Resources

About Us

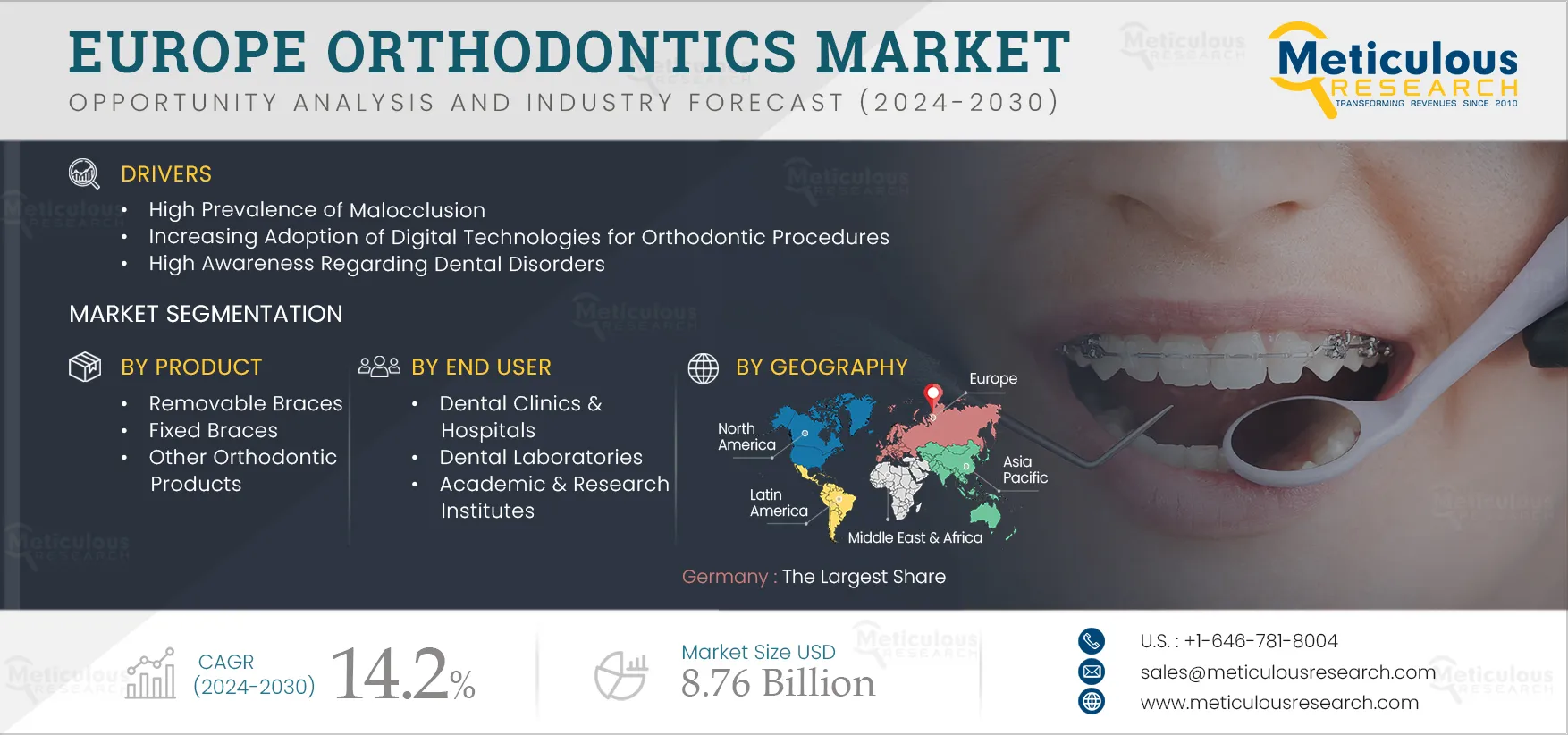

Europe Orthodontics Market by Product (Clear Aligners, Fixed Braces {Brackets, Wires [Nickel, Titanium, Steel], Anchorage, Ligatures}, Bonding, Adhesives, Springs, Tubes, Bands), Patient (Teen, Adult), End User (Hospital, Clinics, Research) - Forecast to 2032

Report ID: MRHC - 1041018 Pages: 200 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Europe Orthodontics Market is projected to reach $8.76 billion by 2032, at a CAGR of 14.2% from 2025 to 2032. Orthodontics is the branch of dentistry that corrects teeth and jaws that are positioned improperly. Removable braces, brackets, archwires, anchorage appliances, ligatures, and other orthodontic products are used in orthodontic procedures. Orthodontic products are used to correct malocclusions by straightening the teeth or moving them into better positions to improve an individual’s appearance and restore the normal function of teeth of chewing and speaking.

The Europe orthodontics market is growing due to the high prevalence of malocclusion, the increasing adoption of digital technologies for orthodontic treatments, and high awareness regarding dental disorders. Furthermore, the growing demand for aesthetic and cosmetic dentistry offers significant opportunities for the market’s growth.

However, the unavailability of reimbursement policies for orthodontic treatments hinders the growth of this market. In addition, the high cost of orthodontic treatments is a major challenge to the market’s growth.

The number of cosmetic procedures is increasing due to rising awareness regarding oral health and rapid technological advancements. The demand for cosmetic procedures has been high among populations aged 24–40 and 57–75. People aged 24–40 are largely interested in improving dental aesthetics with the help of orthodontic procedures.

Patients’ choices and requirements, ranging from mere hygiene to definite image enhancement, are changing industry dynamics. People today are more willing to invest in themselves than ever before. Baby boomers with high disposable income, the younger generation of working individuals who want the perfect appearance for better careers, and significant advances in the industry have contributed to the rise of cosmetic dentistry.

Moreover, the high disposable incomes coupled with social media influence have led to an increased willingness to spend on aesthetic improvement. For instance, the Hallyu effect, also known as the Korean Wave, is a phenomenon in Korean pop culture wherein Korean movies, K-dramas, pop music, and fashion are being accepted and shared globally. This effect has increased the demand for cosmetic and aesthetic dentistry in younger generations due to social media influence. For instance, according to the Korea Foundation, there were about 13.2 million hallyu fans in Europe in 2022, a 37 percent jump from 2021. Therefore, the growing demand for cosmetic dentistry is increasing the adoption of orthodontic procedures, driving the market's growth.

Click here to: Get Free Sample Pages of this Report

The High Prevalence of Malocclusion is Driving the Demand for Orthodontics

The high incidence of malocclusion is a major driving factor for the Europe orthodontics market. Malocclusion can be caused by various factors, such as genetics and thumb-sucking in children, and it can have a negative impact on an individual’s oral health.

Malocclusion is one of the most prevalent clinical dental conditions, affecting approximately 60% to 75% of the global population (Source: Align Technologies., Inc. [U.S.]). Similarly, according to the European Journal of Pediatric Dentistry in 2020, the prevalence of malocclusion in Europe was 72%, with 52.05% being normal overbite, 34% open bite, 7% crossbites, and 3.82% posterior crossbite requiring orthodontic treatment. Thus, the high prevalence of malocclusion in Europe drives the adoption of orthodontic products, driving the market growth in the region.

In 2025, the Removable Braces Segment is Expected to Account for the Largest Share of the Market

In 2025, the removable braces segment is expected to account for the largest share of the market due to the high prevalence of malocclusion. Removable braces are clear plastic trays that can be snapped in and out of the mouth to correct orthodontic conditions. The treatment of removable braces can be shorter than traditional braces, owing to which the demand is higher. Malocclusion is a condition where the teeth and jaw bones are misaligned. This condition affects an individual's chewing patterns, speech, and appearance. Thus, braces are used in correcting misaligned teeth. The high prevalence of malocclusion coupled with the growing preference for aesthetic dental products such as invisible braces as opposed to traditional metal braces is the major factor attributed to the large share of the segment.

In 2025, the Adult Segment is Expected to Account for the Largest Share of the Market

Oral diseases are increasing the demand for orthodontic therapy among adults. The treatment of malocclusions in adults is important for preventing orthodontic complications. Furthermore, over the past few years, the overall diagnosis rate for malocclusions and treatment rates has increased significantly. Thus, the high prevalence of malocclusion in adults has increased the adoption of orthodontic treatments.

In 2025, the Dental Clinics & Hospitals Segment is Expected to Account for the Largest Share of the Market

Based on end user, the Europe orthodontics market is segmented into dental clinics & hospitals, dental laboratories, and academic & research institutes. In 2025, the dental clinics & hospitals segment is expected to account for the largest share of the market. The large market share of this segment is attributed to the high number of independent dental clinics & dental chains and the high preference for dental clinics & hospitals by patients for orthodontic procedures coupled with the wide availability of dentists in the region. For instance, in 2021, Bulgaria had 7,560 dentists, accounting for 109.9 dentists per 100,000 people (Source: Eurostat).

Furthermore, the consolidation of dental clinics provides them with better resources, which enables these clinics to provide better patient care and focus on customer acquisition, which also leads to the segment’s large share.

Germany to Dominate the Regional Market in 2025

In 2025, Germany is expected to account for the largest share of Europe orthodontics market in Europe. The large share of this market is attributed to the increasing prevalence of malocclusion, rising awareness and expenditure on oral health, and high accessibility to dental care owing to the wide availability of dentists.

According to the Institute for Health Metrics and Evaluation, in 2019, more than half of Europe’s population had dental disorders. Untreated caries of permanent and deciduous teeth is the most prevalent oral disease in the region. One in three people (33%) across the EU is estimated to suffer from caries of permanent dentition (and 3% from untreated caries in deciduous teeth). Also, one in six people suffered from periodontal diseases (16%), and one in ten had total tooth loss.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by major market players in the last 3–4 years. The key players profiled in the Europe orthodontics market report are Align Technology, Inc. (U.S.), Institut Straumann AG (Switzerland), Envista Holdings Corporation (U.S.), 3M Company (U.S.), DENTSPLY SIRONA Inc. (U.S.), DENTRUM GmbH & Co.KG (Germany), SmileDirectClub, Inc. (U.S), TP Orthodontics, Inc. (U.S.), DB Orthodontics Limited (U.K.), and Geniova Technologies, S.L (Spain).

Scope of the Report:

Europe Orthodontics Market, by Product

Europe Orthodontics Market, by Patient Type

Europe Orthodontics Market, by End User

Europe Orthodontics Market, by Geography

Key questions answered in the report:

This study offers a detailed assessment of the Europe orthodontics market, including the market sizes & forecasts for various market segments such as product, patient type, and end user. The Europe orthodontics market study provides an in-depth analysis of various segments & subsegments of the orthodontics market in European countries.

The Europe orthodontics market is projected to reach $8.76 billion by 2032, at a CAGR of 14.2% during the forecast period.

In 2025, the removable braces segment is expected to account for the largest share. The high prevalence of malocclusion and lower costs of fixed braces compared to removable braces contribute to the large market share of this segment.

In 2025, the adult segment is expected to account for the largest share of the market. The high prevalence of malocclusion and increasing demand for cosmetic dentistry contributes to the large market share of this segment.

The growth of the Europe orthodontics market is attributed to the high prevalence of malocclusion, the increasing adoption of digital technologies for orthodontic treatments, and high awareness regarding dental disorders. Furthermore, the growing demand for aesthetic and cosmetic dentistry offers significant opportunities for the market’s growth.

The key players profiled in the Europe orthodontics market study are Align Technology, Inc. (U.S.), Institut Straumann AG (Switzerland), Envista Holdings Corporation (U.S.), 3M Company (U.S.), DENTSPLY SIRONA Inc. (U.S.), DENTRUM GmbH & Co.KG (Germany), SmileDirectClub, Inc. (U.S) TP Orthodontics, Inc. (U.S.), DB Orthodontics Limited (U.K.), and Geniova Technologies, S.L (Spain).

The U.K. and France are expected to offer significant growth opportunities for the players operating in the Europe orthodontics market. This can be attributed to factors such as high awareness regarding oral health, high healthcare spending, rising cases of oral diseases, and favorable government initiatives for oral health in the U.K. Moreover, factors such as rising cases of malocclusion, increasing affordability and expenditure for oral health, increasing cases of pediatric misalignment, and rising popularity of cosmetic dentistry are fueling the growth of the orthodontics market in France.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Aug-2023

Published Date: May-2023

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates