Resources

About Us

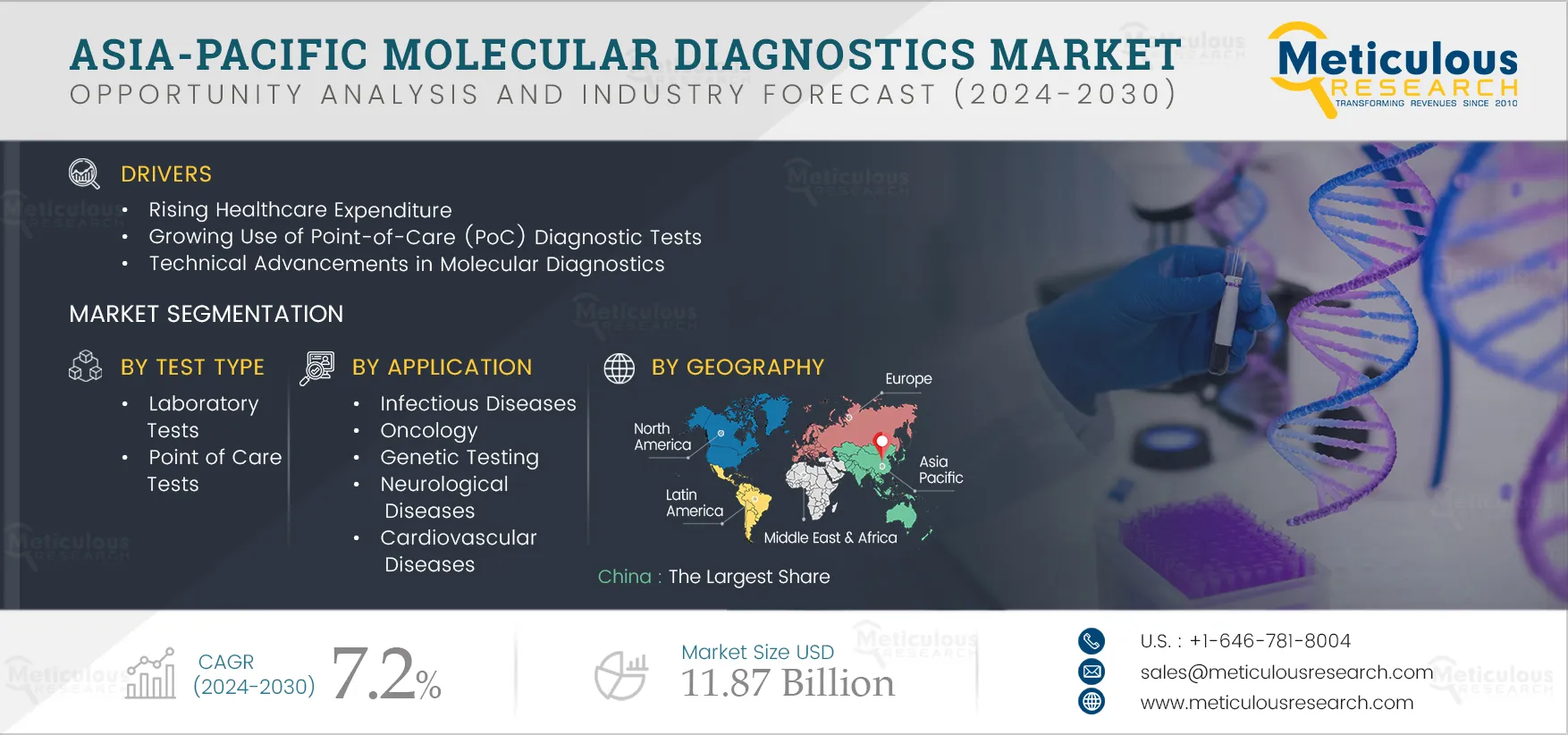

Asia-Pacific Molecular Diagnostics Market by Product & Service (Kits, Instruments) Test Type (Lab, PoC) Technology (PCR, ISH, Sequencing, INAAT, Microarray) Application (Infectious Diseases, Oncology) End User (Hospitals, Diagnostic Lab) - Forecast to 2032

Report ID: MRHC - 1041036 Pages: 200 Jan-2025 Formats*: PDF Category: Healthcare Delivery: 24 to 72 Hours Download Free Sample ReportThe Asia-Pacific Molecular Diagnostics Market is projected to reach $11.87 billion by 2032, at a CAGR of 7.2% from 2025 to 2032. Molecular diagnostics help detect the targeted genetic material in human, viral, and bacterial genomes. Molecular diagnostic tests are increasingly used in many areas, including infectious diseases, oncology, and clinical genetics. Advancements in molecular diagnostics continue to improve the accuracy and speed of diagnosis. Molecular diagnostics is becoming an essential aspect of patient-tailored interventions and therapeutics. The molecular diagnostics market comprises advanced products and technologies used by medical professionals for patient management, from diagnosis to treatment, primarily focusing on areas such as infectious diseases and cancer.

Asia-Pacific molecular diagnostics market is growing due to the rising healthcare expenditure, growing use of PoC diagnostics tests, technological advancements in molecular diagnostics, and increasing funding for R&D in molecular diagnostics. Furthermore, increasing focus on companion diagnostics to offer new growth potential is expected to offer immense growth opportunities for market expansion. However, stringent regulatory frameworks and the high cost of molecular diagnostics tests are expected to restrain the growth of this market to some extent. In addition, the lack of skilled professionals is a major challenge to the market’s growth.

The development of molecular diagnostic systems or assays requires significant capital investments. Thus, financial support in the form of funding is essential to develop and bring the technology into the market. Several organizations are funding many molecular diagnostic devices in the developmental phase. Some of the key companies are receiving funding that helped them focus on developing molecular diagnostics products. For instance,

In July 2021, MiRXES Pte Ltd (Singapore) raised USD 77 million in Series C funding, led by CR-CP Life Science Fund (Thailand) and Keytone Ventures. The funds are being used to deliver cancer early detection tests and preventive healthcare across the globe.

Thus, such initiatives are driving the market’s growth.

Click here to: Get Free Sample Pages of this Report

The healthcare landscape is constantly changing due to innovations in medical technologies. In recent years, companies have been focused on developing advanced diagnostic kits that can allow faster results than traditional kits. These advanced kits enable healthcare providers and caregivers to make crucial medical decisions promptly. Companies have been developing ultra-fast PCR kits to minimize the time required to generate test results. For instance, In November 2021, Genes2Me (India) launched an RT-PCR kit for COVID-19 that shows results in 40 minutes without any instrument and RNA extraction kit. Similarly, Genesystem (South Korea) launched the ultra-fast GENECHECKER UF-300 real-time PCR system to detect novel coronavirus infections. This ultra-fast PCR kit received the CE mark approval in April 2020. The total turnaround time using the GENECHECKER UF-300 real-time PCR platform is 45 minutes.

Furthermore, integrating digital technologies in clinical and ambulatory settings helps improve doctors’ and physicians’ ability to reach an initial diagnosis. Also, the digitalization of diagnostic services helps document and analyze patient data and test results, which minimizes human error and makes treatment and care pathways more consistent. Hence, an increasing number of healthcare providers are adopting digitally compatible diagnostic systems and devices to store patient data and view patients’ medical histories instantly.

Key Findings of the Asia-Pacific Molecular Diagnostics Market Study:

In 2025, the Kits & Reagents Segment is Expected to Dominate the Molecular Diagnostics Market

Among all the products & services covered in the report, in 2025, the kits & reagents segment is expected to account for the largest share of the Asia-Pacific molecular diagnostics market. Recurrent use of assays & kits in the detection of various diseases through molecular diagnostics, rise in product approvals, and technological advancements in molecular techniques contribute to the large market share of this segment.

In 2025, the Laboratory Tests Segment is Expected to Dominate the Molecular Diagnostics Market

Among all the test types covered in the report, in 2025, the lab tests segment is expected to account for the largest share of the Asia-Pacific molecular diagnostics market. Lab tests are traditionally used in hospitals and diagnostic centers and are widely accepted. Laboratory testing is a traditional approach in which the clinician takes a sample from the patient and sends it to the laboratory for processing and testing. It has higher accuracy and reliability when compared to point-of-care testing. The laboratory equipment and analyzers have high sensitivity and specificity. These factors drive the adoption of laboratory tests.

In 2025, the Polymerase Chain Reaction (PCR) Segment is Expected to Dominate the Asia-Pacific Molecular Diagnostics Market

Among all the technologies covered in the report, in 2025, the polymerase chain reaction (PCR) segment is expected to account for the largest share of the Asia-Pacific molecular diagnostics market. The large market share of this segment is attributed to its benefits, such as the ability to test for multi-drug resistance, ease of quantification, greater sensitivity, rapid results compared to traditional diagnostics methods, and launches of PCR kits in the region for the qualitative and quantitative detection of COVID infections. In May 2021, Cipla Inc. (India) launched ViraGen, an RT-PCR test kit for the detection of coronavirus.

In 2025, the Infectious Diseases Segment is Expected to Dominate the Asia-Pacific Molecular Diagnostics Market

Among all the applications covered in the report, in 2025, the infectious diseases segment is expected to account for the largest share of the Asia-Pacific molecular diagnostics market. Infectious diseases are transmissible or communicable illnesses that spread quickly in some areas and become epidemics. It is crucial to quickly diagnose initial infections and prevent further spread through in vitro diagnosis. The growing prevalence of infectious diseases such as HIV, the growing availability of rapid and self-diagnostic tests for HIV, the rising funds for infectious disease diagnostic research activities, the emergence of the COVID-19 pandemic, and the growing need to detect and treat infectious diseases have led to the emergence of new technologies such as molecular systems and PoC, microarrays, and next-generation sequencing are the factors attributed to the segment’s large market share.

In 2025, the Hospitals & Clinics Segment is Expected to Dominate the Molecular Diagnostics Market

Among all the end users covered in the report, in 2025, the hospitals & clinics segment is expected to account for the largest share of the Asia-Pacific molecular diagnostics market. The segment's large market share is attributed to the increased number of hospitalizations due to various diseases requiring molecular diagnosis, the high prevalence of healthcare-associated infections (HAIs) among individuals, growing awareness of the importance of molecular diagnostics and governments of various countries in the region are supporting hospitals by providing funds. In February 2020, the Maharashtra government (India) announced that it would set up a COVID-19 testing facility at Kasturba Hospital (Mumbai) to reduce the burden of testing at the National Institute of Virology (Pune).

China: Largest Share of the Market

Among all the countries covered in the report, in 2025, China is expected to account for the largest share of the Asia-Pacific molecular diagnostics market due to the rising geriatric population and growing prevalence of infectious & chronic diseases. The elderly population is more prone to chronic and infectious diseases due to immune dysfunction, malnutrition, and physiological changes associated with aging. The rising burden of diseases can directly affect the social and economic status of a country. Thus, it is necessary to adopt early diagnostic procedures to minimize the burden of these diseases. The high population growth, the rise in the geriatric population, and the rising prevalence of diseases have increased the demand for molecular diagnostic products in the country.

Key Players

The key players profiled in the Asia-Pacific molecular diagnostics market study are F. Hoffmann-La Roche Ltd (Switzerland), Hologic, Inc. (U.S.), QIAGEN N.V. (Netherlands), Danaher Corporation (U.S.), bioMérieux S.A. (France), Becton, Dickinson and Company (BD) (U.S.), Siemens Healthineers AG (Germany), DiaSorin S.p.A. (Italy), Abbott Laboratories (U.S.), Thermo Fisher Scientific Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Illumina, Inc. (U.S.), and Seegene, Inc. (South Korea).

Scope of the Report:

Asia-Pacific Molecular Diagnostics Market Assessment, by Product & Services

Asia-Pacific Molecular Diagnostics Market Assessment, by Test Type

Asia-Pacific Molecular Diagnostics Market Assessment, by Technology

Asia-Pacific Molecular Diagnostics Market Assessment, by Application

Asia-Pacific Molecular Diagnostics Market Assessment, by End User

Asia-Pacific Molecular Diagnostics Market Assessment, by Country/Region

Key questions answered in the report:

The Asia-Pacific molecular diagnostics market study covers the market sizes and forecasts for various molecular diagnostics products used in the healthcare sector. The report involves the value analysis of various segments and subsegments of the Asia-Pacific molecular diagnostics market at the country level.

The Asia-Pacific molecular diagnostics market is projected to reach $11.87 billion by 2032, at a CAGR of 7.2% during the forecast period.

In 2025, the kits & reagents segment is expected to account for the largest share of the Asia-Pacific molecular diagnostics market. The largest market share of this segment is attributed to the need for kits for the growing prevalence of diseases and the growing awareness of early diagnosis among the people.

In 2025, the hospitals & clinics segment is expected to account for the largest share of the Asia-Pacific molecular diagnostics market. The large market share of this segment is attributed to the increased number of hospitalizations due to various diseases requiring molecular diagnosis and the proliferation of hospitals and clinics in emerging countries, leading to growth in the utilization of molecular diagnostic products.

The growth of this market is driven by rising healthcare expenditure, growing use of PoC diagnostics tests, technical advancements in molecular diagnostics, and increasing funding for R&D of molecular diagnostics products. In addition, companion diagnostics offering new growth potential are expected to provide significant opportunities for the growth of this market.

The key players operating in the Asia-Pacific molecular diagnostics market are F. Hoffmann-La Roche Ltd (Switzerland), Hologic, Inc. (U.S.), QIAGEN N.V. (Netherlands), Danaher Corporation (U.S.), bioMérieux S.A. (France), Becton, Dickinson and Company (BD) (U.S.), Siemens Healthineers AG (Germany), DiaSorin S.p.A. (Italy), Abbott Laboratories (U.S.), Thermo Fisher Scientific Inc. (U.S.), Agilent Technologies, Inc. (U.S.), Illumina, Inc. (U.S.), and Seegene, Inc. (South Korea).

Emerging economies from Asia-Pacific, such as China and India, are projected to offer significant growth opportunities for vendors operating in this market due to the growing awareness about infectious diseases, focus on technological advancements, increasing geriatric population, and increasing investment in the healthcare sector.

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Published Date: Jan-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates