Resources

About Us

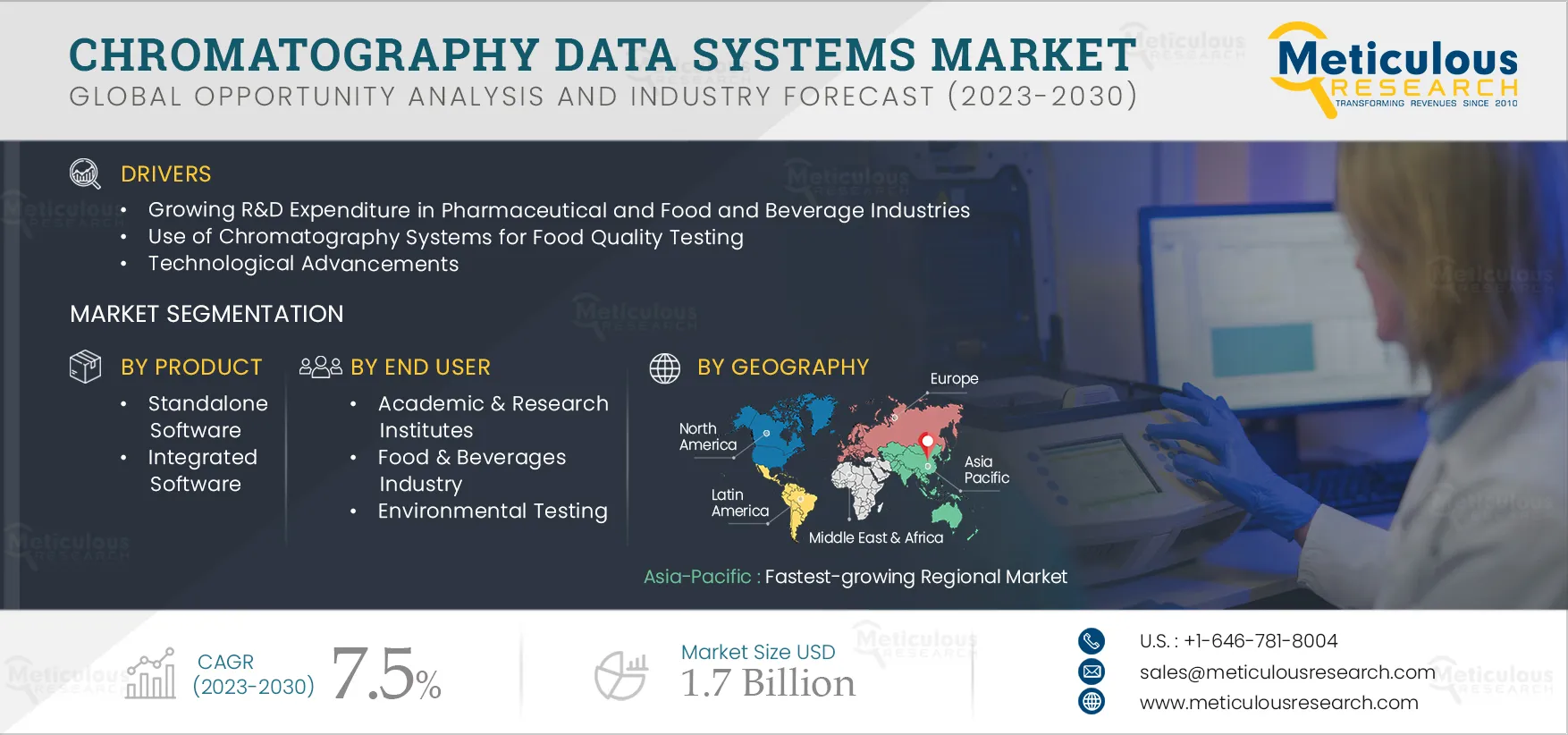

Chromatography Data Systems Market by Type (Standalone, Integrated), Delivery Mode (On Premise, Cloud Based), End User (Pharmaceutical and Biotechnology, Food & Beverages, Academic & Research Institutes, Environmental) - Global Forecast to 2030

Report ID: MRHC - 104135 Pages: 190 Feb-2023 Formats*: PDF Category: Healthcare Delivery: 24 to 48 Hours Download Free Sample ReportThe Chromatography Data Systems Market is projected to reach $1.7 billion by 2030, at a CAGR of 7.5% from 2023 to 2030. Chromatography data systems help researchers and laboratory professionals with faster, more accurate, and paperless analysis of chromatography data. The increasing need for automation in laboratory instrumentation to reduce manual data entry errors has increased the adoption of chromatography data systems among various sectors. The growth of this market is driven by factors such as the growing R&D expenditure in the pharmaceutical and food & beverage industry, the increasing use of chromatography systems for food quality testing, and technological advancements. Additionally, emerging economies are creating opportunities for the growth of this market. However, the lack of integration standards for laboratory informatics restrains the growth of this market to a notable extent.

Click here to: Get a Free Sample Copy of this report

Pharmaceutical companies are investing heavily in R&D and expanding their pharmaceutical manufacturing facilities to meet the growing market demand. The increasing R&D investments in the pharmaceutical industry increase the commercialization of new drugs. According to the International Federation of Pharmaceutical Manufacturers and Associations (IFPMA), R&D investments in the pharmaceutical industries in the U.S. and Europe have grown considerably. As of 2020, the number of drugs developing cancer, immunology, neurology, and infectious diseases was estimated at ~6,900. As the chromatography technique is used in the drug development phase, the increase in R&D activities is expected to increase the chromatography data, leading to the adoption of chromatography data systems.

Additionally, the R&D activities in the F&B industry lead to the development of food products with higher nutritional value and longer shelf life. Hence governments of various countries are supporting R&D activities in various sectors, including F&B. For instance, in the U.K., the R&D expenditure in food, beverages and tobacco product businesses increased from approximately USD 513 Million (GBP 424 Million) in 2015 to USD 553 Million (GBP 457 Million) in 2020.

Furthermore, some countries also provide tax incentives for R&D. For instance, in Australia, innovations in the food & beverage industry are supported by programs like the federal government’s Research & Development Tax Incentive (RDTI). In the 2020–2021 Federal Budget, the Australian government set the refundable R&D tax offset at 18.5%.

Also, in South Africa, companies investing in R&D are rewarded with an additional deduction on operational R&D expenses. Techniques such as liquid and gas chromatography are used to characterize and classify a wide range of agri-food products. This leads to increased demand for chromatography data systems.

The Integrated Software Segment is Projected to Register the Highest CAGR Over the Forecast Period

Based on product, the integrated software segment is projected to register the highest CAGR. The growth of this segment is driven by its features such as rapid screening and efficient workflow management. With the integrated platform, users can have access to all kinds of laboratory data, leading to a quick data review process. This further contributes to the increasing adoption of integrated software.

The Cloud/Web-based Segment is Projected to Register the Highest CAGR Over the Forecast Period

Based on delivery mode, the cloud/web-based segment is projected to register the highest CAGR during the forecast period. Factors such as the feasibility of storing data, effective data management from all types of chromatography instruments, and the ability to retrieve data from any place when required contribute to the growth of this segment.

In 2023, the Pharmaceutical & Biotechnology Industries Segment is Expected to Dominate Chromatography Data Systems Market

Based on end user, in 2023, the pharmaceutical & biotechnology industries segment is expected to account for the largest share of the chromatography data systems market. Pharmaceutical and biopharmaceutical companies have witnessed significant growth in recent years due to the increasing demand for pharmaceutical products, growing incidence & prevalence of various chronic diseases, and rising unmet medical needs in various chronic & rare diseases. Moreover, governments of various countries are taking initiatives by making investments and providing grants & funds to pharmaceutical and biopharmaceutical companies for the manufacture and R&D of biopharmaceuticals. Furthermore, the high usage of chromatography systems in the expanding pharmaceutical industries also supports the large market share of this segment.

Asia-Pacific: Fastest-growing Regional Market

Based on geography, Asia-Pacific is slated to record the highest growth rate during the forecast period. The growth of this market is mainly driven by the considerable scope in the pharmaceutical & biotechnological industries leading to increasing R&D activities. Also, improvements in the healthcare infrastructure in the region, the increasing focus of Asia-Pacific countries on implementing food quality regulations, and the rising demand for advanced chromatography techniques contribute to the growth of this market.

Key Players

The key players profiled in the chromatography data systems market report are Advanced Chemistry Development, Inc. (Canada), Shimadzu Corporation (Japan), Agilent Technologies, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Waters Corporation (U.S.), DataApex, spol. s r.o. (Czech Republic), Gilson, Inc. (U.S.), JASCO (U.S.), Thermo Fisher Scientific Inc. (U.S.), PerkinElmer, Inc. (U.S.), KNAUER Wissenschaftliche Geräte GmbH (Germany), SCION Instruments NL BV (Netherlands), and Justice Innovations Inc. (U.S.).

Scope of the Report:

Chromatography Data Systems Market, by Product

Chromatography Data Systems Market, by Delivery Mode

Chromatography Data Systems Market, by End User

Chromatography Data Systems Market, by Geography

Key questions answered in the report:

The chromatography data systems market study covers the market sizes & forecasts for various chromatography data systems used in various sectors. The report includes the value analysis of various segments of the chromatography data systems market at the regional and country levels.

The chromatography data systems market is projected to reach $1.7 billion by 2030, at a CAGR of 7.5% during the forecast period.

The integrated software is projected to register the highest CAGR during the forecast period due to its feasibility and increasing need in various applications where different types of chromatography techniques are used.

The cloud/web-based segment is slated to register the highest CAGR during the forecast period. The increasing adoption of chromatography techniques and the installation of technologically advanced software in labs drive the growth of this segment.

The pharmaceutical & biotechnology industries segment is slated to register the highest CAGR during the forecast period. The installation of advanced chromatography systems in the labs and the growing utilization of the software contribute to segment growth.

The growth of this market is driven by factors such as the growing R&D expenditure in the pharmaceutical and food & beverage industry, the use of chromatography systems for food quality testing, and technological advancements. Additionally, emerging economies are creating opportunities for market growth.

The key players operating in the chromatography data systems market are Advanced Chemistry Development, Inc. (Canada), Shimadzu Corporation (Japan), Agilent Technologies, Inc. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Waters Corporation (U.S.), DataApex, spol. s r.o. (Czech Republic), Gilson, Inc. (U.S.), JASCO (U.S.), Thermo Fisher Scientific Inc. (U.S.), PerkinElmer, Inc. (U.S.), KNAUER Wissenschaftliche Geräte GmbH (Germany), SCION Instruments NL BV (Netherlands), and Justice Innovations Inc. (U.S.).

Emerging economies from Asia-Pacific, such as China and India, are projected to offer significant growth opportunities for vendors operating in this market due to rising investment in research and development by the pharmaceutical industry and the growing food & beverage sector in this region.

Published Date: Feb-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Mar-2021

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates