Resources

About Us

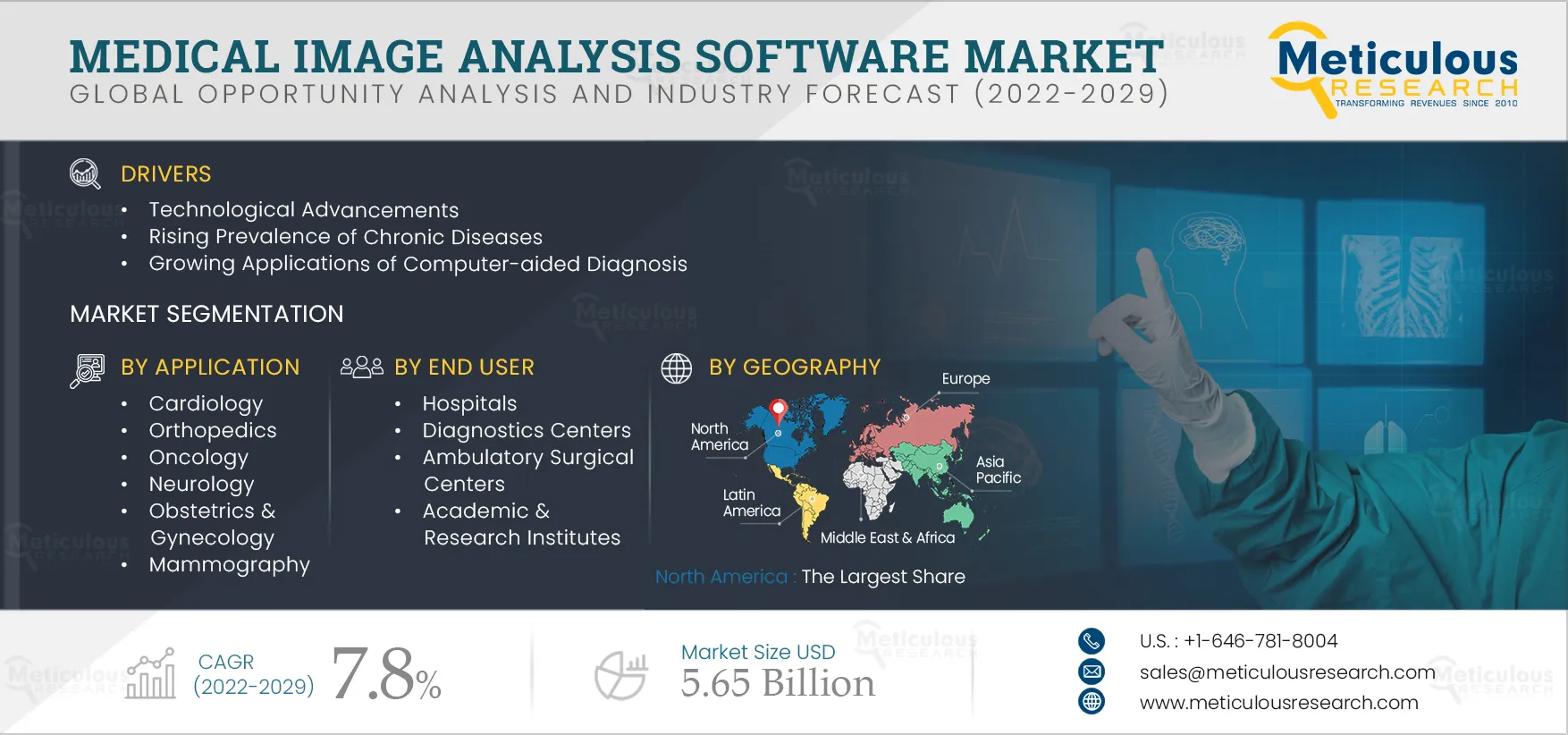

Medical Image Analysis Software Market by Software Type (Integrated, Standalone), Image (2D, 3D, 4D), Modality (X-ray, CT, Ultrasound, MRI), Application (Cardiology, Orthopedic, Neurology), End User (Hospital, Diagnostic Center)—Global Forecast to 2029

Report ID: MRHC - 104699 Pages: 210 Oct-2022 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Medical Image Analysis Software Market is projected to reach $5.65 billion by 2029, at a CAGR of 7.8% from 2022 to 2029. Medical imaging is the process of taking images of the internal human body and analyzing the functions of particular organs and tissues. Medical Imaging is done using devices such as X-ray scanners, computer tomography (CT), ultrasound scanners, and magnetic resonance imaging (MRI) for producing various types of medical scans.

The medical image analysis software market covers various integrated and standalone medical image analysis software offered by key companies for cardiology, orthopedics, oncology, neurology, obstetrics & gynecology, mammography, urology & nephrology, and other applications for use in hospitals, diagnostics centers, and ambulatory surgical centers.

The rising prevalence of chronic diseases, technological advancements, and growing applications of computer-aided diagnosis are factors driving the growth of the medical image analysis software market. In addition, emerging economies with improving healthcare infrastructure are expected to offer growth opportunities to key companies operating in the market.

Click here to: Get Free Sample Copy of this report

Integration of Artificial Intelligence (AI) in Medical Image Analysis Software: Key Trend in the Market

Medical imaging has been a vital tool in diagnosing and monitoring critical diseases and medical conditions. Artificial intelligence (AI) is employed in medical imaging to enhance medical image processing and analysis. AI-enabled medical image analysis software uses vast amounts of medical data to train its algorithms to identify specific anatomical markers in medical images gathered from X-ray imaging, ultrasound imaging, magnetic resonance imaging (MRI), and other modalities. AI-enabled medical image analysis software uses image algorithms to derive metrics and outputs via rigorous analysis of medical image patterns. This process allows healthcare professionals faster patient throughput, scheduling, shorter exam time, and faster diagnosis. AI-enabled medical image software produces clearer, sharper and more detailed medical images, further enabling shorter patient setup times.

AI-enabled medical image analysis software can process numerous medical images at a high rate, allowing healthcare professionals to produce quick and discrete assessments and spot details that are almost impossible to catch with the naked eye. Many companies operating in the image analysis software market have launched AI-enabled medical image analysis software or integrated AI into their existing software to fulfill the rising demand for AI-enabled medical image analysis. For example, in November 2021, at the Radiological Society of North America’s (RSNA) 2021 Annual Meeting, GE Healthcare (U.S.) unveiled around 60 innovative AI and digital technology solutions for the healthcare sector, including patient screening, medical imaging, diagnostics, therapy planning, guidance, and monitoring. Furthermore, in March 2020, Huiying Medical Technology Co., Ltd. (China) developed a medical imaging diagnostic solution using Intel AI technology to detect early-stage COVID-19 infections via CT chest scan images.

Key Findings in the Medical Image Analysis Software Market Study

The Integrated Software Segment is Expected to Generate a Larger Proportion of Revenue Compared to the Standalone Software Segment

In 2022, the integrated software segment is expected to account for the larger share of the medical image analysis software market. Integrated medical image analysis software is software that is pre-installed or is made for specific medical imaging systems. These types of software offer several applications/modules, such as acquisition, annotation, management, processing and analysis, along with data sharing between all or most modules. The large market share of this segment is attributed to the high adoption of diagnostic imaging tools and the benefits offered by integrated medical image analysis software, such as cost-effectiveness, centralized data storage, and ease of data access to single or multiple users.

3D Image Segment is Expected to Dominate the Market in 2022

In 2022, the 3D Image segment is expected to account for the largest share of the medical image analysis software market. 3D Imaging provides a clearer image of a particular organ or tissue than 2D imaging. 3D imaging also offers healthcare professionals better visibility of angles, resolutions, and details of a particular organ or tissue. The large share of this segment is primarily attributed to the high usage of 3D imaging equipment and the high prevalence of chronic diseases.

X-ray Imaging Segment is Expected to Dominate the Market

In 2022, the X-ray imaging segment is expected to account for the largest share of the medical image analysis software market. X-ray imaging uses electromagnetic waves to generate images of tissues and structures inside the body. The large market share of this segment is primarily attributed to the increasing utilization of x-ray imaging for early diagnosis & clinical applications and the rising adoption of digital X-ray systems. Furthermore, the high demand for X-ray imaging scanning for chest infections during the COVID-19 pandemic contributed to the growth of this segment.

Cardiology Segment to Account for the Largest Share of the Medical Image Analysis Software Market

In 2022, the cardiology segment is expected to account for the largest share of the medical image analysis software market. The large market share of this segment is attributed to the rising prevalence of cardiovascular diseases and the growing demand for minimally-invasive surgeries for treating cardiovascular diseases. Cardiovascular diseases (CVD) remain the leading cause of death globally. For example, according to the Centers for Disease Control and Prevention (CDC), in 2020, about 697,000 people died from cardiovascular diseases in the U.S. Thus, the high prevalence of cardiovascular diseases globally is expected to increase the adoption of cardiovascular imaging, driving the growth of the medical image analysis software segment.

Hospitals Segment to Account for the Largest Share of the Medical Image Analysis Software Market

In 2022, the hospitals segment is expected to account for the largest share of the medical image analysis software market. Hospitals perform various imaging procedures to ensure proper clinical treatment planning and prevention of various medical conditions. The large market share of this segment is attributed to the rising number of hospitals across emerging markets and the high spending capabilities of hospitals, resulting in the increased adoption of advanced medical imaging technologies.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants between 2020 and 2022. The key players profiled in the medical image analysis software market report include Koninklijke Philips N.V. (Netherlands), Canon Inc. (Japan), GE HealthCare (U.S.), Siemens Healthineers AG (Germany), Agfa-Gevaert N.V. (Belgium), Carestream Health, Inc. (U.S.), AQUILAB SAS (France), Esaote S.p.A (Italy), MIM Software Inc. (U.S.), and Image Analysis, Ltd. (U.K.) (a subsidiary of IAG, Image Analysis Group (U.K.).

Scope of the Report:

Medical Image Analysis Software Market, by Software Type

Medical Image Analysis Software Market, by Image Type

Medical Image Analysis Software Market, by Modality

Medical Image Analysis Software Market, by Application

(Note: Other applications include Dental, Respiratory, and Vascular)

Medical Image Analysis Software Market, by End User

Medical Image Analysis Software Market, by Geography

Key questions answered in the report:

This study covers various integrated and standalone medical image analysis software offered by key companies for cardiology, orthopedics, oncology, neurology, obstetrics & gynecology, mammography, urology & nephrology, and other applications used in hospitals, diagnostics centers, and ambulatory surgical centers.

The medical image analysis software market is projected to reach $5.65 billion by 2029, at a CAGR of 7.8% during the forecast period.

Based on software type, in 2022, the integrated software segment is expected to account for the largest share of the medical image analysis software market.

Based on application, in 2022, the cardiology segment is expected to account for the largest share of the medical image analysis software market.

The growth of the medical image analysis software market is driven by the rising prevalence of chronic diseases, technological advancements, and growing applications of computer-aided diagnosis. Furthermore, emerging economies with improving healthcare infrastructure are expected to offer significant growth opportunities for companies operating in the market.

Key companies operating in the medical image analysis software market are Koninklijke Philips N.V. (Netherlands), Canon Inc. (Japan), GE HealthCare (U.S.), Siemens Healthineers AG (Germany), Agfa-Gevaert N.V. (Belgium), Carestream Health, Inc. (U.S.), AQUILAB SAS (France), Esaote S.p.A (Italy), MIM Software Inc. (U.S.), and Image Analysis, Ltd. (U.K.) (a subsidiary of IAG, Image Analysis Group (U.K.)).

Published Date: Jan-2026

Published Date: Jan-2025

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates