Resources

About Us

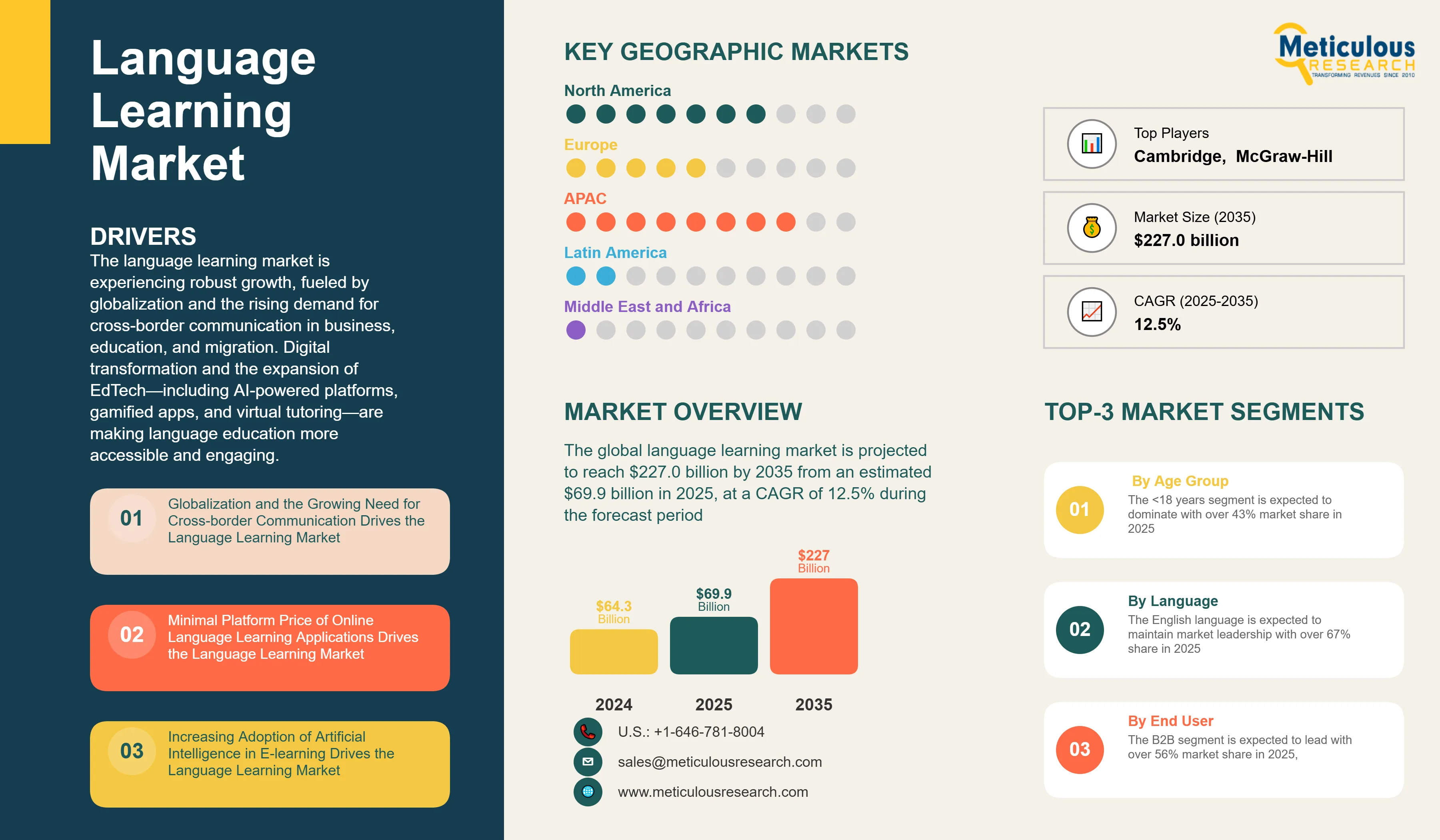

Language Learning Market Size, Share, Forecast, & Trends Analysis by Age Group (<18 years, 18-20 years, 21-30 years, 31-40 years, >40 years), Language (English, Mandarin, Spanish, French, German, Italian, Japanese) End User (B2C, B2B)—Global Forecast to 2035

Report ID: MRICT - 104878 Pages: 410 May-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 48 Hours Download Free Sample ReportThe language learning market is experiencing robust growth, fueled by globalization and the rising demand for cross-border communication in business, education, and migration. Digital transformation and the expansion of EdTech—including AI-powered platforms, gamified apps, and virtual tutoring—are making language education more accessible and engaging. Low-cost subscription models (e.g., Duolingo, Babbel) and government-led multilingualism initiatives (e.g., EU language policies, China’s English education push) further accelerate adoption. Additionally, AI-driven personalization (e.g., ChatGPT tutors, speech recognition) is revolutionizing e-learning efficiency.

Beyond individual learners, multinational corporations increasingly seek multilingual talent, driving demand for corporate language training programs. Startups in the sector are also attracting significant investments, particularly those leveraging immersive tech (VR/AR), adaptive learning algorithms, and niche language specialization. These trends collectively position the market for sustained expansion, with emerging economies (India, Africa, LATAM) offering untapped potential.

Technology is revolutionizing language learning through AI-powered apps, gamification, and virtual classrooms. Platforms like Duolingo and Babbel use adaptive algorithms to personalize lessons, while speech recognition enhances pronunciation practice. Gamified elements, such as rewards and leaderboards, boost engagement and retention. Virtual tutoring services like iTalki connect learners with native speakers worldwide, making education accessible. The rise of mobile learning allows users to study anytime, anywhere. EdTech innovations also include chatbots for conversational practice and AI-driven feedback systems. This digital shift caters to modern learners who prefer flexible, interactive, and cost-effective solutions over traditional classroom-based methods.

Governments worldwide are mandating language education to foster multilingualism and global competitiveness. Countries like China emphasize English proficiency, while the EU promotes regional language diversity. Standardized tests (TOEFL, IELTS) are integral for academic and professional opportunities, driving demand for test prep services. Public schools are incorporating bilingual programs, and national initiatives support adult language training. Policymakers recognize language skills as vital for economic growth, diplomacy, and social integration. Subsidies and partnerships with private educators further expand access. These policies create a structured demand for language learning, ensuring sustained market growth across age groups and socioeconomic backgrounds.

Click here to: Get Free Sample Pages of this Report

Migration and tourism are key drivers of language learning. Immigrants learn host-country languages to improve employability and social integration, with programs targeting Spanish in the U.S. or German in Europe. Post-pandemic travel resurgence fuels demand for conversational skills in popular tourist destinations. Language apps now offer travel-specific courses, teaching phrases for dining, transportation, and emergencies. Governments and NGOs also provide free language resources to aid newcomers. This trend highlights the practical necessity of language acquisition for mobility, cultural adaptation, and global connectivity, making it a persistent growth sector.

The convergence of artificial intelligence and gamification presents unprecedented opportunities in language learning. AI-powered platforms can now deliver hyper-personalized experiences through adaptive algorithms that adjust difficulty, content, and pacing based on individual learning patterns. Companies like Duolingo have demonstrated the market potential, but significant gaps remain in specialized areas like business English, technical vocabulary, and cultural context training. Gamification elements including achievement systems, social competitions, and immersive storylines increase engagement rates by up to 70% compared to traditional methods. The integration of advanced AI features such as real-time pronunciation coaching, conversational chatbots powered by large language models, and predictive analytics for learning optimization creates compelling value propositions. Mobile-first platforms capture the growing demand for flexible, on-demand learning solutions that fit busy lifestyles and leverage microlearning principles.

Emerging markets represent the fastest-growing segment of the global language learning industry, driven by economic development, urbanization, and digital connectivity expansion. In Asia, countries like India, Indonesia, and Vietnam show enormous demand for English proficiency to access global job markets and educational opportunities. Africa's young, mobile-first population creates opportunities for affordable, accessible language learning solutions that address limited internet infrastructure through offline capabilities and SMS-based learning modules. Latin America's growing middle class and business ties with North America fuel demand for professional English skills. These markets require localized approaches including culturally relevant content, regional payment methods, and partnerships with local educational institutions. Mobile-optimized platforms are essential given smartphone penetration rates often exceed computer access. Freemium models work well in price-sensitive markets, while government partnerships for educational initiatives can provide scale and legitimacy for expanding language learning companies.

The <18 years segment is expected to dominate with over 43% market share in 2025, driven by rising preference for interactive and engaging learning experiences, increasing demand for cross-border collaboration skills, and expanding higher education opportunities. This segment benefits from language learning's cognitive advantages including enhanced verbal and spatial reasoning, improved memory, and strengthened problem-solving abilities.

However, the 18-20 years segment shows the highest growth rate, fueled by growing needs to enhance employability and job market competitiveness, deeper cultural engagement requirements, and study abroad enrichment opportunities. This demographic comprises dedicated high school students strongly committed to academic excellence and cognitive growth, exhibiting enthusiastic approaches to embracing diverse languages and cultures through internet-based learning platforms.

The English language is expected to maintain market leadership with over 67% share in 2025, supported by rising demand for English learning programs, accelerating globalization and urbanization trends, growing worldwide English learner populations, increasing popularity of English proficiency tests, and expanding emphasis on English education in schools and institutions.

Mandarin exhibits the fastest growth trajectory, leveraging its status as the world's second most spoken language with 1.117 billion speakers globally according to Busuu Online S.L. data from May 2022. As a group of Sinitic languages natively spoken across northern and southwestern China, Mandarin holds official status in China, Taiwan, and Singapore, with over 70% of China's population speaking the language.

The B2B segment is expected to lead with over 56% market share in 2025, driven by increasing corporate demand for industry-specific language skills to communicate effectively with international clients, partners, and markets. Growth factors include enhanced business communication needs and rising language training demand across government, education, and private sector organizations.

B2C segment demonstrates higher growth potential during the forecast period, supported by similar drivers including industry-specific communication requirements, business communication enhancement needs, and expanding language training demand across various organizational sectors.

In 2025, Asia-Pacific is expected to account for the largest share of over 49.2% of the language learning market. The growth of this market is attributed to the influx of multinational companies, government initiatives to strengthen national education networks, growing government focus on the education sector, rapidly developing economies, and increasing disposable incomes leading to increased Internet penetration. Asia-Pacific holds tremendous growth opportunities for the language learning market. Market players in this region are adopting various strategies to broaden their product portfolios, advance the capabilities of their existing products, cater to the changing needs of the users, and ensure a competitive edge in the language learning market. Various key players in this market launch various initiatives in the development of the market.

Moreover, the Asia-Pacific region is projected to register the highest CAGR during the forecast period.

The report offers a competitive analysis based on an extensive assessment of the product portfolios and geographic presence of leading market players and the key growth strategies adopted by them over the past three to four years. The key players operating in the language learning market include Cambridge University Press (U.K.), New Oriental Education & Technology Group Inc. (China), Houghton Mifflin Harcourt Company (U.S.), McGraw-Hill Education, Inc. (U.S.), Duolingo Inc. (U.S.), Berlitz Corporation (U.S.), Busuu Online S.L. (Spain), Babble GMBH (Germany), Linguistica 360, Inc. (U.S.), Mondly (Romania), ELSA Corp. (U.S.), FluentU (China), Memrise Inc. (U.K.), Mango Languages (U.S.), Rosetta Stone Ltd. (U.S.), Inlingua International Ltd. (Switzerland), Sanako Corporation (Finland), Transparent Language, Inc. (U.S.), and Open Education LLC (U.S.).

|

Particulars |

Details |

|

Number of Pages |

410 |

|

Format |

|

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR |

12.5% |

|

Market Size (2031) |

$69.9 Billion |

|

Market Size (2035) |

$227.0 Billion |

|

Segments Covered |

Language Learning Market Assessment—by Age Group

Language Learning Market Assessment—by Language

Language Learning Market Assessment—by Learning Objective

Language Learning Market Assessment—by End User

|

|

Countries Covered |

Europe (Germany, France, Italy, U.K., Spain, Russia, Poland, Netherlands, Sweden, Belgium, Austria, Switzerland, Finland, Norway, Turkey, Ireland, Luxembourg, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Indonesia, Australia & New Zealand, Taiwan, Hong Kong, Singapore, Malaysia, Vietnam, and Rest of Asia-Pacific), North America (U.S. and Canada), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, and Rest of Middle East & Africa) |

|

Key Companies Profiles |

Cambridge University Press (U.K.), New Oriental Education & Technology Group Inc. (China), Houghton Mifflin Harcourt Company (U.S.), McGraw-Hill Education, Inc. (U.S.), Duolingo Inc. (U.S.), Berlitz Corporation (U.S.), Busuu Online S.L. (Spain), Babble GMBH (Germany), Linguistica 360, Inc. (U.S.), Mondly (Romania), ELSA Corp. (U.S.), FluentU (China), Memrise Inc. (U.K.), Mango Languages (U.S.), Rosetta Stone Ltd. (U.S.), Inlingua International Ltd. (Switzerland), Sanako Corporation (Finland), Transparent Language, Inc. (U.S.), and Open Education LLC (U.S.). |

The global language learning market size was valued at $64.3 billion in 2024.

The language learning market is expected to reach $227.0 billion by 2035, at a CAGR of 12.5% from 2025 to 2035.

The language learning market study focuses on market assessment and opportunity analysis based on the sales of language learning products across different regions, countries, and market segments. This study also includes a competitive analysis of the language learning market based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last three to four years.

Based on age group, in 2025, the <18 years segment is expected to account for the largest share of the language learning market. The large market share of this segment is attributed to the rising preference for interactive and engaging learning experiences, increasing demand for language skills to work and collaborate across borders, expanding higher education opportunities, and increasing need for immersive and practical language practice. Learning new languages can increase verbal and spatial reasoning, long and short-term memory, problem-solving ability, and the potential for creative expressions.

Based on end user, the B2C segment is projected to record the highest CAGR over the forecast period. This segment's growth is driven by the increasing need for Industry-specific language skills to communicate effectively with international clients, partners, and markets, the growing need to enhance business communication, and the rising demand for language training for various organizations such as the government, education, and private sectors.

The growth of the language learning market is driven by globalization and the growing need for cross-border communication, minimal platform price of language learning applications, and increasing adoption of artificial intelligence (AI) in E-learning. Furthermore, the growing preferences for multilingual employees by multinational companies and increasing investments in start-ups and small companies teaching languages are expected to offer significant growth opportunities for the language learning market.

The key players operating in the language learning market include Cambridge University Press (U.K.), New Oriental Education & Technology Group Inc. (China), Houghton Mifflin Harcourt Company (U.S.), McGraw-Hill Education, Inc. (U.S.), Duolingo Inc. (U.S.), Berlitz Corporation (U.S.), Busuu Online S.L. (Spain), Babble GMBH (Germany), Linguistica 360, Inc. (U.S.), Mondly (Romania), ELSA Corp. (U.S.), FluentU (China), Memrise Inc. (U.K.), Mango Languages (U.S.), Rosetta Stone Ltd. (U.S.), Inlingua International Ltd. (Switzerland), Sanako Corporation (Finland), Transparent Language, Inc. (U.S.), and Open Education LLC (U.S.).

Asia-Pacific is projected to register the highest CAGR during the forecast period. The rapid growth of this regional market is attributed to the increasing awareness of personal hygiene, the rising adoption of hygiene & healthcare products, and increasing government initiatives promoting personal hygiene, healthcare, and infant care in the region. Also, the increasing adoption of SAPs for medical applications, including wound dressings and disposable medical products, and the rising demand for sustainable and biodegradable personal care products support the growth of this regional market.

Published Date: May-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates