Resources

About Us

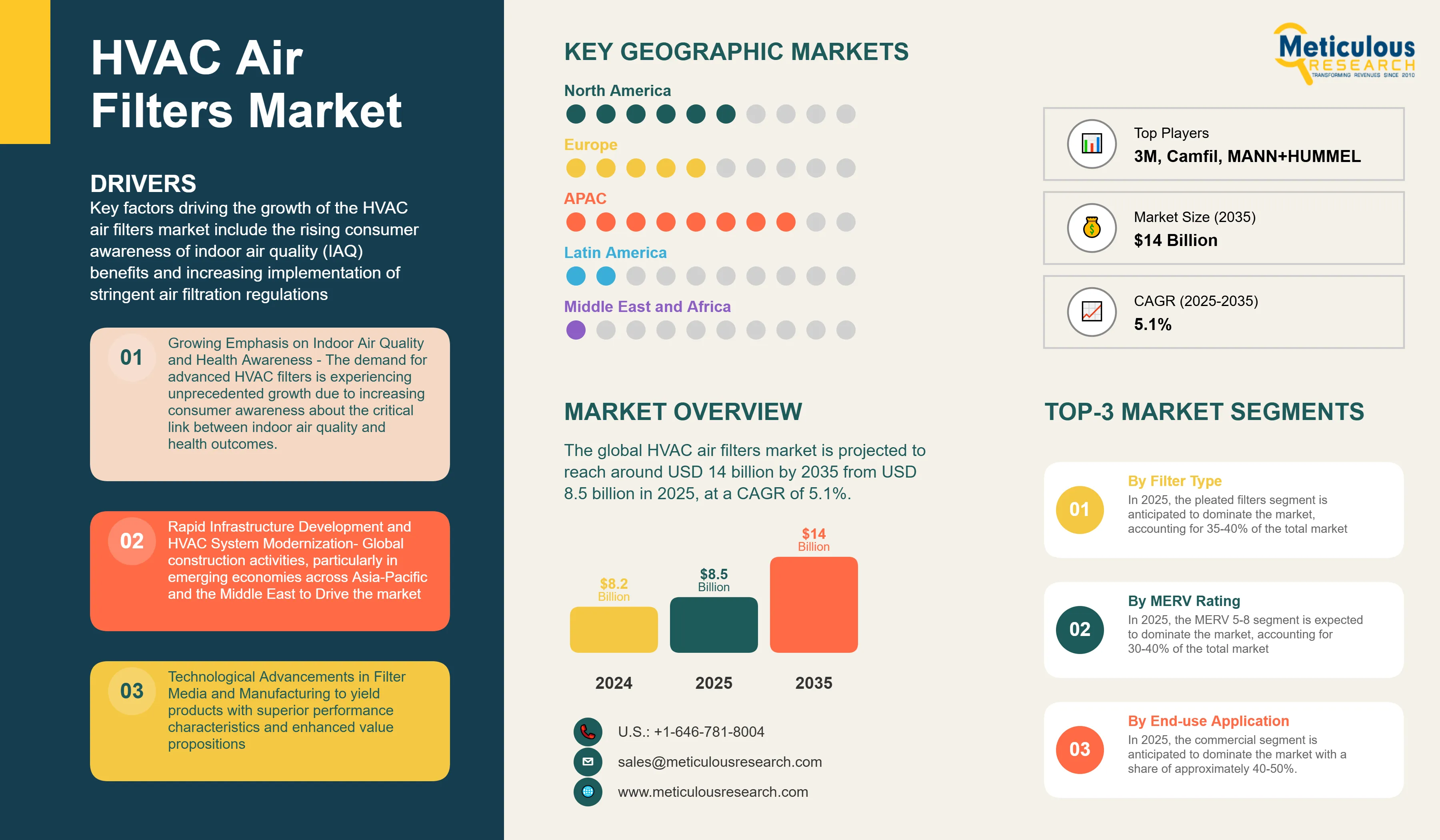

HVAC Air Filters Market Size, Share, Trends, Growth Opportunities & Forecast by Filter Type (Fiberglass, Pleated, Electrostatic, HEPA), MERV Rating, End-Use Industry, and Region – Global Outlook 2025 to 2035

Report ID: MRSE - 1041525 Pages: 335 Aug-2025 Formats*: PDF Category: Semiconductor and Electronics Delivery: 2 to 4 Hours Download Free Sample ReportKey factors driving the growth of the HVAC air filters market include the rising consumer awareness of indoor air quality (IAQ) benefits, increasing implementation of stringent air filtration regulations, steady expansion in global construction activities, accelerating demand for energy-efficient filtration solutions, growing emphasis on health and wellness post-COVID-19, and rising investments in HVAC system modernization and upgrades. However, this growth is restrained by price sensitivity in developing markets, proliferation of counterfeit products compromising market integrity, environmental concerns regarding filter disposal, lack of standardized testing protocols across regions, and energy penalties associated with high-efficiency filters.

Additionally, untapped opportunities in emerging economies with rapid urbanization, development of smart filtration technologies with IoT integration, expansion of antimicrobial and virucidal filter innovations, integration with green building certification programs, and rising demand for specialized filtration in healthcare and pharmaceutical applications are poised to offer significant growth opportunities for market players. The adoption of sustainable filter materials and circular economy approaches to filter lifecycle management are emerging as notable trends in this market.

Market Drivers

Growing Emphasis on Indoor Air Quality and Health Awareness

The demand for advanced HVAC filters is experiencing unprecedented growth due to increasing consumer awareness about the critical link between indoor air quality and health outcomes. Modern energy-efficient buildings often have limited ventilation systems, leading to the accumulation of pollutants, allergens, and pathogens, making effective filtration essential for maintaining healthy indoor environments. The adverse effects of poor air quality, coupled with rising health consciousness and heightened awareness of airborne disease transmission, are driving this trend.

Healthcare and laboratory facilities are at the forefront of adopting specialized filtration solutions like HEPA and ULPA filters to ensure sterile environments and reduce cross-contamination risks. This preference is particularly strong among pharmaceutical and biotechnology industries where cleanroom compliance is critical, driving demand for validated, high-efficiency filtration products with proven performance standards.

The COVID-19 pandemic has further accelerated this trend, with consumers, facility managers, and regulatory bodies prioritizing high-performance filtration systems that can effectively remove particulate matter, volatile organic compounds (VOCs), and biological contaminants from indoor air.

Rapid Infrastructure Development and HVAC System Modernization

Global construction activities, particularly in emerging economies across Asia-Pacific and the Middle East, are generating substantial demand for comprehensive HVAC filtration products. New commercial complexes, residential developments, and industrial facilities require advanced HVAC systems with appropriate filtration capabilities to meet contemporary standards and occupant expectations.

The retrofit market presents significant opportunities as aging HVAC infrastructure requires filter upgrades to meet modern efficiency standards and regulatory requirements. The trend toward green building certifications, including LEED, WELL, and BREEAM standards, emphasizes indoor environmental quality as a critical component, often mandating specific filtration efficiency levels and regular maintenance protocols.

These certification programs create recurring revenue streams through replacement cycles and drive demand for premium filter products that meet stringent performance criteria.

Technological Advancements in Filter Media and Manufacturing

Innovation in filter manufacturing processes and materials science has yielded products with superior performance characteristics and enhanced value propositions. Nanofiber technology enables the production of filters with exceptional particle capture efficiency while maintaining lower resistance to airflow, addressing the traditional trade-off between filtration performance and energy consumption.

Smart filtration solutions incorporating pressure sensors, wireless connectivity, and IoT capabilities allow real-time monitoring of filter conditions and enable predictive maintenance scheduling. These technologies optimize filter replacement intervals, reduce energy consumption, and ensure consistent air quality performance, appealing to facility managers seeking to minimize operational costs while maintaining optimal indoor environments.

Synthetic media formulations offer improved moisture resistance, extended service life, and consistent performance compared to traditional fiberglass filters, providing enhanced value for end-users across various applications.

Market Segmentation Analysis

By Filter Type

Based on filter type, the HVAC air filters market is segmented into pleated filters, panel filters, HEPA filters, ULPA filters, electrostatic filters, and carbon filters. In 2025, the pleated filters segment is anticipated to dominate the market, accounting for approximately 35-40% of the total HVAC filters market. The dominance of pleated filters is attributed to their optimal balance between filtration efficiency, pressure drop characteristics, and cost-effectiveness, along with their increased surface area that enables superior particle capture while maintaining reasonable airflow properties.

However, the HEPA filters segment is projected to record the highest CAGR of 7.1% during the forecast period of 2025-2035. This exceptional growth is driven by heightened health consciousness among consumers, mandatory regulatory requirements in healthcare settings, expanding applications in residential air purifiers and commercial HVAC systems, and the development of energy-efficient HEPA filters with reduced pressure drop characteristics that broaden their applicability beyond traditional cleanroom environments.

The electrostatic filters segment is also experiencing robust growth due to their washable and reusable nature, environmental sustainability benefits, and cost-effectiveness for residential applications.

By MERV Rating

Based on MERV rating, the HVAC filters market is segmented into MERV 1-4, MERV 5-8, MERV 9-12, MERV 13-16, and MERV 17-20. In 2025, the MERV 5-8 segment is expected to dominate the market, accounting for approximately 30-40% of the total market share. MERV 5-8 filters are widely used in residential and light commercial settings due to their optimal balance of cost and performance. They are preferred by homeowners and small business operators who seek meaningful improvements in air quality but do not require significant upgrades to their existing HVAC systems.

While the MERV 5-8 segment maintains steady growth, the fastest-growing segment is MERV 17-20, which comprises HEPA equivalent filters. This segment’s rapid expansion is driven largely by investments in healthcare infrastructure, pharmaceutical manufacturing, semiconductor fabrication, and other mission-critical industries. These environments demand absolute particle control to prevent contamination, a need that justifies premium pricing and more sophisticated installation and maintenance requirements.

By End-Use Application

Based on end-use application, the HVAC air filters market is segmented into residential, commercial, and industrial applications. In 2025, the commercial segment is anticipated to dominate the market with a share of approximately 40-50%, driven by office complexes, retail establishments, hospitality venues, healthcare facilities, and educational institutions prioritizing occupant comfort, health, and regulatory compliance.

However, the transportation segment is witnessing rapid growth as air filtration becomes increasingly critical in vehicles, trains, aircraft, and public transit systems. Rising awareness of in-cabin air quality among consumers, stricter emissions and cabin air quality regulations, and technological advancements in transport HVAC systems are driving this trend. The growth of electric vehicles and premium automotive models, which often feature advanced cabin air filtration systems including HEPA or activated carbon filters, is also contributing to the segment's momentum. In addition, the post-COVID shift in passenger health safety expectations, especially in shared mobility and public transit, has spurred OEMs and transport authorities to adopt higher-grade air filtration solutions, fueling growth in this segment.

Regional Analysis

Based on geography, the HVAC air filters market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Asia-Pacific dominates the global HVAC air filters market both in terms of size and growth rate, driven by rapid urbanization, rising infrastructure development, and increasing demand for air quality management across densely populated countries such as China, India, Japan, and South Korea. The region is witnessing a surge in commercial and residential construction, fueled by economic development and growing middle-class populations, which in turn boosts the installation of HVAC systems and the need for effective filtration solutions. Additionally, severe air pollution in major cities has heightened public and regulatory focus on indoor air quality, prompting stricter standards and greater adoption of air filters in both private and public buildings.

Moreover, industrial expansion and the rise of smart cities and green buildings in Asia-Pacific contribute to growing demand for advanced HVAC filtration systems. Government initiatives encouraging energy-efficient infrastructure, especially in China and India, are further accelerating the integration of high-efficiency filters. The booming electronics and automotive manufacturing hubs across the region also rely heavily on controlled environments that demand high-quality air filtration. Lastly, the rising awareness of health and hygiene post-pandemic and the growing adoption of e-commerce and aftermarket distribution channels are facilitating greater accessibility to HVAC air filters, supporting rapid market growth in the region.

Competitive Landscape

The HVAC air filters market is characterized by a mix of diversified industrial conglomerates, specialized filtration manufacturers, and regional players competing on product innovation, distribution networks, technical support capabilities, and cost-effectiveness. Leading players in the global HVAC filters market include 3M Company, Camfil AB, MANN+HUMMEL Gruppe, American Air Filter Company, Inc. / AAF International, Parker Hannifin Corporation, Donaldson Company, Inc., Filtration Group Corporation, Freudenberg Filtration Technologies SE & Co. KG, Koch Filter Corporation, Air Filters, Inc., Tex-Air Filters, Honeywell International Inc., Carrier Global Corporation, Trane Technologies PLC, Johnson Controls International PLC, Ahlstrom-Munksjö Oyj, Emirates Industrial Filters LLC, General Filter Air, Smith Filter Corporation, Dynamic Filtration Ltd. among others.

These companies are focusing on strategies such as capacity expansions in high-growth regions, development of antimicrobial and virucidal filter technologies, partnerships with HVAC equipment manufacturers for integrated solutions, investments in smart filtration technologies, and sustainability initiatives to strengthen their market position.

|

Particulars |

Details |

|---|---|

|

Number of Pages |

336 |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

5.1% |

|

Market Size 2024 |

USD 8.2 billion |

|

Market Size 2025 |

USD 8.5 billion |

|

Market Size 2035 |

USD 14 billion |

|

Segments Covered |

By Filter Type, MERV Rating, End-Use Application, Distribution Channel |

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Netherlands, Spain, and Rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), and the Middle East & Africa (UAE, Saudi Arabia, South Africa, and Rest of Middle East & Africa) |

The HVAC air filters market is projected to reach USD 14 billion by 2035 from USD 8.5 billion in 2025, at a CAGR of 5.1% during the forecast period.

In 2025, the pleated filters segment is projected to hold the major share of the HVAC filters market, while the HEPA filters segment is slated to record the highest growth rate.

Key factors driving the growth include rising consumer awareness of indoor air quality benefits, increasing implementation of stringent air filtration regulations, steady expansion in global construction activities, accelerating demand for energy-efficient filtration solutions, and growing emphasis on health and wellness post-COVID-19.

North America leads the market with the highest share, while Asia-Pacific is projected to record the highest growth rate during the forecast period, offering significant opportunities for HVAC filter vendors.

Major opportunities include untapped markets in emerging economies with rapid urbanization, development of smart filtration technologies with IoT integration, expansion of antimicrobial and virucidal filter innovations, integration with green building certification programs, and rising demand for specialized filtration in healthcare applications.

Published Date: Jul-2025

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Oct-2024

Published Date: Oct-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates