Resources

About Us

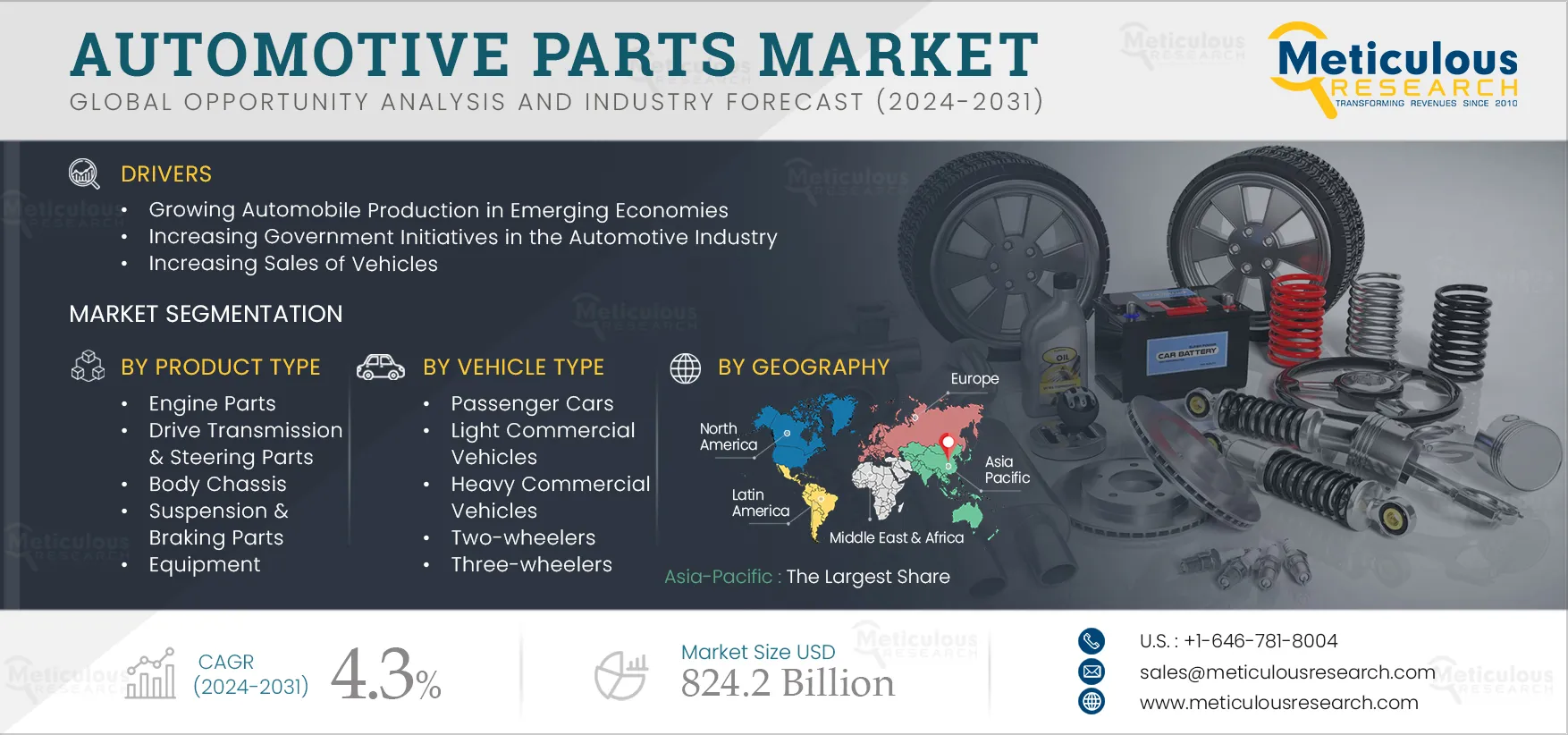

Automotive Parts Market Size, Share, Forecast, & Trends Analysis by Product Type (Engine Parts, Suspension & Braking Parts, Electrical & Electronic Parts), Distribution Channel, Vehicle Type (Passenger Cars, Two-Wheelers), and Geography - Global Forecast to 2032

Report ID: MRAUTO - 1041129 Pages: 250 Jan-2024 Formats*: PDF Category: Automotive and Transportation Delivery: 24 to 72 Hours Download Free Sample ReportThe Automotive Parts Market is expected to reach $824.2 billion by 2032, at a CAGR of 4.3% from 2025 to 2032.The growth of this market is attributed to the growing automobile production in emerging economies, increasing sales of vehicles, and increasing government initiatives in the automotive industry. Moreover, growing demand for electric and hybrid vehicles, technological advancements, and the rising adoption of connected devices in the automotive industry are expected to offer growth opportunities for the players operating in this market.

Governments worldwide are increasingly acknowledging the significance of the automotive industry and are rolling out diverse initiatives to foster its expansion. These efforts include offering financial support and tax incentives to spur research in cutting-edge automotive technologies like autonomous vehicles and advanced materials.

Some of the government initiatives and investments include:

Overall, increased government involvement with a focus on environmental sustainability and domestic manufacturing support the growth of the automotive parts market during the forecast period.

With the increasing sales of vehicles, the direct demand for automotive and spare parts also increasing to maintain and repair vehicles. According to the Society of Indian Automobile Manufacturers (SIAM) (India), in 2024, a total sale of vehicles in India are as follows:

According to Kraftfahrt-Bundesamt (Germany) federal transport authority, in 2024, Germany marked an increase of 7.3% in car sales, reaching a total of 2.8 million vehicles. Also, according to the Japan Automobile Manufacturers Association, Inc. (Japan), in 2024, Japan recorded a rise of 13.8% in sales of cars with 4,779,086 units. As vehicle sales increase, the need for replacement parts such as brake pads, oil filters, tires, and other parts also increases. Such developments support the growth of the automotive parts market during the forecast period.

Click here to: Get a Free Sample Copy of this report

Compact engines, a type of internal combustion engine, are engineered to be smaller and lighter compared to traditional counterparts. This design facilitates reduced fuel consumption, leading to lower greenhouse gas emissions and decreased reliance on fossil fuels. Despite their compact size, advancements in materials science and engineering enable manufacturers to develop these engines to deliver comparable power output to larger models. For example, in June 2021, Cooper Corporation (India) introduced the Bolt Mini, a 5 kilovolt-amperes (KVA) compact diesel genset, offering consumers lower maintenance costs and higher fuel efficiency.

In increasingly congested urban environments, the demand for smaller vehicles rises. Compact engines excel in providing fuel efficiency, especially in stop-and-go traffic typical of urban areas. Moreover, their simpler design and smaller size contribute to reduced manufacturing costs, potentially leading to lower vehicle purchase prices for consumers. These factors drive the proliferation of compact engines and bolster the growth of the automotive parts market.

The global automotive industry is undergoing a gradual shift from fossil fuel-powered vehicles to electric vehicles (EVs). Decreasing prices of EV batteries are driving this transition, making electric vehicles more cost-effective and competitive compared to traditional internal combustion engine vehicles. As EV battery costs decline, the overall ownership expenses of electric vehicles reduce significantly, broadening their accessibility to a wider consumer base and accelerating their global adoption.

Governments worldwide are actively investing in and implementing policies and regulations to facilitate the adoption of EVs. For example, in July 2022, the Government of Chhattisgarh (India) introduced an electric vehicle (EV) policy aimed at bolstering EV charging infrastructure, expediting the transition from internal combustion engine (ICE) vehicles to electric ones, and incentivizing EV manufacturing within the state. Additionally, in August 2021, the U.S. Senate passed a USD 1 trillion infrastructure bill, earmarking substantial funds for electric vehicle infrastructure, including charging stations, as well as supporting EV manufacturing and research endeavors. These government-led initiatives are driving the uptake of electric and hybrid vehicles, thereby further propelling the growth of the automotive parts market.

The automotive industry is experiencing a profound transformation fueled by two primary drivers: advancements in technology by OEMs and the rising prevalence of connected devices. A key emphasis is on the development of cleaner and more efficient vehicles, including hybrids that integrate electric motors with gasoline engines to reduce emissions and enhance fuel efficiency. Companies are prioritizing technological innovations and introducing AI-enabled vehicles to the market. For example, in January 2025, BYD Company Ltd. (China) unveiled an AI-powered smart car system featuring cutting-edge technologies like automated parking, aimed at elevating driving experiences while prioritizing safety and comfort.

Technological progress in artificial intelligence, sensor technology, and mapping is laying the groundwork for the widespread adoption of autonomous vehicles. Innovations like automatic emergency braking, lane departure warning systems, and adaptive cruise control are bolstering safety measures and minimizing human errors on the road. Incorporated into vehicles, these advancements aim to mitigate traffic congestion, prevent accidents, and optimize transportation efficiency. Consequently, the automotive parts market is experiencing a surge in growth, buoyed by the ongoing technological advancements and increasing integration of connected devices within the industry.

Based on product type, the global automotive parts market is segmented into engine parts, drive transmission & steering parts, body chassis, suspension & braking parts, equipment, electrical & electronic parts, and other product types. In 2025, the engine parts machines segment is expected to account for the larger share of ~26% of the automotive parts market. The large market share of this segment can be attributed to the increasing production of vehicles, the growing popularity of electric vehicles, and the increasing demand for engine parts in the aftermarket. In May 2024, MAHLE GmbH (Germany) signed a Memorandum of Understanding (MoU) with Clean Air Power (U.K.) to develop solutions for zero-carbon internal combustion engines for heavy-duty applications.

However, the electrical & electronic parts segment is projected to register the highest CAGR during the forecast period. The segment's growth is attributed to increasing demand for electronics compared to traditional gasoline vehicles, a growing trend of internet connectivity in vehicles, and increasing electrification, automation, and focus on advanced features in cars. In April 2024, ZF Friedrichshafen AG (Germany) launched the Electronic Brake Booster (EBB), a part of the braking system for electric cars.

Based on distribution channel, the global automotive parts market is segmented into OEMs and aftermarket. In 2025, the OEMs segment is expected to account for the larger share of ~74% of the global automotive parts market. The large market share of this segment is attributed to the growing adoption of advanced technologies in vehicles and increasing consumer preference for OEM parts as it offers a warranty, providing consumers with added assurance and protection. In January 2025, Rane Holdings Limited. (India), a manufacturer of steering & suspension products and light metal casting components, opened a new facility for manufacturing steering and suspension parts for passenger vehicle applications in Aguascalientes, Mexico. Moreover, this segment is also projected to register the highest CAGR during the forecast period.

Based on vehicle type, the global automotive parts market is segmented into passenger cars, light commercial vehicles, heavy commercial vehicles, two-wheelers, and three-wheelers. In 2025, the two-wheelers segment is expected to account for the largest share of ~62% of the global automotive parts market. The large market share of this segment is attributed to the increasing disposable income of consumers, urbanization and traffic congestion, and growing environmental concerns that are pushing the demand for electric two-wheelers. In September 2024, Qualcomm Technologies, Inc. (U.S.) launched the Snapdragon Digital Chassis solution to deliver enhanced safety, infotainment, cloud-connected digital services, personalization, and convenience for a wide range of 2-wheelers such as motorcycles, scooters, and e-bikes. Moreover, this segment is also projected to register the highest CAGR during the forecast period.

In 2025, Asia-Pacific is expected to account for the largest share of the global automotive parts market. The market growth in Asia-Pacific is driven by the increasing vehicle production in the region, increasing demand for electric vehicles in the region, and increasing consumer preferences for SUVs in China and India. In April 2021, MAHLE GmbH (Germany) launched its new Electronics and Mechatronics Development center in Changshu, China. The company aimed to develop solutions for alternative drives and further expand the company’s systems expertise in electric powertrains, electronics, and mechatronics. Moreover, this region is also projected to record the highest CAGR of ~5.6% during the forecast period.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies adopted in the last 3–4 years. Some of the key players operating in the automotive parts market are Robert Bosch GmbH (Germany), DENSO Corporation (Japan), Continental AG (Germany), ZF Friedrichshafen AG (Germany), Magna International Inc. (Canada), Hyundai Motor Group (South Korea), Aisin Corporation (Japan), Lear Corporation (U.S.), Yazaki Group (Japan), Valeo (France), Sumitomo Electric Industries, Ltd. (Japan), FORVIA Faurecia (France), Marelli Aftermarket Italy S.p.A.(Italy), Schaeffler Technologies AG & Co. KG (Germany), and BorgWarner, Inc. (U.S.).

In September 2024, ANAND Group (India) signed a joint venture with HL D&I Halla (South Korea) to expand the aftermarket portfolio with products including steering, brake, and suspension systems and build the company’s presence in the Indian market.

In February 2024, Amazon.com, Inc. (U.S.) launched an OEM auto parts store to offer products from 25 car brands spanning categories such as engine parts, tires, RV and motorcycle parts, replacement parts, enthusiast merch, and lockout kits, among others, for auto parts buyers.

|

Particulars |

Details |

|

Number of Pages |

250 |

|

Format |

|

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

4.3% |

|

Market Size (Value) |

USD 824.2 Billion by 2032 |

|

Segments Covered |

By Product Type

By Distribution Channel

By Vehicle Type

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, U.K., France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, China, India, South Korea, Australia & New Zealand, Singapore, Rest of Asia-Pacific), Latin America (Mexico, Brazil, Rest of Latin America), and the Middle East & Africa (UAE, Israel, Rest of Middle East & Africa) |

|

Key Companies |

Robert Bosch GmbH (Germany), DENSO Corporation (Japan), Continental AG (Germany), ZF Friedrichshafen AG (Germany), Magna International Inc. (Canada), Hyundai Motor Group (South Korea), Aisin Corporation (Japan), Lear Corporation (U.S.), Yazaki Group (Japan), Valeo (France), Sumitomo Electric Industries, Ltd. (Japan), FORVIA Faurecia (France), Marelli Aftermarket Italy S.p.A.(Italy), Schaeffler Technologies AG & Co. KG (Germany), and BorgWarner, Inc. (U.S.) |

The automotive parts market study focuses on market assessment and opportunity analysis through the sales of automotive parts across different regions and countries across different market segmentations. This study is also focused on competitive analysis for automotive parts based on an extensive assessment of the leading players’ product portfolios, geographic presence, and key growth strategies.

The global automotive parts market is projected to reach $824.2 billion by 2032, at a CAGR of 4.3% during the forecast period.

In 2025, the engine parts segment is expected to account for the largest share of ~26% of the automotive parts market.

Based on vehicle type, the two-wheeler segment is projected to register the highest CAGR during the forecast period.

The growth of this market is attributed to the growing automobile production in emerging economies, increasing sales of vehicles, and increasing government initiatives in the automotive industry. Moreover, the growing demand for electric and hybrid vehicles, technological advancements, and the rising adoption of connected devices in the automotive industry are expected to offer growth opportunities for the players operating in this market.

The key players operating in the global automotive parts market are Robert Bosch GmbH (Germany), DENSO Corporation (Japan), Continental AG (Germany), ZF Friedrichshafen AG (Germany), Magna International Inc. (Canada), Hyundai Motor Group (South Korea), Aisin Corporation (Japan), Lear Corporation (U.S.), Yazaki Group (Japan), Valeo (France), Sumitomo Electric Industries, Ltd. (Japan), FORVIA Faurecia (France), Marelli Aftermarket Italy S.p.A.(Italy), Schaeffler Technologies AG & Co. KG (Germany), and BorgWarner, Inc. (U.S.).

Asia-Pacific is projected to register the highest CAGR of ~5.6% during the forecast period.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Nov-2024

Published Date: Sep-2024

Published Date: Sep-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates