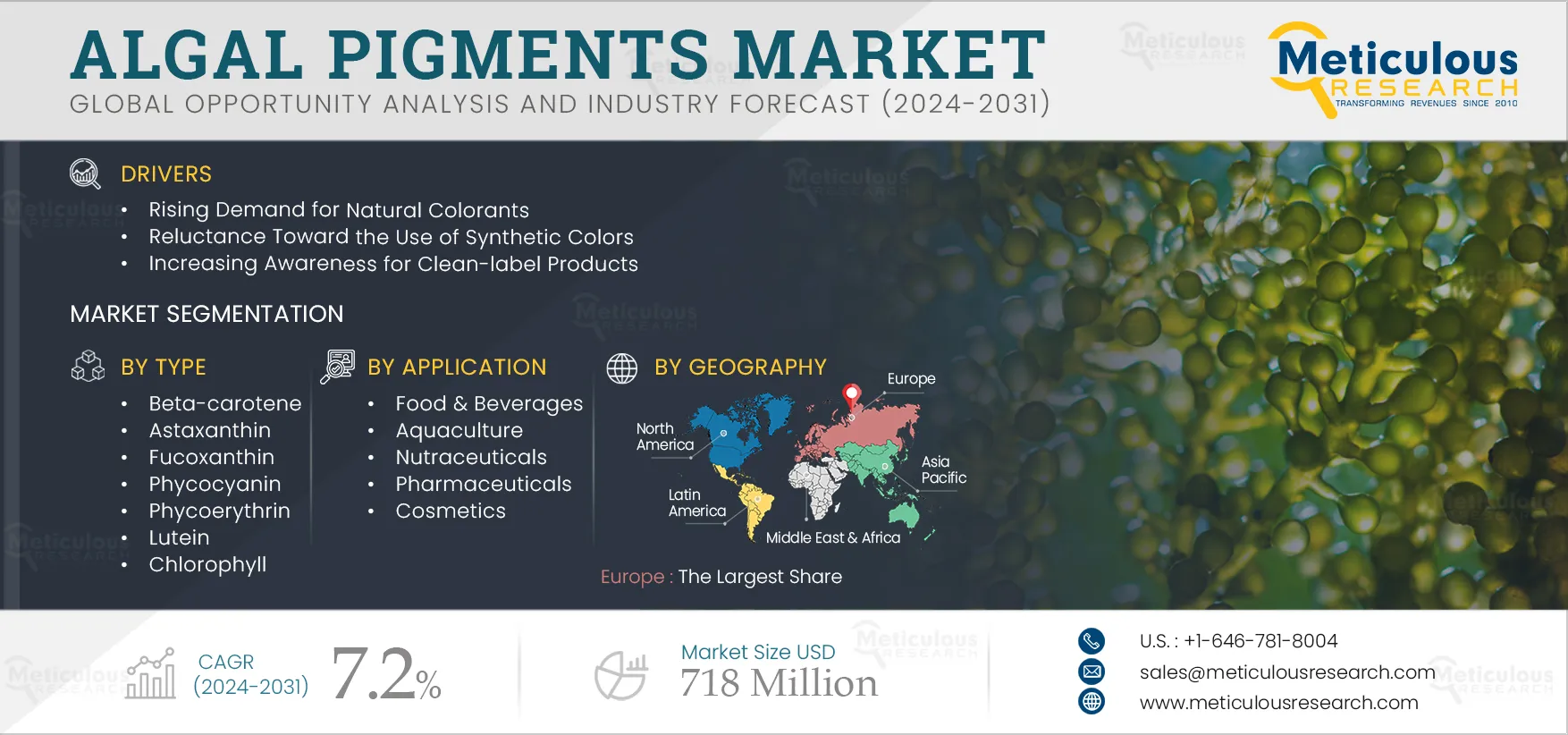

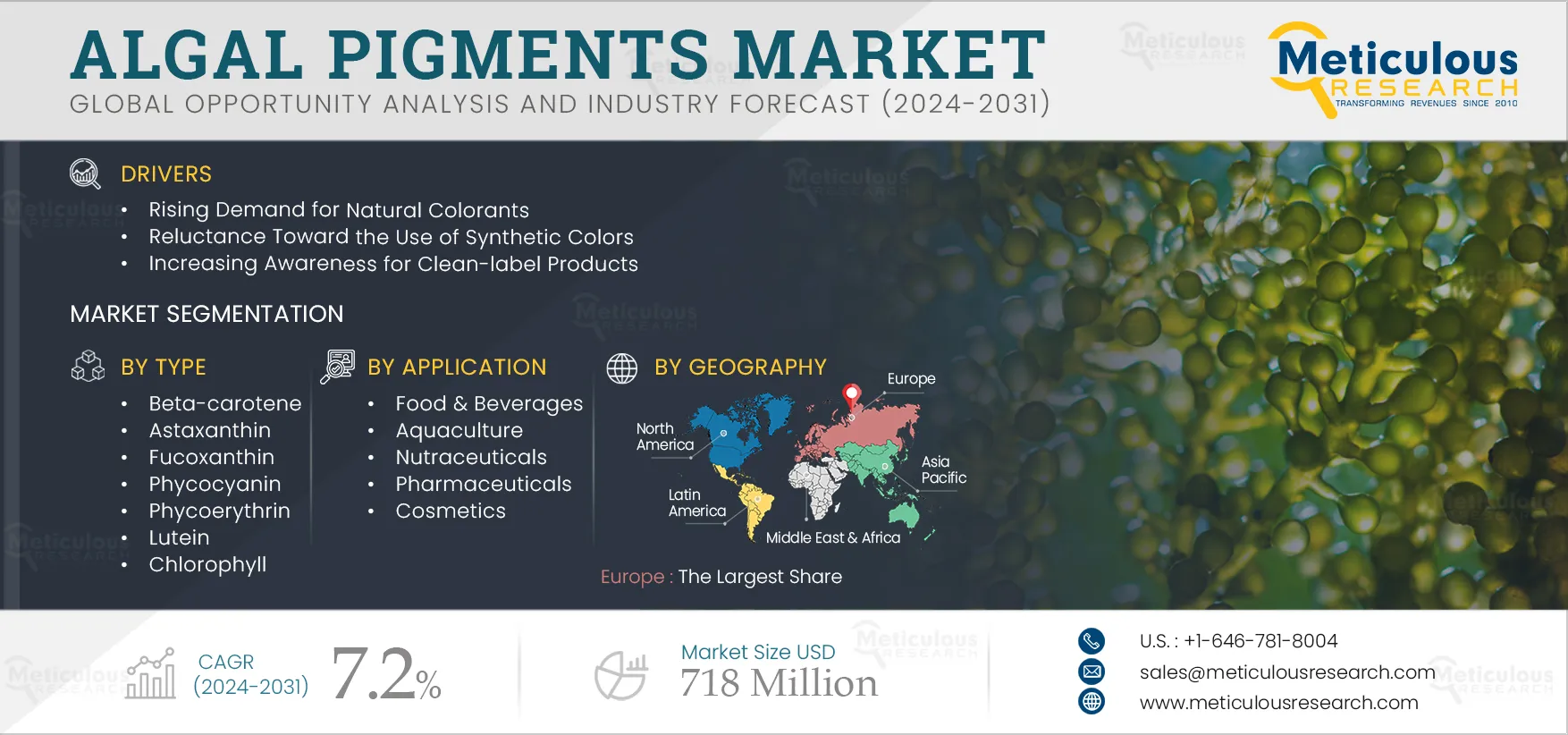

The Algal Pigments Market is slated to reach $669.8 Million by 2030, at a CAGR of 7.2% from 2023 to 2030. The global algal pigments market is driven by rising demand for natural colorants, increased adoption of algal pigments for therapeutic & nutritional purposes, reluctance towards usage of synthetic colors, increasing awareness for clean-label products, and growing need to enhance product appeal. However, the high cost of natural colors, the complex production process for algae, and the risk of algae contamination are expected to restrain the growth of this market to some extent.

Rising Demand for Natural Colorants

The demand for natural food colors over synthetic food colors is increasing due to growing consumer awareness about the health hazards associated with synthetic colors and the benefits of natural food colors. Rapid use of artificial production sources to increase food production has led to various health hazards. Nowadays, factors such as rising health consciousness and inclination towards environment-friendly products are driving the demand for naturally grown food products across the globe. As a result, food manufacturers are widely using natural food colors to restore the attractiveness of food and beverages after processing.

Natural food colors or dyes are mainly obtained from algae, plants, animals, fruits, and minerals, which makes them safe to use as a food additive, as they are free of harmful side effects. Due to its non-toxic or less toxic nature and fewer side effects, the therapeutic use of natural colors is also increasing. Also, the governments of various countries are supporting the use of natural food colors as they are biodegradable and do not cause pollution after disposal. Moreover, several regulations have been passed in many regions regarding the use of natural colors instead of synthetic food colors, which is further expected to drive the demand for natural food colors across the globe. For instance, the Food Safety and Standards Authority of India (FSSAI) has provided the list of permitted food coloring and flavoring agents and their standards in the Food Safety and Standards (Food Product Standards and Food Additives) Regulations, 2011 which permits the use of food colors such as beta-carotene, chlorophyll, caramel, riboflavin, curcumin, and saffron. Artificial colors have been banned under the Food Safety and Standards Act of 2006 (India) as long-term consumption could increase health issues.

Moreover, governments of various countries support the use of natural food colors as they are biodegradable and do not cause pollution after disposal. For instance, in the EU, the European Commission has banned titanium dioxide (E171) as a food additive since August 7, 2022. Several regulations have been passed across regions to limit the use of synthetic food colors.

According to the Department of Health, State Government of Victoria, Australia, in 2021, the Australian retail value of the organic market was estimated to be USD 2.3 billion. Australia has seen an annual growth rate of 13% since 2012, with the number of certified organic operations increasing by 38% since 2011. Furthermore, Denmark has the highest organic food sales share worldwide, with 13.0% in 2020 (Danish Agriculture & Food Council), followed by Austria with a share of 11.3%, and Switzerland with 10.3%. Thus, demand for organic foods is constantly increasing mainly due to consumers' perception that they are healthier and safer than conventional foods. Organic food is produced without synthetic fertilizers, pesticides, growth hormones, antibiotics, and genetically modified organisms (GMOs). In organic food, natural food colors are highly used to make them more attractive. Furthermore, the expansion of the food and beverage industry impacts the global natural food colors market in a positive manner, as the consumption of natural food is increasing across the globe. Therefore, the growing organic food demand and expanding the food and beverage industry fuel the demand for natural food colorants, thereby driving the growth of the algal pigments market.

Click here to: Get a Free Sample Copy of this report

Key Findings in the Algal Pigments Market Study:

The Phycocyanin Segment is Slated to Register the Highest CAGR During the Forecast Period

Based on type, the global algal pigments market is segmented into beta-carotene, astaxanthin, fucoxanthin, phycocyanin, phycoerythrin, lutein, and chlorophyll. The phycocyanin segment is slated to register the highest CAGR during the forecast period. The rapid growth of this segment is driven by the increasing adoption of phycocyanin for nutraceutical & nutritional applications, the reluctance toward the use of synthetic colors, the rising demand for natural blue colorants, and increasing venture investments in phycocyanin production, the high potential of phycocyanin in pharmaceutical applications and the increasing consumer awareness regarding clean-label products.

In 2023, the Microalgae Segment is Expected to Account for the Largest Share

Based on source, the global algal pigments market is segmented into microalgae (spirulina, haematococcus pluvialis, dunaliella salina, chlorella, and other microalgae), macroalgae/seaweed (red seaweed, brown seaweed, and green seaweed). In 2023, the microalgae segment is expected to account for the largest share of the global algal pigments market. The large market share of this segment is attributed to the increasing preference for microalgae-sourced products, the consumer inclination toward health & wellness trends, the growing dietary supplements industry, the rising demand for natural food colors, increasing vegetarianism, and the growing nutraceuticals industry.

In 2023, the Food & Beverages Segment is Expected to Dominate the Algal Pigments Market

Based on application, the algal pigments market is segmented into food & beverages, aquaculture, nutraceuticals, pharmaceuticals, cosmetics, and other applications. In 2023, the food & beverages segment is expected to account for the largest share of the algal pigments market. The large market share of this segment is attributed to factors such as the increasing consumer demand for plant-derived alternatives, stringent regulations against the use of synthetic colors in food products, and properties of algal pigments such as high nutritional value, eco-friendly nature, non-toxicity, and non-carcinogenicity.

Europe: The Dominating Regional Market

The algal pigments market is segmented into five major regions: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, Europe is expected to account for the largest share of the algal pigments market. The large share of this market is attributed to the huge food and beverages industry; strict regulations against the use of synthetic colors; growing health and wellness trends; large demand for natural colorants from various end-use industries; the presence of a number of algal pigment manufacturers; and growing government focus on algae industry.

However, Asia-Pacific is slated to register the highest CAGR during the forecast period. The growth of this market is driven by a large number of local and regional players, growing consumption of natural food ingredients, various government initiatives to promote the use of algae, growing demand for algal pigments from the food and beverages industry, and increasing consumer preference for natural ingredients.

Key Players

The report includes a competitive landscape based on an extensive assessment of the key strategic developments by leading market participants in the industry. Some of the key players operating in the global algal pigments market are Bluetec Naturals Co., Ltd (China), E.I.D. - Parry (India) Limited (India), Cyanotech Corporation (U.S.), AstaReal Group (Japan), Algatechologies Ltd. (Israel), Zhejiang Binmei Biotechnology Co., Ltd. (China), Algae Health Sciences (U.S.), Sochim International S.p.A. (Italy), D.D. Williamson & Co., Inc. (U.S.), Chlostanin Nikken Nature Co. Ltd. (China), DIC Corporation (Japan), Merck KGaA (Germany), Sensient Technologies Corporation (U.S.), Tianjin Norland Biotech Co., Ltd (China), AstaReal Group (Japan), Shaivaa Algaetech LLP (India), and Divi's Laboratories Limited (India).

Scope of the Report:

Algal Pigments Market Assessment, by Type

- Beta-carotene

- Astaxanthin

- Fucoxanthin

- Phycocyanin

- Phycoerythrin

- Lutein

- Chlorophyll

Algal Pigments Market Assessment, by Form

Algal Pigments Market Assessment, by Source

- Microalgae

- Spirulina

- Haematococcus pluvialis

- Dunaliella Salina

- Chlorella

- Other Microalgae

- Macroalgae/Seaweed

- Red Seaweed

- Brown Seaweed

- Green Seaweed

Algal Pigments Market Assessment, by Application

- Food & Beverages

- Aquaculture

- Nutraceuticals

- Pharmaceuticals

- Cosmetics

- Other Applications

Algal Pigments Market Assessment, by Region

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe (RoE)

- Asia-Pacific

- China

- Japan

- India

- Australia

- Rest of Asia-Pacific (RoAPAC)

- Latin America

- Middle East & Africa

Key Questions Answered in the Report: