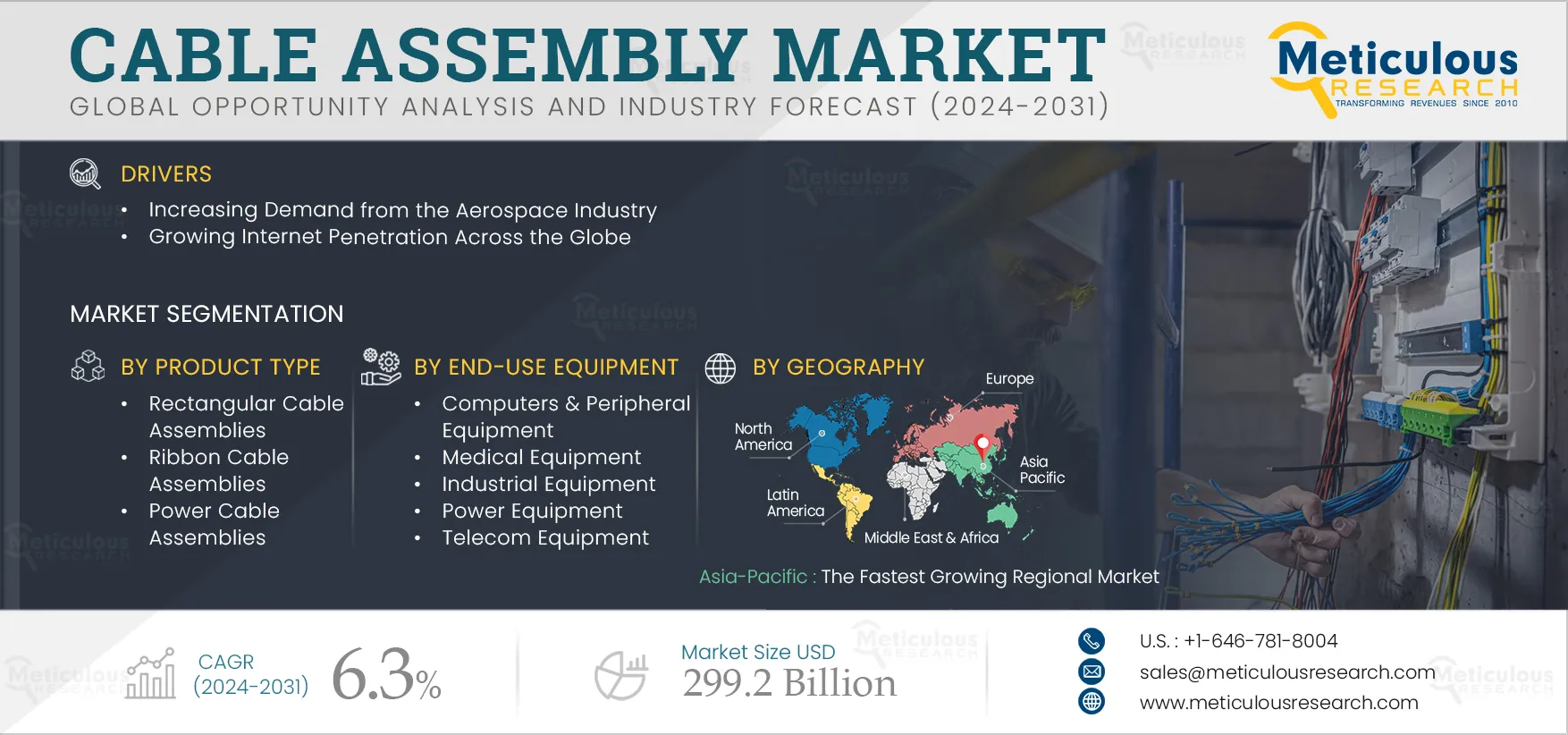

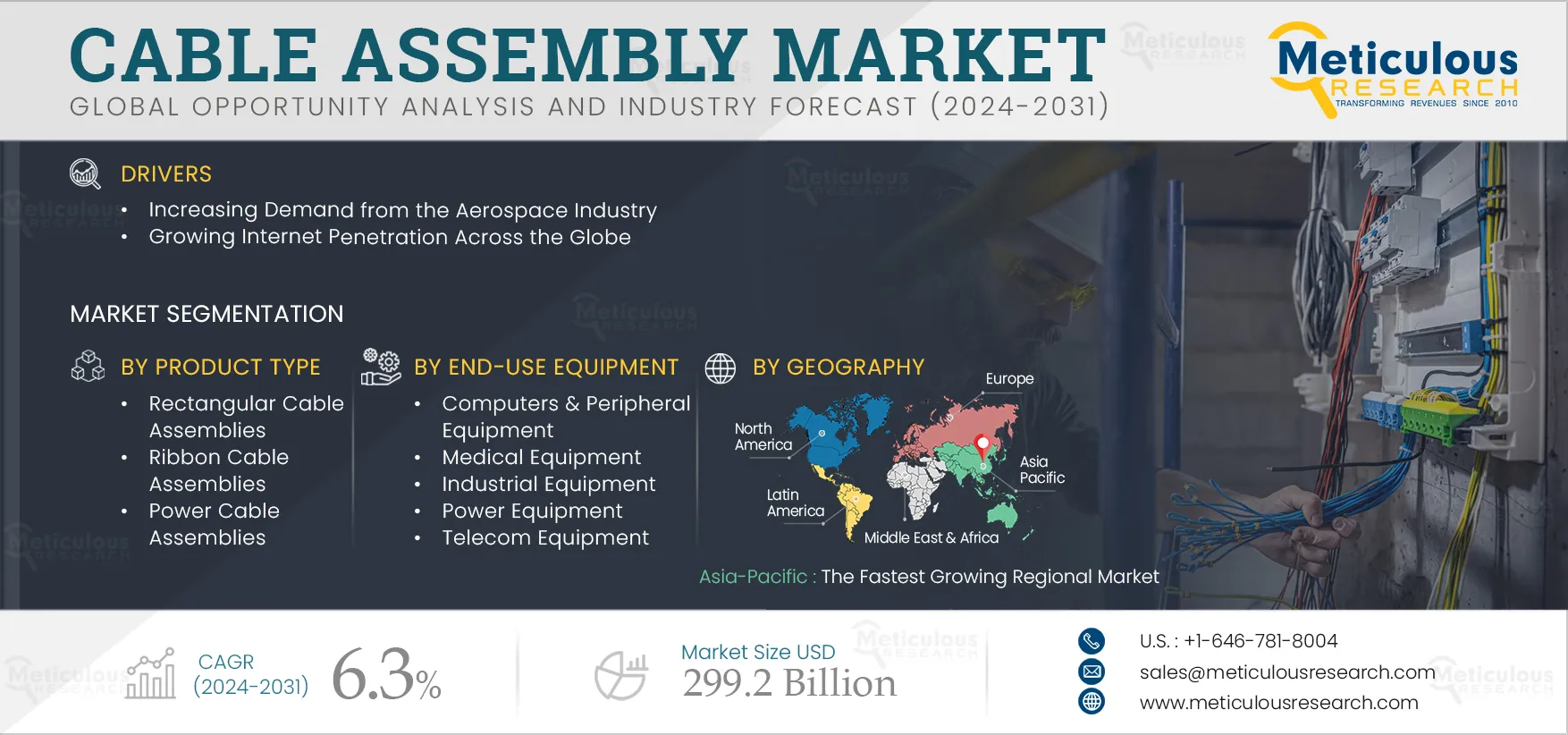

Cable Assembly Market Size & Forecast

The Cable Assembly Market is projected to reach $299.2 billion by 2031, at a CAGR of 6.3% during the forecast period 2024–2031. The growth of this market is driven by the increasing demand from the aerospace industry and growing internet penetration across the globe. Additionally, the expansion of telecommunications infrastructure, the increasing demand for custom cable assemblies, the growing number of electric vehicles, and the increasing adoption of data centers are expected to create market growth opportunities. However, competition from wireless technologies may restrain the growth of this market. The availability of counterfeit products is a major challenge for the players operating in this market.

Additionally, the miniaturization of cable assemblies and the high adoption of Industry 4.0 technologies are the key trends in the cable assembly market.

Increasing Adoption of Data Centers is Expected to Drive Market Growth

Data exists and is connected across multiple data centers, the edge, and public and private clouds. Hence, data centers must be able to communicate across these multiple sites, both on-premises and on the cloud. A data center is a facility used to house computer systems and associated components, including telecommunications and storage systems. The key components of a data center include routers, switches, firewalls, storage systems, servers, and application-delivery controllers. Cable assemblies are the backbone of data centers as they help connect various components, including servers, switches, routers, storage devices, and networking equipment. Cable assemblies are crucial for preventing equipment overheating and ensuring optimal performance within data centers. They help maintain a neat and organized layout, maximizing the available space and airflow for efficient cooling. They also provide the necessary pathways for data transmission that provide seamless communication between different systems and help minimize signal interference and transmission errors.

Some of the cable assemblies used in data centers include rectangular cable assemblies, fiber optic cable assemblies, power cable assemblies, and modular cable assemblies. Fiber optic cable assemblies are most commonly used in data centers for high-speed data transmission over long distances. Power cable assemblies and custom cable assemblies, including those with fire-resistant coating, provide reliable power distribution throughout the facility and help meet specific safety and regulatory requirements within data centers. All such factors, along with the growing need to meet the demands of modern digital operations and the increasing need to ensure efficient connectivity, reliability, and performance within these facilities, are further supporting the overall market growth in the coming years.

Some of the developments in this market space are as follows:

- In June 2023, IBM (U.S.) announced plans to open its first Europe-based quantum data center to facilitate access to cutting-edge quantum computing for companies, research institutions, and government agencies.

- In March 2023, Varanium Cloud Limited (India) announced the launch of its second Edge Data Center under its brand, Hydra, in Maharashtra, India. The data center is built in a container, which enhances its accessibility and facilitates efficient data sharing and communication.

- In February 2023, V. tal (Brazil) launched a new data center, fully integrated with its cable landing station (CLS), in Fortaleza, Brazil. The facility will offer a 4 MW capacity to serve four data halls with space to accommodate 400 racks.

- In February 2023, Equinix, Inc. (U.S.) announced expanding its new data center in the Barcelona site (Spain), as Barcelona is a strategic hub for the terrestrial and subsea cable networks to connect major subsea cables from key metros throughout the Mediterranean, coastal Africa, and the Middle East.

- In April 2022, Bangladesh’s Meghna Bank launched a modular data center from Huawei in Dhaka. The bank also launched an on-premise facility at its head office in the capital city. It announced that it had launched a Tier III Ready Data Center facility at Gulshan-01 in the capital city.

Click here to: Get Free Sample Pages of this Report

Key Findings in the Cable Assembly Market Study:

In 2024, the Rectangular Cable Assemblies Segment is Expected to Dominate the Cable Assembly Market

Based on product type, the global cable assembly market is broadly segmented into rectangular cable assemblies, radio frequency (RF)/coaxial cable assemblies, ribbon cable assemblies, fiber optic cable assemblies, power cable assemblies, custom cable assemblies, circular cable assemblies, barrel connector cable assemblies, video cable assemblies, USB cable assemblies, modular cable assemblies, FFC / FPC jumper cable assemblies, pre-crimped leads assemblies, printed circuit board (PCB) assemblies, telephone cables assemblies, and other product types. In 2024, the rectangular cable assemblies segment is expected to account for the largest share of the global cable assembly market. The large market share of this segment is attributed to the growing connectivity requirements and increasing use of rectangular cable within vehicles, industrial automation systems, machinery, and equipment for transmitting power, signals, and data between different components.

However, the fiber optic cable assemblies segment is projected to register the highest CAGR during the forecast period due to the increasing demand for high-speed internet and data-intensive applications, growing need to interconnect servers & data storage systems within data center facilities, increasing use of fiber optic cables in data centers, industrial automation systems for connecting sensors, actuators, and controllers, growing applications of fiber optics in broadcast and audiovisual systems, telecommunications networks for long-distance transmission, and enterprise networks to support high-speed LAN connections, interconnect multiple office locations, and provide connectivity.

In 2024, the Automotive Equipment Segment is Expected to Dominate the Cable Assembly Market

Based on end-use equipment, the global cable assembly market is broadly segmented into computers & peripheral equipment, business & office equipment, medical equipment, instrumentation equipment, industrial equipment, automotive equipment, power equipment, transportation electronics equipment, military & aerospace equipment, telecom equipment, datacom equipment, consumer electronic equipment, and other equipment. In 2024, the automotive equipment segment is expected to account for the largest share of the global cable assembly market. The large market share of this segment is attributed to the rising demand for electric vehicles, increasing electrification of vehicles, increasing need to create wiring harnesses that organize and route electrical wires and cables within the vehicles, and growing integration of ADAS technologies and in-vehicle infotainment (IVI) systems.

However, the datacom equipment segment is projected to register the highest CAGR during the forecast period due to the growing use of fiber optic cables to support high-speed data transmission and enable efficient interconnection between different data center components, expansion of data center facilities to accommodate growing data storage and processing needs, increasing use of cable assemblies in structured cabling systems to create reliable connections between network devices, and increasing deployment of ethernet networking solutions.

Asia-Pacific to be the Fastest Growing Regional Market

Based on geography, the global cable assembly market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific is projected to register the highest CAGR during the forecast period due to rapid industrialization and urbanization, increasing digitization, growth of electronics manufacturing in countries including China, Japan, and South Korea, expansion of the automotive industry, increasing adoption of data centers, growing investments in telecommunications infrastructure and information technology services, and increasing need to support high-speed data transmission, ensure reliable connectivity, and enable various technological advancements across different industries and sectors in the region.

Cable Assembly Market: Competitive Analysis

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by the leading market participants in the cable assembly market in the last three to four years. The key players profiled in the cable assembly market report are TE Connectivity Ltd. (Switzerland), Amphenol Corporation (U.S.), Molex, LLC (U.S.), 3M (U.S.), Lapp Group (Germany), Eland Cables Limited (“Eland Cables”) (U.K.), Flux Connectivity Inc. (Canada), Fischer Connectors SA (Switzerland), CommScope, Inc. (U.S.), Rosenberger Hochfrequenztechnik GmbH & Co. KG. (Germany), Samtec (U.S.), HARTING Technology Group (Germany), Smiths Interconnect Group Limited (U.S.), Carlisle Interconnect Technologies (U.S.), and W. L. Gore & Associates, Inc. (U.S.).

Cable Assembly Market Report Summary:

|

Particular

|

Details

|

|

Number of Pages

|

210

|

|

Format

|

PDF

|

|

Forecast Period

|

2024-2031

|

|

Base Year

|

2023

|

|

CAGR

|

6.3%

|

|

Estimated Market Size (Value)

|

$299.2 billion by 2031

|

|

Segments Covered

|

By Product Type

- Rectangular Cable Assemblies

- Radio Frequency (RF)/Coaxial Cable Assemblies

- Ribbon Cable Assemblies

- Fiber Optic Cable Assemblies

- Power Cable Assemblies

- Custom Cable Assemblies

- Circular Cable Assemblies

- Barrel Connector Cable Assemblies

- Video Cable Assemblies

- USB Cable Assemblies

- Modular Cable Assemblies

- FFC/FPC Jumper Cable Assemblies

- Pre-Crimped Leads Cable Assemblies

- Printed Circuit Board (PCB) Assemblies

- Telephone Cable Assemblies

- Other Product Types

By End-use Equipment

- Computers & Peripheral Equipment

- Business & Office Equipment

- Medical Equipment

- Instrumentation Equipment

- Industrial Equipment

- Automotive Equipment

- Power Equipment

- Transportation Electronics Equipment

- Military & Aerospace Equipment

- Telecom Equipment

- Datacom Equipment

- Consumer Electronic Equipment

- Other Equipment

|

|

Countries Covered

|

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific), Latin America and Middle East & Africa

|

|

Key Companies

|

TE Connectivity Ltd. (Switzerland), Amphenol Corporation (U.S.), Molex, LLC (U.S.), 3M (U.S.), Lapp Group (Germany), Eland Cables Limited (“Eland Cables”) (U.K.), Flux Connectivity Inc. (Canada), Fischer Connectors SA (Switzerland), CommScope, Inc. (U.S.), Rosenberger Hochfrequenztechnik GmbH & Co. KG. (Germany), Samtec (U.S.), HARTING Technology Group (Germany), Smiths Interconnect Group Limited (U.S.), Carlisle Interconnect Technologies (U.S.), and W. L. Gore & Associates, Inc. (U.S.).

|

Key questions answered in the report: