Resources

About Us

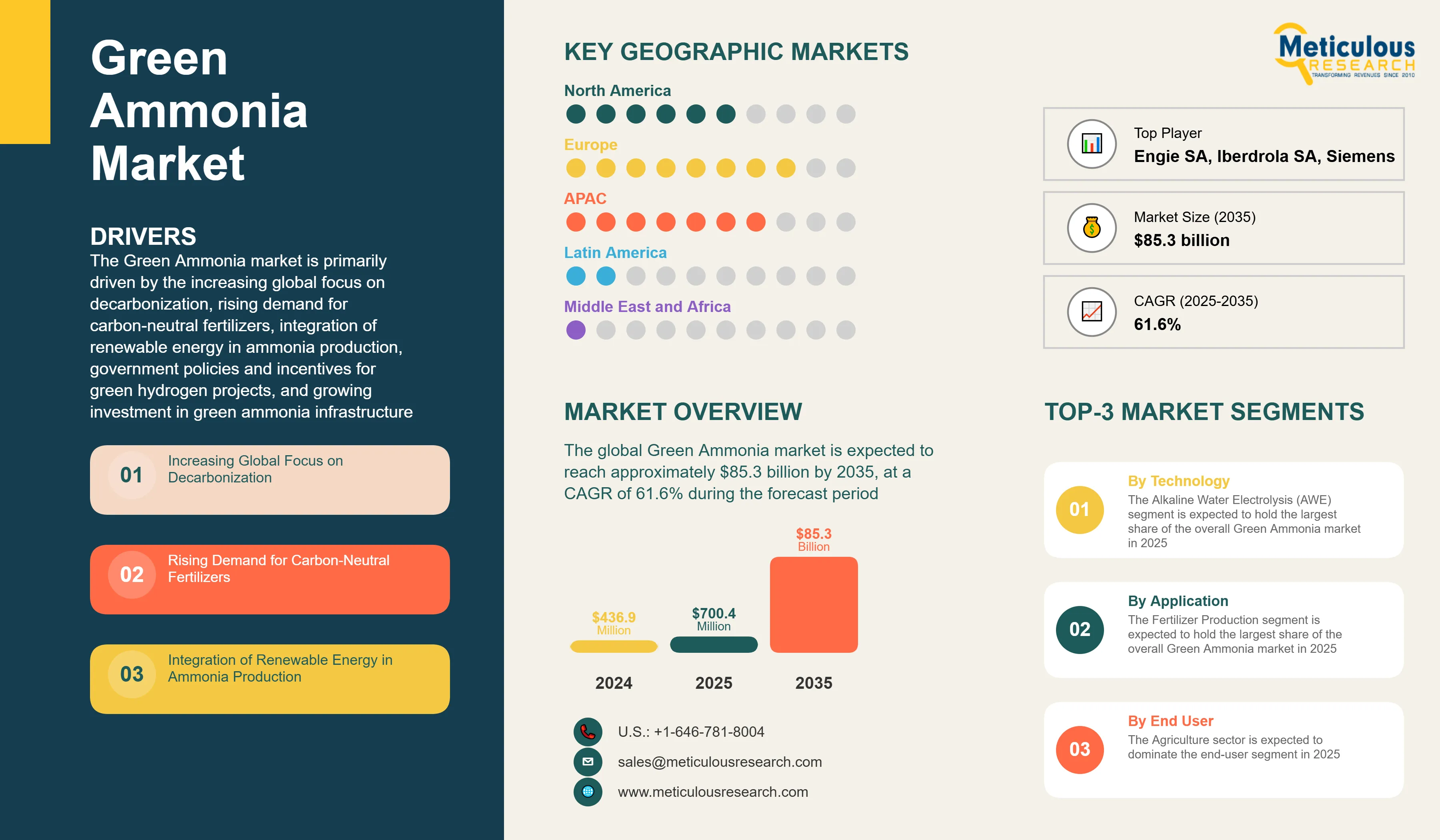

Green Ammonia Market: Size & Forecast by Technology (Alkaline Water Electrolysis, PEM Electrolysis), Production Method (Haber-Bosch with Green Hydrogen, Electrochemical), Application (Fertilizer, Energy Storage) & Region - Global Forecast and Analysis to 2035

Report ID: MRCHM - 1041497 Pages: 185 May-2025 Formats*: PDF Category: Chemicals and Materials Delivery: 24 to 72 Hours Download Free Sample ReportThis comprehensive market research report analyzes the rapidly evolving Green Ammonia market, evaluating how renewable energy integration and sustainable production technologies are revolutionizing the ammonia industry across various applications and regions. The report provides a strategic analysis of market dynamics, growth projections till 2035, and competitive positioning across global and regional/country-level markets.

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

The Green Ammonia market is primarily driven by the increasing global focus on decarbonization, rising demand for carbon-neutral fertilizers, integration of renewable energy in ammonia production, government policies and incentives for green hydrogen projects, and growing investment in green ammonia infrastructure. The increasing strategic partnerships between energy and fertilizer companies are accelerating innovation, while the development of ammonia as a carbon-free marine fuel is creating new application opportunities. Additionally, the declining costs of renewable electricity, advancements in electrolysis technologies, development of ammonia-ready marine engines, and growth in carbon credit trading for green ammonia projects are further driving market growth, especially in Europe and Asia-Pacific regions.

Key Challenges

Despite significant growth potential, the overall Green Ammonia market faces challenges including high production costs compared to conventional ammonia, technical challenges in scaling production, limited infrastructure for green hydrogen supply, and the energy intensity of the ammonia synthesis process. Infrastructure development constraints, particularly renewable energy integration with ammonia plants, represent significant barriers to widespread adoption. The intermittency issues of renewable energy sources and safety concerns in handling and transportation must be addressed. Additionally, maintaining cost competitiveness with gray and blue ammonia production methods and ensuring the availability of specialized components present additional barriers, potentially slowing down market adoption in different regions across the globe.

Growth Opportunities

The Green Ammonia market offers several high-growth opportunities. Ammonia as a carbon-free marine fuel presents a significant opportunity to decarbonize the shipping industry, which is under pressure to reduce emissions. The use of ammonia as a hydrogen carrier for energy storage can solve intermittency issues in renewable energy systems. Declining costs of renewable electricity make green ammonia production increasingly economical, while advancements in electrolysis technologies improve efficiency and reduce capital expenditure. Additionally, the emergence of carbon credit trading for green ammonia projects and specialized applications in industrial decarbonization presents untapped market potential, as organizations increasingly seek innovative solutions to meet sustainability goals.

Market Segmentation Highlights

By Technology

The Alkaline Water Electrolysis (AWE) segment is expected to hold the largest share of the overall Green Ammonia market in 2025, due to its mature technology, lower costs, and established track record. Proton Exchange Membrane (PEM) Electrolysis represents the second-largest segment as it offers higher efficiency and dynamic operation capabilities suitable for integration with variable renewable energy sources. However, Solid Oxide Electrolysis (SOE) is projected to grow at the fastest CAGR through 2035 as this technology offers significantly higher electrical efficiency than other methods, making it increasingly attractive for large-scale green hydrogen production.

By Production Method

The Haber-Bosch Process with Green Hydrogen is expected to dominate the overall Green Ammonia market in 2025, driven by the maturity of the technology and compatibility with existing ammonia production infrastructure. Electrochemical Processes hold the second-largest share due to their potential for direct ammonia synthesis without separate hydrogen production. However, Photocatalytic Processes are expected to grow at the fastest CAGR during the forecast period as this technology offers the potential for direct solar-to-ammonia conversion with minimal electrical requirements. Biomass Gasification maintains a small but growing share in regions with abundant biomass resources.

By Application

The Fertilizer Production segment is expected to hold the largest share of the overall Green Ammonia market in 2025, driven by the agricultural sector's push for decarbonization and consumer demand for sustainable food products. Energy Storage follows as the second-largest segment, as ammonia provides a viable solution for long-duration energy storage. However, the Marine Fuel application is projected to grow at the highest CAGR during the forecast period as the international maritime industry seeks solutions to meet IMO emissions reduction targets. Power Generation also shows strong growth potential as ammonia is increasingly recognized as a viable carbon-free fuel for conventional and fuel cell power generation.

By End User

The Agriculture sector is expected to dominate the end-user segment in 2025, as it is the traditional and largest consumer of ammonia for fertilizer production. Transportation represents the second-largest segment due to the emerging use of ammonia as a marine fuel and potential applications in heavy transport. However, the Power Generation sector is expected to grow at the highest CAGR through 2035 as power producers increasingly look to ammonia as a viable solution for energy storage and carbon-free fuel. The Chemical Industry also shows strong growth potential as it integrates green ammonia as a sustainable feedstock for various chemical processes.

By Geography

Europe is expected to hold the largest share of the global Green Ammonia market in 2025, followed by Asia-Pacific. This leading position is driven by aggressive decarbonization policies, substantial government support for renewable hydrogen projects, and strong industrial commitment to emissions reduction. Germany represents the largest market in Europe, while the Netherlands leads in terms of project development due to its existing ammonia infrastructure and North Sea renewable energy potential. However, the Asia-Pacific region, particularly Australia, Japan, and China, is projected to witness the highest CAGR during the forecast period 2025-2035, driven by abundant renewable resources, export-oriented project development, and significant investments in green hydrogen infrastructure. The Middle East region shows promising growth potential as countries like Saudi Arabia and the UAE leverage their solar resources and existing ammonia production capabilities to position themselves as future green ammonia exporters.

Competitive Landscape

The global Green Ammonia market features a diverse competitive landscape with established fertilizer and chemical manufacturers competing alongside renewable energy developers and engineering firms.

The broader solution provider landscape is categorized into traditional ammonia producers pivoting to green production and renewable energy specialists entering the ammonia value chain, with each group employing distinctive strategies to maintain competitive advantage. Leading providers are focusing on integrated solutions that combine renewable energy generation with ammonia production facilities and developing specialized applications while navigating regulatory frameworks.

The key players operating in the global Green Ammonia market are Yara International ASA, CF Industries Holdings, Inc., BASF SE, Siemens Energy AG, ThyssenKrupp AG, Fertiglobe (OCI N.V. & ADNOC), Haldor Topsoe A/S, Nel ASA, Engie SA, Air Products and Chemicals, Inc., Iberdrola SA, Fortescue Future Industries, ACME Group, MAN Energy Solutions SE, and Ørsted A/S, among others.

|

Particulars |

Details |

|

Number of Pages |

185 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2035 |

|

Base Year |

2024 |

|

CAGR (Value) |

61.6% |

|

Market Size (Value)in 2025 |

$700.4 million |

|

Market Size (Value) in 2035 |

$85.2 billion |

|

Segments Covered |

By Technology

By Production Method

By Application

By End User

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, Netherlands, United Kingdom (U.K.), Norway, Denmark, Spain, Rest of Europe), Asia-Pacific (Australia, Japan, China, South Korea, India, Singapore, Rest of Asia-Pacific), Latin America (Brazil, Chile, Mexico, Rest of Latin America), Middle East & Africa (Saudi Arabia, United Arab Emirates (UAE), Morocco, Egypt, Rest of Middle East & Africa) |

|

Key Companies |

Traditional Ammonia Producers: Yara International ASA, CF Industries Holdings, Inc., BASF SE, Fertiglobe (OCI N.V. & ADNOC), Air Products and Chemicals, Inc. Technology and Engineering Firms: Siemens Energy AG, ThyssenKrupp AG, Haldor Topsoe A/S, Nel ASA Renewable Energy Players: Engie SA, Iberdrola SA, Fortescue Future Industries, ACME Group, Ørsted A/S Marine and Transport Specialists: MAN Energy Solutions SE |

The global Green Ammonia market was valued at $436.9 million in 2024 and is expected to reach approximately $85.3 billion by 2035, growing from an estimated $700.4 million in 2025, at a CAGR of 61.6% during the forecast period of 2025–2035.

The global Green Ammonia market is expected to grow at a CAGR of 61.6% during the forecast period of 2025–2035.

The global Green Ammonia market is expected to reach approximately $85.3 billion by 2035, growing from an estimated $700.2 million in 2025, at a CAGR of 61.6% during the forecast period of 2025–2035.

The key companies operating in this market include Yara International ASA, CF Industries Holdings, Inc., BASF SE, Siemens Energy AG, ThyssenKrupp AG, Fertiglobe (OCI N.V. & ADNOC), Haldor Topsoe A/S, Nel ASA, Engie SA, Air Products and Chemicals, Inc., Iberdrola SA, Fortescue Future Industries, ACME Group, MAN Energy Solutions SE, and Ørsted A/S among others.

Major trends shaping the market include strategic partnerships between energy and fertilizer companies, integration of AI and IoT in production optimization, development of ammonia-ready marine engines, and growth in carbon credit trading for green ammonia projects.

• In 2025, the Alkaline Water Electrolysis (AWE) segment is expected to dominate the overall Green Ammonia market by technology type, accounting for approximately 47% of market value.

• Based on production method, the Haber-Bosch Process with Green Hydrogen is expected to hold the largest share of the overall Green Ammonia market in 2025.

• Based on application, the Fertilizer Production segment is expected to hold the largest share of the global Green Ammonia market in 2025.

• Agriculture is expected to be the largest end-user segment, accounting for 49% of market value in 2025.

• Solid Oxide Electrolysis (SOE) is projected to grow at the highest CAGR of 18.2% in the technology segment through 2035.

• Photocatalytic Process is expected to grow at the highest CAGR of 19.5% during the forecast period among production methods.

• Marine Fuel applications are projected to grow at the highest CAGR of 22.6% during the forecast period.

Europe is expected to hold the largest share of the global Green Ammonia market in 2025, followed by Asia-Pacific. This is driven by aggressive decarbonization policies, substantial government support for renewable hydrogen projects, and strong industrial commitment to emissions reduction. However, the Asia-Pacific region is projected to grow at the highest CAGR of 16.4% during the forecast period.

The growth of this market is driven by increasing global focus on decarbonization, rising demand for carbon-neutral fertilizers, integration of renewable energy in ammonia production, government policies and incentives for green hydrogen projects, and growing investment in green ammonia infrastructure

Published Date: Apr-2025

Published Date: Feb-2025

Published Date: Aug-2024

Published Date: May-2024

Published Date: May-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates