Resources

About Us

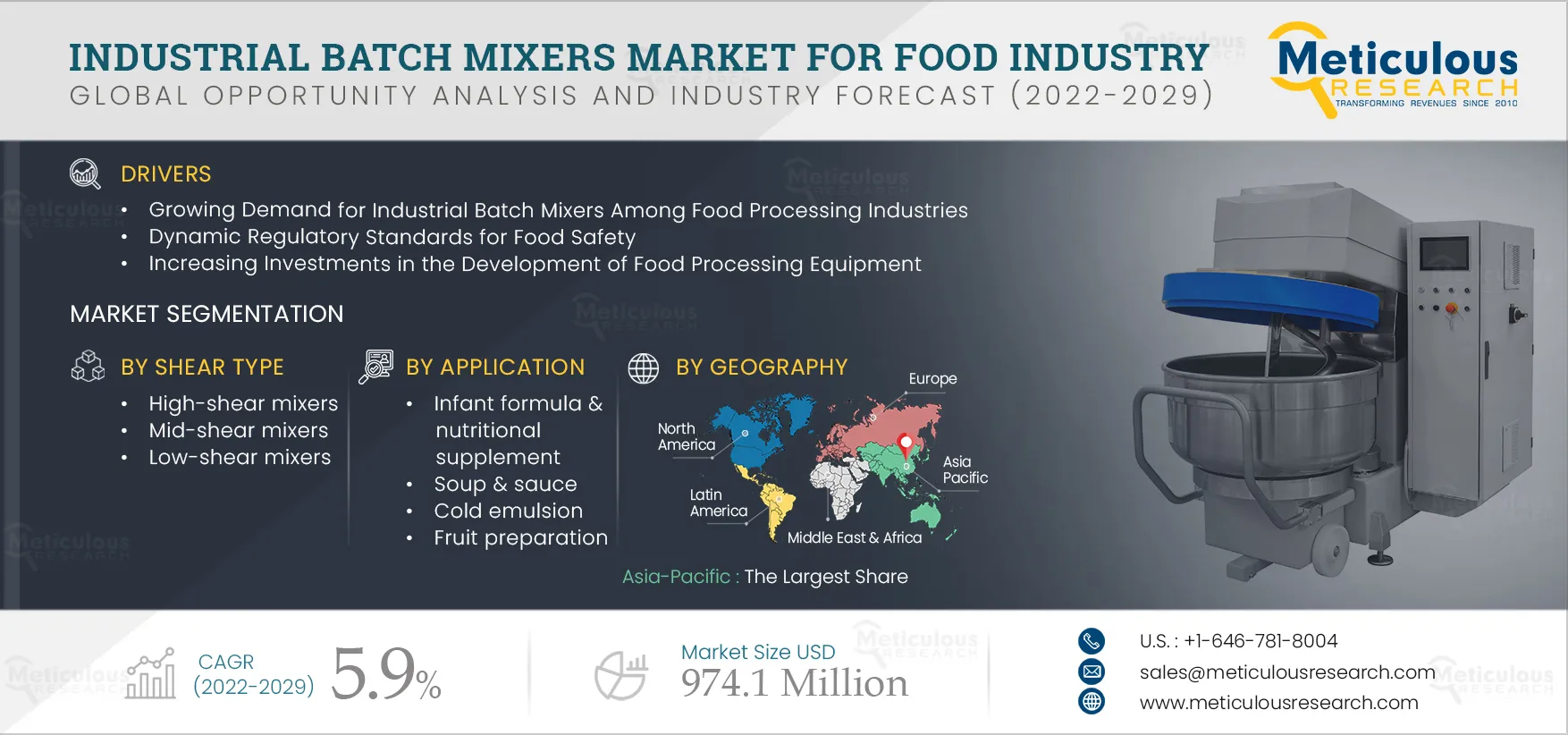

Industrial Batch Mixers Market for Food Industry by Shear Type (High-shear Mixers, Low-shear Mixers), Batch Capacity (Above 10,000 Liters), Application (Infant Formula & Nutritional Supplement, Soup & Sauce), and Geography - Global Forecast to 2029

Report ID: MRSE - 104661 Pages: 249 Oct-2022 Formats*: PDF Category: Semiconductor and Electronics Delivery: 2 to 4 Hours Download Free Sample ReportThe Industrial Batch Mixers Market for Food Industry is expected to reach $974.1 million by 2029, at a CAGR of 5.9% during the forecast period. The growth of the Industrial Batch Mixers Market for the Food Industry is driven by factors such as the increasing demand for processed foods across developed and developing countries, the growing need to reduce manual intervention during food processing, and dynamic regulatory standards for food safety. In addition, the integration of advanced technologies with food processing equipment is expected to offer significant opportunities for the growth of this market. However, cost pressure on manufacturers and challenges in developing efficient & accurate client-specific solutions restrain the market growth of this market.

The COVID-19 pandemic emerged in Wuhan, China, in December 2019. By March 2020, the virus had spread to most countries, with the WHO declaring COVID-19 a global pandemic. Governments worldwide imposed nationwide lockdowns to curb the spread of the disease. The lockdown restrictions impacted manufacturing operations, with production facilities shutting down completely or running at reduced capacities to ensure social distancing and employee safety. Most industries came to a standstill due to raw material & workforce shortages, supply chain disruptions, and restrictions on international trade. The pandemic impacted industries, including food processing equipment manufacturing. The demand for industrial mixers declined as the manufacturing sector was halted due to the lockdowns imposed by governments, adversely affecting the production of food processing equipment.

The industrial batch mixers market for the food industry was significantly impacted due to changes in consumer behavior, low production, and dependency on end-use markets. However, organizations increased their investments in industrial automation technologies despite the disruption due to the growing health consciousness among consumers. Thus, consumers' increasing preference for processed food products drives the demand for industrial mixers. Although the outbreak of the COVID-19 pandemic disrupted the production of industrial mixers worldwide, the market is expected to recover in the coming years.

Get Your Sample Report Now!

Increasing Investments in the Development of Food Processing Equipment

In recent years, industrial batch mixer providers have been focused on developing advanced solutions to prevent food contamination. Advances include the elimination of harbor points & hollow tubing; open frame designs, easy dismantling & reassembling to reduce cleaning times; stainless, easy-to-clean surfaces, compliance with IP69, IP66, and IP65 standards, and washdown enclosures. Prominent food processing equipment providers are focused on developing solutions with advanced functionalities considering factors such as reliability for consistent quality, visual inspection to identify mislabeling or foreign objects, traceability & worker safety, and data collection capabilities to validate manufacturing practices. Companies are taking steps to develop machines with specific cleaning instructions and procedures for food processing industries. Furthermore, CPG industries’ increasing focus on meeting the growing demand, convenient, superior-quality food, and limiting waste creation is encouraging the implementation of industrial batch mixers, stimulating the growth of the industrial batch mixers market for the food industry.

Food preservation technology companies such as Apeel Sciences (U.S.) and Hazel Technologies Inc. (U.S.) are leading the way in reducing food waste while improving product quality during transportation. Pre-consumer food waste comprises 40% of all food wasted in the U.S. This indicates the potential for innovation in food processing equipment. Thus, increasing investments in the development of food processing equipment are expected to drive market growth.

High-shear Mixers Expected to Continue their Dominance in the Market Over the Forecast Period

Based on shear type, the industrial batch mixers market for the food industry is segmented into low-shear mixers, mid-shear mixers, and high-shear mixers. In 2022, the high-shear mixers segment is expected to account for the largest share of the industrial batch mixers market for the food industry. The large market share of this segment is attributed to the rising demand for high-quality emulsions and solutions production and the growing requirement for industrial mixers with less mixing and processing time. Furthermore, the high-shear mixers segment is slated to register the highest CAGR during the forecast period. High-shear mixers are preferred for high viscosity and high-density preparatory foods. The growing demand across different food preparation channels drives the demand for high-shear mixers.

Growing Demand for High-capacity Food Mixers to Drive the Demand for Mixers with Capacities of 10,000 Liters and Above

Based on batch capacity, the industrial batch mixers market for the food industry is segmented into up to 500 liters, 501 liters to 2,000 liters, 2,001 liters to 10,000 liters, and above 10,000 liters. In 2022, the above 10,000 liters segment is expected to account for the largest share of the industrial batch mixers market for the food industry. The large market share of this segment is attributed to the growing demand for industrial mixers to improve operational efficiency and enable large batch production in food manufacturing processes. Furthermore, the above 10,000 liters segment is slated to register the highest CAGR during the forecast period

Infant Formula & Nutritional Supplement Emerges as the Major Application Segment in the Industrial Batch Mixers Market

Based on application, the industrial batch mixers market for the food industry is segmented into infant formula & nutritional supplement; soup & sauce; dessert, pudding, and custard; cold emulsion; fruit preparation; and other food applications. In 2022, the infant formula & nutritional supplement segment is expected to account for the largest share of the industrial batch mixers market for the food industry. The growth of this segment is attributed to the growing awareness of infant food products and the rising need for manufacturing regulatory standards for food safety and quality. The infant formula & nutritional supplement segment is also projected to register the highest CAGR during the forecast period.

Asia-Pacific Projected to Register the Highest CAGR During the Forecast Period

Based on geography, the Industrial batch mixers market for the food industry is segmented into North America, Asia-Pacific, Europe, Latin America, and the Middle East & Africa. In 2022, Asia-Pacific is expected to account for the largest share of the industrial batch mixers market for the food industry. Asia-Pacific’s major market share is attributed to its rising population and favorable government initiatives to support industrial automation in the food industry.

Asia-Pacific is a manufacturing hub for various sectors, including the food industry, which is a major factor in the high adoption of automation technologies in the region. There has been a significant increase in automation in the food processing industry in Asian countries, including China, Japan, South Korea, and India.

This regional market is also slated to register the highest CAGR during the forecast period. Governments in Asia-Pacific are taking several initiatives to boost the food & beverage processing and manufacturing industry. For instance, in 2022, the Indian Ministry of Food Processing Industries (MOFPI) signed a Memorandum of Understanding (MoU) with Japan, Italy, Vietnam, and Taiwan to enhance food quality, promote capacity building, and advance food processing technologies. In addition, the rising focus on enhancing nutritional supplements in food products, food processing efficiencies, and reducing costs in the production process is driving the growth of this market in the region.

Key Players

The key players operating in the industrial batch mixers market for the food industry are ProXES GmbH (Germany), GEA Group Aktiengesellschaft (Germany), ARDE Barinco, Inc. (U.S.), Silverson (U.S.), Amixon GmbH (Germany), HOSOKAWA MICRON B.V. (Netherlands), Charles Ross & Son Company (U.S.), BHS-Sonthofen GmbH (Germany), Gericke AG (Switzerland), Admix Inc. (U.K.), and Frain Industries, Inc. (U.S.).

Scope of the Report:

Industrial Batch Mixers Market for Food Industry, by Application

Industrial Batch Mixers Market for Food Industry, by Shear Type

Industrial Batch Mixers Market for Food Industry, by Batch Capacity

Industrial Batch Mixers Market for Food Industry, by Geography

Key questions answered in the report:

The global industrial batch mixers market for food industry is projected to reach $974.1 million by 2029 at a CAGR of 5.9% during the forecast period.

The growth of this market is driven by the growing demand for industrial batch mixers among food processing industries to reduce manual intervention in food processing and the dynamic regulatory standards for safety in the food industry. In addition, the integration of advanced technologies with food processing equipment and the growing demand for food processing equipment in developing countries is expected to offer significant opportunities for the growth of this market.

The key players operating in the industrial batch mixers market for food industry are ProXES GmbH (Germany), GEA Group Aktiengesellschaft (Germany), ARDE Barinco, Inc. (U.S.), Silverson (U.S.), Amixon GmbH (Germany), HOSOKAWA MICRON B.V. (Netherlands), Charles Ross & Son Company (U.S.), BHS-Sonthofen GmbH (Germany), Gericke AG (Switzerland), Admix Inc. (U.K.), and Frain Industries, Inc. (U.S.) among others.

Asia-Pacific is slated to register the highest CAGR during the forecast period. The growth of this regional market is driven by the high demand for processed foods, positive government encouragement towards mechanization of the food processing industry and the presence of numerous food processing equipment providers.

Published Date: Jan-2026

Published Date: Nov-2024

Published Date: Jan-2023

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates