1. Introduction

1.1. Market Ecosystem

1.2. Currency and Limitations

1.2.1. Currency

1.2.2. Limitations

1.3. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.1.1. Secondary Research

2.1.2. Primary Research

2.1.3. Market Size Estimation

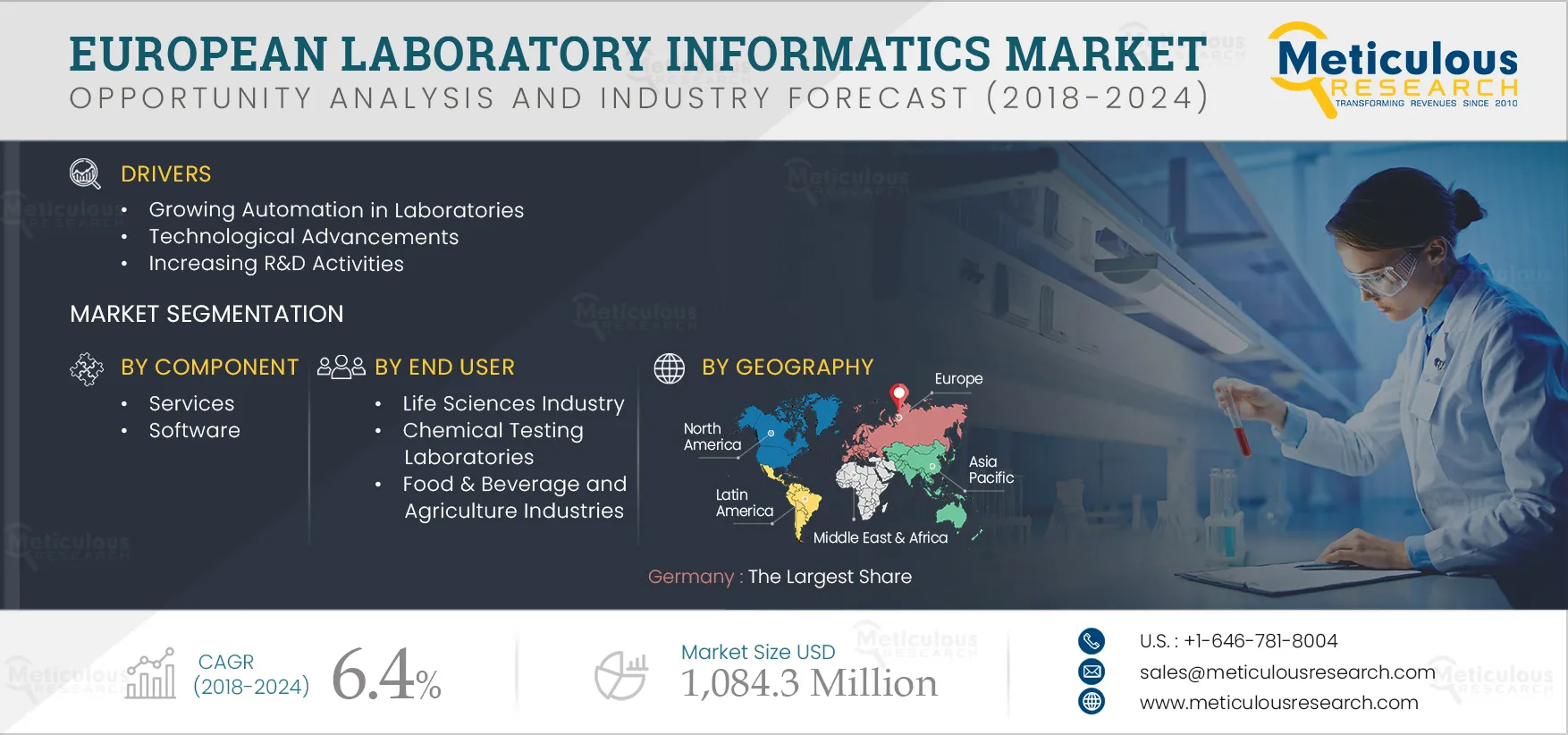

3. Executive Summary

4. Market Insights

4.1. Introduction

4.2. Drivers

4.2.1. Growing Automation in Laboratories

4.2.2. Technological Advancements

4.2.3. Increasing R&D Activities

4.2.4. Growing Need for Regulatory Compliance

4.3. Restraint

4.3.1. Lack of Skilled Professionals

4.4. Opportunity

4.4.1. Cloud-Based Informatics

4.5. Challenges

4.5.1. Interfacing & Integration

4.5.2. Migrating from Legacy LIMS to New Systems

5. European Laboratory Informatics Market, by Product Type

5.1. Introduction

5.2. Laboratory information Management System (LIMS)

5.3. Electronic Lab Notebook (ELN)

5.4. Chromatography Data System (CDS)

5.5. Electronic Data Capture (EDC) & Clinical Data Management System (CDMS)

5.6. Laboratory Execution Systems (LES)

5.7. Enterprise Content Management (ECM)

5.8. Scientific Data Management System (SDMS)

6. European Laboratory Informatics Market, by Mode of Delivery

6.1. Introduction

6.2. On-Premise Solutions

6.3. Cloud-Based Solutions

6.4. Web-Based Solutions

7. European Laboratory Informatics Market, by Component

7.1. Introduction

7.2. Services

7.3. Software

8. European Laboratory Informatics Market, by End User

8.1. Introduction

8.2. Life Sciences Industry

8.2.1. Pharmaceutical and Biotechnology Companies

8.2.2. Biobanks and Biorepositories

8.2.3. Academic Research institutes and Contract Research Organizations (CROs)

8.2.4. Molecular Diagnostics & Clinical Research Labs

8.3. Chemical Testing Laboratories

8.4. Food & Beverage and Agriculture industries

8.5. Petrochemical and Oil & Gas industries

8.6. Others

9. European Laboratory Informatics Market, by Geography

9.1. Introduction

9.1.1. Europe

9.1.1.1. Germany

9.1.1.2. U.K.

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Benelux

9.1.1.7. Nordics

9.1.1.8. Rest of Europe

10. Competitive Landscape

10.1. Introduction

10.1.1. New Product & Service Launches, Upgradations & Enhancements

10.1.2. Partnerships, Agreements & Collaborations

10.1.3. Mergers & Acquisitions

10.1.4. Expansion

11. Company Profiles (Business Overview, Financial Overview, Product & Service Portfolio, and Strategic Developments)

11.1. Abbott Laboratories

11.2. Agilent Technologies, Inc.

11.3. Autoscribe Informatics

11.4. Bio-ITech BV (elabJournal)

11.5. Biomed Systems Limited

11.6. Broughton Software Limited.

11.7. Bytewize AB

11.8. Dassault Systemes SE

11.9. GenoLogics (an Illumina Company)

11.10. LabLynx, Inc.

11.11. LabVantage Solutions, Inc.

11.12. LabWare, Inc.

11.13. Novatek International

11.14. PerkinElmer, Inc.

11.15. RURO, Inc.

11.16. Thermo Fisher Scientific Inc.

11.17. Waters Corporatio

12. Appendix

12.1. Questionnaire

List of Tables

Table 1 Europe: Laboratory Informatics Market Drivers: Impact Analysis (2018-2024)

Table 2 Research and Development Expenditure, 2006 and 2016

Table 3 Europe: Laboratory Informatics Market Restraint: Impact Analysis (2018-2024)

Table 4 European Laboratory Informatics Market Size, by Product, 2016-2024 ($Million)

Table 5 Key Laboratory Information Management Systems and its Providers

Table 6 European Laboratory Information Management Systems (LIMS) Market Size, by Country/Region, 2016-2024 ($Million)

Table 7 Key ELNs and its Providers

Table 8 European Electronic Lab Notebook (ELN) Market Size, by Country/Region, 2016-2024 ($Million)

Table 9 European Chromatography Data System (CDS) Market Size, by Country/Region, 2016-2024 ($Million)

Table 10 Evolution of Clinical Data Management Systems Using Various Software Systems

Table 11 European Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS) Market Size, by Country/Region, 2016-2024 ($Million)

Table 12 European Laboratory Execution Systems (LES) Market Size, by Country/Region, 2016-2024 ($Million)

Table 13 European Enterprise Content Management (ECM) Market Size, by Country/Region, 2016-2024 ($Million)

Table 14 European Scientific Data Management System (SDMS) Market Size, by Country/Region, 2016-2024 ($Million)

Table 15 European Laboratory Informatics Market Size, by Mode of Delivery, 2016-2024 ($Million)

Table 16 European On-Premise Laboratory Informatics Market Size, by Country/ Region, 2016-2024 ($Million)

Table 17 European Cloud-Based Laboratory Informatics Market Size, by Country/ Region, 2016-2024 ($Million)

Table 18 European Web-Based Laboratory Informatics Market Size, by Country/ Region, 2016-2024 ($Million)

Table 19 European Laboratory Informatics Market Size, by Component, 2016-2024 ($Million)

Table 20 European Laboratory Informatics Services Market Size, by Country/ Region, 2016-2024 ($Million)

Table 21 European Laboratory Informatics Software Market Size, by Country/ Region, 2016-2024 ($Million)

Table 22 European Laboratory Informatics Market Size, by End User, 2016-2024 ($Million)

Table 23 European Laboratory Informatics Market Size for Life Sciences Industry, by Type, 2016-2024 ($Million)

Table 24 European Laboratory Informatics Market Size for Life Sciences Industry, by Country/Region, 2017-2024 ($Million)

Table 25 European Laboratory Informatics Market Size for Pharmaceutical and Biotechnology Companies, by Country/Region, 2016-2024 ($Million)

Table 26 European Laboratory Informatics Market Size for Biobanks & Biorepositories, by Country/Region, 2016-2024 ($Million)

Table 27 European Laboratory Informatics Market Size for Academic Research Institutes & Contract Research Organizations (CROs), by Country/Region, 2016-2024 ($Million)

Table 28 European Laboratory Informatics Market Size for Molecular Diagnostics & Clinical Research Labs, by Country/Region, 2016-2024 ($Million)

Table 29 European Laboratory Informatics Market Size for Chemical Testing Laboratories, by Country/Region, 2016-2024 ($Million)

Table 30 European Laboratory Informatics Market Size for Food & Beverage and Agriculture Industries, by Country/Region, 2016-2024 ($Million)

Table 31 European Laboratory Informatics Market Size for Petrochemical and Oil & Gas Industries, by Country/Region, 2016-2024 ($Million)

Table 32 European Laboratory Informatics Market Size for Other End Users, by Country/Region, 2016-2024 ($Million)

Table 33 European Conferences and Workshops on Laboratory Informatics Market

Table 34 European Laboratory Informatics Market Size, by Country, 2016-2024 ($Million)

Table 35 European Laboratory Informatics Market Size, by Product, 2016-2024 ($Million)

Table 36 European Laboratory Informatics Market Size, by Mode of Delivery, 2016-2024 ($Million)

Table 37 European Laboratory Informatics Market Size, by Component, 2016-2024 ($Million)

Table 38 European Laboratory Informatics Market Size, by End User, 2016-2024 ($Million)

Table 39 European Laboratory Informatics Market Size for Life Sciences Industry, 2016-2024 ($Million)

Table 40 Germany: Laboratory Informatics Market Size, by Product, 2016-2024 ($Million)

Table 41 Germany: Laboratory Informatics Market Size, by Mode of Delivery, 2016-2024 ($Million)

Table 42 Germany: Laboratory Informatics Market Size, by Component, 2016-2024 ($Million)

Table 43 Germany: Laboratory Informatics Market Size, by End User, 2016-2024 ($Million)

Table 44 Germany: Laboratory Informatics Market Size for Life Sciences Industry, 2016-2024 ($Million)

Table 45 U.K.: Laboratory Informatics Market Size, by Product, 2016-2024 ($Million)

Table 46 U.K.: Laboratory Informatics Market Size, by Mode of Delivery, 2016-2024 ($Million)

Table 47 U.K.: Laboratory Informatics Market Size, by Component, 2016-2024 ($Million)

Table 48 U.K.: Laboratory Informatics Market Size, by End User, 2016-2024 ($Million)

Table 49 U.K.: Laboratory Informatics Market Size for Life Sciences Industry, 2016-2024 ($Million)

Table 50 France: Laboratory Informatics Market Size, by Product, 2016-2024 ($Million)

Table 51 France: Laboratory Informatics Market Size, by Mode of Delivery, 2016-2024 ($Million)

Table 52 France: Laboratory Informatics Market Size, by Component, 2016-2024 ($Million)

Table 53 France: Laboratory Informatics Market Size, by End User, 2016-2024 ($Million)

Table 54 France: Laboratory Informatics Market Size for Life Sciences Industry, 2016-2024 ($Million)

Table 55 Italy: Laboratory Informatics Market Size, by Product, 2016-2024 ($Million)

Table 56 Italy: Laboratory Informatics Market Size, by Mode of Delivery, 2016-2024 ($Million)

Table 57 Italy: Laboratory Informatics Market Size, by Component, 2016-2024 ($Million)

Table 58 Italy: Laboratory Informatics Market Size, by End User, 2016-2024 ($Million)

Table 59 Italy: Laboratory Informatics Market Size for Life Sciences Industry, 2016-2024 ($Million)

Table 60 Spain: Laboratory Informatics Market Size, by Product, 2016-2024 ($Million)

Table 61 Spain: Laboratory Informatics Market Size, by Mode of Delivery, 2016-2024 ($Million)

Table 62 Spain: Laboratory Informatics Market Size, by Component, 2016-2024 ($Million)

Table 63 Spain: Laboratory Informatics Market Size, by End User, 2016-2024 ($Million)

Table 64 Spain: Laboratory Informatics Market Size for Life Sciences Industry, 2016-2024 ($Million)

Table 65 Benelux: Laboratory Informatics Market Size, by Product, 2016-2024 ($Million)

Table 66 Benelux: Laboratory Informatics Market Size, by Mode of Delivery, 2016-2024 ($Million)

Table 67 Benelux: Laboratory Informatics Market Size, by Component, 2016-2024 ($Million)

Table 68 Benelux: Laboratory Informatics Market Size, by End User, 2016-2024 ($Million)

Table 69 Benelux: Laboratory Informatics Market Size for Life Sciences Industry, 2016-2024 ($Million)

Table 70 Nordics: Laboratory Informatics Market Size, by Product, 2016-2024 ($Million)

Table 71 Nordics: Laboratory Informatics Market Size, by Mode of Delivery, 2016-2024 ($Million)

Table 72 Nordics: Laboratory Informatics Market Size, by Component, 2016-2024 ($Million)

Table 73 Nordics: Laboratory Informatics Market Size, by End User, 2016-2024 ($Million)

Table 74 Nordics: Laboratory Informatics Market Size for Life Sciences Industry, 2016-2024 ($Million)

Table 75 RoE: Laboratory Informatics Market Size, by Product, 2016-2024 ($Million)

Table 76 RoE: Laboratory Informatics Market Size, by Mode of Delivery, 2016-2024 ($Million)

Table 77 RoE: Laboratory Informatics Market Size, by Component, 2016-2024 ($Million)

Table 78 RoE: Laboratory Informatics Market Size, by End User, 2016-2024 ($Million)

Table 79 RoE: Laboratory Informatics Market Size for Life Sciences Industry, 2016-2024 ($Million)

Table 80 Number of Developments by The Key Players During 2015-2018

Table 81 New Product & Service Launches, Upgradations & Enhancements

Table 82 Partnerships, Agreements and Collaborations

Table 83 Mergers & Acquisitions

Table 84 Expansion

List of Figures

Figure 1 Research Process

Figure 2 Key Executives Interviewed

Figure 3 Primary Research Techniques

Figure 4 Key Adoptors

Figure 5 Key Opportunities

Figure 6 Scope: European Laboratory Informatics Market

Figure 7 European Laboratory Informatics Market, by Product

Figure 8 European Laboratory Informatics Market, by Mode of Delivery

Figure 9 European Laboratory Informatics Market, by Component

Figure 10 European Laboratory Informatics Market, by End User

Figure 11 European Laboratory Informatics Market, by Geography

Figure 12 European Laboratory Informatics Market: Competitive Landscape

Figure 13 Market Dynamics: European Laboratory Informatics Market

Figure 14 European Laboratory Informatics Market Size, by Product, 2018-2024 ($Million)

Figure 15 European Laboratory Informatics Market Size, by Mode of Delivery, 2018-2024 ($Million)

Figure 16 European Laboratory Informatics Market Size, by Component, 2018-2024 ($Million)

Figure 17 European Laboratory Informatics Market Size, by End User, 2018-2024 ($Million)

Figure 18 European Laboratory Informatics Market Size for Life Sciences Industry, by Type, 2018-2024 ($Million)

Figure 19 Europe: Laboratory Informatics Market Size, by Country, 2018-2024 ($Million)

Figure 20 Gross Expenditure on R&D in Germany, 2017

Figure 21 Gross Expenditure on R&D in France, 2017

Figure 22 Italy: Gross Domestic Spending on R&D

Figure 23 Gross Domestic Spending on R&D in Benelux

Figure 24 Gross Domestic Spending on R&D in Nordics

Figure 25 Poland: Gross Domestic Spending on R&D

Figure 26 Growth Strategies Adopted by Key Players, 2015-2018

Figure 27 New Product & Service Launches, Upgradations & Enhancements, by Leading Players, 2015-2018

Figure 28 Partnerships, Agreements & Collaborations, by Leading Players, 2015-2018

Figure 29 Mergers & Acquisitions, by Leading Players, 2015-2018

Figure 30 Abbott Laboratories: Financial Overview (2015-2017)

Figure 31 Agilent Technologies, Inc.: Financial Overview (2015-2017)

Figure 32 Dassault Systemes SE: Financial Overview (2015-2017)

Figure 33 Illumina, Inc.: Financial Overview (2015-2017)

Figure 34 PerkinElmer, Inc.: Financial Overview (2015-2017)

Figure 35 Thermo Fisher Scientific Inc.: Financial Overview (2015-2017)

Figure 36 Waters Corporation: Financial Overview (2015-2017)