1. Introduction

1.1. Market Definition & Scope

1.2. Currency & Limitations

1.2.1. Currency

1.2.2. Limitations

2. Research Methodology

2.1. Research Approach

2.2. Process of Data Collection and Validation

2.2.1. Secondary Research

2.2.2. Primary Research/Interviews with Key Opinion Leaders of the Industry

2.3. Market Sizing and Forecast

2.3.1. Market Size Estimation Approach

2.3.2. Growth Forecast Approach

2.4. Assumptions for the Study

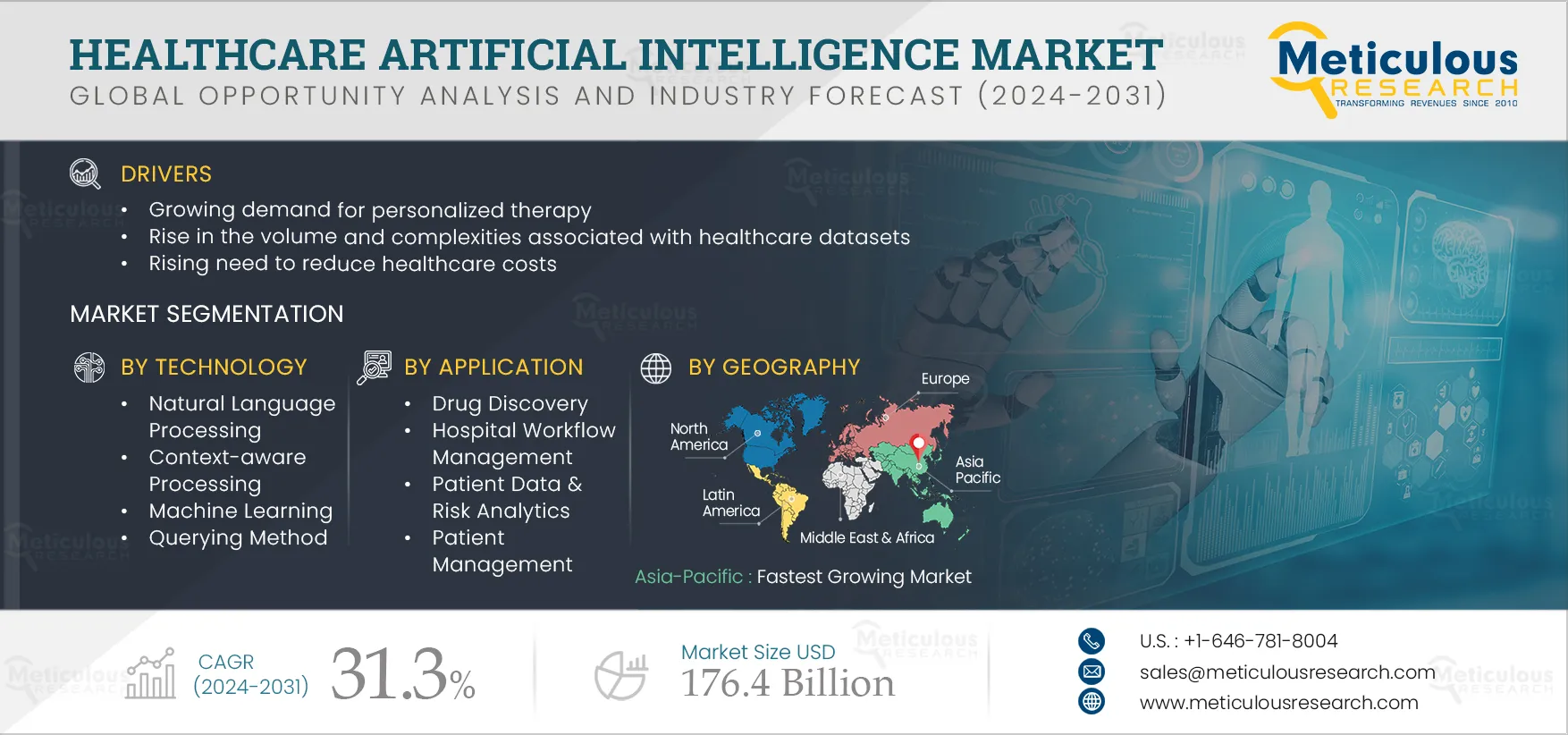

3. Executive Summary

3.1. Market Overview

3.2. Market Analysis, by Offering

3.3. Market Analysis, by Technology

3.4. Market Analysis, by Application

3.5. Market Analysis, by End User

3.6. Market Analysis, by Geography

3.7. Competitive Analysis

4. Market Insights

4.1. Overview

4.2. Factors Affecting Market Growth

4.2.1. Growing Demand for Personalized Therapy

4.2.2. Rise in the Volume and Complexities Associated with Healthcare Datasets

4.2.3. Rising Need to Reduce Healthcare Costs

4.2.4. Reluctance to Adopt AI Technologies Due to Lack of Trust

4.2.5. Growing Potential of AI-based Tools in the Treatment of Chronic and Infectious Diseases

4.2.6. Rising Incorporation of AI in Clinical Trials to Accelerate New Drug Launches

4.2.7. Discrepancies Arising Due to Upgrades and Human Barriers to AI Adoption

4.3. Trends

4.3.1. Growing AI-based Clinical Decision Support Systems (CDSS) to Identify Patient Risk

4.4. Case Studies

4.4.1. Case Study A

4.4.2. Case Study B

4.4.3. Case Study C

5. Healthcare Artificial Intelligence Market, by Offering

5.1. Overview

5.2. Software

5.3. Services

5.3.1. Installation & Integration

5.3.2. Support & Maintenance

5.4. Hardware

6. Healthcare Artificial Intelligence Market, by Technology

6.1. Overview

6.2. Natural Language Processing

6.3. Context-Aware Processing

6.4. Machine Learning

6.5. Querying Method

7. Healthcare Artificial Intelligence Market, by Application

7.1. Overview

7.2. Drug Discovery

7.3. Hospital Workflow Management

7.4. Patient Data & Risk Analytics

7.5. Medical Imaging & Diagnosis

7.6. Patient Management

7.7. Precision Medicine

7.8. Other Applications

8. Healthcare Artificial Intelligence Market, by End User

8.1. Overview

8.2. Hospitals & Diagnostic Centers

8.3. Pharmaceutical & Biotechnology Companies

8.4. Healthcare Payers

8.5. Patients

8.6. Other End Users

9. Healthcare Artificial Intelligence Market, by Geography

9.1. Overview

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.3. Europe

9.3.1. Germany

9.3.2. U.K.

9.3.3. France

9.3.4. Italy

9.3.5. Spain

9.3.6. Rest of Europe

9.4. Asia-Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Singapore

9.4.6. Rest of Asia-Pacific

9.5. Latin America

9.6. Middle East & Africa

10. Competition Analysis

10.1. Introduction

10.2. Key Growth Strategies

10.3. Competitive Benchmarking

10.4. Competitive Dashboard

10.4.1. Industry Leaders

10.4.2. Market Differentiators

10.4.3. Vanguards

10.4.4. Emerging Companies

10.5. Market Ranking, By Key Players

11. Company Profiles (Company Overview, Financial Overview, Product Portfolio, and Strategic Developments)

11.1. NVIDIA Corporation

11.2. Google LLC (A Subsidiary of Alphabet Inc.)

11.3. Intel Corporation

11.4. International Business Machines Corporation

11.5. Microsoft Corporation

11.6. GE HealthCare Technologies Inc.

11.7. Amazon.com, Inc.

11.8. Verint Systems Inc.

11.9. General Vision, Inc.

11.10. Siemens Healthineers AG

11.11. CloudMedx Inc.

11.12. AltexSoft Inc.

11.13. IQVIA Holdings Inc.

11.14. Welltok, Inc.

11.15. iCarbonX

(Note: SWOT Analysis of the Top 5 Companies Will Be Provided)

12. Appendix

12.1. Related Reports

List of Tables

Table 1 Currency Conversion Rate, 2019–2023

Table 2 Global Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 3 Global Healthcare Artificial Intelligence Software Market, By Country/Region, 2022–2031 (USD Million)

Table 4 Global Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 5 Global Healthcare Artificial Intelligence Services Market, By Country/Region, 2022–2031 (USD Million)

Table 6 Global Healthcare Artificial Intelligence Installation & Integration Market, By Country/Region, 2022–2031 (USD Million)

Table 7 Global Healthcare Artificial Intelligence Support & Maintenance Market, By Country/Region, 2022–2031 (USD Million)

Table 8 Global Healthcare Artificial Intelligence Hardware Market, By Country/Region, 2022–2031 (USD Million)

Table 9 Global Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 10 Global Healthcare Artificial Intelligence Market for Natural Language Processing, By Country/Region, 2022–2031 (USD Million)

Table 11 Global Healthcare Artificial Intelligence Market for Context-Aware Processing, By Country/Region, 2022–2031 (USD Million)

Table 12 Global Healthcare Artificial Intelligence Market for Machine Learning, By Country/Region, 2022–2031 (USD Million)

Table 13 Global Healthcare Artificial Intelligence Market for Querying Method, By Country/Region, 2022–2031 (USD Million)

Table 14 Global Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 15 Global Healthcare Artificial Intelligence Market for Drug Discovery, By Country/Region, 2022–2031 (USD Million)

Table 16 Global Healthcare Artificial Intelligence Market for Hospital Workflow Management, By Country/Region, 2022–2031 (USD Million)

Table 17 Global Healthcare Artificial Intelligence Market for Patient Data & Risk Analytics, By Country/Region, 2022–2031 (USD Million)

Table 18 Global Healthcare Artificial Intelligence Market for Medical Imaging & Diagnosis, By Country/Region, 2022–2031 (USD Million)

Table 19 Global Healthcare Artificial Intelligence Market for Patient Management, By Country/Region, 2022–2031 (USD Million)

Table 20 Global Healthcare Artificial Intelligence Market for Precision Medicine, By Country/Region, 2022–2031 (USD Million)

Table 21 Global Healthcare Artificial Intelligence Market for Other Applications, By Country/Region, 2022–2031 (USD Million)

Table 22 Global Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 23 Global Healthcare Artificial Intelligence Market for Hospitals & Diagnostic Centers, By Country/Region, 2022–2031 (USD Million)

Table 24 Global Healthcare Artificial Intelligence Market for Pharmaceutical & Biotechnology Companies, By Country/Region, 2022–2031 (USD Million)

Table 25 Global Healthcare Artificial Intelligence Market for Healthcare Payers, By Country/Region, 2022–2031 (USD Million)

Table 26 Global Healthcare Artificial Intelligence Market for Patients, By Country/Region, 2022–2031 (USD Million)

Table 27 Global Healthcare Artificial Intelligence Market for Other End Users, By Country/Region, 2022–2031 (USD Million)

Table 28 Global Healthcare Artificial Intelligence Market, By Country/Region, 2022–2031 (USD Million)

Table 29 North America: Healthcare Artificial Intelligence Market, By Country, 2022–2031 (USD Million)

Table 30 North America: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 31 North America: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 32 North America: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 33 North America: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 34 North America: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 35 U.S.: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 36 U.S.: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 37 U.S.: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 38 U.S.: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 39 U.S.: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 40 Canada: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 41 Canada: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 42 Canada: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 43 Canada: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 44 Canada: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 45 Europe: Healthcare Artificial Intelligence Market, By Country/Region, 2022–2031 (USD Million)

Table 46 Europe: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 47 Europe: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 48 Europe: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 49 Europe: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 50 Europe: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 51 Germany: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 52 Germany: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 53 Germany: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 54 Germany: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 55 Germany: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 56 U.K.: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 57 U.K.: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 58 U.K.: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 59 U.K.: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 60 U.K.: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 61 France: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 62 France: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 63 France: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 64 France: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 65 France: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 66 Italy: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 67 Italy: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 68 Italy: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 69 Italy: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 70 Italy: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 71 Spain: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 72 Spain: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 73 Spain: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 74 Spain: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 75 Spain: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 76 Rest of Europe: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 77 Rest of Europe: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 78 Rest of Europe: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 79 Rest of Europe: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 80 Rest of Europe: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 81 Asia-Pacific: Healthcare Artificial Intelligence Market, By Country/Region, 2022–2031 (USD Million)

Table 82 Asia-Pacific: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 83 Asia-Pacific: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 84 Asia-Pacific: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 85 Asia-Pacific: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 86 Asia-Pacific: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 87 China: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 88 China: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 89 China: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 90 China: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 91 China: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 92 Japan: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 93 Japan: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 94 Japan: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 95 Japan: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 96 Japan: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 97 India: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 98 India: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 99 India: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 100 India: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 101 India: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 102 South Korea: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 103 South Korea: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 104 South Korea: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 105 South Korea: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 106 South Korea: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 107 Singapore: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 108 Singapore: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 109 Singapore: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 110 Singapore: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 111 Singapore: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 112 Rest of Asia-Pacific: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 113 Rest of Asia-Pacific: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 114 Rest of Asia-Pacific: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 115 Rest of Asia-Pacific: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 116 Rest of Asia-Pacific: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 117 Latin America: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 118 Latin America: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 119 Latin America: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 120 Latin America: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 121 Latin America: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 122 Middle East & Africa: Healthcare Artificial Intelligence Market, By Offering, 2022–2031 (USD Million)

Table 123 Middle East & Africa: Healthcare Artificial Intelligence Services Market, By Type, 2022–2031 (USD Million)

Table 124 Middle East & Africa: Healthcare Artificial Intelligence Market, By Technology, 2022–2031 (USD Million)

Table 125 Middle East & Africa: Healthcare Artificial Intelligence Market, By Application, 2022–2031 (USD Million)

Table 126 Middle East & Africa: Healthcare Artificial Intelligence Market, By End User, 2022–2031 (USD Million)

Table 127 Recent Developments by Major Market Players (2021–2024)

List of Figures

Figure 1 Market Ecosystem

Figure 2 Key Stakeholders

Figure 3 Research Process

Figure 4 Secondary Sources Referenced For This Study

Figure 5 Primary Research Techniques

Figure 6 Key Executives Interviewed

Figure 7 Breakdown Of Primary Interviews (Supply-Side & Demand-Side)

Figure 8 Market Sizing And Growth Forecast Approach

Figure 9 Key Insights

Figure 10 In 2024, The Software Segment is Expected to Dominate the Healthcare Artificial Intelligence Market

Figure 11 In 2024, The Natural Language Processing Segment is Expected to Dominate the Healthcare Artificial Intelligence Market

Figure 12 In 2024, The Hospital Workflow Management Segment is Expected to Dominate the Healthcare Artificial Intelligence Market

Figure 13 In 2024, The Hospitals & Diagnostic Centers Segment is Expected to Dominate the Healthcare Artificial Intelligence Market

Figure 14 In 2024, North America Region is Expected to Dominate the Healthcare Artificial Intelligence Market

Figure 15 Impact Analysis of Market Dynamics

Figure 16 Vendor Selection Criteria/ Factors Influencing Buying Decisions

Figure 17 Global Healthcare Artificial Intelligence Market, By Offering, 2024 Vs. 2031 (USD Million)

Figure 18 Global Healthcare Artificial Intelligence Market, By Technology, 2024 Vs. 2031 (USD Million)

Figure 19 Global Healthcare Artificial Intelligence Market, By Application, 2024 Vs. 2031 (USD Million)

Figure 20 Global Healthcare Artificial Intelligence Market, By End User, 2024 Vs. 2031 (USD Million)

Figure 21 Global Healthcare Artificial Intelligence Market, By Region, 2024 Vs. 2031 (USD Million)

Figure 22 Geographic Snapshot: Healthcare Artificial Intelligence Market in North America

Figure 23 Geographic Snapshot: Healthcare Artificial Intelligence Market in Europe

Figure 24 Geographic Snapshot: Healthcare Artificial Intelligence Market in Asia-Pacific

Figure 25 Growth Strategies Adopted By Leading Market Players (2021–2024)

Figure 26 Vendor Market Positioning Analysis (2021–2024)

Figure 27 Global Healthcare Artificial Intelligence Market Share, By Key Players (2022)

Figure 28 NVIDIA Corporation: Financial Overview (2020–2022)

Figure 29 Alphabet Inc.: Financial Overview (2020–2022)

Figure 30 Intel Corporation: Financial Overview (2020–2022)

Figure 31 International Business Machines Corporation: Financial Overview (2020–2022)

Figure 32 Microsoft Corporation: Financial Overview (2020–2022)

Figure 33 GE HealthCare Technologies Inc.: Financial Overview (2020–2022)

Figure 34 Amazon.com, Inc.: Financial Overview (2020–2022)

Figure 35 Verint Systems Inc.: Financial Overview (2020–2022)

Figure 36 Siemens Healthineers AG: Financial Overview (2020–2022)

Figure 37 IQVIA Holdings Inc.: Financial Overview (2020–2022)