Resources

About Us

Milking Automation Market by Offering (Hardware, Software, Services), System Type (Robotic Milking Systems, Automated Milking Parlors), Livestock (Dairy Cattle, Sheep, Goats), Farm Size, and End Use - Global Forecast to 2036

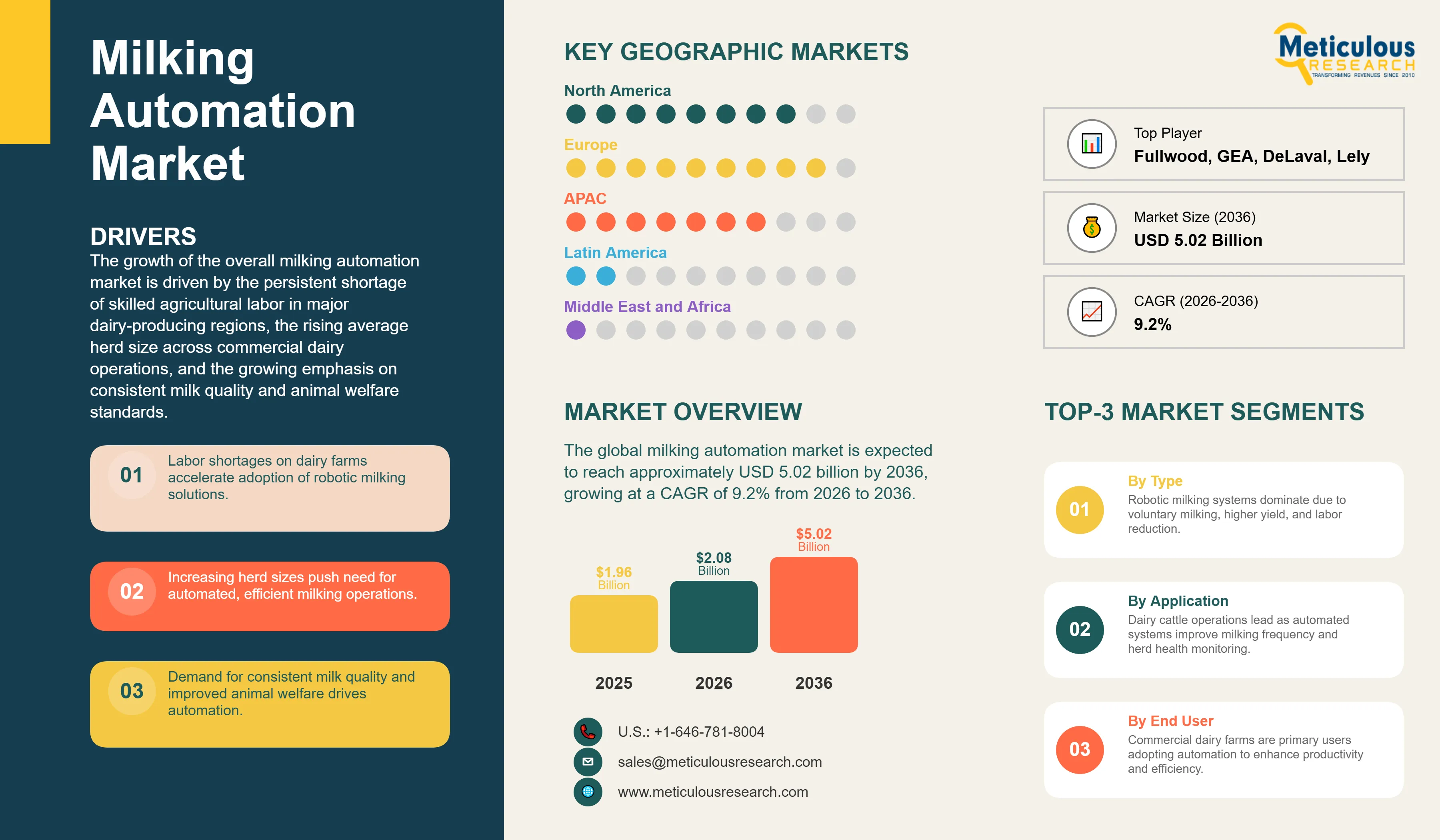

Report ID: MRAGR - 1041801 Pages: 271 Feb-2026 Formats*: PDF Category: Agriculture Delivery: 24 to 72 Hours Download Free Sample ReportThe global milking automation market was valued at USD 1.96 billion in 2025. The market is expected to reach approximately USD 5.02 billion by 2036 from USD 2.08 billion in 2026, growing at a CAGR of 9.2% from 2026 to 2036. The growth of the overall milking automation market is driven by the persistent shortage of skilled agricultural labor in major dairy-producing regions, the rising average herd size across commercial dairy operations, and the growing emphasis on consistent milk quality and animal welfare standards. As dairy farm operators seek to reduce dependency on manual milking routines while maintaining production efficiency, automated milking systems have become central to the modernization of dairy farm infrastructure. The expanding adoption of sensor-integrated robotic milking systems and cloud-based herd management platforms continues to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Milking automation refers to the use of mechanical and digital technologies to automate the process of milking dairy animals, eliminating or substantially reducing the need for manual labor across milking operations. These systems range from standalone robotic milking units designed for small and medium-sized farms to large-scale automated milking rotaries and integrated parlor systems designed for high-throughput commercial operations with thousands of animals. At their core, milking automation systems use robotic arms, laser-guided teat detection, automated cup attachment mechanisms, inline milk quality sensors, and individual cow identification technologies to carry out the entire milking process with minimal human involvement.

The market includes a diverse range of solutions that extend well beyond the milking robot itself. Leading manufacturers now offer integrated ecosystems that combine robotic milking hardware with farm management software platforms, herd health monitoring tools, and connected cloud services. Systems such as the Lely Astronaut A5 and the DeLaval VMS V300 series come equipped with AI- powered vision systems, automated teat disinfection, and real-time milk quality analysis, while farm management platforms like Lely Horizon and DeLaval DELPRO provide farmers with continuous data on individual cow performance, health indicators, and reproductive cycles. GEA's DairyRobot R9500 introduces inline udder preparation, milking, and post-dipping within a single teat cup liner attachment, improving hygiene and reducing the time cows spend inside the milking unit.

The global dairy industry is under sustained pressure to raise productivity while reducing operational costs and improving animal welfare outcomes. This has accelerated the shift from conventional twice-daily milking routines toward voluntary milking systems in which cows access milking units freely throughout the day, typically milking three to four times per day compared to two times in conventional setups. Data from research programs across major dairy nations indicate that voluntary milking systems contribute to measurable improvements in milk yield per cow, early disease detection, and herd reproductive performance. These operational advantages, combined with long-term labor cost savings, are making the case for milking automation increasingly compelling across commercial dairy operations of varying sizes.

Integration of Artificial Intelligence and Vision-Based Teat Detection in Robotic Milking Systems

Manufacturers across the milking automation industry are rapidly embedding artificial intelligence into the core of robotic milking hardware. DeLaval's InSight vision system, standard on the VMS V300 2025 model, uses AI-powered image processing to accurately locate teat positions with a high degree of consistency, even for heifers entering the robot for the first time. Lely's stronaut A5 uses a laser-guided arm combined with real-time motion tracking to maintain cup attachment accuracy even as the cow shifts position during milking. GEA's DairyRobot R9500 incorporates 3D camera technology to guide its robotic arm with precision across variable udder conformations. These developments are reducing attachment failures, shortening milking cycle times, and improving udder health outcomes — all of which directly affect the return on investment calculations that dairy farmers use when evaluating automation decisions.

Beyond hardware performance, the newest milking automation platforms are generating rich datasets on individual cow milking behavior, milk composition, and health indicators. Manufacturers are leveraging these datasets to develop predictive analytics tools that alert farmers to early signs of mastitis, metabolic disorders, and reproductive irregularities, often days before visible clinical symptoms appear. The combination of faster, more accurate milking hardware with data-driven health management is shifting the value proposition of robotic milking systems from labor substitution to comprehensive precision dairy management.

Expansion of Connected Farm Management Platforms and Cloud-Based Dairy Analytics

The milking automation market is witnessing a clear shift toward integrated digital platforms that connect milking data with broader farm management functions. Manufacturers are no longer competing solely on the technical performance of their milking hardware but increasingly on the depth and usability of the software ecosystems that surround their equipment. Lely Horizon, DeLaval DELPRO, and GEA's DairyNet platform allow farm operators to monitor individual cow milking frequency, yield per quarter, somatic cell counts, and activity levels from a single interface accessible via desktop or mobile device.

The integration of milking systems with third-party farm management software, nutritional management platforms, and veterinary data systems is also gaining momentum. Partnerships such as the one between DeLaval and John Deere, announced in late 2023, are creating connected digital environments in which milking data feeds into broader farm sustainability tracking tools — measuring nutrient use efficiency and carbon output alongside production performance. As regulatory requirements around milk traceability and environmental reporting grow across Europe and North America, these integrated digital platforms are becoming increasingly important for dairy farmers seeking to demonstrate compliance while optimizing day-to-day operational decisions.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 5.02 Billion |

|

Market Size in 2026 |

USD 2.08 Billion |

|

Market Size in 2025 |

USD 1.96 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 9.2% |

|

Dominating Region |

Europe |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Offering, System Type, Livestock, Farm Size, End-use, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Persistent Agricultural Labor Shortages and Rising Herd Consolidation

One of the most consistent and widely documented forces driving the milking automation market is the sustained difficulty that dairy farm operators face in recruiting and retaining milking labor. In major dairy regions including the United States, Canada, Germany, the Netherlands, and Australia, dairy farms rely heavily on employees willing to work early morning and late evening milking shifts seven days a week, year-round. The USDA's most recent Farm Labor Survey data indicates that dairy farm operators routinely log 45 to 60

working hours per week, and annual worker turnover on dairy operations frequently exceeds 30 percent. Against this backdrop, robotic milking systems offer a reliable and consistent alternative — eliminating the scheduling dependency on human labor while maintaining or improving milking frequency.

Alongside labor dynamics, the structural consolidation of dairy farming — whereby a smaller number of farms manage increasingly larger herds — is creating operational demand for systems capable of milking hundreds of cows per day without proportional increases in labor. Larger herds concentrate milking demand in ways that make automated solutions economically rational over a multi-year horizon, even given the substantial upfront investment that robotic milking systems require.

Opportunity: Greenfield Dairy Investments and Agricultural Modernization Programs in Emerging Markets

Large-scale dairy development programs across Asia and the Middle East are creating significant new market opportunities for milking automation suppliers. China's pursuit of vertically integrated mega-dairy complexes, often housing several thousand cows under a single management structure, creates an environment well-suited to high-throughput automated milking rotary systems from manufacturers such as DeLaval, GEA, and Lely. Similarly, government-backed dairy infrastructure programs in India, Saudi Arabia, and the UAE are funding the establishment of modern dairy facilities in which automation is built into the initial design rather than retrofitted after the fact. These greenfield developments bypass some of the barn infrastructure challenges that have historically slowed automation adoption on existing farms, and they represent a growing proportion of new milking automation installations globally.

Why Does the Hardware Segment Lead the Market?

The hardware segment accounts for the largest share of the global milking automation market in 2026. This is primarily driven by the high unit value of robotic milking systems, which individually range from USD 150,000 to over USD 230,000 per unit, and by the substantial number of new installations being completed globally each year. Robotic milking hardware includes the milking robot unit itself along with teat cup attachments, robotic arm assemblies, vacuum pump systems, milk quality sensors, automated teat disinfection equipment, and individual cow identification readers. Manufacturers such as Lely, DeLaval, and GEA continue to generate the majority of their milking automation revenue from hardware sales, with each new farm installation requiring multiple units depending on herd size.

However, the software and services segments are both expected to grow at a faster rate than hardware during the forecast period. Farm management software subscriptions, cloud-based analytics platforms, and connected herd monitoring tools are becoming standard components of new robotic milking installations, generating recurring revenue streams for manufacturers beyond the initial hardware sale. The growing use of precision dairy management tools and predictive health analytics is expanding the total addressable market for software beyond the installed base of milking robots to include conventional dairy farms adopting sensor-based monitoring without full robotic milking.

How Does the Robotic Milking Systems Segment Dominate?

Based on system type, the robotic milking systems segment holds the largest share of the overall market in 2026. Robotic milking systems, also known as voluntary milking systems (VMS) or automatic milking systems (AMS), allow individual cows to enter the milking unit at their own discretion, guided by feed incentives and free-flow barn traffic management. Each robot identifies the cow using electronic ear tags or neck collars, retrieves individual milking parameters, attaches teat cups automatically, conducts the milking, and monitors milk quality in real time — all without operator involvement. Leading products in this category include the Lely Astronaut A5, the DeLaval VMS V300 series, and the GEA DairyRobot R9500, each of which serves farms typically milking 50 to 80 cows per robot unit.

Within robotic milking systems, the single-stall unit configuration holds the dominant share in 2026, as it is the most widely adopted configuration for small and medium-sized commercial dairy farms. Multi-stall configurations and automated milking rotary systems, offered by manufacturers including DeLaval and GEA, are gaining traction among large and industrial-scale operations where throughput requirements exceed what a collection of individual single-stall robots can practically achieve. Automated milking parlors — including herringbone, parallel, and rotary configurations equipped with automated cluster removal, electronic identification, and milk metering — retain significant relevance for farms that are not ready to transition to fully voluntary robotic systems but still wish to reduce manual labor involvement.

Why Does the Dairy Cattle Segment Lead the Market?

The dairy cattle segment commands the largest share of the global milking automation market in 2026. This dominance reflects the global concentration of commercial dairy production in cattle operations, the established commercial viability of robotic milking hardware sized for cattle udder anatomy and milking volumes, and the well-developed dealer and service networks that support cattle milking automation in major dairy regions. Dairy cattle, particularly high-producing Holstein, Friesian, and Jersey breeds, benefit directly from the increased milking frequency that robotic milking systems enable, with research consistently documenting yield improvements when cows shift from twice-daily to three- or four-times-daily milking.

The sheep and goat segments are expected to grow during the forecast period, supported by the increasing commercial scale of sheep and goat dairy operations in Southern Europe, the Middle East, and parts of Asia. Manufacturers including Fullwood Packo and Lely have developed or adapted milking hardware for small ruminant applications, and growing demand for specialty dairy products such as sheep and goat cheese in premium food markets is encouraging further investment in these segments.

Which Farm Size Segment is Expected to See the Fastest Growth?

The large farm segment — typically defined as operations milking more than 500 cows — is expected to register the fastest growth rate during the forecast period. Large commercial operations have the scale to achieve a return on robotic milking investment within a commercially acceptable timeframe, and they increasingly view automation as a prerequisite for managing labor costs and maintaining consistent output quality as herds grow. Industrial-scale mega- dairies in China, the Middle East, and Eastern Europe typically milk thousands of cows and are adopting high-capacity automated milking rotary systems alongside comprehensive digital farm management platforms.

The medium farm segment — operations with 100 to 500 cows — holds the largest share in 2026, as this farm size cohort represents the core customer base for robotic milking in mature markets such as Germany, the Netherlands, Denmark, Canada, and the United States. Small farms, while the most numerous globally, face the steepest financial barriers to adoption, though flexible financing models offered by manufacturers and cooperatives, as well as government subsidy programs in markets such as the Netherlands and Canada, are gradually improving access for smaller operations.

How is Europe Maintaining Dominance in the Global Milking Automation Market?

Europe holds the largest share of the global milking automation market in 2026. This position is sustained by the concentration of global milking automation technology development in European nations, including the Netherlands, Sweden, Germany, and Ireland, where companies such as Lely, DeLaval, GEA Farm Technologies, Nedap Livestock Management, and Dairymaster are headquartered. European dairy farms have been adopting robotic milking systems since the early 1990s, and voluntary milking system penetration rates in leading markets such as Denmark and the Netherlands are among the highest in the world. Regulatory frameworks across the European Union that support animal welfare and sustainable farming practices also incentivize investment in precision dairy technologies including automated milking.

Which Factors Support North America and Asia-Pacific Market Growth?

North America represents the second-largest regional market, driven by the growing pressure on dairy farm operators in the United States and Canada to manage labor costs and workforce availability. The USDA Farm Labor Survey indicates that immigration policy uncertainty and high labor turnover are accelerating automation investment decisions on mid-sized and large dairy operations across the Midwest and Northeast United States. Canada's AgriInvest and Growing Forward programs have historically supported on-farm automation investment, contributing to high robotic milking adoption rates in provinces such as Ontario and Quebec.

Asia-Pacific represents the fastest-growing regional market and is expected to sustain this position throughout the forecast period. China's aggressive investment in large-scale commercial dairy infrastructure — including vertically integrated operations with tens of thousands of animals — is creating demand for high-throughput automated milking rotary systems. India's National Action Plan for Dairy Development and cooperative modernization programs are supporting milking parlor upgrades across commercial cooperatives. Australia and New Zealand, as established large-scale dairy exporters, continue to invest in automated parlor and robotic milking solutions that are compatible with pasture-based production systems.

Companies such as Lely (Netherlands), DeLaval International AB (Sweden), and GEA Group AG (Germany) lead the global milking automation market, offering comprehensive voluntary milking system portfolios, integrated herd management software platforms, and global dealer and service networks suited to large-scale commercial dairy operations. Meanwhile, players including Fullwood Packo (UK), Nedap Livestock Management (Netherlands), Dairymaster (Ireland), and BouMatic (U.S.) focus on specialized milking hardware, sensor-based herd monitoring, and automated parlor solutions targeting a broad range of farm sizes and livestock types. Emerging and specialized players such as AMS Galaxy USA (U.S.), Waikato Milking Systems NZ LP (New Zealand), Milkomax Solutions Laitières Inc. (Canada), System Happel GmbH (Germany), Afimilk Ltd. (Israel), and Hokofarm Group (Netherlands, a GEA company) are strengthening the market through innovations in precision herd monitoring, flexible parlor automation, and region-specific milking technologies.

The global milking automation market is expected to grow from USD 2.08 billion in 2026 to USD 5.02 billion by 2036.

The global milking automation market is projected to grow at a CAGR of 9.2% from 2026 to 2036.

Hardware is expected to dominate the market in 2026 due to the high unit value of robotic milking systems and the scale of ongoing new farm installations globally. However, the software and services segments are projected to grow at a faster pace, driven by expanding farm management software subscriptions, cloud-based analytics platforms, and demand for ongoing technical support and maintenance services.

AI and real-time data analytics are transforming milking automation by enabling predictive health management, precise teat detection, and continuous performance monitoring at the individual cow level. These technologies allow farm operators to detect early signs of illness, optimize milking schedules, and improve reproductive outcomes — shifting the value of milking automation beyond labor savings to comprehensive precision dairy management.

Europe holds the largest share of the global milking automation market in 2026. This dominance is primarily attributed to the high concentration of leading milking automation manufacturers, mature voluntary milking system adoption in key dairy nations, and regulatory frameworks that support precision and sustainable dairy farming.

The leading companies include Lely (Netherlands), DeLaval International AB (Sweden), GEA Group AG (Germany), BouMatic (U.S.), Fullwood Packo (UK), Nedap Livestock Management (Netherlands), Dairymaster (Ireland), and Afimilk Ltd. (Israel).

Published Date: Jan-2025

Published Date: Dec-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates