Resources

About Us

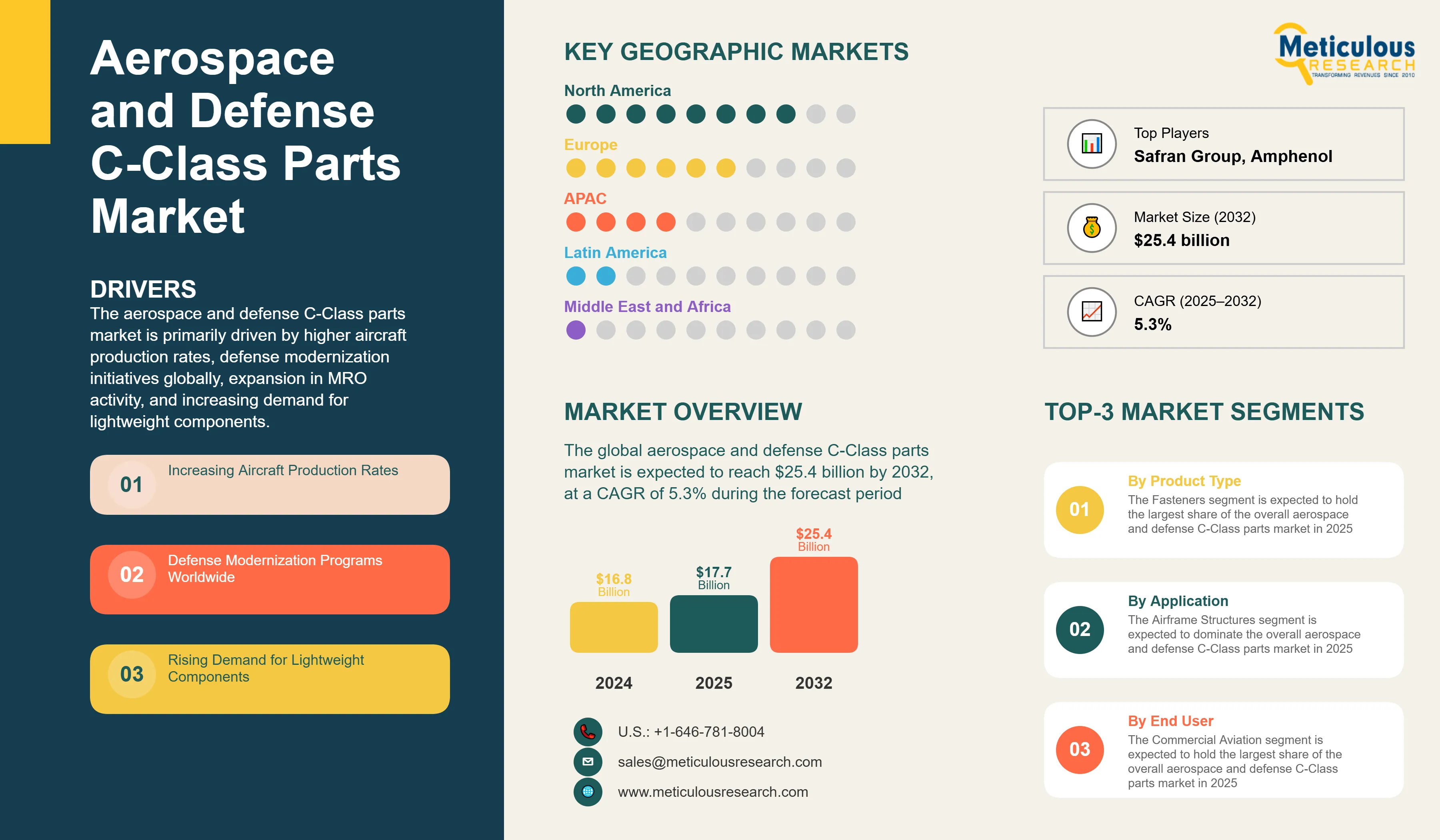

Aerospace and Defense C-Class Parts Market by Product Type (Fasteners, Bearings and Bushings, Seals & Gaskets, Electrical and Electronic Components, Fluid System Components, Standard Hardware, Machined & Precision Components), Application, End User, Distribution Channel, and Geography - Global Forecast to 2032

Report ID: MRAD - 1041485 Pages: 280 May-2025 Formats*: PDF Category: Aerospace and Defense Delivery: 24 to 72 Hours Download Free Sample ReportThis comprehensive market research report analyzes the global aerospace and defense C-Class parts market, evaluating how these critical components support aircraft manufacturing, defense systems, and MRO operations across various industries and regions. The report provides a strategic analysis of market dynamics, growth projections till 2032, and competitive positioning across global and regional/country-level markets.

Key Market Drivers & Trends and Insights

Click here to: Get Free Sample Pages of this Report

The aerospace and defense C-Class parts market is primarily driven by higher aircraft production rates, defense modernization initiatives globally, expansion in MRO activity, and increasing demand for lightweight components. Advanced materials and digital supply chain technologies are reshaping the industry, while Industry 4.0 technology adoption and integration of value-added services are gaining significant traction. Additionally, supplier consolidation and sustainability initiatives aimed at carbon footprint reduction are further driving market growth, especially in commercial aviation, military applications, and space industry sectors.

Key Challenges

Despite significant growth potential, the overall aerospace and defense C-Class parts market faces challenges including complex supply chains and disruptions in globally distributed manufacturing networks. Additionally, strict certification processes, prolonged qualification and approval periods, fluctuating raw material costs, and quality assurance issues present significant barriers. Furthermore, counterfeit parts concerns, skilled labor shortages, and the need to comply with evolving regulations potentially slow down market adoption across different sectors.

Growth Opportunities

The aerospace and defense C-Class parts market offers several high-growth opportunities. Advanced materials are substantially enhancing component performance and weight reduction capabilities. Another major opportunity lies in digital supply chain solutions creating new efficiencies beyond traditional procurement methods. Additionally, emerging markets with growing aerospace sectors are opening untapped regional segments for expansion. The market is also benefiting from increased interest in the commercial space industry and advancement of Industry 4.0 technologies specifically designed for aerospace manufacturing.

Market Segmentation Highlights

By Product Type

The Fasteners segment is expected to hold the largest share of the overall aerospace and defense C-Class parts market in 2025, due to their essential role in structural integrity, extensive use across all aircraft sections, and high replacement frequency in MRO operations. The Electrical and Electronic Components segment is expected to grow at the fastest CAGR during the forecast period, driven by rising demand for advanced avionics, increased aircraft electrification, and growing implementation of connected aircraft systems.

By Application

The Airframe Structures segment is expected to dominate the overall aerospace and defense C-Class parts market in 2025, primarily due to the high volume of components required, their essential role in structural integrity, and sustained demand from both new aircraft production and existing fleet maintenance. However, the Avionics and Electrical Systems segment is expected to grow at the fastest CAGR through 2032, driven by the rapid advancement of aircraft electronics, increased emphasis on system integration, and the growing complexity of flight control systems.

By End-User

The Commercial Aviation segment is expected to hold the largest share of the overall aerospace and defense C-Class parts market in 2025, as it establishes foundational demand within the market with its large global fleet size, high aircraft production rates, and recurring need for replacement parts. The Spacecraft & Satellite Manufacturers segment is expected to experience the fastest growth rate during the forecast period, driven by expanding commercial space activities, increasing satellite constellation deployments, and growing investments in space exploration programs.

By Distribution Channel

The OEM Direct Sales segment is expected to hold the largest share of the global aerospace and defense C-Class parts market in 2025, driven by aircraft manufacturers' preference for direct supplier relationships, especially for critical components requiring certification. However, the Aftermarket/Distribution Channels segment is witnessing the fastest growth rate during the forecast period, primarily driven by increasing global fleet age, expanding MRO activities in emerging markets, and the growing demand for efficient part sourcing solutions.

By Geography

North America is expected to hold the largest share of the global aerospace and defense C-Class parts market in 2025, attributed to the region's concentration of major aerospace OEMs, substantial defense budgets, advanced manufacturing capabilities, and robust MRO infrastructure. Europe follows as the second-largest market, supported by the presence of Airbus and other major manufacturers. However, Asia-Pacific is witnessing the fastest growth rate during the forecast period, primarily driven by rapidly expanding domestic aerospace industries, increasing defense modernization efforts, growing commercial air travel, and substantial investments in manufacturing capabilities.

Competitive Landscape

The global aerospace and defense C-Class parts market features a diverse competitive landscape with established component manufacturers, specialized aerospace suppliers, and diversified industrial groups with aerospace divisions pursuing varied approaches to parts manufacturing and distribution.

Market dynamics are increasingly influenced by key trends such as vertical integration strategies, enhancement of manufacturing technologies, and development of comprehensive supply chain solutions. Leading companies are prioritizing improvements in material science, production efficiency, and certification compliance to address evolving customer requirements and regulatory frameworks.

The key players operating in the global aerospace and defense C-Class parts market include Precision Castparts Corp (Berkshire Hathaway), Howmet Aerospace, TriMas Corporation, Consolidated Aerospace Manufacturing (CAM), Stanley Black & Decker (Engineered Fastening), Lisi Aerospace, RBC Bearings, Trelleborg Sealing Solutions, TransDigm Group, Eaton Aerospace, Parker Hannifin Corporation, Safran Group, Amphenol Corporation, and Wesco Aircraft (Incora) among others.

|

Particulars |

Details |

|

Number of Pages |

280 |

|

Format |

PDF & Excel |

|

Forecast Period |

2025–2032 |

|

Base Year |

2024 |

|

CAGR (Value) |

5.3% |

|

Market Size (Value)in 2025 |

USD 17.7 Billion |

|

Market Size (Value) in 2032 |

USD 25.4 Billion |

|

Segments Covered |

By Product Type

By Application

By End User

By Distribution Channel

|

|

Countries Covered |

North America (U.S., Canada) |

|

Key Companies |

Precision Castparts Corp (Berkshire Hathaway), Howmet Aerospace (formerly Arconic), TriMas Corporation, Consolidated Aerospace Manufacturing (CAM), Stanley Black & Decker (Engineered Fastening), Lisi Aerospace, RBC Bearings, Trelleborg Sealing Solutions, TransDigm Group, Eaton Aerospace, Parker Hannifin Corporation, Satcom Direct (Carlisle Companies), Safran Group, Amphenol Corporation, AMG Advanced Metallurgical Group, Barnes Group Inc., Wesco Aircraft (Incora), and KLX Aerospace (Boeing Distribution Services), among others. |

The global aerospace and defense C-Class parts market was valued at $16.8 billion in 2024. This market is expected to reach $25.4 billion by 2032 from an estimated $17.7 billion in 2025, at a CAGR of 5.3% during the forecast period of 2025–2032.

The global aerospace and defense C-Class parts market is expected to grow at a CAGR of 5.3% during the forecast period of 2025–2032.

The global aerospace and defense C-Class parts market is expected to reach $25.4 billion by 2032 from an estimated $17.7 billion in 2025, at a CAGR of 5.3% during the forecast period of 2025–2032.

The key companies operating in this market include Precision Castparts Corp (Berkshire Hathaway), Howmet Aerospace (formerly Arconic), TriMas Corporation, Consolidated Aerospace Manufacturing (CAM), Stanley Black & Decker (Engineered Fastening), Lisi Aerospace, RBC Bearings, Trelleborg Sealing Solutions, TransDigm Group, Eaton Aerospace, Parker Hannifin Corporation, Satcom Direct (Carlisle Companies), Safran Group, Amphenol Corporation, AMG Advanced Metallurgical Group, Barnes Group Inc., Wesco Aircraft (Incora), KLX Aerospace (Boeing Distribution Services), among others.

Major trends shaping the market include consolidation among suppliers, value-added service integration, adoption of Industry 4.0 technologies, sustainability initiatives for carbon footprint reduction, and increased focus on advanced materials development.

In 2025, the fasteners segment is expected to account for the largest share of the aerospace and defense C-Class parts market; based on application, airframe structures are expected to hold the largest share of the overall market in 2025; and the commercial aviation segment is expected to account for the largest market share in 2025.

North America leads the global market followed by Europe due to concentration of major aerospace OEMs, substantial defense budgets, and robust MRO infrastructure. Asia-Pacific is witnessing the highest growth rate driven by expanding domestic aerospace industries, increasing defense modernization efforts, and growing commercial air travel, particularly in China, Japan, and India.

The growth of this market is driven by increasing aircraft production rates, defense modernization programs worldwide, growth in MRO activities, rising demand for lightweight components, and emergence of advanced materials for high-performance applications.

Published Date: Jan-2026

Published Date: Aug-2025

Published Date: Aug-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates