Resources

About Us

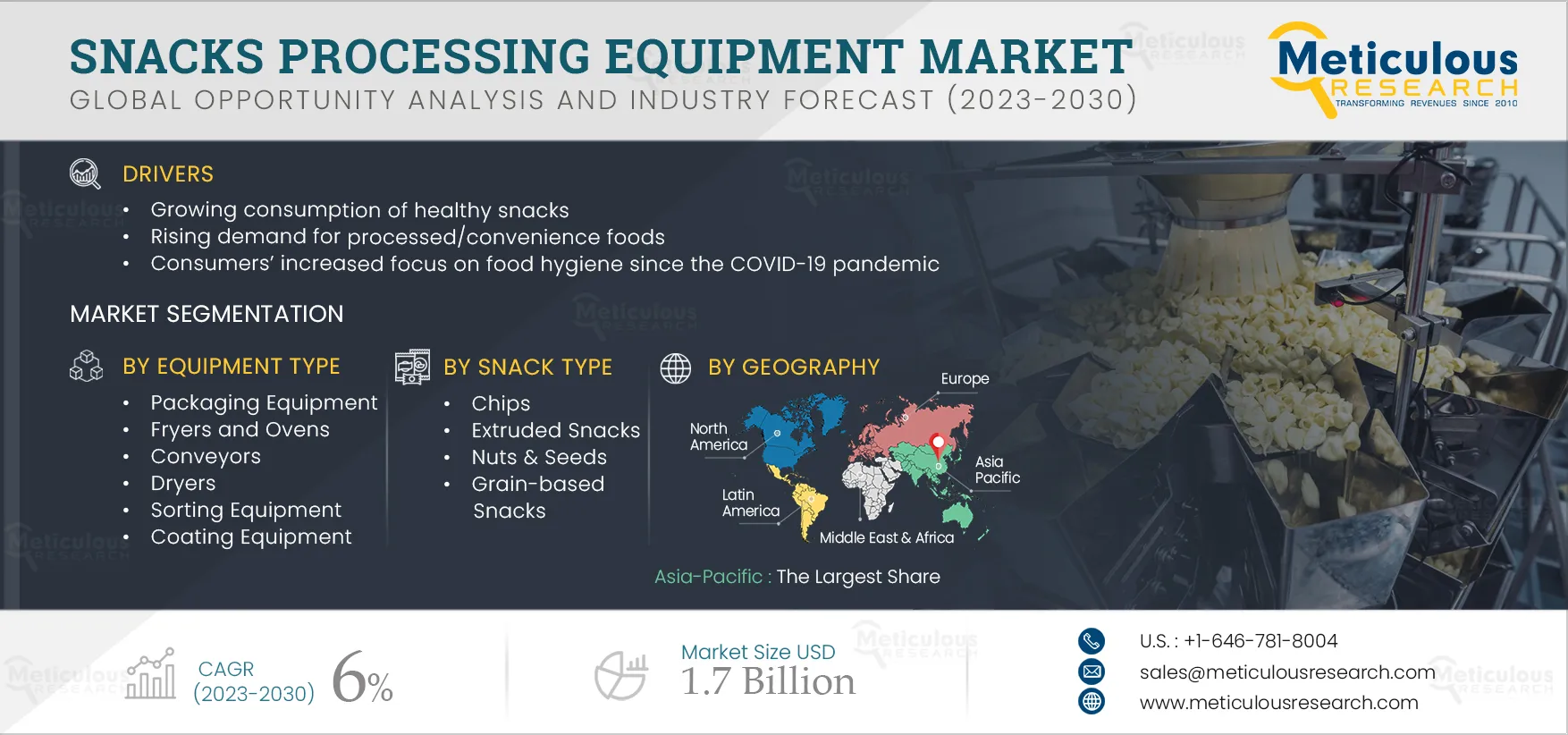

Snacks Processing Equipment Market By Type (Conveyers, Sorting, Dryers, Mixing, Cutting, Coating, Packaging, Mode of Operation (Semi/Manual, Automatic), Snack Type (Chips, Extruded Snacks, Bakery & Confectionery), and Geography - Global Forecasts to 2030

Report ID: MRFB - 104589 Pages: 218 Jan-2024 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThe Snacks Processing Equipment Market is projected to reach $1.7 billion by 2030, at a CAGR of 6% during the forecast period 2023–2030. The growth of the snacks processing equipment market is driven by the growing consumption of healthy snacks, the rising demand for processed/convenience foods, and consumers’ increased focus on food hygiene since the COVID-19 pandemic. However, the high cost of snack processing equipment restrains the growth of this market. Furthermore, increasing government support for the food processing industry is expected to generate growth opportunities for the players operating in this market. However, the shortage of trained labor and consumers’ increasing inclination toward minimally processed food products are major challenges impacting the market’s growth.

Additionally, the integration of automation and smart technologies into snack processing equipment is a key trend in the global snacks processing equipment market.

Increasing Government Support for the Food Processing Industry Expected to Generate Growth Opportunities for Market Players

Government support benefits buyers from the food processing industry in several ways, including making food processing equipment more competitive and innovative. Several governments across the globe are offering incentives, such as tax rebates, grants, and low-interest loans, to encourage companies to invest in modernizing their food processing facilities. These initiatives provide financial support to companies, especially SMEs, allowing them to upgrade their food processing capabilities with the latest equipment and integrate advanced technologies to develop innovative products.

Click here to: Get Free Sample Pages of this Report

Governments across the globe are increasingly recognizing the importance of the food processing sector in fostering economic development, creating employment opportunities, and ensuring food security. As a result, several initiatives have been undertaken by governments across the globe to support food processors, including snack processing companies. Some of such initiatives are as follows:

Such supportive policies and initiatives by governments worldwide are reducing financial burdens for food processing businesses and stimulating innovation and technological advancements in equipment manufacturing including in the snacks processing equipment industry. Also, increasing government initiatives for enhancing the overall efficiency and sustainability of the food processing sector are expected to generate growth opportunities for the players operating in the snacks processing equipment market during the forecast period.

Key Findings in the Snacks Processing Equipment Market Study:

In 2023, the Packaging Equipment Segment is Expected to Dominate the Snacks Processing Equipment Market

Based on equipment type, the snacks processing equipment market is segmented into forming & extruder equipment, conveyers, sorting equipment, dryers, mixing & blending machines, cutting & slicing equipment, fryers & ovens, coating equipment, packaging equipment, cooling & buffering equipment, and other equipment. In 2023, the packaging equipment segment accounted for the larger share of the global snacks processing equipment market.

The large share of this segment is mainly attributed to the increasing need for convenient and portable snack packaging solutions for consumers to carry and consume on the go, the need to maintain the freshness and extend the shelf life of snacks, the growing demand for sustainable packaging solutions, the rise of e-commerce, and stringent regulations regarding food safety and packaging standards. The segment is projected to register the highest CAGR over the forecast period.

In 2023, the Semi-Automated/Manual Segment is Expected to Dominate the Snacks processing equipment Market

Based on mode of operation, the snacks processing equipment market is segmented into automated and semi-automated/manual. In 2023, the semi-automated/manual accounted for the larger share of the global snacks processing equipment market. The large share of this segment is mainly attributed to their adaptability to smaller spaces, needing less specialized skills to operate, need to reduce downtime, lower maintenance expenses, lower upfront capital investment compared to automated equipment, and the increasing demand for flexibility in handling diverse product types and recipe variations for niche markets.

However, the automated segment is projected to register a higher CAGR over the forecast period due to the increasing need to ensure consistency in processing parameters, integration of advanced technologies, including smart packaging, growing demand for higher production efficiency, reducing the reliance on manual labor, and the increasing need to handle larger volumes of raw materials and finished products.

In 2023, the Bakery & Confectionary Products Segment is Expected to Dominate the Snacks Processing Equipment Market

Based on snack type, the snacks processing equipment market is segmented into chips, extruded snacks, nuts & seeds, non-vegetarian snacks, bakery & confectionery products, grain-based snacks, and other snack types. In 2023, the bakery & confectionary products segment accounted for the largest share of the global snacks processing equipment market. The large share of this segment is mainly attributed to the increasing demand for diverse and high-quality baked & confectionery snacks, growing demand for single-serve packaging and portion-controlled snacks, and increasing demand for premium and artisanal bakery & confectionery snacks. Also, the increasing use of automated equipment, including mixing & blending, packaging equipment to maintain uniform taste, texture, distribution of flavors, and extend shelf life and maintain product quality of snacks supports the segment growth.

However, the chips segment is projected to register the largest CAGR over the forecast period. Factors such as the growth of e-commerce, the growing shift toward healthier processing methods, including baked and air-fried snack options, and the growing demand for convenient and portable snacks for on-the-go consumption are supporting the segment’s growth. Also, the increasing need for high quality and consistency of raw materials in the overall chip production process, the growing need for processing equipment including slicing, frying, baking, seasoning, and packaging, and increasing food safety regulations and labeling requirements in chip processing are contributing to the segment’s growth.

Asia Pacific to be the Largest Regional Market

Based on geography, the global snacks processing equipment market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific is expected to account for the largest share of the global snacks processing equipment market due to the growing consumer awareness and preferences for healthier snack options, increasing demand for snacks processing equipment that can meet diverse cultural preferences and regional tastes, rising investments from major food & beverage players, expansion and establishment of new snack manufacturing facilities, and the rising demand for gluten-free and allergen-free snack options. Additionally, this region is witnessing tremendous growth in its food & beverage industry primarily due to increasing urbanization, growing health awareness, and rising disposable income levels. Also, understanding the changing regulatory environment and shifting consumer preferences can provide growth opportunities for the market players operating in the region.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by the leading market participants in the Snacks processing equipment market in the last three to four years. The key players profiled in the snacks processing equipment market report are Marel (Iceland), GEA Group Aktiengesellschaft (Germany), Bühler AG (Switzerland), John Bean Technologies Corporation (U.S.), Syntegon Technology GmbH (Germany), Alfa Laval AB (Sweden), Clextral S.A.S. (France), Heat and Control, Inc. (U.S.), Key Technology, Inc. (U.S.), Tetra Pak (Switzerland), Baker Perkins Ltd. (U.K.), Kiremko B.V. (Netherlands), AC Horn Manufacturing (U.S.), Ishida Co., Ltd. (Japan), NP & Company, Inc. (Japan), Dayi Machine (China), Cablevey Conveyors (U.S.), Kiron Food Processing Technologies LLP (India), Grace Food Processing and Packaging Machinery, Inc. (India), Tsung Hsing Food Machinery Co., Ltd. (Taiwan), and Jinan Sunward Machinery Co., Ltd. (China).

Report Summary:

|

Particular |

Details |

|

Number of Pages |

218 |

|

Format |

|

|

Forecast Period |

2023-2030 |

|

Base Year |

2022 |

|

CAGR |

6% |

|

Estimated Market Size (Value) |

$1.7 billion by 2030 |

|

Segments Covered |

By Equipment Type

By Mode of Operation

By Snack Type

By Geography

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, RoE), Asia-Pacific (China, Japan, India, South Korea, RoAPAC), Latin America and Middle East & Africa |

|

Key Companies |

Marel (Iceland), GEA Group Aktiengesellschaft (Germany), Bühler AG (Switzerland), John Bean Technologies Corporation (U.S.), Syntegon Technology GmbH (Germany), Alfa Laval AB (Sweden), Clextral S.A.S. (France), Heat and Control, Inc. (U.S.), Key Technology, Inc. (U.S.), Tetra Pak (Switzerland), Baker Perkins Ltd. (U.K.), Kiremko B.V. (Netherlands), AC Horn Manufacturing (U.S.), Ishida Co., Ltd. (Japan), NP & Company, Inc. (Japan), Dayi Machine (China), Cablevey Conveyors (U.S.), Kiron Food Processing Technologies LLP (India), Grace Food Processing and Packaging Machinery, Inc. (India), Tsung Hsing Food Machinery Co., Ltd. (Taiwan), and Jinan Sunward Machinery Co., Ltd. (China). |

Key questions answered in the report:

The global snacks processing equipment market is projected to reach $1.7 billion by 2030, at a CAGR of 6.0% during the forecast period.

Factors such as the growing consumption of healthy snacks, the rising demand for processed/convenience foods, and consumers’ increased focus on food hygiene since the COVID-19 pandemic are driving the growth of this market.

The key players operating in the snacks processing equipment market are Marel (Iceland), GEA Group Aktiengesellschaft (Germany), Bühler AG (Switzerland), John Bean Technologies Corporation (U.S.), Syntegon Technology GmbH (Germany), Alfa Laval AB (Sweden), Clextral S.A.S. (France), Heat and Control, Inc. (U.S.), Key Technology, Inc. (U.S.), Tetra Pak (Switzerland), Baker Perkins Ltd. (U.K.), Kiremko B.V. (Netherlands), AC Horn Manufacturing (U.S.), Ishida Co., Ltd. (Japan), NP & Company, Inc. (Japan), Dayi Machine (China), Cablevey Conveyors (U.S.), Kiron Food Processing Technologies LLP (India), Grace Food Processing and Packaging Machinery, Inc. (India), Tsung Hsing Food Machinery Co., Ltd. (Taiwan), and Jinan Sunward Machinery Co., Ltd. (China).

The shortage of trained labor and consumers’ increasing inclination toward minimally processed food products are major challenges impacting the market’s growth.

Majority of the players are adopting product launches & enhancements strategies to strengthen their product portfolios and enhance their geographic reach in the Snacks processing equipment market. Some of the leading companies that adopted these strategies were GEA Group Aktiengesellschaft (Germany), Key Technology, Inc. (U.S.), John Bean Technologies Corporation (U.S.), Syntegon Technology GmbH (Germany), Alfa Laval AB (Sweden), Clextral S.A.S. (France), and Ishida Co., Ltd. (Japan).

Published Date: Feb-2025

Published Date: Jan-2025

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates