Resources

About Us

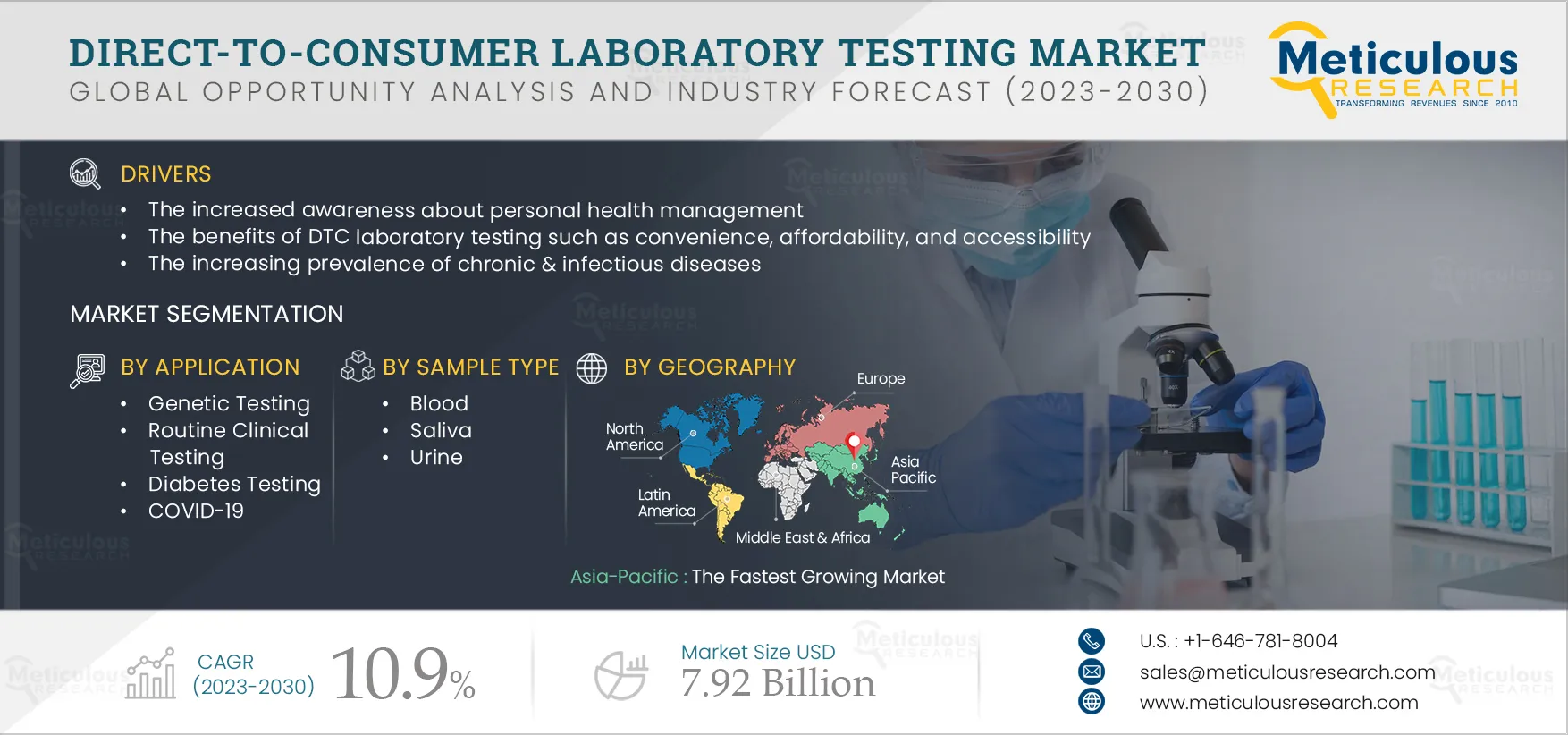

Direct-to-consumer (DTC) Laboratory Testing Market by Application (Genetic Testing {Ancestry, Carrier Status, Disease Risk [Cancer, Neurological, Cardiac]}, Diabetes, COVID, STD, Routine, CBC), Sample Type (Saliva, Urine, Blood) - Global Forecast to 2030

Report ID: MRHC - 104667 Pages: 209 May-2023 Formats*: PDF Category: Healthcare Delivery: 2 to 4 Hours Download Free Sample ReportThe DTC Laboratory Testing Market is projected to reach $7.92 billion by 2030, at a CAGR of 10.9% during the forecast period 2023–2030. Direct-to-consumer laboratory tests are tests that can be self-ordered by consumers without the involvement of their healthcare providers. The sample collected from the consumer is processed at a laboratory, and the results are sent directly to the consumer. The growth of the direct-to-consumer laboratory testing market is driven by the increased awareness about personal health management, the benefits of DTC laboratory testing such as convenience, affordability, and accessibility, the increasing prevalence of chronic & infectious diseases, increasing healthcare costs, rising consumer awareness about ancestry/genealogy testing, and the rising elderly population. However, sample integrity and interference issues, regulatory concerns, the lack of reimbursements, and the lack of extensive test portfolios compared to conventional laboratory testing are restraining the growth of this market.

The growing adoption of telehealth, the rising popularity of DTC laboratory testing in emerging economies, and the increasing penetration of DTC pharmacogenomic testing are expected to generate growth opportunities for the players operating in this market. However, concerns regarding the security and privacy of genomic data, misinterpretation of test results, and the lack of professional medical counseling are major challenges to market growth.

Click here to: Get a Free Sample Copy of this report

Disease risk assessment genetic testing provides information about the potential risk of some disease or condition that may occur in the future. It is also known as predictive testing. These tests identify changes or mutations in an individual's genome and assess their risk of developing certain diseases. Some diseases that can be assessed using this test are certain types of cancer, cardiovascular diseases, and neurological diseases. Factors such as increased awareness about early disease diagnosis & prevention, technological advancement in genetic testing to make these tests affordable & accessible, and the rising prevalence of various chronic diseases drive the adoption of disease risk assessment genetic testing.

Moreover, if an individual has a family health history of chronic diseases, such as cancer, diabetes, heart disease, or osteoporosis, they have a high predisposition to the disease. Understanding family health history through predictive testing can help individuals prevent or manage these chronic conditions with proper guidance from a physician. Thus, the growing prevalence of such conditions globally, coupled with the adoption of preventive technologies, is aiding chronic disease management, thus driving the growth of this market.

Ease of Accessibility to DTC Tests and Effective Marketing to Consumers Drives the Market growth

Over the last few years, consumers have been actively participating in decisions affecting their health, enabling people to be informed of their health and lead healthy lifestyles. Clinical laboratory testing is an important part of healthcare. These tests can be ordered online or bought from pharmacies without any prescription, making them easy to access for consumers. The easy accessibility and convenience of ordering the tests online also attract customers.

Companies operating in this market are conducting marketing campaigns and advertisements to interest consumers and inform them about the benefits of DTC tests. This encourages customers to order these tests without needing to consult a physician. Consumers can get personalized information about their health, disease risk, and other traits and gain awareness of their genetic predisposition to illnesses using these DTC tests. Thus, the ease of accessibility to DTC tests and effective marketing to consumers

Based on Application, in 2023, the Genetic Testing Segment is Expected to Dominate the DTC Laboratory Testing Market

The large market share of this segment is attributed to the rising appeal of DTC genetic testing to explore information regarding family health history and disease risk assessment testing, the launch of new DTC genetic tests for new applications and increasing curiosity among people in developed countries regarding their ancestry and lineage. DTC genetic tests identify individuals at risk of specific conditions to reduce mortality and morbidity through timely screening, surveillance, and prevention.

Based on Sample Type, in 2023, the Blood Segment is Expected to Account for the Largest Share of the Market

The large market share of this segment is attributed to the benefits of blood samples, such as the high reliability of the results, the wide range of test options available, and the convenience of at-home blood collection service.

Asia Pacific: The Fastest Growing Market

Asia-Pacific is slated to register the highest CAGR during the forecast period. The factors driving the growth of the DTC laboratory testing market in Asia-Pacific are the increasing prevalence of infectious & chronic diseases and the increasing awareness in people regarding disease risk prediction and healthy lifestyle.

Key Players

The report includes a competitive landscape based on an extensive assessment of the product portfolio offerings, geographic presences, and key strategic developments in leading industry market players over the past 3–4 years. The key players profiled in the global DTC laboratory testing market are Quest Diagnostics Incorporated (U.S.), Laboratory Corporation of America Holdings (U.S.), 23andMe Holding Co. (U.S.), Myriad Genetics, Inc. (U.S.), Everlywell, Inc. (U.S.), DirectLabs, LLC. (U.S.), Ancestry.com, LLC (U.S.), MyMedLab, Inc. (U.S.), ANY LAB TEST NOW (U.S.), Thorne HealthTech, Inc. (U.S.), and LetsGetChecked, Inc. (U.S.).

Other than these, there are several regional players such as Color Health, Inc. (U.S), Laboratoire CERBA (France), MyHeritage Ltd. (Israel), Genova Diagnostics Inc. (U.S.), Gene by Gene, Ltd. (U.S.), Metropolis Healthcare Limited (India), Vitagene (U.S.), SRL Limited (India), Hirotsu Bio Science (Japan), Ambry Genetics Corporation (U.S.), Mapmygenome India Limited (India), FamilyTreeDNA (U.S.), Genera (Brazil), Veritas Intercontinental (Spain), Medichecks.com Ltd. (U.K.), EasyDNA (U.S.) (Subsidiary of Genetic Technologies Limited (Australia), Cerascreen Biotech LLC (U.K.), and Living DNA Ltd (U.K.).

Scope of the Report:

DTC Laboratory Testing Market, by Application

DTC Laboratory Testing Market, by Sample Type

DTC Laboratory Testing Market, by Geography

Key questions answered in the report:

This market study covers the market sizes & forecasts of the direct-to-consumer laboratory testing market based on application, sample type, and geography. This market study also provides the value analysis of various segments and subsegments of the mice model market at the regional and country levels.

The global DTC laboratory testing market is projected to reach $7.92 billion by 2030, at a CAGR of 10.9% during the forecast period.

Based on the application, in 2023, the genetic testing segment is expected to account for the largest share of the DTC laboratory testing market. The rising appeal of DTC genetic testing to explore information regarding family health history and predictive testing, the launch of new DTC genetic tests for new applications, and the increasing curiosity among people in developed countries regarding their ancestry and lineage contribute to the growth of this segment.

In 2023, based on the sample type, the blood segment is expected to account for the largest share of the DTC laboratory testing market due to the advantages of blood samples, such as the availability of a large number of tests, a high convenience of at-home sample collection through a phlebotomist.

Easy accessibility of DTC tests, the growing awareness regarding family health history and predictive testing, the increasing demand for early disease diagnosis, and the rising geriatric population that prefers convenient care are expected to propel the global DTC laboratory testing market. Moreover, the increasing adoption of telehealth offers an opportunity to players operating in the DTC laboratory testing market.

The key players operating in the global DTC laboratory testing market are Quest Diagnostics Incorporated (U.S.), Laboratory Corporation of America Holdings (U.S.), 23andMe Holding Co. (U.S.), Myriad Genetics, Inc. (U.S.), Everlywell, Inc. (U.S.), DirectLabs, LLC. (U.S.), Ancestry.com, LLC (U.S.), MyMedLab, Inc. (U.S.), ANY LAB TEST NOW (U.S.), Thorne HealthTech, Inc. (U.S.), and LetsGetChecked, Inc. (U.S.).

Other than these, there are several regional players such as Color Health, Inc. (U.S), Laboratoire CERBA (France), MyHeritage Ltd. (Israel), Genova Diagnostics Inc. (U.S.), Gene by Gene, Ltd. (U.S.), Metropolis Healthcare Limited (India), Vitagene (U.S.), SRL Limited (India), Hirotsu Bio Science (Japan), Ambry Genetics Corporation (U.S.), Mapmygenome India Limited (India), FamilyTreeDNA (U.S.), Genera (Brazil), Veritas Intercontinental (Spain), Medichecks.com Ltd. (U.K.), EasyDNA (U.S.) (Subsidiary of Genetic Technologies Limited (Australia), Cerascreen Biotech LLC (U.K.), and Living DNA Ltd (U.K.).

The emerging Asian-Pacific countries are projected to offer significant growth opportunities for the vendors in this market owing to the increasing prevalence of infectious and chronic diseases and the increasing awareness in people regarding disease risk prediction and a healthy lifestyle.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates