Resources

About Us

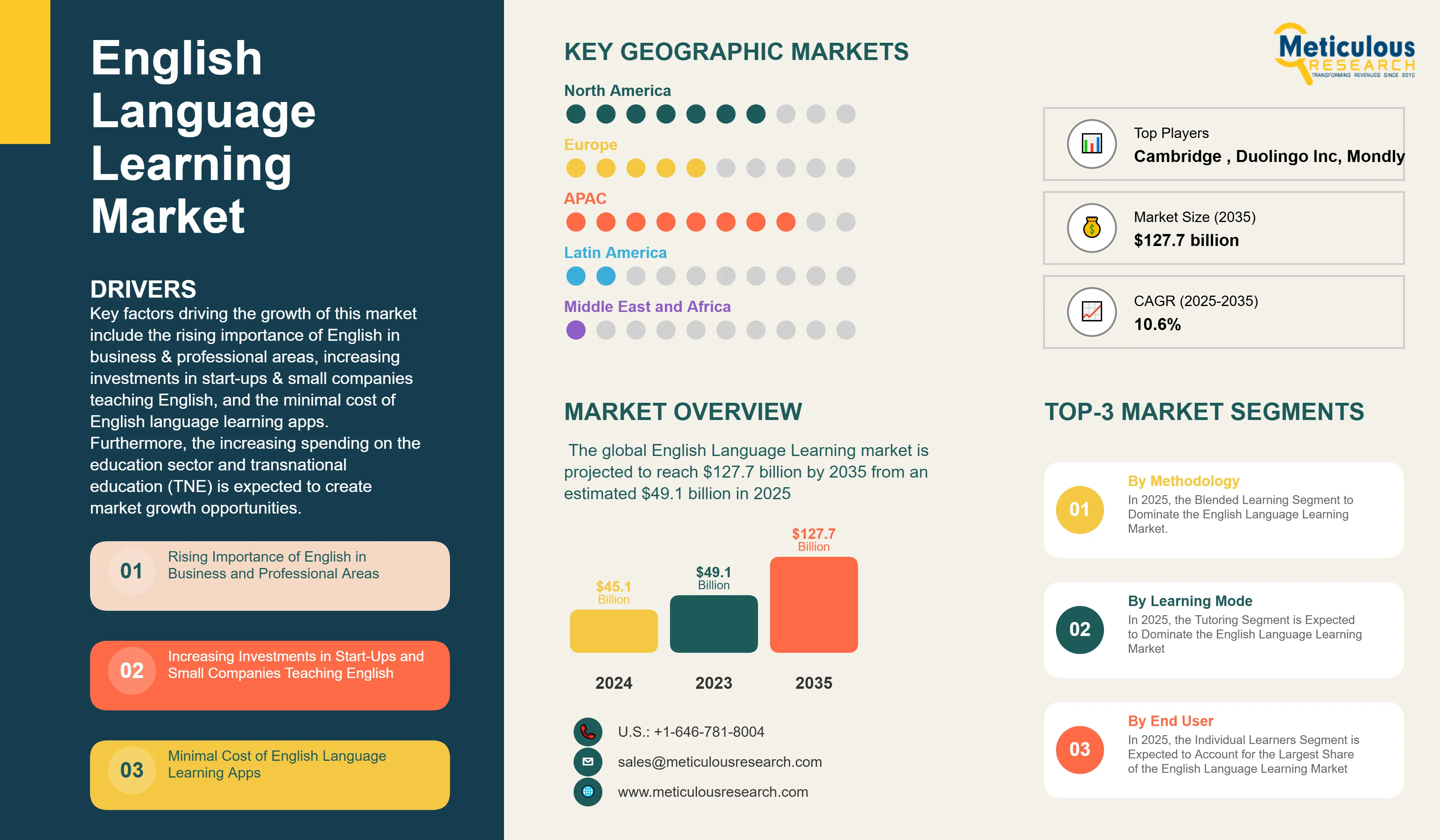

English Language Learning Market Size, Share, Forecast, & Trends Analysis by Methodology (Blended, Offline, Online), Learning Mode, Age Group, End User (Individual Learners, Educational Institutes, Government Bodies, Corporate Learners) - Forecast to 2035

Report ID: MRICT - 104431 Pages: 295 May-2025 Formats*: PDF Category: Information and Communications Technology Delivery: 24 to 48 Hours Download Free Sample ReportKey factors driving the growth of this market include the rising importance of English in business & professional areas, increasing investments in start-ups & small companies teaching English, and the minimal cost of English language learning apps. Furthermore, the increasing spending on the education sector and transnational education (TNE) is expected to create market growth opportunities.

The rapid digital transformation in education, accelerated by the COVID-19 pandemic, has significantly expanded access to online learning platforms, making English education more accessible to populations in emerging markets where traditional classroom-based instruction was previously limited. Technological advancements, particularly in artificial intelligence and machine learning, are revolutionizing language acquisition through personalized adaptive learning systems, speech recognition tools, and AI-powered tutors that provide instant feedback and customized lesson plans.

Government initiatives in many non-English speaking countries to improve English proficiency among their workforce are further stimulating market growth, as seen in national education reforms across the Middle East and Southeast Asia. The rise of digital nomadism and remote work arrangements has created additional demand for business English and communication skills training. Furthermore, the proliferation of smartphones and improving internet infrastructure in emerging economies has enabled mobile-first learning solutions to reach previously underserved populations, while gamification techniques are enhancing learner engagement and retention rates.

Click here to: Get Free Sample Pages of this Report

Education start-ups are evolving rapidly to cater to the needs of hundreds of millions of non-English medium students and individual learners for English language training. The global demand for higher education is expected to increase, and nearly 600 million students will be enrolled in universities worldwide by 2040. Many students present a unique opportunity for education start-ups to expand their product portfolio for English language learning platforms. Since the advent of the COVID-19 pandemic, English language learning apps have seen a boom in interest by investors as traditional classroom learning models have been flipped upside down. Alternative language learning companies are attracting investors and reaching “unicorn” status, a term used in the venture capital industry to describe a privately held startup company with a valuation of over USD 1 billion, more frequently than ever before. Several companies, including start-ups, have received investments for accelerating the English language learning platforms. For instance:

AI and robot technology are transforming the English language learning market by enabling personalized, efficient, and scalable education. Platforms like Duolingo and ELSA Speak use AI for real-time feedback and adaptive lessons. Robot-assisted tools like Elias offer immersive, teacher-like interaction, especially in regions with limited native instructors. AI chatbots, VR classrooms, and automated assessments are reducing costs and improving access. Despite challenges like privacy concerns and development costs, AI-driven learning continues to gain traction globally across education and corporate training.

E-learning is accelerating language learning through flexible, low-cost, and accessible digital platforms. With the rise of internet users and mobile technology, animated and interactive content is enhancing learner engagement. Platforms like the British Council’s myClass Online offer live and self-paced courses with expert guidance. Customized modules, available on-demand, help users manage learning alongside work or personal responsibilities. Distance learning’s adaptability and growing investment in digital education continue to drive e-learning’s expansion across age groups and global markets.

Emerging markets like India, Brazil, and Nigeria show rising demand for English skills driven by globalization and digital jobs. Mobile-first learning apps are bridging access gaps caused by limited infrastructure and teacher shortages. With high smartphone adoption, platforms like Hello English and Cake offer gamified, offline-capable learning on low-end devices. Governments and NGOs are also driving growth via digital education partnerships. Voice-based and vernacular tools are gaining popularity, while localized freemium and ad-supported models make learning affordable. These trends are unlocking vast opportunities for scalable, inclusive English education in underserved regions.

Transnational education (TNE) allows students to earn foreign degrees from their home country through partnerships, branch campuses, or virtual programs. Post-pandemic, TNE gained momentum as international mobility declined and institutions sought alternative revenue streams. TNE supports skill development, reduces brain drain, and increases access to quality education without relocation. It benefits professionals seeking flexible upskilling and fosters competition between local and foreign providers. As demand for globally recognized education grows—especially in developing regions—TNE fuels the adoption of English language learning (ELL) tools, creating new opportunities for digital platforms and international academic partnerships.

Based on offering, the global English language learning market is segmented into blended learning, offline learning, and online learning. In 2025, the blended learning segment is estimated to account for the largest share of the global English language learning market. Traditional and digital learning methods offer a complex and diverse learning environment, significantly increasing students’ motivation to learn. Technology advancements and internet access have changed the teaching process for all languages. Blended learning is also known as hybrid learning or mixed learning process. It comprises two or more learning methods: face-to-face teaching and online learning. Additionally, this learning methodology offers many advantages, including learning from independent locations and offering learners the same training opportunities at all locations.

However, the online learning segment is projected to register the highest CAGR during the forecast period. The rapid growth of this segment is driven by the increasing user base for mobile phones, the growing digitalization in the education sector, the increasing budget allocations and investments for E-learning programs, and the emergence of new online learning platforms after the COVID-19 pandemic. With the emergence of new technologies and improved digital tools and techniques online, English learning is gaining significant traction.

Based on age group, the global English language learning market is segmented into 40 years. In 2025, the 13-17 years segment is expected to account for the largest share of of the global English language learning market. The large market share of this segment is attributed to the increasing digitization of public schools, the rising number of English learners, the significant increase in smartphone users, the increasing demand for kids' learning apps, the rising preference for interactive and engaging learning experiences, and increasing need for immersive and practical language practice.

Based on end user, the global English language learning market is segmented into individual learners, educational institutes, government bodies, and corporate learners. The educational institutes is further segmented into K-12, and higher education. In 2025, the individual learners segment is expected to account for the largest share of the global English language learning market. Also, this segment is expected to register the highest CAGR during the forecast period. The large share of this market is attributed to the increasing adoption of smart devices coupled with faster internet penetration, the growing need for transmission of live content on the internet for better brand engagement and student reach, and the high number of established language learning sites.

In 2025, Asia-Pacific is estimated to account for the largest share of the global English language learning market. The large market share of this market is attributed to the increasing digitalization of educational content, increasing demand for language skills to work and collaborate across borders, wide availability of E-learning courses, and growing popularity of English learning programs in the region, growing Internet penetration, increasing government focus on education through various initiatives, and the growing need to enhance employability and competitiveness in the future job opportunities.

Moreover, the market in Asia-Pacific is also projected to register the highest CAGR during the forecast period.

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by key market players over the past three years (2022-2025). The key players profiled in the global English language learning market report are Cambridge University Press (U.K.), New Oriental Education & Technology Group Inc. (China), Houghton Mifflin Harcourt Company (U.S.), McGraw-Hill Education, Inc. (U.S.), Duolingo Inc. (U.S.), Berlitz Corporation (U.S.), Busuu Online S.L. (Spain), Babble GMBH (Germany), Linguistica 360, Inc. (U.S.), Mondly (Romania), ELSA Corp. (U.S.), FluentU (A part of Enux Education Limited) (China), Memrise Inc. (U.K.), Mango Languages (U.S.), Rosetta Stone Ltd. (A part of IXL Learning, Inc.) (U.S.), Inlingua International Ltd. (Switzerland), Sanako Corporation (Finland), Transparent Language, Inc. (U.S.), and Open Education LLC (U.S.).

|

Particulars |

Details |

|

Number of Pages |

295 |

|

Format |

|

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

10.0% |

|

Market Size (Value) |

USD 127.7 Billion by 2035 |

|

Segments Covered |

Global English Language Learning Market, by Methodology

Global English Language Learning Market, by Learning Mode

Global English Language Learning Market, by Age Group

Global English Language Learning Market, by End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Russia, Poland, Netherlands, Belgium, Sweden, Austria, Switzerland, Finland, Norway, Turkey, Ireland, Luxembourg, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Indonesia, Australia & New Zealand, Taiwan, Hongkong, Singapore, Malaysia, Vietnam, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, Rest of Middle East & Africa) |

|

Key Companies |

Cambridge University Press (U.K.), New Oriental Education & Technology Group Inc. (China), Houghton Mifflin Harcourt Company (U.S.), McGraw-Hill Education, Inc. (U.S.), Duolingo Inc. (U.S.), Berlitz Corporation (U.S.), Busuu Online S.L. (Spain), Babble GMBH (Germany), Linguistica 360, Inc. (U.S.), Mondly (Romania), ELSA Corp. (U.S.), FluentU (A part of Enux Education Limited) (China), Memrise Inc. (U.K.), Mango Languages (U.S.), Rosetta Stone Ltd. (A part of IXL Learning, Inc.) (U.S.), Inlingua International Ltd. (Switzerland), Sanako Corporation (Finland), Transparent Language, Inc. (U.S.), and Open Education LLC (U.S.). |

The global English language learning market size was valued at $45.1 billion in 2024.

The market is projected to grow from $49.1 billion in 2025 to $127.7 billion by 2035.

The English language learning market analysis indicates substantial growth, with projections indicating that the market will reach $127.7 billion by 2035 at a compound annual growth rate (CAGR) of 10.0% from 2025 to 2035.

The key companies operating in this market include Cambridge University Press (U.K.), New Oriental Education & Technology Group Inc. (China), Houghton Mifflin Harcourt Company (U.S.), McGraw-Hill Education, Inc. (U.S.), Duolingo Inc. (U.S.), Berlitz Corporation (U.S.), Busuu Online S.L. (Spain), Babble GMBH (Germany), Linguistica 360, Inc. (U.S.), Mondly (Romania), ELSA Corp. (U.S.), FluentU (A part of Enux Education Limited) (China), Memrise Inc. (U.K.), Mango Languages (U.S.), Rosetta Stone Ltd. (A part of IXL Learning, Inc.) (U.S.), Inlingua International Ltd. (Switzerland), Sanako Corporation (Finland), Transparent Language, Inc. (U.S.), and Open Education LLC (U.S.).

Artificial intelligence (AI) & robot technology and e-learning are prominent trends in the English language learning market.

By methodology, the blended learning segment is forecasted to hold the largest market share during 2025-2035; by learning mode, the tutoring segment is expected to dominate the market during 2025-2035; by age group, the 13-17 years segment is poised to record the dominant position in the market during 2025-2035; by end user, the individual learners segment is expected to dominate the market during 2025-2035; and by geography, the Asia-Pacific region is expected to hold the largest market share during 2025-2035.

By region, Asia-Pacific holds the largest share of the English language learning market in 2025. Moreover, this market is projected to register the highest growth rate during the forecast period, driven by the influx of multinational companies, the growing need to improve communication across borders, increasing access to language learning platforms, high demand for multilingual professionals, government initiatives to strengthen national education networks, and rising demand for cost-effective programs that address the knowledge gap in students.

Key factors driving the growth of this market include the rising importance of English in business & professional areas, increasing investments in start-ups & small companies teaching English, and the minimal cost of English language learning apps.

Published Date: May-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates