Resources

About Us

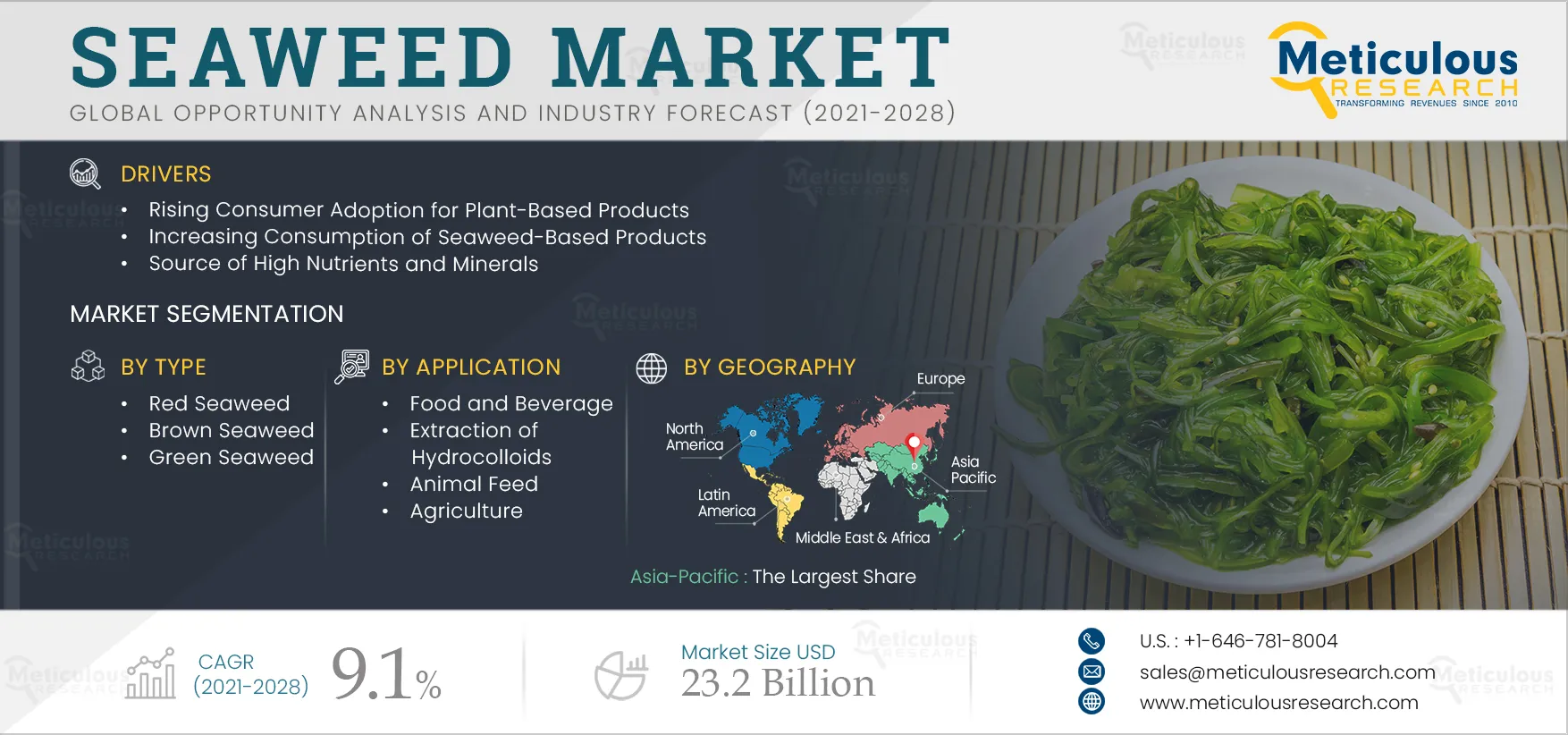

Seaweed Market Size, Share, Forecast, & Trends Analysis by Type (Red Seaweed, Brown Seaweed, Green Seaweed), Form (Dry, Liquid), Application (Food and Beverage, Extraction of Hydrocolloids, Animal Feed, Agriculture) — Global Forecast to 2031

Report ID: MRFB - 104489 Pages: 165 May-2024 Formats*: PDF Category: Food and Beverages Delivery: 24 to 48 Hours Download Free Sample ReportThe growth of this market is driven by the increasing demand for plant-based products, rising consumption of seaweed-based products due to their nutrient-rich profile, and government initiatives to boost seaweed cultivation. However, disruptions caused by natural calamities may restrain market growth.

Additionally, the growing demand for biofuels and technological advancements in seaweed cultivation are expected to create market growth opportunities. However, health complications associated with excess intake of seaweed pose a major challenge to the market’s growth. Furthermore, the growing focus on environmental sustainability is a prominent trend in the seaweed market.

Seaweed cultivation can potentially improve the livelihoods of coastal fishing communities. Governments worldwide have implemented policies and allocated funds to bolster the seaweed industry. For instance, since 1950, the Chinese national and provincial governments have incentivized seaweed cultivation through various means such as policy support, financial assistance, allocation of onshore and offshore farming areas, and access to freshwater resources. However, starting in 2015, the Chinese national government initiated a restructuring of the seaweed industry in response to serious environmental and ecological concerns, including air and water pollution and unsustainable resource exploitation. China’s National Fisheries & Aquaculture Authority is focusing on the transition of the Chinese aquaculture industry towards a period of stable and gradual growth. The focus of the entire aquaculture sector is expected to shift from prioritizing quantity, value, and rapid expansion to emphasizing quality, safety, and sustainability.

In India, approximately 46-50 seaweed-based industries are grappling with raw material shortages. To address this issue, the Indian government allocated a fund of around USD 86.37 million in 2020 to boost seaweed cultivation domestically.

Additionally, Indonesia, a significant seaweed producer, is undertaking initiatives to modernize and develop its seaweed industry to increase export earnings and improve the livelihoods of coastal communities. The government has launched various programs aimed at providing high-quality seeds, enhancing farming techniques, and improving post-harvest and processing technologies. As a result, many small-scale fishermen in Indonesia have transitioned from fishing to seaweed farming to increase their incomes.

Moreover, since 2014, Switzerland's State Secretariat for Economic Affairs funded the SMART-Fish Indonesia program. Implemented by the United Nations Industrial Development Organization in collaboration with Indonesia's Ministry of Marine Affairs and Fisheries, the program aims to enhance the productivity of the seaweed value chain in Indonesia and boost the competitiveness of the seaweed industry.

The Scottish Government is committed to promoting sustainable aquaculture growth while ensuring the preservation of the wider marine environment. In 2014, the government introduced seaweed cultivation policies aimed at fostering employment and enhancing the economic prosperity of numerous rural communities throughout Scotland. These initiatives encompass support for the traditional aquaculture sectors and exploration of potential diversification into other species, including seaweed cultivation.

These supportive government initiatives aimed at boosting seaweed cultivation are anticipated to drive the growth of the global seaweed market in the coming years.

Click here to: Get Free Sample Pages of this Report

A wide variety of seaweed species are utilized in numerous food products worldwide. Traditionally, seaweeds have been staples in Asian cuisine, particularly in countries like China, Japan, and South Korea. However, in recent decades, these seaweed-based foods have gained popularity in Western nations, driven by their recognized health benefits.

In developed regions such as North America and Europe, the perceived health advantages of seaweed-based products are driving their adoption. Consumers view seaweed as a safe, fresh, protein-rich, iodine-rich, and low-calorie dietary option. Additionally, seaweed is rich in vitamins, minerals, and fibers, further enhancing its appeal. Major players in Western markets are focusing on innovating food products to cater to diverse demographics, capitalizing on the health benefits of seaweed, including its antioxidant properties, micronutrients, and fiber content. As a result, seaweed-containing food items such as snacks, noodles, and health beverages are witnessing a surge in demand worldwide.

In recent decades, global awareness of environmental issues has led to the development of eco-friendly solutions to mitigate these issues. The rising environmental consciousness has caused significant shifts in consumer preferences, driving increased demand for sustainable products worldwide. Rising social and regulatory concerns for the environment have prompted a growing number of food and beverage companies to prioritize green initiatives as a key driver of strategic change.

The growing focus on environmental sustainability is driving seaweed cultivation efforts worldwide. Seaweed cultivation is generally considered sustainable, as it involves fast-growing, nutrient-rich macroalgae that absorb carbon dioxide (CO2) and release oxygen (O2). Furthermore, the growing demand for seaweed production is driven by the increasing popularity of veganism. According to Proveg International, global sales of plant-based meat products reached nearly USD 12 billion in 2019.

The increasing demand for secure, sustainable, and clean energy sources is fueling the global demand for biofuels. Factors such as rising oil prices and government policies aimed at reducing greenhouse gas emissions have further contributed to this demand. Many countries have initiated or expanded renewable energy programs in response to these trends.

Both microalgae and macroalgae present promising biodiesel feedstock options that could eventually replace petroleum-based fuels. Seaweed, in particular, is a highly viable source of biofuels due to its numerous advantages, including high oil content, rapid growth rates, and minimal land and freshwater requirements. Unlike crops like soybeans, seaweed cultivation is faster, more space-efficient, and does not necessitate the use of freshwater or fertilizers. Furthermore, seaweed does not compete for land area, making it highly suitable for biofuel production.

Seaweed's composition, with approximately 85 to 90% water content, makes it ideal for biofuel production methods such as anaerobic digestion for biogas and fermentation for ethanol. Certain seaweed species, such as sugar kelp, have high carbohydrate and low lignin content, making them ideal for bioethanol production.

There is a rising need to decarbonize the transportation and aviation sectors, particularly in Europe, where these sectors exhibit rising greenhouse gas (GHG) and CO2 emissions. For instance, emissions from aviation have doubled since 1990. While electrification is a likely scenario for passenger cars, heavy transport, shipping, and aviation are expected to remain heavily reliant on liquid fuels for the foreseeable future. Seaweed is a sustainable bio-based feedstock for liquid transportation fuels, offering fast growth rates and requiring only CO2, sunlight, and nutrients naturally present in seawater. Seaweeds' high sugar content further enhances their suitability for advanced biofuel production.

Based on type, the seaweed market is mainly segmented into red seaweed, brown seaweed, and green seaweed. In 2024, the red seaweed segment is expected to account for the largest share of 52.3% of the seaweed market. Moreover, the red seaweed segment is projected to register the highest CAGR of 10.8% during the forecast period. This growth can be attributed to the increasing health consciousness among consumers, expanding applications of red seaweed in the food industry, and rising demand for red seaweed extracts like agar and carrageenan hydrocolloids across various sectors.

Based on form, the seaweed market is segmented into dry and liquid. In 2024, the dry segment is expected to account for the larger share of 60.4% of the seaweed market. This segment’s large market share can be attributed to the increasing demand for seaweed powder in the food and cosmetics industries. Moreover, the dry segment is projected to register a higher CAGR during the forecast period. This growth can be attributed to the advantages offered by powdered seaweed over their liquid counterparts, including a longer shelf-life and ease of transportation & storage.

Based on application, the seaweed market is mainly segmented into food and beverage, hydrocolloid extraction, animal feed, agriculture, and other applications. In 2024, the food and beverage segment is expected to account for the largest share of 54.5% of the seaweed market. This segment’s large market share can be attributed to the rising demand for organic food products, the growing consumption of plant proteins and vegan diets, and the expanding applications of seaweed in the food & beverage sector. Additionally, factors such as population growth, increasing awareness of the health benefits of seaweeds, shifts in lifestyle patterns and consumer tastes, adoption of healthier eating habits, and rising disposable incomes are expected to drive the growth of this segment.

However, the animal feed segment is projected to register the highest CAGR of 11.3% during the forecast period. This growth can be attributed to the expansion of the livestock sector, resulting in the increased demand for animal feed and the growing utilization of seaweeds as additives in animal feed formulations.

Based on region, the seaweed market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2024, Asia-Pacific is expected to account for the largest share of 63.0% of the seaweed market, followed by North America, Europe, Latin America, and the Middle East & Africa. Asia-Pacific’s seaweed market is estimated to be worth USD 12.0 billion in 2024. Asia-Pacific’s significant market share can be attributed to the presence of numerous local and regional players, government initiatives aimed at promoting seaweed cultivation and utilization across various industries, increasing demand for organic food products, and expanding applications of sea vegetables, particularly in the food sector. Furthermore, Moreover, in the Asia-Pacific region, there is extensive production and consumption of seaweeds due to the abundant availability of raw materials, favorable climatic conditions for seaweed cultivation, and low labor costs. These factors contribute to the growth of the seaweed market in Asia-Pacific.

However, the market in Europe is slated to register the highest CAGR of 17.7% during the forecast period of 2024-2031. The growth of this regional market can be attributed to the increasing demand for natural and high-quality supplements, the growing vegan and vegetarian population, rising health consciousness, and the growing demand for alternative proteins.

The report offers a competitive analysis based on an extensive assessment of the leading players’ product portfolios and geographic presence and the key growth strategies adopted by them over the past 3–4 years. Some of the key players operating in the global seaweed market are Seaweed & Co. (U.K.), Cargill, Incorporated (U.S.), Green Rise Agro Industries (India), VietDelta Ltd. (Vietnam), Ocean rainforest (Denmark), Thorverk hf. (Iceland), ALGAplus (Portugal), MYCSA Ag, Inc. (U.S.), Seaweed Solutions AS (Norway), The Seaweed Company (Netherlands), Baoji Earay Bio-Tech Co., Ltd. (China), Shore Seaweed (U.K.), Rongcheng Jingyi Ocean Technology Co., Ltd. (China), Sar Agrochemicals & Fertilizers Pvt. Ltd. (India), and Algea, the Arctic Company (Part of Valagro Group) (Norway).

|

Particulars |

Details |

|

Number of Pages |

165 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

10.3% |

|

Market Size (Value) |

USD 37.84 Billion by 2031 |

|

CAGR (Volume) |

11.1% |

|

Market Size (Volume) |

18,871.4 Tons by 2031 |

|

Segments Covered |

By Type

By Form

By Application

|

|

Countries Covered |

North America (U.S., Canada), Europe (France, Germany, Italy, Spain, U.K., Norway, Ireland, Netherlands, Denmark, Sweden, and Rest of Europe), Asia-Pacific (China, India, South Korea, Japan, Australia, Indonesia, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, Chile, and Rest of Latin America), and the Middle East & Africa. |

|

Key Companies |

Seaweed & Co. (U.K.), Cargill, Incorporated (U.S.), Green Rise Agro Industries (India), VietDelta Ltd. (Vietnam), Ocean rainforest (Denmark), Thorverk hf. (Iceland), ALGAplus (Portugal), MYCSA Ag, Inc. (U.S.), Seaweed Solutions AS (Norway), The Seaweed Company (Netherlands), Baoji Earay Bio-Tech Co., Ltd. (China), Shore Seaweed (U.K.), Rongcheng Jingyi Ocean Technology Co., Ltd. (China), Sar Agrochemicals & Fertilizers Pvt. Ltd. (India), and Algea, the Arctic Company (Part of Valagro Group) (Norway). |

The seaweed market study provides insights into market sizes and forecasts in terms of both value and volume for the market segments: type and geography. However, it focuses only on value-based insights and forecasts for form and application segments.

Seaweeds encompass various macroscopic, multicellular marine algae species that grow in oceans, seas, lakes, rivers, and other aquatic environments. They are rich sources of minerals and vitamins and can yield various hydrocolloids, including agar, alginate, and carrageenan. Seaweeds offer various functional and health benefits and find diverse applications in food and beverage production, hydrocolloid extraction, animal feed, agriculture, wastewater treatment, bio-refining, and dietary supplements.

The seaweed market is projected to reach $37.84 billion by 2031, at a CAGR of 10.3% during the forecast period 2024–2031.

The red seaweed segment is expected to hold the major share of the market in 2024.

The animal feed segment is projected to record the highest growth rate during the forecast period 2024–2031.

¡ Drivers

o Rising Demand for Plant-based Products

o Rising Consumption of Seaweed-based Products Due to their Nutrient-rich Profile

o Government Initiatives to Boost Seaweed Cultivation

¡ Opportunities

o Growing Demand for Biofuels

o Technological Advancements in Seaweed Cultivation

The key players operating in the seaweed market are Seaweed & Co. (U.K.), Cargill, Incorporated (U.S.), Green Rise Agro Industries (India), VietDelta Ltd. (Vietnam), Ocean rainforest (Denmark), Thorverk hf. (Iceland), ALGAplus (Portugal), MYCSA Ag, Inc. (U.S.), Seaweed Solutions AS (Norway), The Seaweed Company (Netherlands), Baoji Earay Bio-Tech Co., Ltd. (China), Shore Seaweed (U.K.), Rongcheng Jingyi Ocean Technology Co., Ltd. (China), Sar Agrochemicals & Fertilizers Pvt. Ltd. (India), and Algea, the Arctic Company (Part of Valagro Group) (Norway).

Europe is projected to register the highest growth rate of 17.7% during the forecast period (2024–2031) and offer significant growth opportunities for vendors operating in this market. The growth of this regional market can be attributed to the increasing demand for natural and high-quality supplements, the growing vegan and vegetarian population, rising health consciousness, and the growing demand for alternative proteins.

Published Date: Apr-2023

Published Date: Jan-2024

Published Date: Mar-2024

Published Date: Jan-2025

Published Date: Jun-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates