Resources

About Us

Massive Open Online Courses Market Size, Share, Forecast & Trends by Component (Platform, Service), Learning Mode (cMOOCs, xMOOCs), Subject, End-user - Global Forecast to 2035

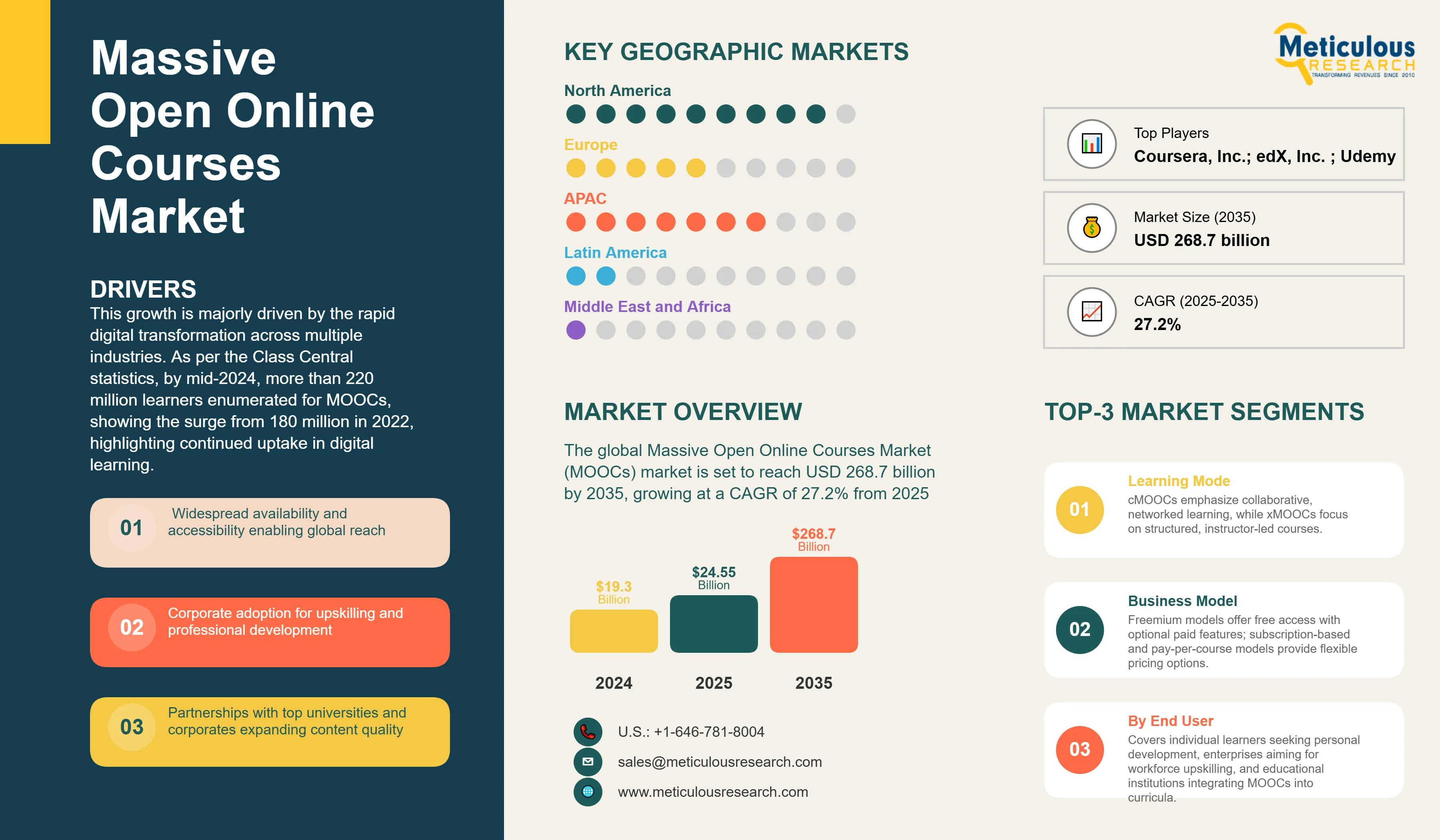

Report ID: MRICT - 1041555 Pages: 245 Aug-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 72 Hours Download Free Sample ReportThe global Massive Open Online Courses Market (MOOCs) market was valued at USD 19.3 billion in 2024 and is set to reach USD 268.7 billion by 2035, growing at a CAGR of 27.2% from 2025.

This growth is majorly driven by the rapid digital transformation across multiple industries. As per the Class Central statistics, by mid-2024, more than 220 million learners enumerated for MOOCs, showing the surge from 180 million in 2022, highlighting continued uptake in digital learning. Platforms such as Coursera, edX, and FutureLearn have collaborated with universities and corporate institutions, offering stackable credentials and upskilling certificates. In 2024 alone, Coursera stated a 35% Y-o-Y growth in enterprise enrolments, fuelled by increased demand for AI, cybersecurity, and data analytics certifications. Additionally, mobile-first delivery and AR/VR labs are facilitating the expansion of access in emerging regions, thereby overcoming geographical barriers and generating new revenue streams for providers.

Click here to: Get Free Sample Pages of this Report

The MOOCs sector is dominated by key players including Coursera, Udemy, and edX. Coursera’s alliance with Google and IBM unveiled accredited tech certifications to approximately 300,000 Indian learners. Similarly, Udemy’s partnership with Docker provided enterprise cloud-native pathways, while edX’s collaboration with Degreed embedded micro credentials into HR tolls facilitating over three million employees. Niche players such as the FutureLearn in the UK and Squirrel AI in China emphasize healthcare and adaptive learning. Thus, the strategic differentiation is highly based on credentialing, mobile user experience, and incorporation with LMS tools. Collaborations with universities and national agencies further strengthen the content credibility and reach in national markets.

Recent Developments

Coursera’s AI SkillSets Engine Revolutionizes Career Learning

In May 2024, Coursera unveiled ‘SkillSets’, an AI-enabled platform engine that matches learners to streamlined course pathways based on real-time job market information feed. This tool has been employed by 147 universities and corporate institutions; SkillSets enhanced learner engagement by 37% during Q12024.

Accenture’s Acquisition of Udacity Accelerates Enterprise Upskilling (Nov 2023)

In November 2023, Accenture announced the acquisition Udacity, incorporating its nano-degree courses into Accenture’s digital transformation section. This move increased a 25% Y-o-Y growth in MOOC adoption among Accenture’s enterprise clients by mid-2024.

Key Market Drivers

Key Market Restraints

Base CAGR: 27.2%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Enterprise Imperative to Upskill at Scale |

Corporate learning demand rises |

Lifelong upskilling normalizes |

▲ +5.0% |

|

2. Surge in Microcredentials and Degree Pathways |

Certificate enrollment spikes |

Formal recognition by employers |

▲ +4.2% |

|

|

3. Supportive Policies and Public-Private Initiatives |

More public-private pilots |

Government platforms mainstreamed |

▲ +3.7% |

|

|

Restraints |

1. Low Course Completion and Learner Engagement |

High dropout rates persist |

Ongoing engagement innovations |

▼ −2.8% |

|

2. Infrastructure and Access Barriers in Emerging Regions |

Digital divide remains |

Gradual tech adoption |

▼ −2.2% |

|

|

Opportunities |

1. Integration of AI, data analytics, and adaptive learning for personalization |

More tailored course experiences |

Intelligent personalized pathways |

▲ +4.3% |

|

1. Expansion into vocational, K12, and underserved language markets |

Field-specific content growth |

Broad inclusion across learner types |

▲ +4.0% |

|

|

Trends |

1. Rise of micro-credentials, nano degrees, and stackable programs |

Short-format program innovation |

Modular, creditable learning norms |

▲ +3.5% |

|

Challenges |

1. Ensuring sustained learner motivation and engagement |

Motivation strategies tested |

New engagement models established |

▼ −1.7% |

North America Leads Corporate and Academic MOOC Adoption

Driven by high digital literacy, corporate training demand, and university partnerships, North America continues to be the largest and most mature MOOC market, accounting for 40-45% of the total market share. Deloitte reported that in 2024, more than 60% of U.S. companies implemented MOOCs for employee development. Additionally, the region is a leader in credential-based learning, as platforms such as Coursera and edX collaborate with Ivy League institutions to provide credit-bearing courses. In 2023, the Canadian government allocated CAD 50 million to the development of digital learning infrastructure, which facilitated the integration of MOOCs into public education. A MOOC-based reskilling initiative that targets displaced workers in manufacturing and retail was initiated by the U.S. Department of Labor. North America remains a leader in the development and implementation of MOOCs, owing to its robust venture capital support and policy alignment.

Asia-Pacific’s Rapid Expansion Fuelled by Government Initiatives

The Asia-Pacific region is the fastest-growing MOOC region, expanding at 30.1% CAGR during 2025 to 2035. This growth is fuelled by the increasing demand for English-language education, government skilling programs, and mobile-first learning. By mid-2024, the Swayam platform had accumulated more than 30 million enrolments in India, with Tier 2 and Tier 3 cities experiencing substantial growth. In 2024, the national MOOC platform of China implemented AI-based personalization features, which resulted in a 20% increase in learner engagement. In Southeast Asia, vocational training is experiencing rapid adoption, as Indonesia and Vietnam have implemented MOOC-based teacher training programs. Japan's Ministry of Education collaborated with Coursera to provide university students with courses in artificial intelligence (AI) and robotics. Mobile penetration and policy support are driving exponential growth in MOOC usage across the region, despite infrastructure gaps in rural areas.

Corporate and University Alliances Strengthens MOOC Leadership in the U.S.

The U.S. MOOCs market was valued at USD 2 billion in 2024 and is projected to grow at 26.1% CAGR from 2025 to 2035. In the U.S., MOOCs form a foundational base of upskilling in higher education and corporate learning ecosystems. In 2024, Stanford and MIT offered their MOOC credentialing with credit-bearing courses in AI ethics and quantum computing. The U.S. Department of Education provided a USD 100 million initiative fund to assist MOOC advancement for community colleges. Moreover, Amazon and Walmart are deploying MOOCs for front-office training, demonstrating their robust corporate utilization. The U.S. leads in credentialing innovation, with platforms offering digital badges and blockchain-based certificates for verified learning outcomes.

Government-Funded Growth and Local Platform Innovation Accelerate China’s Market

China’s MOOCs market experienced incremental growth in the analysis timeframe and is expected grow at 29.4% CAGR during the forecast period, propelled by state-funded programs and national platforms. China has institutionalized MOOCs as part of its national education strategy. In 2023, the Ministry of Education mandated MOOC integration into university curricula, with over 1,000 courses approved for credit. Baidu and Alibaba launched AI-powered MOOC platforms offering real-time translation and adaptive learning. The government’s “Smart Education China” initiative aims to reach 100 million learners by 2025. MOOCs are also being used for rural teacher training and vocational education, with strong uptake in provinces like Sichuan and Henan.

EU Policy and University Collaborations Drive Uptake is Driving Germany’s MOOCs Market Expansion

Germany holds significant share of the overall massive open online courses market and was estimated to grow at a CAGR of 28.3% from 2025 to 2035. Germany is emerging as a European leader in MOOC-based vocational training. In 2024, the Federal Employment Agency partnered with Udemy to offer free courses to unemployed workers, focusing on digital skills and language training. Universities like TU Munich and RWTH Aachen are offering MOOCs in engineering and sustainability, with credit transfer options. The government’s Digital Pact for Schools includes funding for MOOC integration into secondary education. Germany’s emphasis on data privacy and open-source platforms makes it a model for scalable, compliant MOOC deployment.

xMOOCs and Hybrid Models Drive Scalable, Interactive Learning Across Global Markets

xMOOCs is set to grow at 29.5% CAGR by 2035. Coursera’s Degree Partnerships program enrolled 65,000 students in specialized bachelor’s and master’s tracks, contributing significantly to revenue. In contrast, cMOOCs emphasize peer interaction and collaborative projects. Hybrid models blending live webinars and offline workshops are gaining traction in corporate L&D, where blended training delivered ROI improvements. Technological enhancements, including AI-driven content recommendations and VR simulations, are increasingly applied across both formats to elevate interactivity and real-world applicability.

Individual Learners Fuel MOOC Growth Through Mobile Access and Personalized Credential Pathways

Individual learners accounted for significant market share, accounting for over 70% in 2024. Degree and master’s pathways attracted the most interest, capturing 57% of consumer enrollments, while informal learners pursued micro credentials and language courses. Student segments benefit from cost-effective streams, with Pepperdine’s MicroMasters witnessing 8,000 registrations in its first month. Both groups rely significantly on use of mobile apps and AI-driven customization for guided learning. As MOOC platforms integrate with social media and messaging apps, community-building features are enhancing networking and peer support, improving learner retention across segments.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 24.2 billion |

|

Revenue forecast in 2035 |

USD 268.7 billion |

|

CAGR (2025-2035) |

27.2% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Component (Platform, Service), Learning Mode (cMOOCs {Connectivist MOOCs}, xMOOCs {Extended MOOCs/Instructor-led}), Subject, End-user, Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

Coursera, Inc.; edX, Inc. (2U Inc.); Udemy, Inc.; Udacity, Inc. (part of Accenture); FutureLearn Ltd (Global University Systems); Canvas Network (Instructure, Inc.); openSAP (SAP SE); Miríadax (Telefónica Learning Services S.L.U); Blackboard, Inc. (Providence Equity Partners); 360training.com, Inc. |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

The Massive Open Online Courses Market is estimated to be USD 24.2 billion in 2025 and grow at a CAGR of 27.2% to reach USD 268.7 billion by 2035.

In 2024, the Massive Open Online Courses Market was valued at USD 19.3 billion, with projections to reach USD 24.2 billion in 2025.

Coursera, Inc., edX, Inc. (2U Inc.), Udemy, Inc., Udacity, Inc. (part of Accenture), FutureLearn Ltd (Global University Systems), Canvas Network (Instructure, Inc.), openSAP (SAP SE), Miríadax (Telefónica Learning Services S.L.U), and Blackboard, Inc. among others are the major companies operating in the Massive Open Online Courses Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

Individual learners accounted for significant market share, accounting for over 70% in 2024.

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates