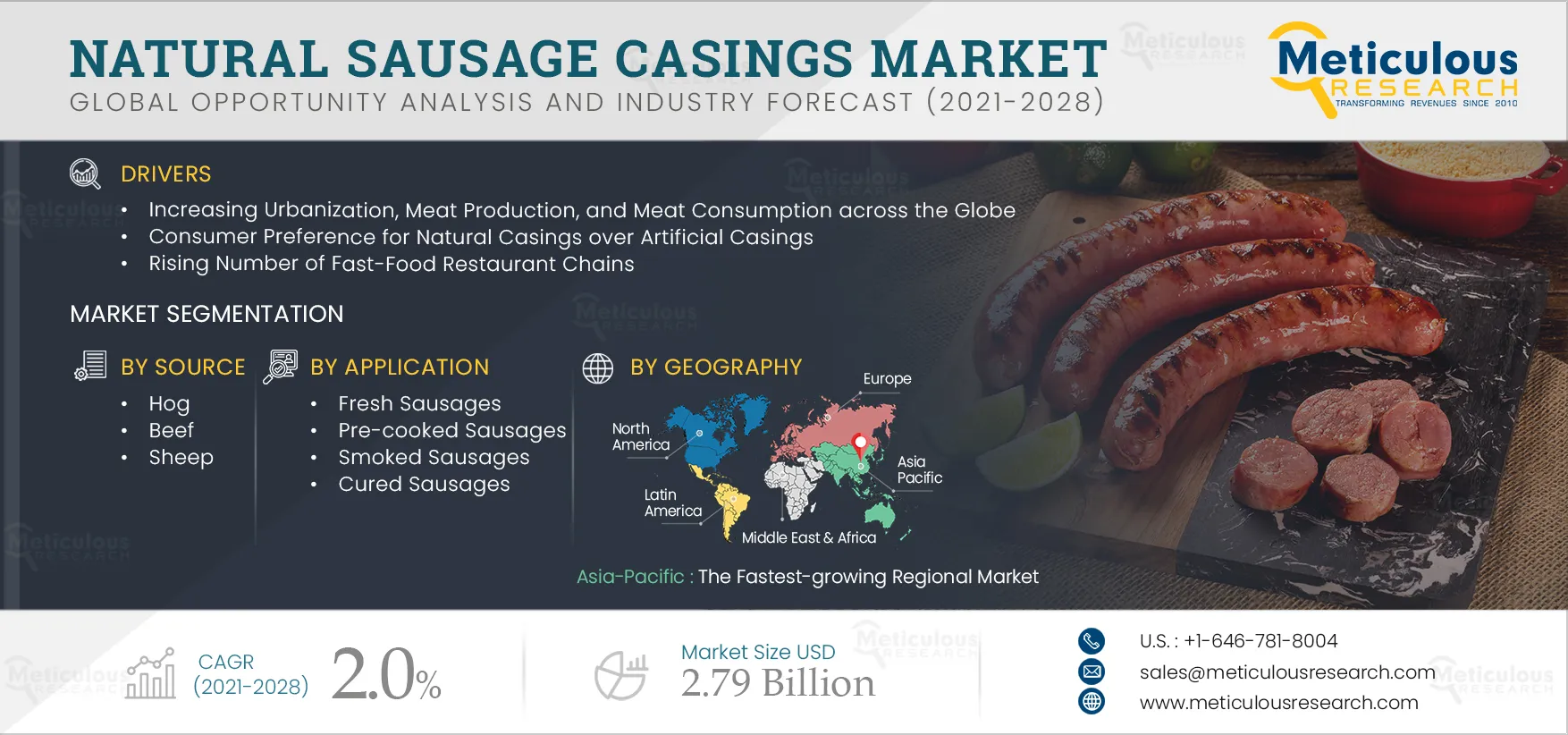

Natural Sausage Casings Market by Source (Hog, Beef, Sheep), by Application (Fresh Sausages, Pre-cooked Sausages, Smoked Sausages, and Cured Sausages), by Distribution Channel (Offline and Online) - Global Forecast To 2028

Report ID: MRFB - 104462 Pages: 166 Sep-2021 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThe Natural Sausage Casings Market is expected to grow at a CAGR of 2.0% from 2021 to 2028 to reach USD 2.79 billion by 2028 from USD 2.44 billion in 2021. In terms of volume, the global natural sausage casings market is expected to grow at a CAGR of 1.4% from 2021 to 2028 to reach 36,213.3 million meters by 2028 from 32,867.5 million meters in 2021.

Increasing urbanization, meat production, & meat consumption; consumer preference for natural casings over artificial casings; and the rising number of fast-food restaurant chains are the key factors driving the natural sausage casings market's growth. Moreover, growing demand from emerging economies—Asia-Pacific, Latin America, and the Middle East and Africa are expected to create lucrative opportunities for players operating in this market. However, casings manufactures’ shift from natural casings to artificial casings due to operational challenges and increasing consumers' interest in vegan products are expected to hinder the growth of this market.

COVID-19 Outbreak is Stimulating Consumers to Rethink Consumption of Animal-based Products

The natural sausage casings industry has been harshly affected by the COVID-19 pandemic in the developed regions, such as North America and Europe. According to Rabobank, as of April 2020, U.S. meat production declined by 20% compared to the previous year. This decline in meat production is expected to increase meat product prices, thereby increasing natural sausage casing prices. The outbreaks also have impelled the closure of 17 meat processing facilities in the U.S. Furthermore, the COVID-19 outbreak and negative associations with animal-based food have also hampered the demand for natural sausage casings in Europe. Numerous countries in the European region have witnessed the worst outcomes of COVID-19, especially in 2020. As a result, there is an increasing trend of veganism in Europe, which is expected to weaken the demand for natural sausage casings in Europe.

The COVID-19 pandemic has caused severe disruptions throughout the entire meat industry in developing regions, including Asia-Pacific, the Middle East and Africa, and Latin America. Processed meat products face significantly reduced consumption, disrupted supply chains, and stringent trade regulations in these regions. As of July 2020, China’s National Health Commission issued coronavirus control guidelines for meat companies, including imported livestock and poultry products, that need to be virus-free before processing in Chinese plants. Also, the Chinese government aims to reduce both emissions and obesity levels by 2030. Customers in Asia and the Middle East tend to avoid short shelf life and non-essential products; there has been an increased emphasis on fresh produce like vegetables. These processed meat markets disrupt the demand for natural sausage casings in developing countries, thereby negatively impacting the global natural casings market.

Rising Number of Fast Food Restaurant Chains To Drive the Market Growth

Globalization and urbanization have impacted eating habits, changing the trend towards increasing processed ready-to-eat products. The consumption pattern changes due to busy lifestyles, increasing per capita income, and preference for convenience food products are leading to a growing trend of fast-food consumption.

As demand for fast food increases, fast-food restaurant chains, and small eateries are also growing steadily across the globe. According to the International Franchise Association, globally, fast food generates revenue of over $570 billion. The United States has a major contribution to global fast-food revenue. Around 50 million people in the U.S. depend upon fast food. The fast-food industry in the United States is worth ~$198.9 billion. By 2020, this figure is forecasted to exceed $223 billion.

Thus, the growing fast-food industry and a rise in the number of fast-food restaurants & eateries that sell processed meat products, including sausages and hot dogs, drive the market for natural casings.

Manufacturers’ Shift from Natural Casings to Artificial Casings due to Operational Challenges to Restrict the Market Growth

Natural casings manufacturing involves several challenges, such as the difficulties in sourcing animal intestines, the volatility of raw material prices, and the long production time of natural casings. The cleansing requirement for animal intestines, the necessity of a cold storage environment, and high labor costs increase the overall operational cost.

In contrast, collagen casings are more suited to automated production and cheaper to manufacture than natural casings. They also meet food hygiene and traceability requirements more easily and can be more readily produced to technical specifications ensuring consistency, reliability, and versatility. This is expected to shift the focus of casing manufacturers from natural to artificial casings.

Click here to: Get Free Sample Pages of this Report

Key Findings in the Natural Sausage Casings Market Study:

In 2021, the hog casings segment is estimated to account for the largest share of the overall natural sausage casings market

Based on source, the natural sausage casings market is segmented into hog, beef, sheep, and other sources. The hog casings segment is estimated to account for the largest share of the overall natural sausage casings market in 2021. Hog casings are mostly made from the main intestine of the pig, measuring approx. 20 yards in length. This segment's leading position is mainly attributed to its competency to offer wider caliber, high resistance capacity than other natural sausages casing sources, and molding ability into a wide variety of shapes. These casings are mostly used in pork or beef sausages, butcher’s thick sausages, Cumberland sausage, boerewors, frankfurters, smoked sausage, liver sausage, pepperoni, and bratwurst. However, the sheep segment is expected to grow at the fastest CAGR during the forecast period due to its unique properties such as the highest quality, small diameter, thinner wall, and tenderness.

The smoked sausages segment expected to grow with the fastest CAGR during the forecast period

Based on application, the natural sausage casings market is segmented into fresh, pre-cooked, smoked, and cured sausages. The smoked sausages segment is expected to grow at the fastest CAGR during the forecast period due to increasing demand for ready-to-go premium meat products, a greater variety of smoked products available in modern groceries, and increasing preference by craft food producers for smoking technology.

The offline segment to dominate the natural sausage casings market in 2021

Based on distribution channel, the natural sausage casings market is segmented into offline and online. The offline segment is estimated to account for the largest share of the overall natural sausage casings market in 2021. This market's large share is mainly attributed to the growing number of modern groceries due to higher-quality products offering, a broader assortment, and an improved shopping experience. However, the online distribution channel segment is expected to grow at the fastest CAGR during the forecast period. The rapid growth of this segment is mainly attributed to faster accessibility and cost-effectiveness.

Asia-Pacific: the fastest growing regional market

At the regional level, Europe is estimated to account for the largest share of the overall natural sausage casings market in 2021. The prominent position of Europe in the natural sausage casings market is primarily attributed to the presence of a large number of sausage manufacturers, changing food consumption patterns in favor of convenience food, and a surge in meat and sausage consumption. However, Asia-Pacific possesses lucrative growth potential for the natural casings market during the forecast period. This is mainly attributed to the rising number of fast-food restaurant chains, rising expenditure on sausage casings, growing westernization, growing population & urbanization. Most of the natural casings in this region will be driven by developing countries, including Indonesia, Thailand, and India, due to the increasing livestock production and processing and growing focus on processed meat products. The need for convenience is the major driver behind this region’s growing processed meat markets.

Key Players

The natural sausage casings market is fragmented with many small private vendors in the market. Some of the key players operating in the natural sausage casings market are Amjadi GmbH (Germany), World Casing Corporation (U.S.), Peter Gelhard Naturdärme KG (Germany), Combinatie Teijsen V.D. Hengel (Part of Darling Ingredients) (Netherlands), Almol Casing Pty Ltd (Australia), Natural Casing Company, Inc. (U.S.), A Holdijk GmbH (Germany), Agrimares Group (Spain), Carl Lipmann & Co. KG (GmbH & Co.) (Germany), Fortis Srl (Italy), Irish Casing Company (Ireland), Elshazly Casings Company (Egypt), MCJ casings (U.K.), Oversea Casing Company LLC.(U.S.), DAT-Schaub Group (Denmark), Saria Se And Co. Kg (Germany), Rugao Qingfeng Casing CO., LTD (China), Baoding Dongfang Group (China), CDS Hackner GmbH (Germany), Saarland Metzgereibedarf Strobel GmbH & Co. KG (Germany), and De Wied International Inc. (U.S.)

Scope of the report

Natural Sausage Casings Market, by Source

Natural Sausage Casings Market, by Application

Natural Sausage Casings Market, by Distribution Channel

Natural Sausage Casings Market, by Geography

Key questions answered in the report:

Published Date: Nov-2025

Published Date: May-2025

Published Date: Jan-2025

Published Date: Jul-2024

Published Date: Aug-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates