Resources

About Us

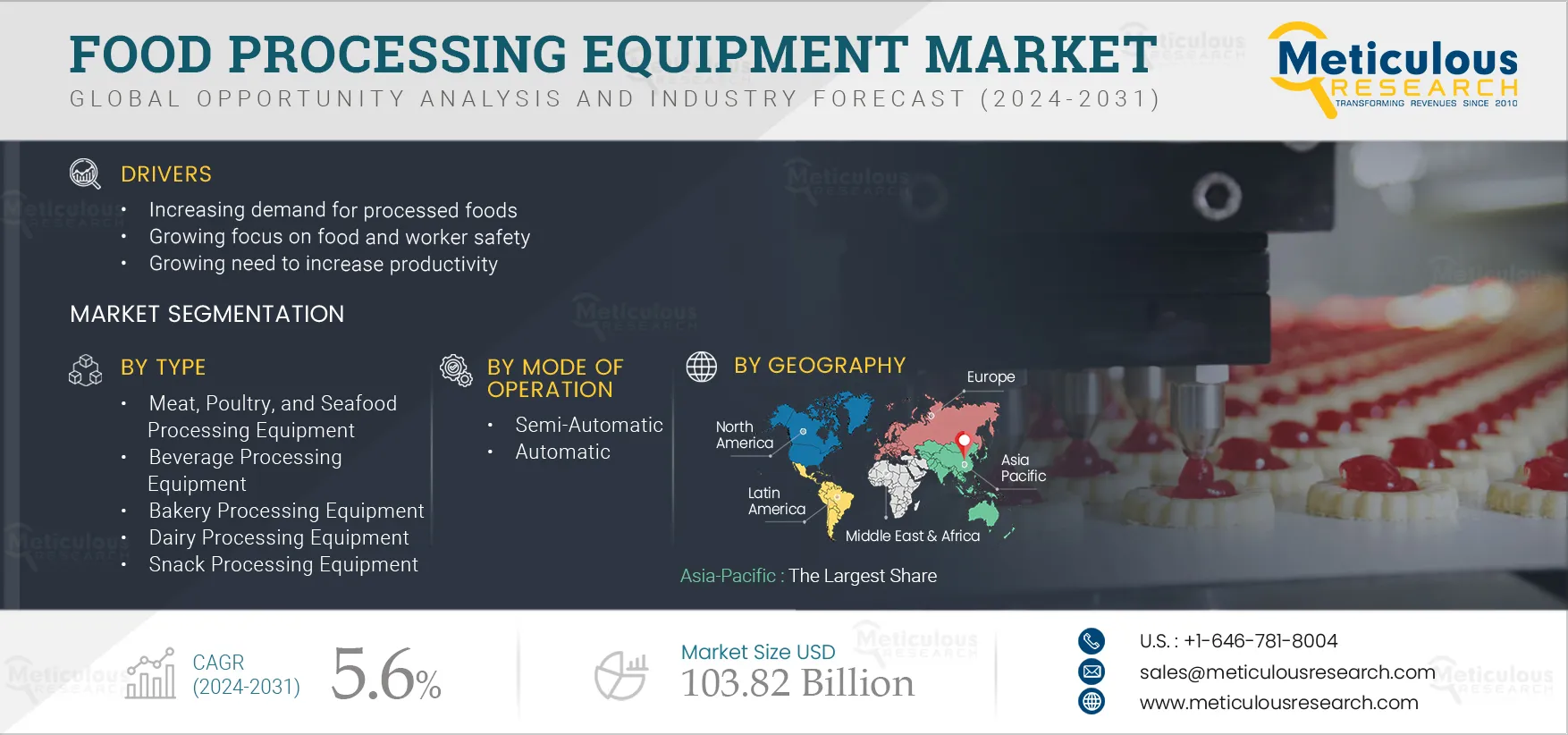

Food Processing Equipment Market Size, Share, Forecast, & Trends Analysis by Type (Meat, Poultry, and Seafood, Beverage, Bakery, Dairy, Fruit and Vegetable Processing Equipment), Mode of Operation (Semi-Automatic, Automatic)- Global Forecast to 2031

Report ID: MRFB - 104350 Pages: 590 Jan-2024 Formats*: PDF Category: Food and Beverages Delivery: 2 to 4 Hours Download Free Sample ReportThe growth of the food processing equipment market is driven by increasing demand for processed foods, a growing focus on food and worker safety, a growing need to increase productivity, food manufacturers’ increasing focus on reducing production costs, and government support to promote the food processing industry. However, the high cost of equipment and the consumers’ increasing inclination towards minimally processed food products restrain the growth of this market.

In addition, emerging economies such as Latin America, Southeast Asia, and Africa and a rapidly growing plant-based foods market are expected to generate growth opportunities for the players operating in this market. However, the lack of trained labor is a major challenge for market growth.

The demand for food is expected to grow substantially by 2050. The major factor for this increase is the growth in the world population. According to the Department of Economic and Social Affairs of the United Nations, the world population reached 7.8 billion in 2020 and is projected to reach 9.7 billion by 2050. Also, according to FAO, the global food supply would need to increase by 50% to meet the food demand in 2050 from 2020. At the same time, global economic growth would significantly reduce or even eliminate absolute economic poverty in developing countries. These trends mean that the demand for food or processed foods will continue to grow.

Moreover, changes in agricultural practices over the past 50 years have increased the world's capacity to provide food for its people through increased productivity, greater food diversity, and lower seasonal dependence. However, the food industry faces challenges such as food wastage and international trade. According to the Food and Agriculture Organization of the U.S. (FAO), every year, more than one-third of the food produced is lost or wasted during operations globally. This postharvest loss accounts for the greatest overall loss; hence, reducing postharvest losses could be a sustainable solution to increase food availability. Thus, understanding the capacities of agricultural systems, projecting the future demand for food, and reducing food wastage is only possible through the adoption of modern food processing technologies and equipment among food processors. Therefore, increased agricultural production and the need to minimize postharvest losses are expected to drive the global food processing equipment market.

Click here to: Get Free Sample Pages of this Report

The global consumption of processed foods has seen a significant uptick in recent decades. This surge in demand can be attributed to several interconnected factors, including the global trend of urbanization, fast-paced lifestyles, a growing prevalence of nuclear families, an increasing number of working women, and the limited time available for food preparation. Additionally, the rise of brand consciousness, exposure to Western products in Asian countries, the introduction of new food categories, and the development of product variants catering to diverse tastes contribute to the widespread acceptance of processed food products. Among these influences, the predominant driver for the escalating demand for processed foods is the ongoing trend of increasing urbanization.

Further, processed foods have become increasingly accessible to all age groups and are sold in preprepared/ready-to-eat forms. Processed foods are a vital part of the global food supply and contribute to food security (ensuring that sufficient food is available) and nutrition security (ensuring that food quality meets human nutrient needs). Furthermore, there have been major shifts in dietary patterns, such as from the consumption of basic staples to more diversified diets. Consumers are increasingly preferring more value-added food categories, with their health goals greatly impacting food processors. This increasing consumer preference for processed foods has led to increased production by food processors. As the demand for processed foods is on the rise, technological advancements have become necessary for the growth of the sector and the diversification of the processed food manufacturers’ existing production capabilities. Thus, to gain a technological edge in the market, food processors are exploring new processing and preservation technologies with the help of advanced processing equipment, thereby fueling the adoption of food processing equipment across the globe.

The burgeoning market for plant-based foods presents substantial growth opportunities for manufacturers of food equipment. As the demand for plant-based alternatives continues to rise, there is a growing need for specialized machinery to process and produce these products efficiently. This trend is driven by various factors, including increasing consumer awareness of health and sustainability, ethical considerations, and a shift towards plant-based diets.

Food equipment manufacturers can capitalize on this shift by developing and offering machinery tailored to the unique requirements of plant-based food processing. This may include equipment for the extraction of plant proteins, processing of alternative ingredients, and the creation of meat and dairy substitutes.

In recent years, the plant-based foods sector has garnered substantial investments, leveraging the growing popularity of veganism and the increasing demand for sustainable food options. According to the Good Food Institute, a U.S.-based nonprofit organization, plant-based meat, seafood, egg, and dairy companies attracted USD 1.9 billion in investments in 2021, a figure comparable to the USD 2.1 billion raised in 2020 and nearly three times the USD 693 million raised in 2019. Since 2010, these companies have collectively secured USD 6.3 billion in investments, with 30% of this total raised in the year 2021 alone.

The dynamics of the COVID-19 pandemic reshaped the food market in North America, notably leading to a 200% increase in plant-based meat sales in the last week of April 2020 compared to the same period the previous year. Such remarkable growth in the plant-based foods industry is poised to enhance investors' confidence in the food processing equipment sector.Top of Form Thus, the rapidly growing plant-based foods market is expected to offer growth opportunities for the players operating in the food processing equipment market.

Based on type, the food processing equipment market is segmented into meat, poultry, and seafood processing equipment; bakery processing equipment; beverage processing equipment; dairy processing equipment; chocolate and confectionery processing equipment; fruit and vegetable processing equipment; snacks processing equipment; and other food processing equipment. In 2024, the meat, poultry, and seafood processing equipment segment is expected to account for the largest share of 25.5% of the global food processing equipment market. The large share of this segment is attributed to growing meat production, high demand for processed meat products, growing focus on food safety requirements of meat processors, and consumer preference for protein-rich food products.

However, the beverage processing equipment segment is projected to witness the highest growth rate of 6.6% during the forecast period of 2024–2031 due to the increasing demand for alcoholic beverages, increasing consumption of ready-to-drink beverages, increasing per capita spending of the population in developing countries, and rising use of advanced technologies to enhance productivity & product efficacy.

Based on mode of operation, the food processing equipment market is segmented into semi-automatic and automatic. In 2024, the semi-automatic segment is expected to account for the larger share of 60.3% of the global Food Processing Equipment market. The large market share of this segment can be attributed to the benefits of semi-automatic food processing equipment, such as greatly improved labor productivity, flexibility in production processes, and technical & economic feasibility.

However, the automatic segment is projected to register the higher CAGR of 6.4% during the forecast period of 2024–2031. The growth of this segment is driven by the increasing need for higher efficiency and improved food safety and the benefits of automatic food processing equipment, such as monitored production, reduced labor costs, automatic tracking of individual loads, no human errors, effective cleaning, and no cross-contamination.

Based on geography, the global food processing equipment market is majorly segmented into five regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of 43.0% of the global food processing equipment market, followed by Europe and North America. Asia-Pacific’s food processing equipment market is estimated to be worth USD 30.38 billion in 2024. The large share of this market is mainly attributed to the increasing demand for processed food products in emerging and developing countries of the region, including India, China, Indonesia, and Thailand; rising investments from major food and beverage players; and government support to promote the food processing sector. Moreover, this region is projected to register the highest CAGR of 6.1% during the forecast period, mainly due to tremendous growth in its food & beverage industry, primarily due to increasing urbanization, growing health awareness, and rising disposable income levels.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the food processing equipment market are Bühler AG (Switzerland), Marel hf (Iceland), GEA Group Aktiengesellschaft (Germany), Bucher Industries AG (Switzerland), John Bean Technologies Corporation (U.S.), The Middleby Corporation (U.S.), Heat and Control Inc. (U.S.), SPX Flow, Inc. (U.S.), Alfa Laval AB (Sweden), Krones AG (Germany), Paul Mueller Company (U.S.), Tetra Pak International S.A. (Sweden), Bigtem Makine A.S. (Turkey), TNA Australia Pty Limited (Australia), and Hosokawa Micron B.V. (Netherlands).

|

Particulars |

Details |

|

Number of Pages |

590 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

5.6% |

|

Market Size (Value) |

USD 108.32 Billion by 2031 |

|

CAGR (Volume) |

3.1% |

|

Market Size (Volume) |

2.96 Million Units by 2031 |

|

Segments Covered |

By Type

By Mode of Operation

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, Australia, Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Rest of Latin America), and Middle East & Africa |

|

Key Companies |

Bühler AG (Switzerland), Marel hf (Iceland), GEA Group Aktiengesellschaft (Germany), Bucher Industries AG (Switzerland), John Bean Technologies Corporation (U.S.), The Middleby Corporation (U.S.), Heat and Control Inc. (U.S.), SPX Flow, Inc. (U.S.), Alfa Laval AB (Sweden), Krones AG (Germany), Paul Mueller Company (U.S.), Tetra Pak International S.A. (Sweden), Bigtem Makine A.S. (Turkey), TNA Australia Pty Limited (Australia), and Hosokawa Micron B.V. (Netherlands) |

Food processing equipment plays a crucial role in transforming raw agricultural products into consumable food items that can be easily prepared and consumed by consumers. Process equipment is essential for the food industry as it enables efficient mass production, maintains food safety standards, and ensures the quality of the final products reaches consumers.

This global food processing equipment market report provides detailed market insights and market sizes & forecasts for food processing equipment in terms of value (by type, mode of operation, and geography) & volume (by type and geography). It provides the market sizes & forecasts of each segment across five key geographies (North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa) along with the key countries.

The global food processing equipment market is projected to reach $103.82 billion by 2031, at a CAGR of 5.6% during the forecast period.

The meat, poultry, and seafood processing equipment segment is expected to hold a major share during the forecast period of 2024–2031.

The automatic segment is expected to witness the fastest growth during the forecast period of 2024–2031.

The increasing demand for processed foods, a growing focus on food and worker safety, a growing need to increase productivity, food manufacturers’ increasing focus on reducing production costs, and government support to promote the food processing industry are factors supporting growth of this market. Moreover, emerging economies such as Latin America, Southeast Asia, and Africa and a rapidly growing plant-based foods market creates opportunities for players operating in this market.

The key players operating in the food processing equipment market are Bühler AG (Switzerland), Marel hf (Iceland), GEA Group Aktiengesellschaft (Germany), Bucher Industries AG (Switzerland), John Bean Technologies Corporation (U.S.), The Middleby Corporation (U.S.), Heat and Control Inc. (U.S.), SPX Flow, Inc. (U.S.), Alfa Laval AB (Sweden), Krones AG (Germany), Paul Mueller Company (U.S.), Tetra Pak International S.A. (Sweden), Bigtem Makine A.S. (Turkey), TNA Australia Pty Limited (Australia), and Hosokawa Micron B.V. (Netherlands).

Asia-Pacific is slated to register the highest CAGR of 6.1% during the forecast period of 2024–2031, mainly due to the tremendous growth in its food & beverage industry, primarily due to increasing urbanization, growing health awareness, and rising disposable income levels.

Published Date: Feb-2025

Published Date: Jan-2025

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates