Resources

About Us

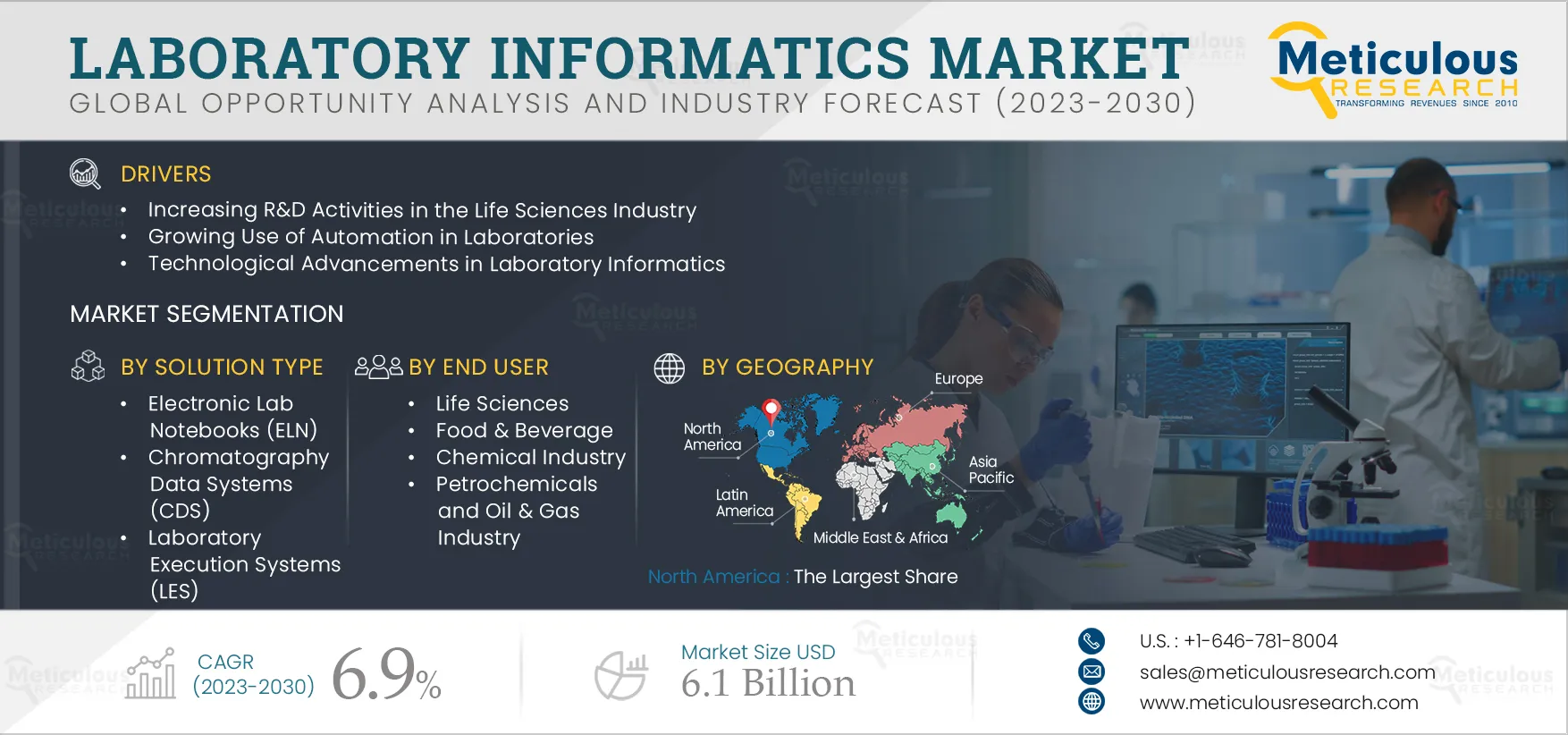

Laboratory Informatics Market by Solution Type (LIMS, ELN, EDC, CDMS, LES, ECM, SDMS), Delivery Mode (Web, Cloud, On-Premise), Component (Service, Software), End User (Pharma & Biotech, CROs, CMOs, Food & Beverage, Chemical) - Global Forecast to 2030

Report ID: MRHC - 10492 Pages: 210 Jan-2023 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportLaboratory informatics solutions help to reduce manual efforts, labor cost, cost of error, and throughput time; offer paperless information management and effective data analytics; improve data traceability, accessibility, security and sharing; streamline processes; enhance quality management; abide by the regulatory requirements; and provide better control of all business processes and decision support. Thus, automation of laboratory processes and integration of data provides a robust platform to drive scientific decisions and improve quality and operational efficiency, thereby enabling lab professionals to productively advance research, development, and manufacturing.

The pandemic brought unprecedented demand for innovative laboratory informatics solutions to pave the way for digital transformation. This avoided a complete shutdown, and the laboratory technicians could continue their work without interruptions. The pandemic also accelerated the adoption of secure cloud-based laboratory solutions for efficient remote-based working.

In November 2021, Insightful Science (U.S.) acquired LabArchives (U.S.) to expand its LIMS solutions for scientific discovery. Additionally, in July 2021, Francisco Partners (U.S.) acquired the STARLIMS informatics product suite from Abbott (U.S.).

The increasing R&D activities in the life sciences industry, the growing use of automation in laboratories, technological advancements in laboratory informatics solutions, and the rising need to comply with regulatory frameworks are some of the major drivers for the growth of this market.

Automation in laboratories includes advanced, programmable and automated workstations that can perform a multitude of tasks; sophisticated robotics that can perform tasks once restricted to humans; and artificial intelligence systems on chips that can learn from their experiences much like ordinary humans. Laboratory automation and the growing emergence of new technological solutions have transformed the research and manufacturing work for scientists and lab professionals. The laboratory automation industry has seen a steady evolution from automating routine pipetting tasks to fully-integrated workstations that provide total application solutions. Automation in laboratories includes automated lab instruments, software, processes, and systems that reduce human errors and cycle time, streamlining operations, increasing productivity, advancement in accuracy, data management, product/service quality, and ensuring compliance.

Factors such as the need to abide by regulations, improve lab infrastructure in developed and developing countries, progress drug discovery and outsourcing of research to CROs, improve efficiencies and have a competitive edge in the market are pushing laboratories across the globe towards automation. The degree of automation that any laboratory executes depends on its process, budget, and the kind of work they carry out.

Click here to: Get a Free Sample Copy of this report

Emerging countries in Asia-Pacific, Latin America, and the Middle East hold significant market growth opportunities. These countries are developing R&D infrastructure that uses modern technologies to abide by international regulatory standards. Developed countries in North America and Europe have been major revenue generators for the stakeholders of the laboratory informatics market. However, these markets will eventually reach saturation encouraging laboratory informatics providers to expand their geographical presence.

Asia-Pacific is considered a high-potential market as countries such as India and China have shown high research potential over the past decade. The increasing population and the growing incidence of chronic disorders have encouraged countries to develop laboratory infrastructure and increase the number of laboratories to effectively carry out research. Increasing clinical trials and outsourcing research activities to CROs in Asia-Pacific have boosted the implementation of lab informatics solutions due to their cost-effectiveness. Moreover, growing government support for digitalization in these countries is expected to create opportunities for lab automation and informatics vendors. Such developments indicate the enormous scope for laboratory informatics solutions providers as the life sciences industry is one of the key end users.

The factors contributing to the large market share of this segment are improved lab productivity and efficiency, rising research & development expenditure, effective management and pressure on maintaining regulatory compliance in clinical trials, and other advantages such as integration of instruments, workflow automation, and management of samples & associated information.

Based on component, in 2023, the services segment is expected to account for the largest share

Industries are paying subscription charges based on customization intended in the software-as-a-service model. The key factors attributing to the large market share for the services segment are increased demand for consulting, implementation, integration, management, and other lab informatics services, rise in outsourcing solutions, and evolving regulatory requirements.

The key factors attributing to the large market share of this segment are the rise in R&D activities, high adoption of laboratory informatics in pharmaceutical laboratories, increased concern over data integrity, validity, and security due to regulatory pressures, cost efficiency, and enhanced productivity.

North America: Estimated Largest Regional Market

The key factors supporting the largest share of North America are strict government regulations that push laboratories to deploy data management systems across industries, a well-established economy and financial capability to adopt new & advanced technologies, a high level of automation in laboratories, the presence of leading laboratory informatics vendors, and need for integration of laboratory systems. High spending on R&D across universities in the U.S. also contributes to the large share of this segment. The top ten universities in the National Science Foundation’s (NSF) 2020 listing spend an excess of USD 1 billion on R&D. For instance, Johns Hopkins University (JHU) spent USD 3.1 billion in 2020.

The report includes a competitive landscape based on an extensive assessment of the key strategic developments adopted by leading market players over the past three years. The key players profiled in the global laboratory informatics market report are Agilent Technologies, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), ID Business Solutions Limited (U.K.), PerkinElmer, Inc. (U.S.), STARLIMS Corporation (U.S.), Labworks (U.S.), LabLynx, Inc. (U.S.), LabVantage Solutions Inc. (U.S.), LabWare, Inc. (U.S.), Autoscribe Informatics (U.K.), Novatek International (Canada), Dassault Systèmes (France), and Waters Corporation (U.S.), among others.

Laboratory Informatics Market, by Solution Type

Laboratory Informatics Market, by Delivery Mode

Laboratory Informatics Market, by Component

Laboratory Informatics Market, by End User

Laboratory Informatics Market, by Geography

Key questions answered in the report:

This study offers a detailed assessment of the laboratory informatics market, including the market size & forecast for various segmentation like type of solution, mode of delivery, component, and end user. The laboratory informatics market studied in this report also involves the value analysis of various segments and sub-segments of laboratory informatics at regional and country levels.

The global laboratory informatics market is projected to reach $6.1 billion by 2030, at a CAGR of 6.9% during the forecast period.

Based on component, the services segment is projected to register the highest CAGR over the forecast period due to a surge in outsourcing solutions and evolving regulatory requirements.

The growth of this market is mainly attributed to the increasing R&D activities in the life sciences industry, the growing use of automation in laboratories, technological advancements in laboratory informatics solutions, and the rising need to comply with regulatory frameworks. Moreover, untapped markets in emerging economies and the adoption of laboratory informatics in the cannabis industry will offer significant opportunities for market growth.

The key players profiled in the global laboratory informatics market are Agilent Technologies, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), ID Business Solutions Limited (U.K.), PerkinElmer, Inc. (U.S.), STARLIMS Corporation (U.S.), Labworks (U.S.), LabLynx, Inc. (U.S.), LabVantage Solutions Inc. (U.S.), LabWare, Inc. (U.S.), Autoscribe Informatics (U.K.), Novatek International (Canada), Dassault Systèmes (France), and Waters Corporation (U.S.), among others.

Emerging economies in the Asia-Pacific region are projected to offer significant growth opportunities to the market players due to the rising adoption of laboratory informatics and the increasing patient population.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates