Resources

About Us

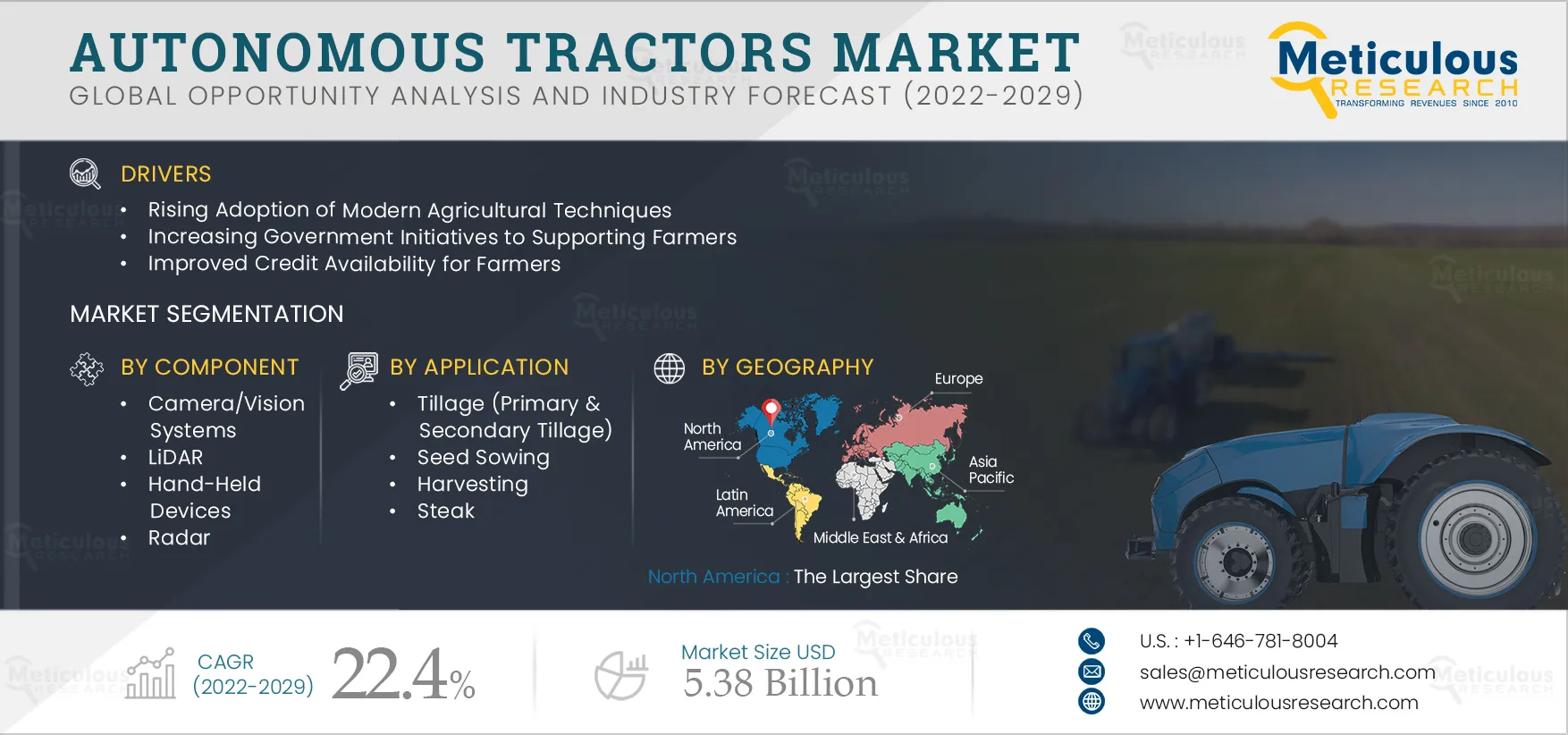

Autonomous Tractors Market by Type (Fully Autonomous, Semi-Autonomous Tractors), Component (LiDAR, Radar, Ultrasonic Sensors, GPS), Power Output (Up to 30 HP, 31–100 HP, 101 HP & Above), Application (Tillage, Seed Sowing, Harvesting) - Global Forecast to 2029

Report ID: MRAGR - 104704 Pages: 250 Nov-2022 Formats*: PDF Category: Agriculture Delivery: 24 to 72 Hours Download Free Sample ReportThe growth of this market is driven by the rising adoption of modern agricultural techniques, the increasing government initiatives to support farmers, and improved credit availability. However, the high initial cost of advanced agriculture equipment and the rising fragmentation of land are factors restraining the growth of the autonomous tractors market.

Technological advancements and the shortage of farm laborers are expected to offer significant growth opportunities for players operating in this market. However, the low awareness of advanced agriculture technologies poses a major challenge to the market’s growth. Furthermore, agriculture digitalization is a major trend observed in this market.

The COVID-19 pandemic adversely affected the global economy. The lockdowns and quarantines imposed to curb the spread of the SARS-CoV-2 virus negatively impacted many sectors, including the agricultural sector. In the initial days of the pandemic, disrupted logistics and transportation impacted the movement of agricultural commodities. Hence, the autonomous tractors market registered a decline in sales in 2020.

In addition to the interruptions in the industry’s value chain from raw materials supply to manufacturing, packaging, and distribution, the COVID-19 pandemic also led to restrictions on the movement of workers, the closure of equipment manufacturing facilities, and reluctance among farmers to buy expensive equipment due to the uncertainty in the market. The industry suffered severe labor shortages due to repeated lockdowns, affecting machinery production. The decline in revenues during the initial months of 2020, coupled with reductions in demand from major markets, impacted the profitability of autonomous tractor manufacturers and vendors. Therefore, disruptions in transportation & logistics impacted production and adversely affected the autonomous tractors market in terms of sales volumes during the initial phase of the pandemic in 2020.

However, government bodies gradually eased restrictions on transportation, making it easier for autonomous tractor providers to meet the demand from farmers across most countries. In 2021, strong growth was witnessed in the autonomous tractors market due to the growing demand for agricultural commodities. In addition, the increasing number of government subsidiaries for purchasing autonomous tractors contributed to the market's growth.

Click here to: Get Free Sample Copy of this report

The implementation of farm loan waiver schemes encourages farmers to buy farm equipment. Several governments have launched various schemes in different parts of the world to relieve farmers from their loans and encourage farm mechanization.

Government subsidies play an essential role in the agriculture sector of a country. For instance, the U.S. Farm Service Agency (FSA) provides guaranteed and direct farm ownership and operating loans to family-size farmers who cannot obtain commercial credit from a bank, farm credit system institution, or other lenders. FSA loans can also purchase land, livestock, equipment, feed, seed, and supplies. The United States Department of Agriculture also announced various loan programs, including direct farm ownership down payment program. The maximum loan amount increased from USD 250,000 to USD 300,000, and the guaranteed amount on conservation loans increased from 75 to 80%. Thus, the Government spends heavily on various subsidies to drive the agricultural sector.

Farm equipment, such as tractors, combines, and harvesters are expensive; hence, it is challenging for farmers to purchase this equipment with limited funding sources. In India, Rashtriya Krishi Vikas Yojana is a state government scheme that provides 100% subsidy to farmers. The scheme aims to develop the agriculture sector keeping agro-climatic, natural resources, and technology in mind. The Government also provides agricultural machinery where assistance is provided for farm mechanization and women-friendly equipment and tools. Furthermore, the NABARD loan scheme provides a subsidy of up to 30% on the purchase of tractors. Apart from this, up to 100% subsidy is given for other agricultural machinery to increase farmers' productivity.

Therefore, several governments have increased their support through improved subsidies/credits to encourage farmers to adopt autonomous equipment and increase crop production.

Based on component, the autonomous tractors market is segmented into camera/vision segments, LiDAR, hand-held devices, radar, ultrasonic sensors, and GPS. In 2022, the radar segment is expected to account for the largest share of the autonomous tractors market. Radar sensors can determine the range, velocity, and angle of moving objects and work in almost all weather conditions. Furthermore, they are much more cost-effective than LiDAR systems making them a better option than other detection systems for incorporation in autonomous tractors.

Based on power output, the autonomous tractors market is segmented into up to 30 HP, 31–100 HP, and 101 HP & above. In 2022, the 31–100 HP segment is expected to account for the largest share of the autonomous tractors market. The large market share of this segment is primarily attributed to the high demand for tractors with 31–100 HP to perform various farm operations such as planting, sowing, harvesting, and tilling. These tractors offer high durability and loading capacity, making them ideal for transportation. In addition, 31–100 HP range tractors are very versatile and provide excellent work efficiency in clay soil as well. These factors drive the demand for 31–100 HP tractors.

Based on application, the autonomous tractors market is segmented into tillage (primary & secondary tillage), seed sowing, harvesting, and other applications (spraying and fertilizing). In 2022, the tillage segment is expected to account for the largest share of the autonomous tractors market. The large market share of this segment is attributed to advancements in technology and several research & development activities by agronomists. Furthermore, as manual tillage activities are more time-consuming and expensive, there is an increasing need for automation of tillage on medium and large farms for row crops worldwide.

Based on crop type, the autonomous tractors market is segmented into cereals & grains, oilseeds & pulses, and fruits & vegetables. In 2022, the fruits & vegetables segment is expected to account for the largest share of the autonomous tractors market. The large market share of this segment is attributed to the rising demand for fruits & vegetables with the rise in the global population. Weeding and harvesting fruits & vegetables are labor intensive. As a result, there is an increase in the demand for new technologies, such as autonomous tractors, to carry out labor-intensive farming.

Based on geography, in 2022, North America is expected to account for the largest share of the autonomous tractors market. North America’s major market share is attributed to the high adoption rate of advanced technologies due to the large sizes of farms. Farmers from developed countries such as the U.S. face labor shortage challenges. Thus, to overcome these challenges, farmers in these countries adopt advanced agricultural equipment, such as autonomous tractors, driving the market’s growth. Furthermore, the high disposable incomes of farmers contribute to the increased adoption of advanced agricultural technologies, which contributes to the growth of the autonomous trackers market in the region.

However, the market in Asia-Pacific is slated to register the fastest growth rate during the forecast period of 2022–2029. The growth of this regional market is attributed to the increasing agricultural activities and the rising disposable incomes of farmers in developing economies such as India and China.

Key Players

The key players profiled in the autonomous tractors market study are AGCO Corporation (U.S.), AgJunction Inc. (U.S.), Autonomous Solutions Inc (U.S), CNH Industrial N.V. (U.K), Deere & Company (U.S.), Kubota Corporation (Japan), Mahindra & Mahindra Ltd. (India), Raven Industries (U.S.), TRIMBLE INC (U.S.), YANMAR CO., LTD. (Japan), and Zimeno Inc. (DBA Monarch Tractor) (U.S.).

Key questions answered in the report:

The Autonomous Tractors Market comprises self-operating tractors that enhance farming efficiency and reduce labor needs.

The market is expected to reach $5.38 Billion by 2029, driven by advancements in agricultural technology.

The forecast indicates a robust growth trajectory, with a compound annual growth rate (CAGR) of 22.4% from 2022 to 2029.

The market size is projected to be $5.38 Billion by 2029, reflecting significant investment in autonomous agricultural technology.

Key players include AGCO, Deere & Company, CNH Industrial, Kubota, and Mahindra & Mahindra, among others.

A prominent trend is the digitalization of agriculture, enhancing efficiency and productivity through technology adoption.

Drivers include rising adoption of modern techniques, government support for farmers, and increased credit availability for equipment purchase.

Segments include power output, application (e.g., tillage), component (e.g., radar), and crop type (e.g., fruits & vegetables).

The global outlook is positive, with increasing technology adoption and government initiatives supporting growth in agriculture.

The market is set for significant growth due to rising demand for efficient farming solutions and government incentives for mechanization.

The market is projected to grow at a CAGR of 22.4% during the forecast period from 2022 to 2029.

North America holds the highest market share, attributed to advanced technology adoption and significant farm sizes.

Published Date: Jan-2025

Published Date: Jun-2023

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates