Resources

About Us

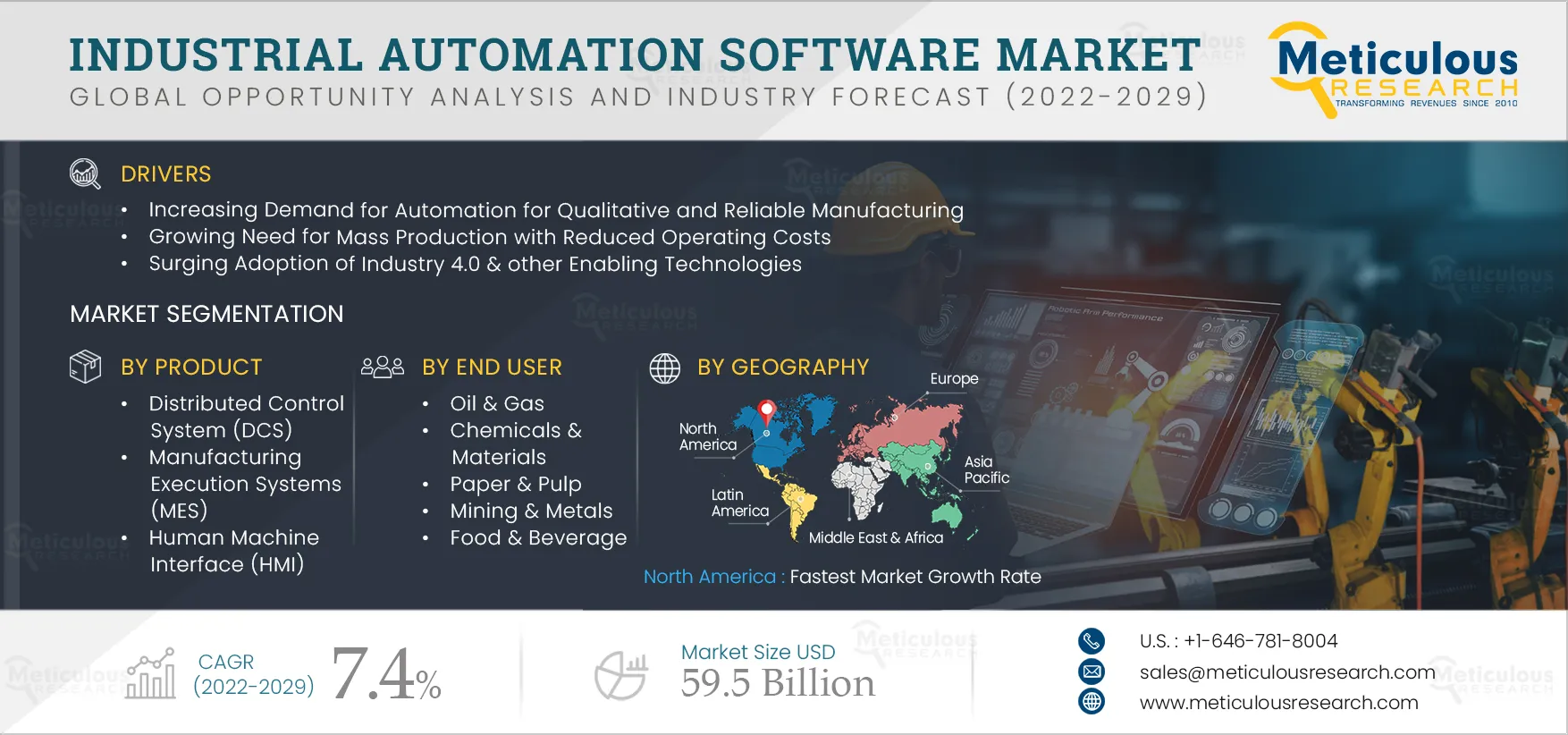

Industrial Automation Software Market by Product (SCADA, DCS, MES, HMI, PLC, IT and Software Environment Integration Solutions, Production Process Test Systems), Deployment Type, End User, and Geography - Global Forecast to 2029

Report ID: MRSE - 104593 Pages: 233 Jul-2022 Formats*: PDF Category: Semiconductor and Electronics Delivery: 2 to 4 Hours Download Free Sample ReportThe Industrial Automation Software Market is expected to reach a value of $59.5 billion by 2029, at a CAGR of 7.4% during the forecast period 2022–2029. An increase in demand for automation for qualitative & reliable manufacturing, the growing need for mass production with reduced operation costs, and the emergence of Industry 4.0 & enabling technologies are the key factors driving the growth of the global industrial automation software market. The emerging automation-driven industries in developing countries provide significant growth opportunities for players operating in this market.

The outbreak of the COVID-19 pandemic has led to a widespread economic downturn as several countries imposed strict lockdowns to contain the infection. These lockdowns have affected diverse industries, primarily due to the impact on manufacturing operations. There has been a significant impact on supply chains globally. Manufacturing & processing companies faced huge losses in the first and second quarters of 2020 due to disrupted supply chains and delayed production schedules. The rapid spread of the coronavirus in the U.S., Europe, and Asian countries resulted in nationwide lockdowns and a temporary halting of production facilities to prevent further spread.

The COVID-19 pandemic led to the downsizing of various businesses and negatively impacted the growth of the industrial automation software market. Many small- and medium-sized enterprises are unable to afford the large investment needed for deploying automation for processes. New strategies with the objective being on the rapid recovery of losses as restrictions have been lifted and more mobility and functionality resume.

Click here to: Get Free Sample Pages of this Report

Growing Need for Mass Production with Reduced Operation Cost

The automation software market is growing due to government support and initiatives, high demand for industrial automation for mass production, and mounting pressure to reduce operational costs. Product lifecycle management and enterprise-level solutions are gaining high demand globally. Mass production enables companies to produce larger quantities with fewer workers. Instead of paying several workers to complete a task by hand, manufacturers use machines to produce goods faster. This allows companies to sell their products at a lower cost without losing profit. The increased use of automation in manufacturing shows how rapid advancements in technology have reduced the need for the human touch in refining, developing, and assembling the individual parts of a product. Automated inspection and identification of parts save time and are also less prone to errors, so the likelihood of damage control will be drastically lower. Even though it requires a significant investment, an automated system has an extremely positive return in the long run in terms of operational costs. This is expected to drive the demand for industrial automation software in the coming years.

The Human Machine Interface (HMI) Segment Projected to Grow at the Highest CAGR During the Forecast Period

Based on product, the human machine interface (HMI) segment is projected to grow at the highest CAGR during the forecast period. HMI enables workers to perform duties with the help of concise automation equipment via an interface instead of switches and levers. As a tool for convergence of visual computing and automation control systems, industrial automation with HMI systems usually consist of LCD panels, often with touch screen capability, mounted on the control consoles of industrial automation equipment. In industrial automation, HMI systems face challenges of creating scalable HMI product families with varying performance levels, scalable graphics resolutions, and different display types.

The Cloud-based Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Based on deployment type, the cloud-based segment is expected to grow at the highest CAGR during the forecast period. The number of vendors supplying cloud industrial automation software systems is rapidly growing due to the benefits offered by these systems, such as improved efficiency, mobility, business productivity, and capability.

The Chemicals & Materials Segment is Projected to Grow at Highest CAGR During the Forecast Period

Based on end user, the chemicals & materials segment is expected to grow at the highest CAGR during the forecast period due to the increasing implementation of IoT and process automation solutions. The chemical industry is witnessing intense global competition and low product differentiation, making cost control necessary. In such an environment, automation solutions offer dual benefits of innovation in the areas that matter to consumers and improved cost efficiency throughout optimized production. The chemicals & materials industry also needs to control raw material & energy costs, which can be achieved using IIoT and automation technologies.

North America to Witness Fastest Market Growth Rate

North America is expected to register the highest growth rate during the forecast period. Key factors contributing to this growth rate are increasing initiatives across various industries for boosting digitalization, the presence of key market players, growing demand for robotic solutions, and the need to improve productivity, quality, & safety of products.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategies adopted by the leading market participants in the global industrial automation software market over the last four years. The key players profiled in the global industrial automation software market are Emerson Electric Co. (U.S.), ABB Ltd (Sweden), Siemens AG (Germany), General Electric Company (U.S.), Schneider Electric SE (France), Honeywell International Inc. (U.S.), Rockwell Automation Inc. (U.S.), HCL Technologies Ltd.(India), Parsec Automation Corporation (U.S.), SAP SE (Germany), Tata Consultancy Services Limited (India), Hitachi, Ltd. (Japan), OMRON Corporation (Japan), Aegis Industrial Software Corporation (U.S.) and IBM Corporation (U.S.).

Scope of the Report

Industrial Automation Software Market, by Product

Industrial Automation Software Market, by Deployment Type

Industrial Automation Software Market, by End User

Industrial Automation Software Market, by Country

Key Questions Answered in the Report:

Published Date: Apr-2022

Published Date: May-2024

Published Date: Aug-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates