Resources

About Us

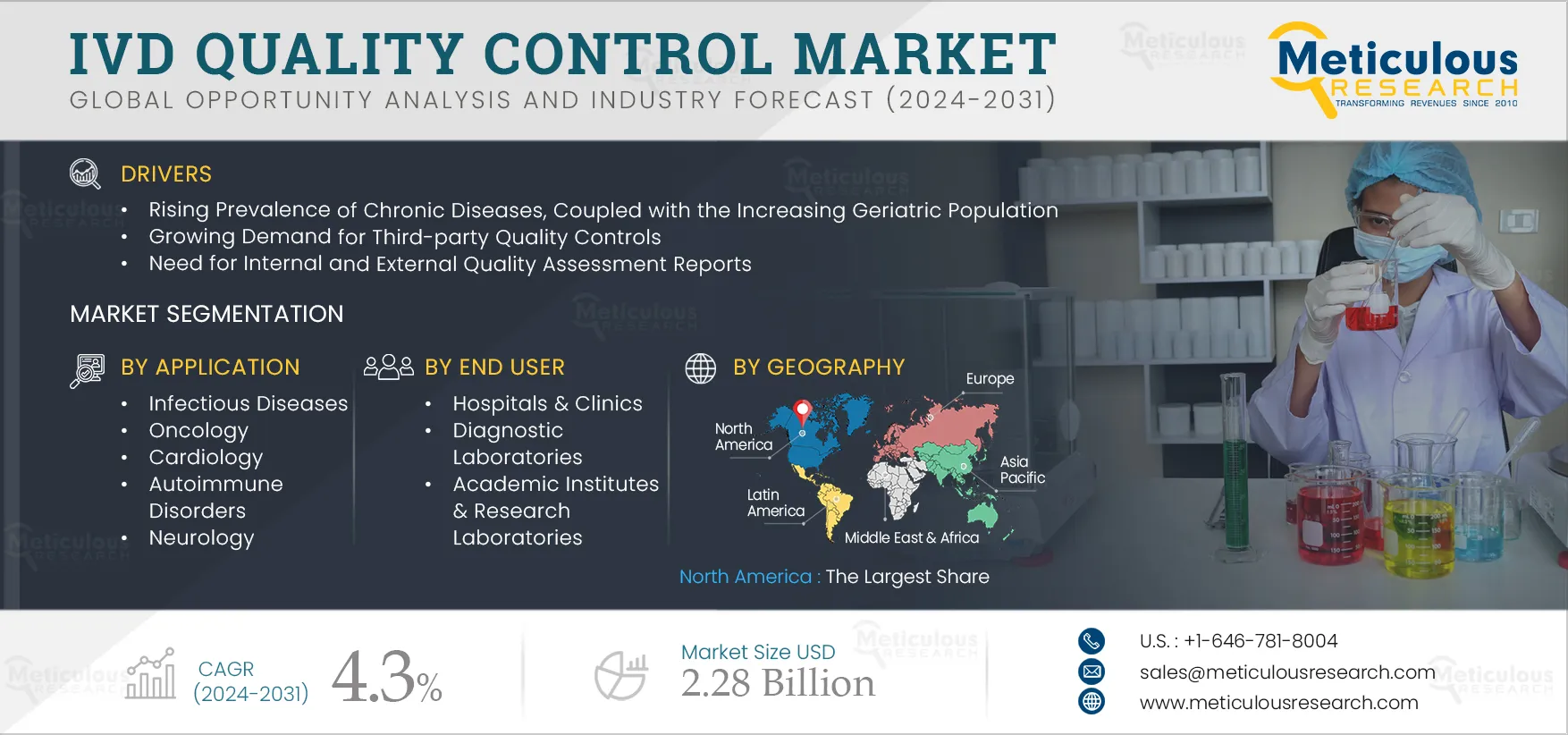

IVD Quality Control Market Size, Share, Forecast & Trends Analysis by Offering (Product [Serum, Blood], Data Management, Service) Technology (Biochemistry, Molecular, Immunoassay) Application (cardiology, Oncology) End User – Global Forecast to 2031

Report ID: MRHC - 104119 Pages: 267 Jan-2024 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe IVD quality control market covers quality control products, external quality assessment services, and data management solutions offered by companies for infectious diseases, cardiology, hematology, oncology, and other applications for use in hospitals & clinics, diagnostic laboratories, academic & research institutes, and blood banks.

The rising prevalence of chronic diseases, coupled with the increasing geriatric population, growing demand for third-party quality controls, need for internal and external quality assessment reports, increasing number of clinical laboratories, and growing demand for Point-of-Care (POC) and rapid diagnostics drive the market growth. However, stringent technical requirements and regulatory processes for quality controls restrain this market's growth.

Among the IVD quality controls commercially available, there is an increasing demand for multi-analyte and multi-instrument controls. Multi-analyte controls are designed to contain multiple analytes of interest, representing a range of concentrations typically found in patient samples. On the other hand, multi-instrument controls are designed to be compatible with different types of laboratory instruments and testing platforms.

There is an increasing demand for multi-analyte controls as they eliminate the need to use separate controls for each analyte, streamlining the quality control process and saving time and resources. They are also cost-effective, as consolidating multiple analytes into a single control can be more cost-effective than purchasing separate controls for each analyte. Overall, the demand for multi-analyte and multi-instrument controls is driven by the need for efficient, cost-effective, and standardized quality control processes in diagnostic testing.

Click here to: Get Free Sample Pages of this Report

Both the internal and external quality assessment reports are required due to several reasons. Quality Assessment (QA) reports provide a systematic evaluation of the laboratory's performance by monitoring the accuracy and precision of test results. These reports ensure that the laboratory consistently produces reliable results. Internal QA reports contribute to meeting regulatory standards and accreditation requirements. These reports demonstrate the laboratory's commitment to quality and compliance with established guidelines. By analyzing internal QA data, laboratories can identify trends, patterns, and potential sources of error. This information facilitates targeted process improvements, leading to enhanced testing procedures and reduced chances of errors. Whereas external QA reports enable laboratories to compare their results with those of other facilities. Discrepancies can identify areas for improvement and prompt corrective actions. Moreover, participation in external QA programs is often a requirement for laboratory accreditation. Proficiency testing through external QA helps laboratories maintain their accreditation status. External QA reports validate the accuracy of a laboratory's testing methods and verify its ability to generate reliable results. These assessment data are analyzed using quality controls, hence driving the market growth.

Among the IVD quality controls commercially available, there is an increasing demand for multi-analyte and multi-instrument controls. Multi-analyte controls are designed to contain multiple analytes of interest, representing a range of concentrations typically found in patient samples. On the other hand, multi-instrument controls are designed to be compatible with different types of laboratory instruments and testing platforms. There is an increasing demand for multi-analyte controls as they eliminate the need to use separate controls for each analyte, streamlining the quality control process and saving time and resources.

Furthermore, they are also cost–effective, as consolidating multiple analytes into a single control can be more cost-effective than purchasing separate controls for each analyte. Overall, the demand for multi-analyte and multi-instrument controls is driven by the need for efficient, cost-effective, and standardized quality control processes in diagnostic testing.

Based on offering, the quality control products segment is segmented into quality control products, quality assessment services, and data management solutions. In 2024, the quality control products segment is expected to account for the largest share of 77.4% of the IVD quality control market. The large market share of this segment is attributed to the wide availability of controls for various applications. Also, advancements in these controls have expanded their utilization. For instance, in February 2020, Bio-Rad Laboratories, Inc. (U.S.) launched EDX RP Positive Run Control for clinical respiratory assays. It contains 22 respiratory analytes.

Furthermore, the quality control products segment is projected to witness the highest growth rate of 4.4% during the forecast period of 2024–2031.

Based on technology, the quality control products segment is segmented into immunoassay/immunochemistry, biochemistry/clinical chemistry, molecular diagnostics, hematology, coagulation/hemostasis, microbiology, and other technologies. In 2024, immunoassay/immunochemistry segment is expected to account for the largest share of 32.8% the IVD quality control market. The increasing use of immunoassays in POC & infectious disease testing, development of novel tests, increasing usage of miniaturized devices, and rising demand for immunoassay-based tests are expected to support the segment’s largest share. For instance, in February 2021, Agilent Technologies Inc. (U.S.) launched Agilent Dako SARS-CoV-2 IgG, an immunoassay kit to detect SARS-CoV-2 IgG antibodies.

Based on applications, the quality control products segment is segmented into infectious diseases, oncology, cardiology, autoimmune disorders, neurology, and other applications. In 2024, the infectious diseases segment is expected to account for the largest share of the IVD quality control market. There has been an increasing prevalence of infectious diseases globally. According to a 2022 article published by Families Fighting Flu, Inc. (U.S.), an estimated 1 billion people worldwide are infected by seasonal influenza every year, of which 3-5 million people have a severe case of flu. Moreover, according to the WHO, a total of 1.6 million people died from TB in 2021 globally (out of which 187,000 were HIV patients). Hence, the higher adoption of sensitive and cost-effective tests to diagnose increasing infectious diseases resulted in an increased demand for IVD quality controls for infectious diseases.

Based on end users, the quality control products segment is segmented into hospitals & clinics, diagnostics laboratories, academic & research institutes, and blood banks. In 2024, the hospitals & clinics segment is expected to account for the largest share of the IVD quality control market. The largest share of this segment is mainly attributed to the large share of diagnostics tests performed in the hospital-attached laboratories and the relatively higher demand for quality controls in these healthcare settings to ensure the accuracy and reliability of IVD test results of the patients. Additionally, during COVID-19, hospital admissions increased, which further led to the adoption of COVID-19 test quality controls in hospitals & clinics.

In 2024, North America is expected to account for the largest share of the 38.2% global IVD quality control market. The large market share of this region is attributed to the rising prevalence of chronic and infectious diseases, increasing awareness regarding early disease diagnosis, advanced diagnostics infrastructure, a large number of laboratory tests performed annually, the mandatory quality assessments of laboratories, and the participation of laboratories in external quality assessment programs.

Moreover, the market in Asia-Pacific is slated to register the highest growth rate of 5.4% during the forecast period. The rising population of the country, the increasing prevalence of disorders such as diabetes and HIV, the growth in the number of medical laboratories to increase the testing capacity of the patients and the focus of the country toward the quality assurance standards of these medical laboratories are some of the factors diving the demand for IVD quality control in China.

This report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants in the last few years. The key players profiled in the IVD quality control market report are Seimens Healthineers AG (Germany), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), LGC Group (U.K.), Thermo Fisher Scientific Inc. (U.S.), SERO AS (Norway), Randox Laboratories Ltd. (U.K.), QuidelOrtho Corporation (U.S.), Streck LLC (U.S.), and Microbiologics, Inc. (U.S.).

|

Particular |

Details |

|

Page No |

267 |

|

Format |

|

|

Forecast Period |

2024-2031 |

|

Base Year |

2023 |

|

CAGR |

4.3% |

|

Market Size (Value) |

USD 2.28 billion by 2031 |

|

Segments Covered |

By Offering

By Technology

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, Italy, U.K., Spain, and Rest of Europe), Asia-Pacific (China, Japan, India, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa |

|

Key Companies |

Seimens Healthineers AG (Germany), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), LGC Group (U.K.), Thermo Fisher Scientific Inc. (U.S.), SERO AS (Norway), Randox Laboratories Ltd. (U.K.), QuidelOrtho Corporation (U.S.), Streck LLC (U.S.), and Microbiologics, Inc. (U.S.). |

This study covers quality control products, quality assessment services, and data management solutions applied in hospitals & clinics, diagnostic laboratories, academic institutes & research laboratories, and other end users.

The IVD quality control market is projected to reach $2.28 billion by 2031, at a CAGR of 4.3% during the forecast period.

Based on offering, in 2024, the quality control products segment is expected to account for the largest share of the IVD quality control market. Developments of multi-analyte quality controls and new product launches contribute to the segment’s largest share.

Based on technology, in 2024, the immunoassay/immunochemistry segment is expected to account for the largest share of the IVD quality control market. The growing number of immunoassay/immunochemistry tests, as they provide rapid, convenient, and accurate results for the detection and quantitation of targets and the continuous development of new biomarkers, contribute to the segment’s largest share.

Based on application, in 2024, the infectious diseases segment is expected to account for the largest share of the IVD quality control market. The rising prevalence of infectious diseases and government initiatives to promote awareness and testing of these infectious diseases contribute to the segment’s largest share.

Based on end user, in 2024, the hospitals & clinics segment is expected to account for the largest share of the IVD quality control market. The expansion of hospitals, the increasing number of patients visiting the hospitals & clinics, and the collaborations between hospitals and government organizations for screening programs support the segment’s largest share.

The rising prevalence of chronic diseases, coupled with the increasing geriatric population, growing demand for third-party quality controls, need for internal and external quality assessment reports, increasing number of clinical laboratories, growing demand for Point-of-Care (POC) and rapid diagnostics are some of the factors driving the growth of this market. Additionally, the growing demand for multi-analyte and multi-instrument controls offers opportunities for market growth.

Key companies operating in the IVD quality control market are Seimens Healthineers AG (Germany), Bio-Rad Laboratories, Inc. (U.S.), Danaher Corporation (U.S.), LGC Group (U.K.), Thermo Fisher Scientific Inc. (U.S.), SERO AS (Norway), Randox Laboratories Ltd. (U.K.), QuidelOrtho Corporation (U.S.), Streck LLC (U.S.), Microbiologics, Inc. (U.S.), and Bio-Techne Corporation (U.S.)

Published Date: Apr-2025

Published Date: Jan-2025

Published Date: Jul-2024

Published Date: Jan-2024

Published Date: Sep-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates