Resources

About Us

Industrial Pumps Market by Type (Centrifugal Pumps, Positive Displacement Pumps), Position (Submersible, Non-submersible), Driving Force (Electric Motor-driven, Engine-driven), and Vertical (Water & Wastewater, Oil & Gas, Chemicals, Food & Beverages, Power Generation, Pharmaceuticals) – Global Forecast to 2036

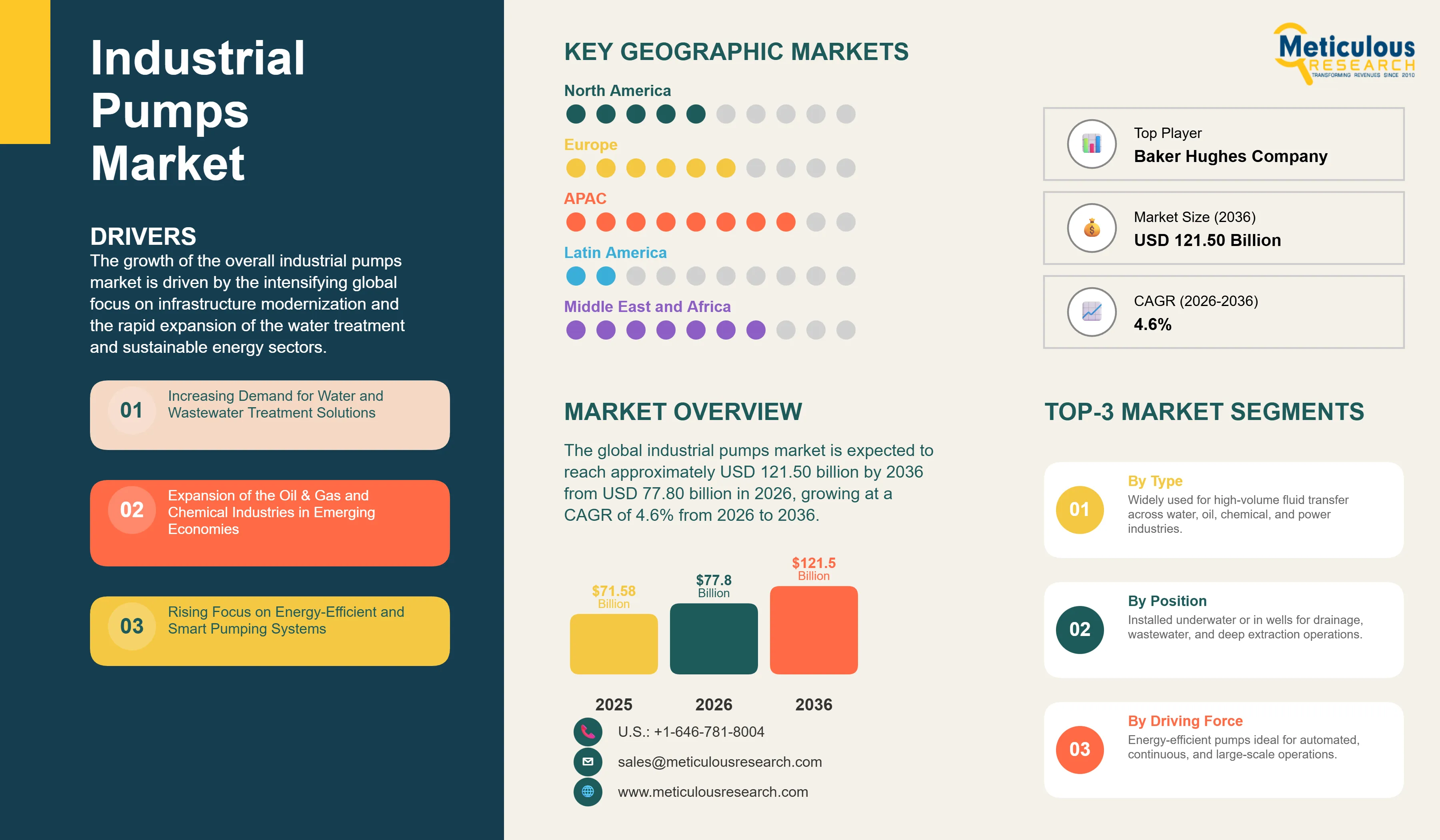

Report ID: MRSE - 1041739 Pages: 271 Feb-2026 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe global industrial pumps market was valued at USD 71.58 billion in 2025. The market is expected to reach approximately USD 121.50 billion by 2036 from USD 77.80 billion in 2026, growing at a CAGR of 4.6% from 2026 to 2036. The growth of the overall industrial pumps market is driven by the intensifying global focus on infrastructure modernization and the rapid expansion of the water treatment and sustainable energy sectors. As industrial operators seek to integrate more functionality into fluid management and energy-efficient facility collections, pump infrastructure has become essential for maintaining high-reliability operational performance and brand loyalty. The rapid expansion of global industrialization and the increasing need for authentic resource optimization in manufacturing demographics continue to fuel significant growth of this market across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

Industrial pumps are critical fluid environments that leverage advanced designs to provide optimized transport experiences and improved equipment engagement through a connected digital infrastructure. These systems include integrated centrifugal units, reciprocating manifolds, and rotary assemblies designed to automate flow choices and enhance facility identity across the industrial continuum. The market is defined by high-efficiency technologies such as AI-powered predictive maintenance and blockchain-enabled energy tracking, which significantly enhance design precision and resource utilization in high-pressure manufacturing environments. These systems are indispensable for facility administrators seeking to optimize their internal operations and meet aggressive production and operational reliability targets.

The market includes a diverse range of solutions, ranging from simple water pumps for basic facility expression to complex chemical-resistant immersion and AI-driven personalized fluid platforms. These systems are increasingly integrated with advanced components such as cloud-based facility management and 5G-enabled mobile monitoring to provide services such as real-time flow notifications and virtual try-on of pump-inspired layouts. The ability to provide stable, high-precision design while minimizing facility lead times has made industrial pump technology the choice for brands where fluid accuracy and operational reliability are paramount.

The global industrial sector is pushing hard to modernize facility capabilities, aiming to meet AI-driven production targets and consumer-centric efficiency goals. This drive has increased the adoption of high-speed digital solutions, with advanced facility networks helping to stabilize transaction processing for ultra-high-demand resource drops. At the same time, the rapid growth in the smart manufacturing and green energy markets is increasing the need for high-reliability, secure digital solutions.

Industrial houses across the industry are rapidly shifting to AI-optimized collections, moving well beyond traditional mechanical setups toward high-end and smart-enabled setups. Grundfos’ latest iSOLUTIONS platforms deliver significantly higher brand prestige, while Xylem’s recent installations have slashed the barrier between traditional fluid handling and high-tech fashion. The real game-changer comes with “generative” fluid systems featuring integrated natural language processing that maintains peak creative efficiency even in high-volume facility environments. These advancements make high-precision pump collaborations practical and cost-effective for everyone from independent operators to global industrial conglomerates chasing excellence in consumer appeal and lower operational costs.

Innovation in smart manufacturing and automated manufacturing is rapidly driving the industrial pumps market, as fluid procedures become more precise and facility operations more automated. Brand suppliers like Flowserve are now designing units that combine the functionality of daily transport with the intelligence of character-inspired design in a single platform, saving valuable facility space and simplifying fluid logistics. These systems often involve advanced fabric technology and 3D visualization capable of handling complex fluid motifs without compromising equipment comfort or design reliability.

At the same time, growing focus on sustainable manufacturing is pushing manufacturers to develop industrial pump solutions tailored to eco-friendly and waste reduction principles. These systems help reduce environmental impact through smart supply chain automation and the use of organic or recycled fluid components. By combining high-density design connectivity with robust environmental performance, these new designs support both technological advancement and corporate sustainability, strengthening the resilience of the broader industrial value chain.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 121.50 Billion |

|

Market Size in 2026 |

USD 77.80 Billion |

|

Market Size in 2025 |

USD 71.58 Billion |

|

Market Growth Rate (2026-2036) |

CAGR of 4.6% |

|

Dominating Region |

Asia-Pacific |

|

Fastest Growing Region |

Middle East & Africa |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Type, Position, Driving Force, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

A key driver of the industrial pumps market is the rapid movement of the global manufacturing industry toward culture-first, consumer-centric models. Global demand for seamless fluid journeys, real-time flow updates, and data-driven collection planning has created significant incentives for the adoption of pump infrastructure. The trend toward “Industry 4.0” and the integration of facility IP into unified digital platforms drive brands toward scalable solutions that industrial pumps can uniquely provide. It is estimated that as consumer adoption of digital-inspired lifestyles rises and design tools become more decentralized through 2036, the need for robust, connected infrastructure increases significantly; therefore, AI-driven software and high-speed connectivity, with their ability to ensure high-density data processing, are considered a crucial enabler of modern fluid delivery strategies.

The rapid growth of the smart city market and virtual fluid technologies provides great opportunities for the industrial pumps market. Indeed, the global surge in digital asset deployment has created a compelling demand for systems that can handle massive asset throughput and provide ultra-low latency for virtual try-ons. These applications require high reliability, data security, and the ability to handle high-bandwidth visual data, all attributes that are met with advanced pump solutions. The virtual fluid market is set to expand significantly through 2036, with industrial pumps poised for an expanding share as brands seek to maximize digital presence and minimize physical production costs. Furthermore, the increasing demand for AI-driven personalization and smart facility automation is stimulating demand for modular digital solutions that provide high-speed data transmission and operational flexibility.

The centrifugal pumps segment accounts for a significant portion of the overall industrial pumps market in 2026. This is mainly attributed to the versatile use of this technology in supporting graphic-heavy designs, mass-market collaborations, and complex character motifs within modern facility environments. These systems offer the most comprehensive way to ensure design interoperability across diverse fluid applications. The water and oil sectors alone consume a large share of pump-inspired solutions, with major projects in Asia-Pacific and North America demonstrating the technology’s capability to handle high-density data requirements. However, the positive displacement pumps segment is expected to grow at a rapid CAGR during the forecast period, driven by the growing need for robust implementation, limited edition drops, and technical support in complex fluid digital transformations.

Based on position, the non-submersible segment holds the largest share of the overall market in 2026. This is primarily due to the massive volume of surface-themed apparel and the rigorous design standards required for authentic character representation. Current large-scale facility systems are increasingly specifying high-density digital platforms to ensure compliance with global IP standards and consumer expectations for high-quality pump-inspired menswear.

The submersible segment is expected to witness the fastest growth during the forecast period. The shift toward deep-well and underwater themed fashion and the complexity of multi-functional lifestyle collections are pushing the requirement for advanced smart systems that can handle varied style formats and high-resolution designs while ensuring absolute reliability for safety-critical fluid decisions.

The electric motor-driven segment commands the largest share of the global industrial pumps market in 2026. This dominance stems from its superior ability to process vast amounts of consumer data, provide predictive analytics, and automate routine transaction tasks, making it the channel of choice for high-performance fluid. Large-scale operations in manufacturing, processing, and personalized marketing drive demand, with advanced algorithms from providers like Grundfos and Xylem enabling reliable performance in complex facility environments.

However, the engine-driven segment is poised for steady growth through 2036, fueled by expanding applications in remote sites and experiential retail. Brands face mounting pressure to optimize costs for high-volume, less demanding applications, where engine-driven provides a cost-effective alternative for basic consumer connectivity.

Asia-Pacific holds the largest share of the global industrial pumps market in 2026. The largest share of this region is primarily attributed to the deep-rooted manufacturing culture and the presence of the world’s leading industrial innovators, particularly in China. China alone accounts for a significant portion of global pump investment, with its position as a leading adopter of character-inspired lifestyle driving sustained growth. The presence of leading manufacturers like Flowserve and a well-developed fluid supply chain provides a robust market for both standard and high-density smart solutions.

Middle East & Africa and Europe together account for a substantial share of the global industrial pumps market. The growth of these markets is mainly driven by the need for technological modernization in the retail and lifestyle sectors. The demand for advanced smart systems in Middle East & Africa is mainly due to its large-scale desalination infrastructure projects and the presence of innovators in Saudi Arabia and the UAE.

In Europe, the leadership in design engineering and the push for sustainable fluid innovation are driving the adoption of high-reliability smart solutions. Countries like Germany, France, and the UK are at the forefront, with significant focus on integrating smart digital solutions into fluid workflows and advanced consumer care systems to ensure the highest levels of performance and reliability.

The companies such as Flowserve Corporation, Grundfos Holding A/S, Xylem Inc., and KSB SE & Co. KGaA lead the global industrial pumps market with a comprehensive range of digital and design-driven solutions, particularly for large-scale facility applications and high-speed fulfillment. Meanwhile, players including Sulzer Ltd., Wilo SE, ITT Inc., and Ebara Corporation focus on specialized licensed infrastructure, data analytics, and cloud platforms targeting the fluid operations and administrative sectors. Emerging manufacturers and integrated players such as Alfa Laval AB, Baker Hughes Company, Spirax-Sarco Engineering plc, and Crane Co. are strengthening the market through innovations in collaborative fluid and modular digital platforms.

The global industrial pumps market is expected to grow from USD 77.80 billion in 2026 to USD 121.50 billion by 2036.

The global industrial pumps market is projected to grow at a CAGR of 4.6% from 2026 to 2036.

Centrifugal pumps is expected to dominate the market in 2026 due to its superior ability to support graphic-heavy designs and mass-market collaborations. However, the positive displacement pumps segment is projected to be the fastest-growing segment owing to the increasing need for limited edition drops and technical support in complex fluid environments.

AI and 5G are transforming the industrial pumps landscape by demanding higher data integrity, lower latency, and improved style decision support. These technologies drive the adoption of advanced platforms like cloud-based inventory management and real-time monitoring systems, enabling fluid providers to support the complex workflows and high-frequency requirements of next-generation digital supply chains.

Asia-Pacific holds the largest share of the global industrial pumps market in 2026. The largest share of this region is primarily attributed to the deep-rooted manufacturing culture and the presence of leading industrial innovators in China. Middle East & Africa is expected to witness the fastest growth, driven by massive investments in desalination projects.

The leading companies include Flowserve Corporation, Grundfos Holding A/S, Xylem Inc., KSB SE & Co. KGaA, and Sulzer Ltd.

Published Date: Jan-2026

Published Date: Jan-2025

Published Date: Jul-2024

Published Date: Apr-2023

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates