Resources

About Us

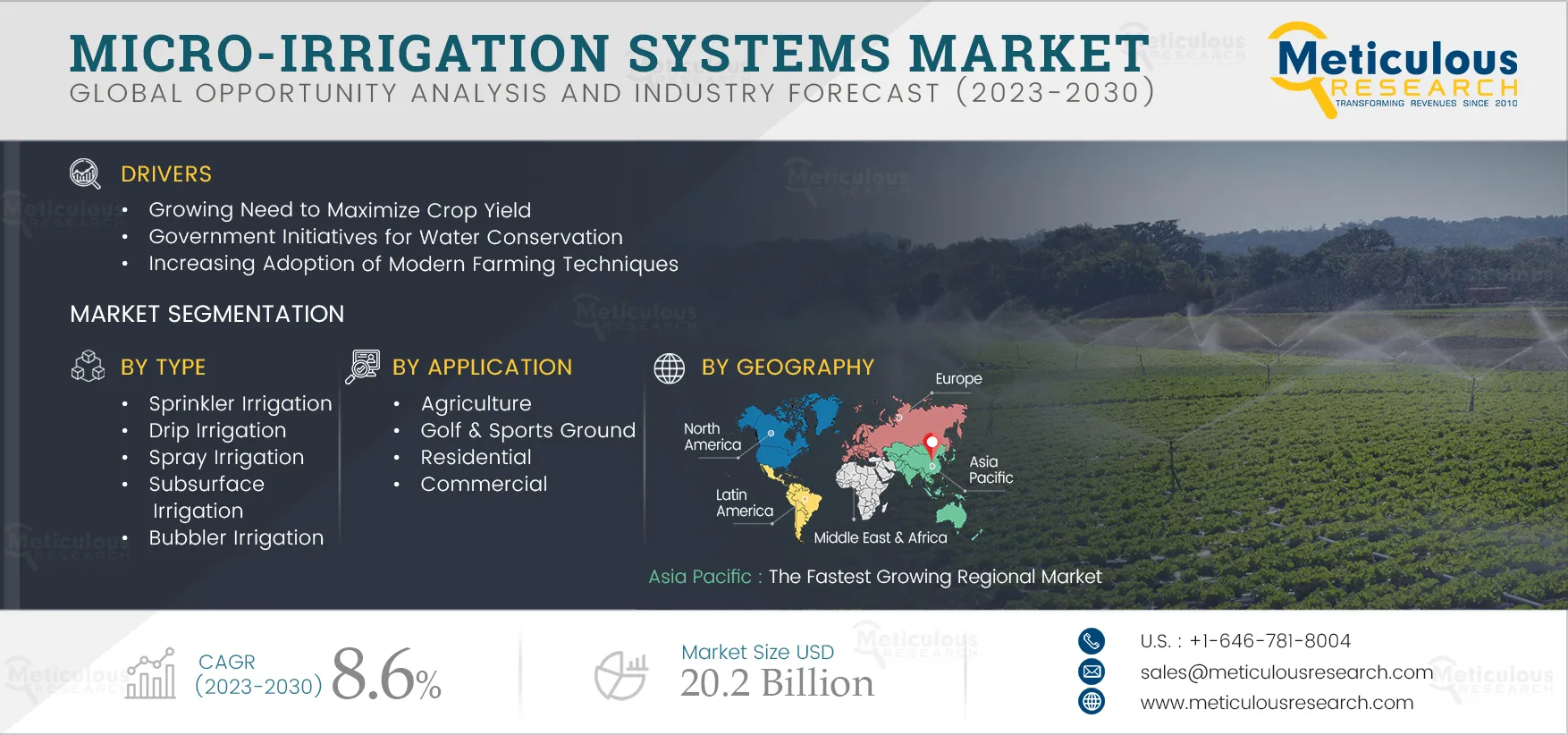

Micro-irrigation Systems Market by Type (Sprinkler, Drip, Spray), Offering (Hardware, Software, Services), Crop (Plantation, Orchard & Vineyards, Field), Application (Agriculture, Sports, Residential, Commercial), and Geography - Global Forecast to 2030

Report ID: MRAGR - 104208 Pages: 303 May-2023 Formats*: PDF Category: Agriculture Delivery: 2 to 4 Hours Download Free Sample ReportThe Micro-irrigation Systems Market is projected to reach $20.2 billion by 2030, at a CAGR of 8.6% during the forecast period 2023–2030. The growth of this market is mainly driven by the increasing government initiatives for water conservation, the growing need to maximize crop yield, and the increasing adoption of modern farming techniques. Additionally, the increasing use of automation in irrigation systems and growing government support for irrigation projects are expected to create market growth opportunities. However, the high initial investments required to implement micro-irrigation systems restrain the growth of this market. Further, the lack of awareness regarding advanced irrigation technologies in developing countries is a major challenge for the players operating in this market. Integration of artificial intelligence and IoT technologies into irrigation systems are technology trends in the market. Also, irrigation as a service (IaaS) is a major market trend in this space.

Water conservation is the preservation, control, and management of water resources and their use. Unfortunately, the existing water resources on the earth are limited and unevenly distributed. Therefore, water scarcity is one of the greatest challenges of the 21st century, where developing countries and developed countries confront water shortage problems due to the growing population, increasing need for more agricultural production, and changing climates. The maladministration of water, inefficiencies in irrigation methods and systems, limited adoption of modern irrigation techniques, and failure to judge the essential quantity of water for the landscape are expected to cause huge irrigation water wastages. For example, in April 2021, the Environmental Protection Agency (EPA) of the U.S. stated that every day, about 50% of 9 billion gallons of water used for residential outdoor purposes is wasted due to overwatering caused by inefficiencies in irrigation methods and systems. Hence, there is a need to swing focus from land productivity to water productivity to get the highest yield from every drop of water used in agriculture. Governments are imposing regulations on water use to promote water conservation and offering financial incentives and subsidies to farmers to encourage them to adopt water-saving technologies such as micro-irrigation systems. This help farmers offset the initial costs of purchasing and installing the systems, making them more affordable and accessible. In 2022, the Government of India launched the Pradhan Mantri Krishi Sinchai Yojana (PMKSY) with an investment of approximately USD 7.7 billion (Rs. 50,000 crores) to develop irrigation sources for providing a permanent solution to drought.

Several governments across the globe are taking similar initiatives with the help of new irrigation technologies to avoid future circumstances of water scarcity. Many countries are promoting different techniques for water conservation. Rainwater harvest techniques and other traditional water conservation methods, along with modern irrigation management systems, such as micro-irrigation systems, are promoted in developed countries to converse water. For instance, in November 2020, the U.S. Department of Agriculture (USDA) Natural Resources Conservation Service (NRCS) selected 31 priority areas to receive USD 13 million to conserve water as part of the WaterSMART Initiative (WSI). Also, in August 2019, Cerrado Waters Consortium, an initiative by coffee growers, producers, researchers, and environmentalists, launched a climate-smart investment scheme to promote sustainable land and water use in Brazil’s Cerrado region. All such focus on water conservation and governments’ positive approach to installing modern irrigation methods & techniques, including micro-irrigation systems for managing residential and landscape irrigation, are expected to boost the growth of this market in the coming years.

Click here to: Get Free Sample Pages of this Report

In 2023, the Sprinkler Irrigation Segment is Expected to Dominate the Micro-irrigation Systems Market

Based on type, the global micro-irrigation systems market is broadly segmented into sprinkler irrigation, drip irrigation, spray irrigation, subsurface irrigation, and bubbler Irrigation. In 2023, the sprinkler irrigation segment is expected to account for the largest share of the global micro-irrigation systems market. The large market share of this segment is attributed to the increasing need for small sprinklers or sprayers to distribute water in a controlled manner, improve water-use efficiency, and achieve higher crop yields by delivering water and nutrients directly to the plants’ roots. However, the drip irrigation segment is projected to register the highest CAGR during the forecast period due to the surging need for a cost-effective and sustainable solution to improve crop yields while conserving water resources, the increasing use of drip irrigation in row crops, orchards & vineyards, lawns and gardens with varying water requirements, and the need to maintain soil moisture levels in between rows.

In 2023, the Hardware Segment is Expected to Dominate the Micro-irrigation Systems Market

Based on offering, the global micro-irrigation systems market is broadly segmented into hardware, software, and services. In 2023, the hardware segment is expected to account for the largest share of the global micro-irrigation systems market. The large market share is attributed to the increasing use of polyethylene tubing to connect the micro-irrigation system's components and the surging use of valves, sprays and sprinklers over a larger area to manage the water supply efficiently and drippers in orchards & vineyards, and vegetable gardens. This segment is also projected to register the highest CAGR during the forecast period due to the increasing need for a more efficient and precise way to deliver water to crops and reduce water waste, conserve water resources and manual labor at the same time.

In 2023, the Traditional Micro-irrigation Segment is Expected to Dominate the Micro-irrigation Systems Market

Based on method, the global micro-irrigation systems market is broadly segmented into smart micro-irrigation and traditional micro-irrigation. In 2023, the traditional micro-irrigation segment is expected to account for the largest share of the global micro-irrigation systems market. The large market share of this segment is attributed to its easy installation and maintenance compared to smart micro-irrigation and the need to grow a range of crops with limited resources or technical expertise. Also, the traditional method is relatively inexpensive compared to smart irrigation methods, which makes it a popular choice for small-scale farmers and growers. However, the smart micro-irrigation segment is projected to register the highest CAGR during the forecast period due to the increasing need for real-time data on soil moisture levels, weather conditions, and crop water requirements to optimize water use and increase crop yields, improve water-use efficiency, and provide a precise amount of water and fertilizer needed.

In 2023, the Field Crops Segment is Expected to Dominate the Micro-irrigation Systems Market

Based on crop type, the global micro-irrigation systems market is broadly segmented into plantation crops, orchard crops & vineyards, field crops, grasslands & grazelands, and other crops. In 2023, the field crops segment is expected to account for the largest share of the global micro-irrigation systems market. The large market share of this segment is attributed to the increasing need for irrigating field crops for efficient and precise water and nutrient delivery and the growing need to improve crop yields and reduce water waste and fertilizer runoff.

However, the orchard crops & vineyards segment is projected to register the highest CAGR during the forecast period due to the growing use of drip irrigation for orchard crops & vineyards with high water requirements and subsurface irrigation for reducing water loss due to evaporation and runoff and the increasing need to apply nutrients directly to the root zone of the plants.

In 2023, the Agriculture Segment is Expected to Dominate the Micro-irrigation Systems Market

Based on application, the global micro-irrigation systems market is broadly segmented into agriculture, golf & sports ground, residential, commercial, and other applications. In 2023, the agriculture segment is expected to account for the largest share of the global micro-irrigation systems market. The large market share of this segment is attributed to the adoption of micro-irrigation systems in agriculture to improve crop yields, reduce the need for manual labor and improve water-use efficiency. This segment is also projected to register the highest CAGR during the forecast period due to the increasing need to deliver water directly to the plant’s root zones through emitters or drippers while minimizing water waste. Further, the need to reduce the amount of water and fertilizer needed in crops to control environmental impact and improve sustainability is also expected to contribute to the growth of this segment.

Asia Pacific to be the Fastest Growing Regional Market

Based on geography, the micro-irrigation systems market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific is projected to register the highest CAGR and growth during the forecast period due to the increasing technological advancements in irrigation systems, surging government initiatives to conserve water, increase crop yields and optimize plant growth, the increasing need for a more sustainable way to irrigate crops and reduce water waste, rising environmental concerns including soil degradation, and increasing water scarcity in the region.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by the leading market participants in the micro-irrigation systems market in the last 3–4 years. The key players profiled in the micro-irrigation systems market report are Valmont Industries, Inc. (U.S.), The Toro Company (U.S.), Jain Irrigation Systems Ltd. (India), T-L Irrigation (U.S.), Rivulis Irrigation Ltd. (Israel), Reinke Manufacturing Co., Inc. (U.S.), Rain Bird Corporation (U.S.), Netafim Limited (Israel), Nelson Irrigation Corporation (U.S.), Lindsay Corporation (U.S.), Hunter Industries, Inc. (U.S.), Antelco Pty Ltd (Australia), Elgo Irrigation Ltd. (Israel), Harvel Agua India Private Limited (India), and Irritec S.p.A (U.S.).

Scope of the report:

Micro-irrigation Systems, by Type

Micro-irrigation Systems, by Offering

Micro-irrigation Systems, by Method

Micro-irrigation Systems, by Crop type

Micro-irrigation Systems, by Application

Micro-irrigation Systems, by Geography

Key Questions Answered in the Report :

The global micro-irrigation systems market is projected to reach $20.2 billion by 2030, at a CAGR of 8.6% during the forecast period.

Factors such as the growing need to maximize crop yield, government initiatives for water conservation, and increasing adoption of modern farming techniques are driving the growth of this market.

The key players operating in the micro-irrigation systems market are Jain Irrigation Systems Ltd. (India), Valmont Industries, Inc. (U.S.), The Toro Company (U.S.), T-L Irrigation (U.S.), Rivulis Irrigation Ltd. (Israel), Reinke Manufacturing Co., Inc. (U.S.), Rain Bird Corporation (U.S.), Irritec S.p.A (U.S.), Netafim Limited (Israel), Lindsay Corporation (U.S.), Hunter Industries, Inc. (U.S.), Antelco Pty Ltd (Australia), Elgo Irrigation Ltd. (Israel), Harvel Agua India Private Limited (India), and Nelson Irrigation Corporation (U.S.).

Lack of awareness regarding advanced irrigation technologies in developing countries is a major challenge for the players operating in this market.

The drip irrigation segment is projected to register the highest CAGR during the forecast period due to the surging need for a cost-effective and sustainable solution to improve crop yields while conserving water resources, the increasing use of drip irrigation in row crops, orchards & vineyards, lawns and gardens with varying water requirements, and the need to maintain soil moisture levels in between rows.

Increasing use of automation in irrigation systems and growing government support for irrigation projects are expected to create market growth opportunities.

Most players are adopting agreements, collaborations, and partnership strategies to strengthen their product portfolios and enhance their geographic reach in the micro-irrigation systems market.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Apr-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates