Resources

About Us

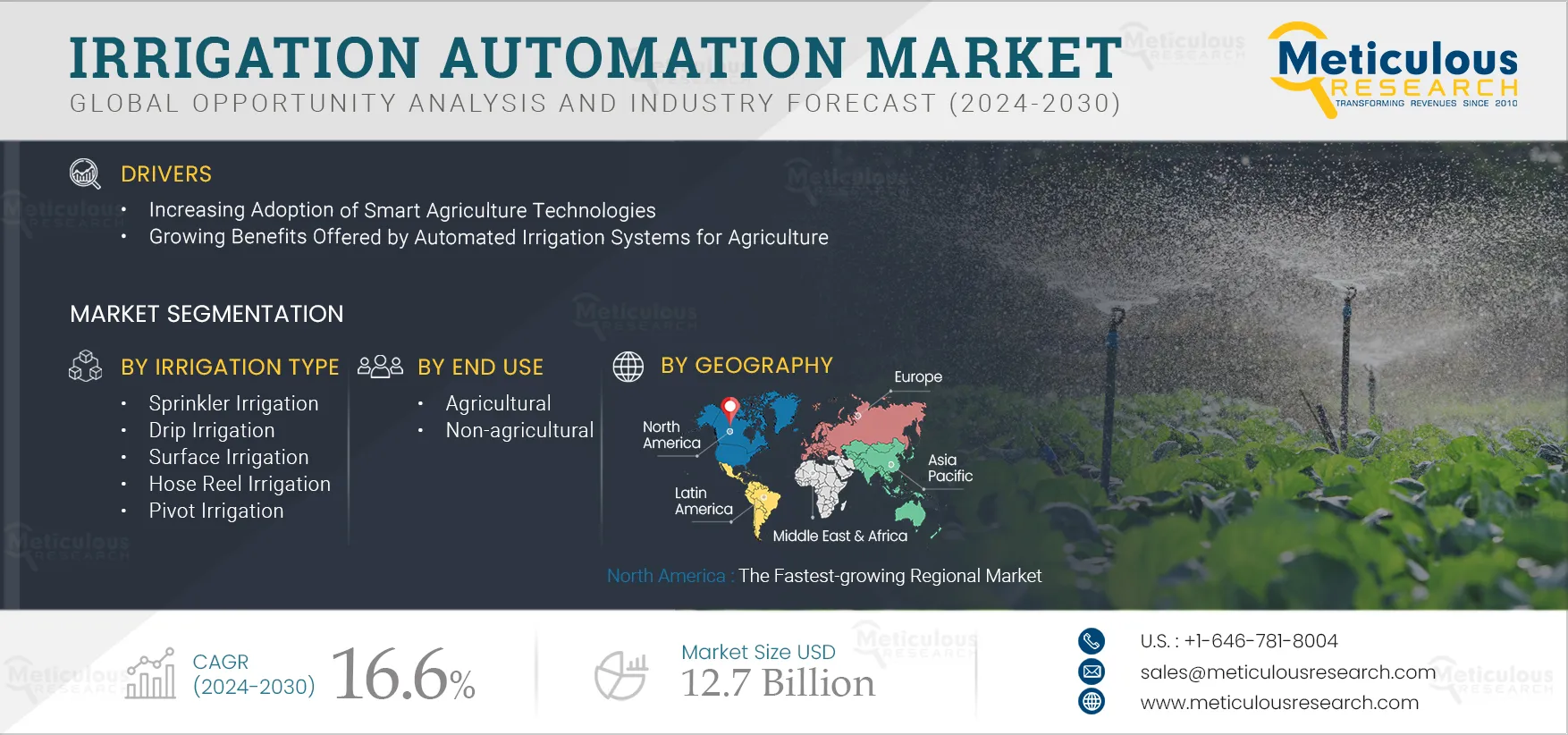

Irrigation Automation Market by System, Irrigation Type, Component, End Use (Agricultural, Non-agricultural) and Geography - Global Forecast to 2032

Report ID: MRAGR - 104895 Pages: 250 Jan-2025 Formats*: PDF Category: Agriculture Delivery: 24 to 72 Hours Download Free Sample ReportThe Irrigation Automation Market is projected to reach $12.7 billion by 2032, at a CAGR of 16.6% from 2025 to 2032. The growth of this market is driven by the increasing adoption of smart agriculture technologies and the growing benefits offered by automated irrigation systems for agriculture. The increasing government support for automated farming technologies and the growing proliferation of automated irrigation systems for large-scale farming are expected to offer significant growth opportunities for the stakeholders in the irrigation automation market.

The high cost of installing automated irrigation systems may restrain the market's growth. Furthermore, implementing automated irrigation systems in fragmented land is expected to pose challenges to the growth of the irrigation automation market.

Agriculture is the major source of food production to the growing demand of its population, and irrigation is an essential process that influences crop growth and crop yield. Small land-holding farmers with low returns from the field avoid adopting newer technology. However, it may help them indirectly by saving time, labor costs, and precise watering of crops, which would result in increased yield and, ultimately, better financial returns. Currently, most farmers run irrigation systems manually; the entire process is difficult and requires frequent maintenance.

Manual operations also lead to inconsistent irrigation and are a major cause of water wastage and low crop yield because of improper irrigation. Adopting automatic irrigation systems for large or small fields will make irrigation smarter and more effective, ultimately leading to higher financial returns for the farmers.

Click here to: Get Free Sample Pages of this Report

Automation technology can be incorporated into various irrigation devices. Farmers can upgrade manually operated drip, sprinkler, or surface irrigation systems to semi-automatic and then to fully automatic irrigation systems based on their budget. Automation in irrigation makes the farmer’s work much easier, and his presence in the field is not mandatory. These automated irrigation systems are customizable; even manual drip, surface, and sprinkler irrigation systems can be upgraded to overcome their existing limitations.

Such benefits are expected to improve the demand for irrigation automation systems in the agriculture sector, supporting the growth of this market.

The growth of this segment is driven by the growing implementations of automatic irrigation systems, surging demand for automatic plant irrigation systems to reduce water use and save customers time, and technological advancements in automatic irrigation systems to offer unique and advanced features.

The growth of this segment is driven by the exerting efforts by market players to design and implement intelligent irrigation control systems, growing use of valves, sprays, and sprinklers over a larger area to manage the water supply efficiently and drippers in orchards & vineyards, and vegetable gardens, rapid implementations of sensors to give feedback and information about the irrigated area to customers, and increasing demand for smart irrigation controllers and sensors to reduce outdoor water use by irrigating based on plant water need.

The growth of this segment is driven by the rising need for sprinklers or sprayers to distribute water in a controlled manner, the increasing need to improve water-use efficiency and achieve higher crop yields by delivering water and nutrients directly to the plant’s roots, and the growing need for affordable irrigation systems.

The growth of this segment is driven by the growing demand for smart water irrigation systems among farmers to automate their irrigation processes and reduce water use, the increasing need for cost savings due to minimized water waste, the growing popularity of IoT ecosystem for smart irrigation, growing need of consistent and efficient water usage, and to rising need to increase crop productivity even in low rainfall.

North America is projected to register the highest CAGR during the forecast period. The growth of this region is driven by the presence of leading market players such as The Toro Company (U.S.), Valmont Industires, Inc. (U.S.), Rain Bird Corporation (U.S.), Calsense (U.S.), Orbit Irrigation Products Inc. (U.S.), Stevens Water Monitoring Systems Inc. (U.S.), increasing implementations of automated irrigation systems, and increasing adoption rate of irrigation systems owing to growing number of initiatives taken by government in the region for better water conservation.

Further, the leading market players are exerting efforts to launch irrigation automation systems, which in turn support the growth of this regional market. For instance, in February 2021, Rain Bird Corporation (U.S.) launched “Rain Bird Resources,” a free mobile app to help landscape contractors and other landscape irrigation professionals get the information they need – anytime and anywhere. Further, in May 2021, Valmont Industires, Inc. (U.S.) acquired Prospera Technologies Inc. (Israel), a global irrigation equipment and service provider for deploying AI technologies on irrigated land. Such developments are expected to support the growth of the market.

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading irrigation automation companies in the last 3–4 years. The key companies operating in the global irrigation automation market are The Toro Company (U.S.), Valmont Industires, Inc. (U.S.), Rain Bird Corporation (U.S.), Jain Irrigation Systems Ltd. (India), Lindsay Corporation (U.S.), Nelson Irrigation (U.S.), Rubicon Water S.L.U. (Spain), Galcon Bakarim Agricultural Cooperative Society Ltd. (Israel), HydroPoint Data Systems, Inc. (U.S.), Calsense (U.S.), Orbit Irrigation Products Inc. (U.S.), Stevens Water Monitoring Systems Inc. (U.S.), Viridix Ltd. (Israel), Niagara Irrigation Automation (India), and Lumo, Inc. (U.S.).

Irrigation Automation Market Assessment, by System

Irrigation Automation Market Assessment, by Irrigation Type

Irrigation Automation Market Assessment, by Component

Irrigation Automation Market Assessment, by End Use

Irrigation Automation Market Assessment, by Geography

The irrigation automation market is projected to reach $12.7 billion by 2032, at a CAGR of 16.6% during the forecast period.

The hardware segment is projected to register the highest CAGR during the forecast period due to the exerting efforts by market players to design and implement intelligent irrigation control systems; growing use of valves, sprays, and sprinklers over a larger area to manage the water supply efficiently and drippers in orchards & vineyards, and vegetable gardens; and rapid implementations of sensors to give feedback and information about the irrigated area to customers.

The agricultural segment is projected to register the highest CAGR during the forecast period due to the growing demand for smart water irrigation systems among farmers to automate their irrigation processes and reduce water use, increasing need for cost savings due to minimized water waste, growing popularity for IoT ecosystem for smart irrigation, and growing need of consistent and efficient water usage.

The growth of this market is driven by the increasing adoption of smart agriculture technologies and the growing benefits offered by automated irrigation systems for agriculture. The increasing government support for automated farming technologies and the growing proliferation of automated irrigation systems for large-scale farming are expected to offer significant growth opportunities for the stakeholders in the irrigation automation market.

The key players operating in the global irrigation automation market are The Toro Company (U.S.), Valmont Industries, Inc. (U.S.), Rain Bird Corporation (U.S.), Jain Irrigation Systems Ltd. (India), Lindsay Corporation (U.S.), Nelson Irrigation (U.S.), Rubicon Water S.L.U. (Spain), Galcon Bakarim Agricultural Cooperative Society Ltd. (Israel), HydroPoint Data Systems, Inc. (U.S.), Calsense (U.S.), Orbit Irrigation Products Inc. (U.S.), Stevens Water Monitoring Systems Inc. (U.S.), Viridix Ltd. (Israel), Niagara Irrigation Automation (India), and Lumo, Inc. (U.S.).

The market in countries such as Japan, China, India, Thailand, the U.S., Germany, and the U.K. are expected to witness strong growth in the coming years and offer significant growth opportunities for market players.

Published Date: Jan-2025

Published Date: Apr-2024

Published Date: May-2023

Published Date: Jun-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates