1. Introduction

1.1. Market Ecosystem

1.2. Currency and Limitations

1.2.1. Currency

1.2.2. Limitations

1.3. Key Stakeholders

2. Research Methodology

2.1. Research Process

2.1.1. Secondary Research

2.1.2. Primary Research

2.1.3. Market Size Estimation

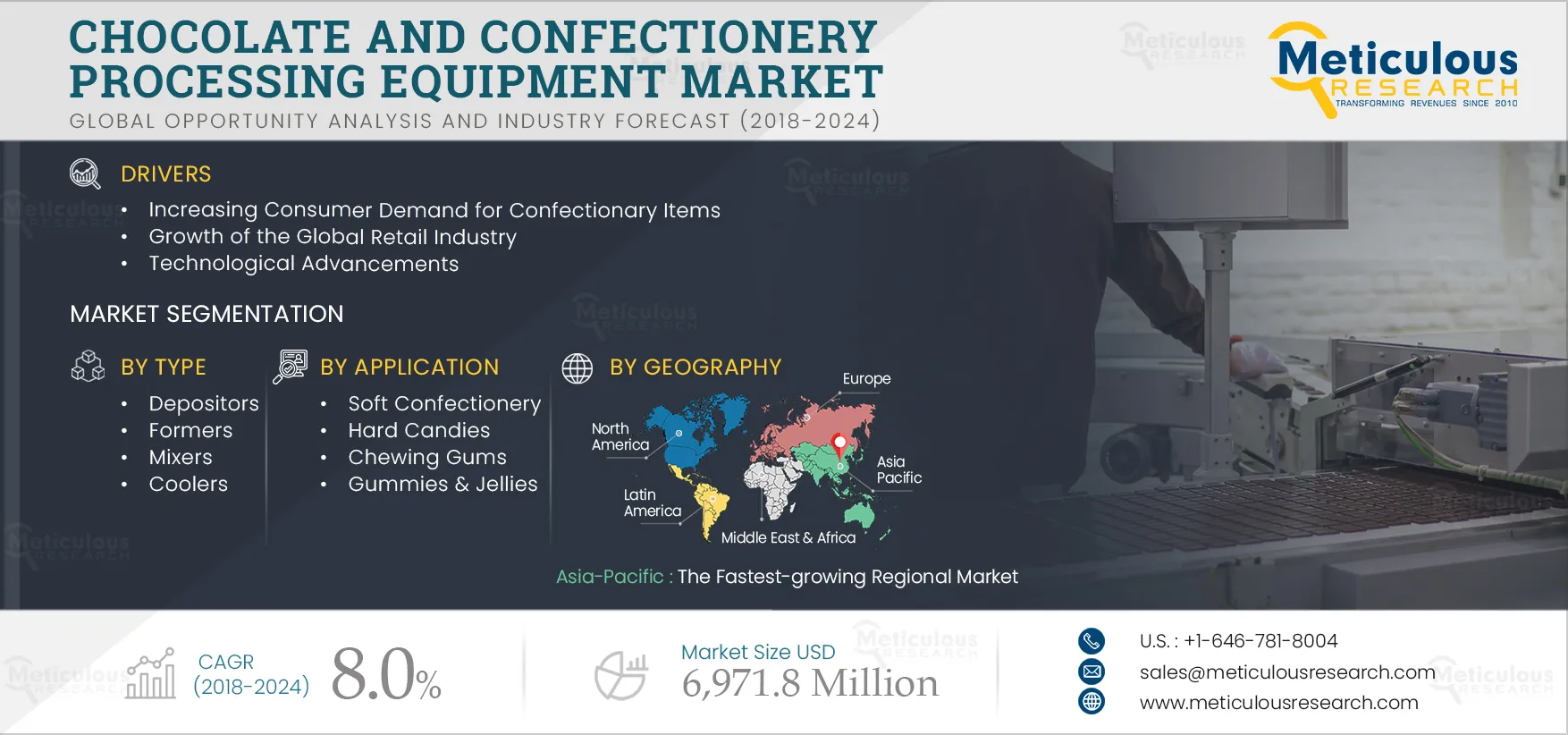

3. Executive Summary

3.1. Introduction

3.2. Market Dynamics

3.3. Segment Analysis

3.3.1. Type Analysis

3.3.2. Application Analysis

3.4. Regional Analysis

3.5. Key Players

4. Market Insights

4.1. Introduction

4.2. Drivers

4.2.1. Increasing Consumer Demand for Confectionary Items

4.2.2. Growth of the Global Retail Industry

4.2.3. Technological Advancements

4.2.4. Growing Focus on Safety of Confectionery Products and the Safety of Workers

4.3. Restraints

4.3.1. High Cost of Equipment Due to its High Production Cost

4.4. Opportunities

4.4.1. Emerging Economies- Asia-Pacific, Latin America, and Middle East and Africa

4.5. Challenges

4.5.1. Lack of Skilled Labour Force

5. Global Chocolate and Confectionery Processing Equipment Market, by Type

5.1. Introduction

5.1.1. Depositors

5.1.2. Formers

5.1.3. Coating and Spraying Systems

5.1.4. Mixers

5.1.5. Coolers

5.1.6. Others

6. Global Chocolate Processing Equipment Market, by Application

6.1. Introduction

6.2. Soft Confectionery

6.3. Hard Candies

6.4. Chewing Gums

6.5. Gummies & Jellies

6.6. Other

7. Chocolate Processing Equipment Market, by Geography

7.1. Introduction

7.2. North America

7.2.1. Introduction

7.2.2. U.S.

7.2.3. Canada

7.3. Europe

7.3.1. Germany

7.3.2. France

7.3.3. Italy

7.3.4. U.K.

7.3.5. Spain

7.3.6. The Netherlands

7.3.7. Rest of Europe

7.4. Asia-Pacific

7.4.1. China

7.4.2. India

7.4.3. Japan

7.4.4. Australia

7.4.5. Rest of Asia-Pacific

7.5. Rest of World

7.5.1. Latin America

7.5.1.1. Brazil

7.5.1.2. Mexico

7.5.1.3. Argentina

7.5.1.4. Rest of Latin America

7.5.2. Middle East and Africa

8. Company Profiles (Business Overview, Financial Overview, Product Portfolio, and Recent Developments)

8.1. Buhler AG

8.2. GEA Group Aktiengesellschaft

8.3. John Bean Technologies Corporation

8.4. Heat and Control Inc.

8.5. Alfa Laval Ab

8.6. Robert Bosch Packaging Technology GmbH

8.7. Aasted APS

8.8. Baker Perkins Limited

8.9. Tomric Systems, Inc

8.10. Caotech B.V.

8.11. Sollich KG

8.12. Apex Machinery & Equipment Co., Ltd.

8.13. Royal Duyvis Wiener B.V.

8.14. Tecno 3 S.R.L.

8.15. BCH Limited

9. Appendix

9.1. Questionnaire

9.2. Available Customization

List of Tables

Table 1 Total Global Chocolate and Confectionery Processing Equipment Market: Impact Analysis of Market Drivers (2018–2024)

Table 2 Total Global Chocolate and Confectionery Processing Equipment Market: Impact Analysis of Market Restrains (2018–2023)

Table 3 Global Chocolate and Confectionery Processing Equipment Market Size, by Type, 2016-2024 (USD Million)

Table 4 Depositors Market Size for Chocolate and Confectionery Processing, by Country/Region, 2016-2024 (USD Million)

Table 5 Formers Market Size for Chocolate and Confectionery Processing, by Country/Region, 2016-2024 (USD Million)

Table 6 Coating and Spraying System Market Size for Chocolate and Confectionery Processing, by Country/Region, 2016-2024 (USD Million)

Table 7 Mixers Market Size for Chocolate and Confectionery Processing, by Country/Region, 2016-2024 (USD Million)

Table 8 Coolers Market Size for Chocolate and Confectionery Processing, by Country/Region, 2016-2024 (USD Million)

Table 9 Others Chocolate and Confectionery Processing Equipment Market Size, by Country/Region, 2016-2024 (USD Million)

Table 10 Global Chocolate and Confectionery Processing Equipment Market Size, by Application, 2016-2024 (USD Million)

Table 11 Soft Confectionery Processing Equipment Market Size, by Country/Region, 2016-2024 (USD Million)

Table 12 Hard Candies Processing Equipment Market Size, by Country/Region, 2016-2024 (USD Million)

Table 13 Chewing Gums Processing Equipment Market Size, by Country/Region, 2016-2024 (USD Million)

Table 14 Gummies and Jellies Processing Equipment Market Size, by Country/Region, 2016-2024 (USD Million)

Table 15 Other Chocolate and Confectionery Products Processing Equipment Market Size, by Country/Region, 2016-2024 (USD Million)

Table 16 Chocolate and Confectionery Processing Equipment Market Size, by Country/Region, 2016–2024 (USD Million)

Table 17 North America: Chocolate and Confectionery Processing Equipment Market Size, by Country, 2016-2024 (USD Million)

Table 18 North America: Market Size, by Type, 2016-2024 (USD Million)

Table 19 North America: Market Size, by Application, 2016-2024 (USD Million)

Table 20 U.S.: Chocolate and Confectionery Processing Equipment Market Size, by Type, 2016-2024 (USD Million)

Table 21 U.S.: Market Size, by Application, 2016-2024 (USD Million)

Table 22 Canada: Chocolate and Confectionery Processing Equipment Market Size, by Type, 2016-2024 (USD Million)

Table 23 Canada: Market Size, by Application, 2016-2024 (USD Million)

Table 24 Europe: Chocolate and Confectionery Processing Equipment Market Size, by Country, 2016-2024 (USD Million)

Table 25 Europe: Market Size, by Type, 2016-2024 (USD Million)

Table 26 Europe: Market Size, by Application, 2016-2024 (USD Million)

Table 27 Germany: Market Size, by Type, 2016-2024 (USD Million)

Table 28 Germany: Market Size, by Application, 2016-2024 (USD Million)

Table 29 France: Market Size, by Type, 2016-2024 (USD Million)

Table 30 France: Market Size, by Application, 2016-2024 (USD Million)

Table 31 Italy: Market Size, by Type, 2016-2024 (USD Million)

Table 32 Italy: Market Size, by Application, 2016-2024 (USD Million)

Table 33 U.K.: Market Size, by Type, 2016-2024 (USD Million)

Table 34 U.K.: Market Size, by Application, 2016-2024 (USD Million)

Table 35 Spain: Market Size, by Type, 2016-2024 (USD Million)

Table 36 Spain: Market Size, by Application, 2016-2024 (USD Million)

Table 37 The Netherlands: Market Size, by Type, 2016-2024 (USD Million)

Table 38 The Netherlands: Market Size, by Application, 2016-2024 (USD Million)

Table 39 RoE: Market Size, by Type, 2016-2024 (USD Million)

Table 40 RoE: Market Size, by Application, 2016-2024 (USD Million)

Table 41 Asia Pacific: Market Size, by Country, 2016-2024 (USD Million)

Table 42 Asia Pacific: Market Size, by Type, 2016-2024 (USD Million)

Table 43 Asia Pacific: Market Size, by Application, 2016-2024 (USD Million)

Table 44 China: Market Size, by Type, 2016-2024 (USD Million)

Table 45 China: Market Size, by Application, 2016-2024 (USD Million)

Table 46 India: Market Size, by Type, 2016-2024 (USD Million)

Table 47 India: Market Size, by Application, 2016-2024 (USD Million)

Table 48 Japan: Market Size, by Type, 2016-2024 (USD Million)

Table 49 Japan: Market Size, by Application, 2016-2024 (USD Million)

Table 50 Australia: Market Size, by Type, 2016-2024 (USD Million)

Table 51 Australia: Market Size, by Application, 2016-2024 (USD Million)

Table 52 RoAPAC: Market Size, by Type, 2016-2024 (USD Million)

Table 53 RoAPAC: Market Size, by Application, 2016-2024 (USD Million)

Table 54 RoW: Market Size, by Country/Region, 2016-2024 (USD Million)

Table 55 RoW: Market Size, by Type, 2016-2024 (USD Million)

Table 56 Row: Market Size, by Application, 2016-2024 (USD Million)

Table 57 Latin America: Market Size, by Country/Region, 2016-2024 (USD Million)

Table 58 Latin America: Market Size, by Type, 2016-2024 (USD Million)

Table 59 Latin America: Market Size, by Application, 2016-2024 (USD Million)

Table 60 Brazil: Market Size, by Type, 2016-2024 (USD Million)

Table 61 Brazil: Market Size, by Application, 2016-2024 (USD Million)

Table 62 Mexico: Market Size, by Type, 2016-2024 (USD Million)

Table 63 Mexico: Market Size, by Application, 2016-2024 (USD Million)

Table 64 Argentina: Market Size, by Type, 2016-2024 (USD Million)

Table 65 Argentina: Market Size, by Application, 2016-2024 (USD Million)

Table 66 RoLATAM: Market Size, by Type, 2016-2024 (USD Million)

Table 67 RoLATAM: Market Size, by Application, 2016-2024 (USD Million)

Table 68 Middle East and Africa: Market Size, by Type, 2016-2024 (USD Million)

Table 69 Middle East and Africa: Market Size, by Application, 2016-2024 (USD Million)

List of Figures

Figure 1 Scope of the Global Chocolate and Confectionery Processing Equipment Market

Figure 2 Key Stakeholders of the Global Chocolate and Confectionery Processing Equipment Market

Figure 3 Research Process

Figure 4 Key Executives Interviewed

Figure 5 Primary Research Techniques

Figure 6 Market Size Estimation

Figure 7 Depositors Expected to Dominate the Global Chocolate and Confectionery Processing Equipment Market During the Forecast Period

Figure 8 Gummies and Jellies to Witness a Fastest Growth in the Global Chocolate and Confectionery Processing Equipment Market During the Forecast Period

Figure 9 Global Chocolate and Confectionery Processing Equipment Market Share, by Geography, 2017

Figure 10 Asia-Pacific: Lucrative and Growing Market for Chocolate and Confectionery Processing Equipment Market

Figure 11 Market Dynamics

Figure 12 Global Chocolate and Confectionery Processing Equipment Market Size, by Type, 2018-2024 (USD Million)

Figure 13 Global Chocolate and Confectionery Processing Equipment Market Size, by Application, 2018-2024 (USD Million)

Figure 14 Future Geographical Outlook, 2023

Figure 15 Key Adopters of Chocolate and Confectionery Processing Equipment

Figure 16 North America: Chocolate and Confectionery Processing Equipment Market Size, by Country, 2018-2024 (USD Million)

Figure 17 Europe: Chocolate and Confectionery Processing Equipment Market Size, by Country, 2018-2024 (USD Million)

Figure 18 Asia Pacific: Chocolate and Confectionery Processing Equipment Market Size, by Country, 2018-2024 (USD Million)

Figure 19 RoW: Chocolate and Confectionery Processing Equipment Market Size, by Country/Region, 2018-2024 (USD Million)

Figure 20 Latin America: Market Size, by Country/Region, 2018-2024 (USD Million)

Figure 21 Buhler AG: Financial Overview (2015-2017)

Figure 22 GEA Group Aktiengesellschaft: Financial Overview (2015-2017)

Figure 23 John Bean Technologies Corporation: Financial Overview (2015-2017)

Figure 24 Alfa Laval: Financial Overview (2015-2017)

Figure 25 Robert Bosch GmbH: Financial Overview (2015-2017)