Resources

About Us

Aerospace Cold Forgings Market Size, Share, Forecast & Trends by Platform (Fixed Wing and Rotary Wing), Application - Global Forecast to 2035

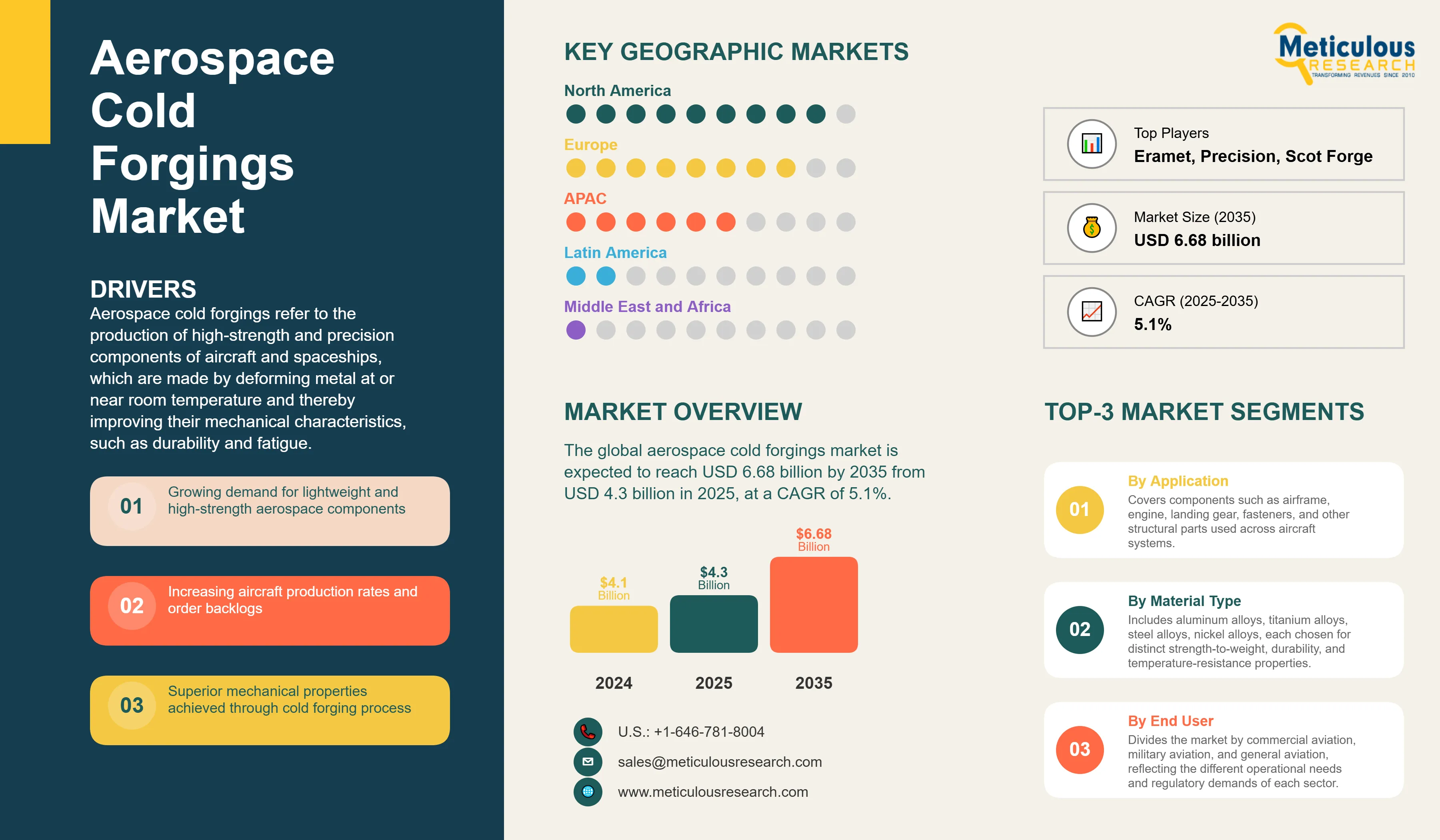

Report ID: MRAD - 1041562 Pages: 185 Aug-2025 Formats*: PDF Category: Aerospace and Defense Delivery: 24 to 72 Hours Download Free Sample ReportThe global aerospace cold forgings market was valued at USD 4.1 billion in 2024. The market is expected to reach USD 6.68 billion by 2035 from USD 4.3 billion in 2025, at a CAGR of 5.1%.

Aerospace cold forgings refer to the production of high-strength and precision components of aircraft and spaceships, which are made by deforming metal at or near room temperature and thereby improving their mechanical characteristics, such as durability and fatigue. The process is essential when manufacturing parts like landing gear parts, turbine shafts, and fasteners, where precision and structural integrity are the main requirements.

Click here to: Get Free Sample Pages of this Report

The aerospace cold forgings market is highly competitive, characterized by the dominance of a select group of established multinational manufacturers with extensive expertise in materials, precision engineering, and strategic partnerships with leading OEMs. Key industry leaders exemplify this trend. Precision Castparts Corp. is recognized for supplying high-strength, critical components for engines, landing gear, and structural applications. Arconic Inc. has built a strong reputation for innovative lightweight and high-strength materials across both commercial and defense aviation sectors. ATI (Allegheny Technologies) stands out as a major supplier of titanium, superalloys, and specialty metals, which are essential for high-performance aerospace applications.

Recent Developments

Rolls-Royce innovates with titanium cold forging

In October 2024, Rolls-Royce announced a contract to manufacture lightweight aerospace components using advanced cold forging techniques. The company has developed new titanium alloys suitable for cold forging, which reduce engine weight while maintaining critical strength and durability. This technology is expected to enhance fuel efficiency and lower the carbon footprint of next-generation aircraft engines.

GKN Aerospace Introduces Advanced Cold Forging Technique for Sustainable Aerospace Manufacturing

In September 2024, GKN Aerospace unveiled an innovative cold forging technique utilizing high-strength aluminum alloys to improve production efficiency, reduce material waste, and enhance component strength—supporting greener, cost-effective aerospace manufacturing.

Key Market Drivers

Rising Demand for Lightweight, High-Strength Components: Modern aircraft require components with a high strength-to-weight ratio to optimize fuel efficiency and overall performance. Aluminum and titanium alloys can be cold-forged to achieve the necessary strength while minimizing additional weight. For example, Rolls-Royce’s titanium cold-forged turbine shafts offer a lightweight yet robust solution for jet engine applications, contributing to improved efficiency and structural reliability. Titanium alloys, such as Ti-17, are renowned for their high strength and fracture toughness, making them ideal for aerospace applications. These alloys exhibit yield and tensile strengths at room temperature of approximately 1,150 MPa and 1,250 MPa, respectively, surpassing many other materials used in the industry.

Growth in Commercial and Defense Aviation: In 2024, global air passenger traffic reached a record high, with airlines carrying 4.8 billion passengers, surpassing pre-pandemic levels by 300 million. The global commercial aircraft fleet is projected to grow from 31,000 aircraft in operation today to 41,100 by 2034, marking an annual growth rate of 2.8%. This growth in both commercial and defense aviation underscores the increasing demand for reliable, high-performance aerospace components. Safety-critical systems, in particular, rely heavily on cold-forged parts due to their superior strength and durability. Leading manufacturers are responding to this demand by outsourcing cold-forged components for critical systems. For instance, Boeing and Airbus are incorporating cold-forged parts in their next-generation airliners to enhance performance and reliability.

Key Market Restraints

High Initial and Tooling Costs: The setup costs for cold forging processes are considerable. Estimates indicate that the initial investment in cold forging equipment and tooling can be significant. However, the long-term cost savings from reduced material waste and machining operations often outweigh the upfront costs. Additionally, the integration of automation and robotics into cold forging processes enhances efficiency and precision but requires further investment in advanced machinery and technology.

Constraints on Material and Process Constraints: Cold forging, while highly effective for producing high-strength, lightweight aerospace components, has limitations when applied to certain alloys or very large parts. In such cases, alternative manufacturing techniques such as hot forging or precision machining often provide more practical solutions. For example, hot forging remains the preferred method for large titanium bulkhead structures in military aircraft, where the component size exceeds the practical limits of cold forging and conventional machining. These substitution techniques ensure structural integrity and performance while accommodating production constraints, highlighting the need for a flexible approach in aerospace manufacturing.

Base CAGR: 8.9%

|

Category |

Key Factor |

Short-Term Impact (2025–2028) |

Long-Term Impact (2029–2035) |

Estimated CAGR Impact |

|

Drivers |

1. Demand for Lightweight and Fuel-Efficient Aircraft |

Higher orders for cold-forged titanium and aluminum components in commercial and defense aircraft |

Cold forging embedded as a standard in next-gen aircraft designs for weight reduction and durability |

▲ +1.2% |

|

2. Supply Chain Resilience & Regional Manufacturing Expansion |

OEMs diversify forging suppliers and open regional facilities to cut lead times |

Established regional forging hubs ensure faster delivery and reduced logistics risks |

▲ +1.1% |

|

|

3. Advancements in Forging Technology |

Adoption of CNC-controlled presses, AI inspection, and improved die materials |

Greater production efficiency, complex geometries possible, and lower scrap rates |

▲ +0.7% |

|

|

Restraints |

1. Demand for Lightweight and Fuel-Efficient Aircraft |

Higher orders for cold-forged titanium and aluminum components in commercial and defense aircraft |

Cold forging embedded as a standard in next-gen aircraft designs for weight reduction and durability |

▲ +1.2% |

|

2. Supply Chain Resilience & Regional Manufacturing Expansion |

OEMs diversify forging suppliers and open regional facilities to cut lead times |

Established regional forging hubs ensure faster delivery and reduced logistics risks |

▲ +0.8% |

|

|

Opportunities |

1. New High-Strength, Forgeable Alloys |

Enables substitution of heavier materials and entry into new component classes |

Expands cold forging’s role in advanced aerospace designs |

▲ +1.5% |

|

2. Aftermarket & MRO Demand |

Higher demand for replacement cold-forged parts in aging fleets |

Stable recurring aftermarket business reduces dependence on new build cycles |

▲ +0.9% |

|

|

Trends |

1. Industry 4.0 Integration |

Increased use of IoT and predictive maintenance in forging equipment |

Fully automated, digitally monitored forging lines become the industry norm |

▲ +1.1% |

|

Challenges |

1. Geopolitical & Supply Chain Risks |

Export controls and transport bottlenecks cause delivery delays |

Long-term supplier diversification mitigates some risks |

▼ −0.9% |

Regional Analysis: North America Leading the Aerospace Cold Forgings Market

North America currently leads the global aerospace cold forgings market, holding the largest revenue share. This dominance is driven primarily by the region’s extensive aerospace manufacturing base and the presence of major OEMs, including Boeing, Lockheed Martin, and Raytheon Technologies, supported by a robust network of Tier-1 suppliers and specialized forging companies.

Sustained procurement by the U.S. defense sector—including fighter jets, transport aircraft, and space systems—continues to fuel demand for cold-forged components such as landing gear assemblies, shafts, and structural parts. Additionally, advancements in forging technologies and substantial investments in high-performance aluminum and titanium alloys enable North American manufacturers to meet stringent aerospace quality standards while improving production efficiency. These factors collectively reinforce the region’s leadership in the aerospace cold forgings market.

Europe Ranks as the Second-Largest Growth Hub in the Aerospace Cold Forgings Market

Europe is the second-fastest-growing region in the aerospace cold forgings market, supported by well-established aerospace hubs in France, Germany, and the UK. The presence of major aircraft manufacturers, including Airbus, Dassault Aviation, and Rolls-Royce, drives steady demand for high-precision forged components used in engines, landing gear, and structural assemblies.

Ongoing investments in advanced forging technologies—particularly for lightweight titanium components and high-strength alloys—enable European manufacturers to meet stringent safety and performance standards. These developments position Europe as a key growth region in the global aerospace cold forgings market.

Strong Defense Backbone and Commercial Aircraft Production in the U.S.

The United States’ aerospace cold forgings market is strongly supported by the presence of major aircraft OEMs, such as Boeing and Lockheed Martin, alongside consistent defense spending. This combination drives sustained demand for high-strength forged components used in fighter jets, transport aircraft, and space systems.

For instance, ongoing production of Boeing’s 737 MAX and KC-46 Pegasus tanker ensures a stable procurement of cold-forged components, including landing gears, engine shafts, and structural assemblies. This steady demand underlines the resilience and growth potential of the U.S. aerospace cold forgings market.

Aerospace Innovation Driven by Airbus and Defense Programs in France

France’s aerospace cold forgings market benefits significantly from Airbus’ large-scale commercial aircraft production and its participation in defense programs such as the A400M transport aircraft and Rafale fighter jet. Supported by leading aerospace suppliers, including Safran and Daher, French forging companies are increasingly adopting precision forging of titanium and aluminum alloys to meet stringent EU regulations on efficiency and emissions.

A notable example is the use of lightweight forged components in the Airbus A350 XWB, which enhances fuel efficiency and overall aircraft performance. These initiatives underscore France’s strategic role in advancing the European aerospace cold forgings market.

Aluminum Alloys Dominate Material Segment with 40-45% Market Share

Based on material type, the aluminum alloys category holds the largest share of revenue in the aerospace cold forgings sector at 40-45% of the total market. The aluminum's overall strength, low weight and good cold formability makes it a popular material for aerospace forgings. The 7000 series aluminum alloys (Al-Zn), particularly 7075 and 7050, account for majority share of aluminum forging applications, primarily used in structural components where high strength-to-weight ratios are critical. These alloys achieve tensile strengths exceeding 570 MPa after cold forging and heat treatment, making them ideal for wing ribs, fuselage frames, and landing gear components.

Engine Components Lead Application Segment with 30-40% Revenue Share

Engine components dominate the aerospace cold forgings application segment with 30-40% market share, reflecting the critical demand for high-performance parts that withstand extreme operational stresses. The compressor blades and discs sub-segment accounts for 40-45% of engine applications with cold-forgings enhancing the grain flow pattern of the part and providing fatigue resistance improvements of 40-50% over cast or machining type manufactured parts.

|

Report Attribute |

Details |

|

Market size (2025) |

USD 4.3 billion |

|

Revenue forecast in 2035 |

USD 6.68 billion |

|

CAGR (2025-2035) |

5.1% |

|

Base Year |

2024 |

|

Forecast period |

2025 – 2035 |

|

Report coverage |

Market size and forecast, competitive landscape and benchmarking, country/regional level analysis, key trends, growth drivers and restraints |

|

Segments covered |

Platform (Fixed Wing and Rotary Wing), Application and Geography |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

|

Key companies profiled |

Eramet, Precision Castparts Corp., Scot Forge, Bharat Forge, ATI Metal VSMPO-AVISMA Corporation, Shaanxi Hongyuan Aviation Forging Co., Ltd., Arconic, and Other Key Players. |

|

Customization |

Comprehensive report customization with purchase. Addition or modification to country, regional & segment scope available |

|

Pricing Details |

Access customized purchase options to meet your specific research requirements. Explore flexible pricing models |

Aerospace Cold Forgings Market Assessment—By Material Type

Aerospace Cold Forgings Market Assessment—By Process Type

Aerospace Cold Forgings Market Assessment—By Application

Aerospace Cold Forgings Market Assessment—By Aircraft Type

Aerospace Cold Forgings Market Assessment—By End-User

The aerospace cold forgings market size is estimated to be USD 4.3 billion in 2025 and grow at a CAGR of 5.1% to reach USD 6.68 billion by 2035.

In 2024, the Aerospace Cold Forgings Market size was estimated at USD 4.1 billion, with projections to reach USD 4.3 billion in 2025.

Eramet, Precision Castparts Corp., Scot Forge, Bharat Forge, ATI Metal, and VSMPO-AVISMA Corporation are the major companies operating in the Aerospace Cold Forgings Market.

The Asia-Pacific region is projected to grow at the highest CAGR over the forecast period (2025-2035).

In 2025, by application, the engine components segment is expected to account for the largest market share.

Published Date: Aug-2025

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates