Resources

About Us

3D Motion Capture System Market by Component (Hardware, Software, Services), Technology (Optical, Inertial, Electromagnetic, Others), End-use (Media & Entertainment, Sports & Performance Analytics, Healthcare & Rehabilitation, Defense & Aerospace, Robotics & Industrial Automation, Education & Research) — Global Forecast to 2036

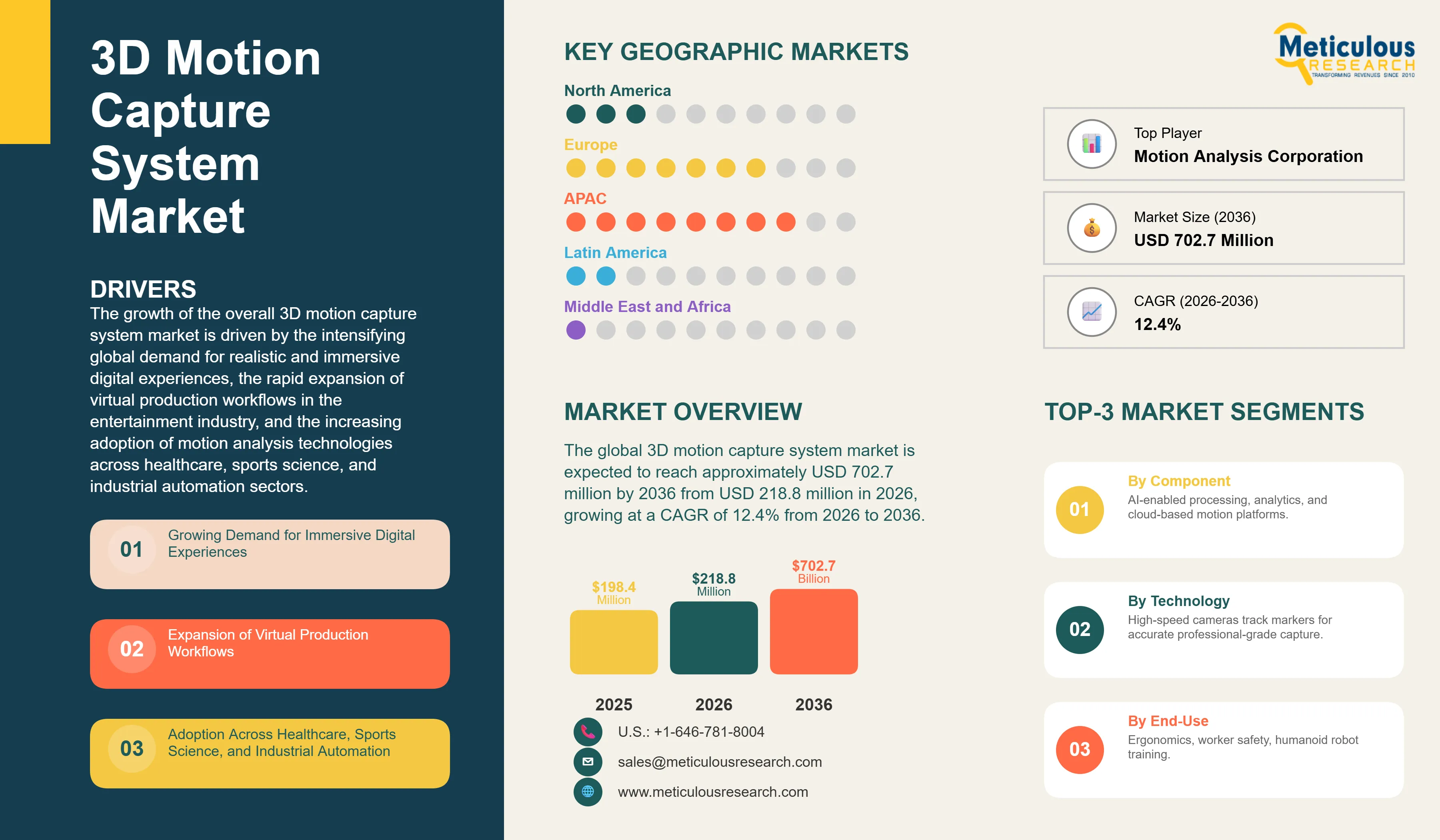

Report ID: MRSE - 1041796 Pages: 312 Feb-2026 Formats*: PDF Category: Semiconductor and Electronics Delivery: 24 to 72 Hours Download Free Sample ReportThe global 3D motion capture system market was valued at USD 198.4 million in 2025. The market is expected to reach approximately USD 702.7 million by 2036 from USD 218.8 million in 2026, growing at a CAGR of 12.4% from 2026 to 2036. The growth of the overall 3D motion capture system market is driven by the intensifying global demand for realistic and immersive digital experiences, the rapid expansion of virtual production workflows in the entertainment industry, and the increasing adoption of motion analysis technologies across healthcare, sports science, and industrial automation sectors. As studios, hospitals, research institutions, and manufacturing facilities seek to capture and interpret human and object movement with greater speed and precision, motion capture systems have become essential for enabling high-quality animation, biomechanical diagnostics, robotic training, and performance optimization. The rapid growth of artificial intelligence-enabled markerless capture solutions and cloud-based motion data platforms continues to fuel significant market expansion across all major geographic regions.

Click here to: Get Free Sample Pages of this Report

Click here to: Get Free Sample Pages of this Report

3D motion capture systems are advanced technology platforms that record the movement of people, objects, or animals and convert that movement into precise digital data, which can be applied across animation, biomechanical research, performance diagnostics, robotic training, and simulation environments. These systems work by tracking the position and orientation of markers, sensors, or reference points across a three-dimensional space using optical cameras, inertial measurement units (IMUs), electromagnetic trackers, or combinations of these technologies. The resulting motion data is processed by specialized software to generate skeletal animations, movement reports, or machine-learning training datasets, depending on the application.

The market encompasses a broad range of solutions, from professional-grade optical camera arrays used on major film and game productions to compact wireless inertial suits designed for on-location sports science and clinical gait analysis. Systems are increasingly integrated with artificial intelligence-powered analytics, real-time rendering engines, and cloud-based data management platforms that allow teams to review, process, and collaborate on motion data without being confined to a traditional studio environment. The ability to deliver high-precision, low-latency movement data across both controlled and unstructured settings has made 3D motion capture systems increasingly relevant to sectors well beyond entertainment.

The global push toward immersive digital experiences, humanoid robotics, remote healthcare delivery, and advanced sports performance analysis is reshaping demand for motion capture systems at both the premium and accessible market tiers. AI-driven markerless capture technologies are lowering the barrier to entry by eliminating the need for time-consuming marker setups and dedicated capture volumes, enabling adoption by smaller studios, clinics, and research groups. At the same time, continued hardware innovation in high-resolution, high-frame-rate cameras and lightweight wearable sensor suits is raising the performance ceiling for professional-grade deployments, supporting the sustained growth of this market across all major verticals and geographies.

Rise of AI-Powered Markerless Capture and Real-Time Motion Data Processing

The motion capture industry is undergoing a significant technological shift as AI-based markerless systems move from experimental to production-ready deployments across entertainment, sports, and healthcare. Unlike traditional marker-based setups that require performers to wear reflective dots or LED-equipped suits, AI-driven markerless systems extract skeletal motion data directly from standard camera feeds using computer vision and deep learning algorithms. Companies such as Move AI have introduced solutions like Move Live 2.0, which supports multi-actor capture volumes without any physical markers, while Southwest Research Institute unveiled its BEAMoCap system in 2025 to help film and gaming studios generate animation-ready 3D data from raw video footage. These developments are dramatically reducing setup time and system complexity, making high-quality motion capture more practical for independent productions, sports training facilities, and outpatient rehabilitation programs that previously could not justify the cost or infrastructure demands of traditional optical systems.

Real-time processing capabilities are equally transforming how motion data is used in live applications. Game developers, virtual production studios, and live event broadcasters are increasingly relying on sub-frame-latency motion capture pipelines that connect directly to game engines such as Unreal Engine and Unity. This real-time feedback loop enhances creative workflows, enables live virtual character performance, and supports immersive simulation environments in defense and industrial training. The combination of AI inference, edge computing, and faster data pipelines is making real-time, high-fidelity capture both more accessible and more scalable.

Expanding Adoption in Robotics Training, Industrial Ergonomics, and Healthcare Diagnostics

Beyond entertainment, 3D motion capture is gaining strong momentum in robotics and industrial automation as manufacturers work to develop more capable and adaptable machines. Motion capture systems are increasingly used to generate high-fidelity human movement datasets for training humanoid robots and collaborative robot arms. Noitom's collaboration with NVIDIA in 2024 to link motion capture outputs with NVIDIA Isaac Sim and Isaac Lab is a notable example, enabling robotics developers to use human motion data to train and simulate robotic behaviors in virtual environments before physical deployment. As global investment in humanoid robotics accelerates through 2026 and beyond, motion capture is set to become a core data generation tool for machine learning training pipelines.

In industrial manufacturing, motion capture is being applied to ergonomics analysis, worker safety optimization, and human-robot collaboration studies. Plant operators and engineering teams use motion data to identify repetitive strain risks, refine workstation layouts, and validate safe interaction zones between human workers and robotic systems. Simultaneously, the healthcare sector is embracing motion capture for clinical gait analysis, physical rehabilitation monitoring, pre-surgical movement planning, and tele-rehabilitation programs that allow physiotherapists to assess patient progress remotely. As reimbursement frameworks for digital health tools evolve and markerless solutions reduce the need for dedicated clinical capture spaces, healthcare is emerging as one of the fastest-growing end-use verticals in this market.

|

Parameter |

Details |

|

Market Size by 2036 |

USD 702.7 Million |

|

Market Size in 2026 |

USD 218.8 Million |

|

Market Size in 2025 |

USD 198.4 Million |

|

Market Growth Rate (2026-2036) |

CAGR of 12.4% |

|

Dominating Region |

North America |

|

Fastest Growing Region |

Asia-Pacific |

|

Base Year |

2025 |

|

Forecast Period |

2026 to 2036 |

|

Segments Covered |

Component, Technology, End-use, and Region |

|

Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers: Growing Demand for Immersive Content and High-Precision Movement Analysis

A fundamental driver of the 3D motion capture system market is the sustained global growth in demand for high-realism digital content across gaming, film, virtual reality, and live entertainment. As audiences increasingly expect lifelike character animation and immersive storytelling, studios and game developers continue to invest in motion capture infrastructure to reduce the manual effort required in traditional animation and to achieve levels of physical authenticity that procedural methods alone cannot deliver. Major AAA game productions, streaming platform-driven content cycles, and the rise of virtual production techniques that blend live-action with real-time digital environments are collectively sustaining strong hardware and software procurement activity across North America, Europe, and Asia-Pacific. Alongside entertainment, the accelerating clinical use of movement diagnostics in sports medicine, neurological rehabilitation, and orthopedic assessment is pushing healthcare providers and research institutions to invest in purpose-built motion capture solutions with validated clinical workflows.

Opportunity: Humanoid Robotics Development and Digital Twin Integration

The rapid global investment in humanoid robotics and digital twin technologies is creating a compelling new demand frontier for 3D motion capture systems. Robot developers require large, high-quality datasets of natural human movement to train the machine learning models that govern locomotion, balance, object manipulation, and human-environment interaction in next-generation robots. Motion capture provides the most precise and diverse source of this training data at scale, positioning system providers to benefit substantially as investment in humanoid robotics continues to grow through 2036. Simultaneously, manufacturers and engineering firms are integrating motion data into digital twin platforms to model human workforce behavior, simulate ergonomic conditions, and optimize factory floor layouts. These applications require repeated, structured motion capture sessions that generate ongoing hardware and software revenue, offering vendors a recurring, high-value demand stream outside of the entertainment sector.

Why Does the Hardware Segment Lead the Market?

The hardware segment accounts for the largest share of the overall 3D motion capture system market in 2026. This dominance reflects the fundamental necessity of physical capture devices — including high-speed optical cameras, inertial measurement unit (IMU) suits, active and passive marker sets, and supporting infrastructure — in recording raw motion data that feeds all downstream software processing and analysis. Hardware systems from companies such as Vicon Motion Systems, OptiTrack, and Movella represent significant capital investments by studios, laboratories, sports facilities, and clinical institutions, and these platforms undergo regular refresh cycles as users seek higher frame rates, improved resolution, and expanded tracking volumes. The growing integration of AI accelerators directly into camera and sensor modules is further elevating average hardware selling prices, supporting continued revenue leadership of this segment.

The software segment is expected to register the fastest growth rate during the forecast period, driven by the shift toward subscription-based licensing models, the growing complexity of AI-enabled post-processing workflows, and the expansion of cloud-based motion data platforms that allow teams to collaborate on capture projects across multiple locations. As markerless systems reduce dependence on proprietary hardware, software differentiation is becoming an increasingly critical competitive battleground for vendors in this market.

How Does the Optical Segment Dominate?

Based on capture technology, the optical segment holds the largest share of the global 3D motion capture system market in 2026. Optical systems, which use high-speed, high-resolution cameras to track the position of reflective passive markers or active LED markers placed on a subject, have been the professional standard for film, animation, and biomechanics applications for decades. Their superior spatial accuracy, high frame rate capability, and compatibility with established animation and rendering pipelines continue to make them the system of choice for premium studio and research deployments. Recent hardware introductions, including Vicon's Valkyrie camera system with up to 26-megapixel resolution and OptiTrack's Prime and Slim 120 camera series, illustrate the continued investment by optical platform providers in raising the performance ceiling of marker-based capture.

The inertial segment is expected to witness the fastest growth during the forecast period. Inertial motion capture systems, which use lightweight IMU-based suits to track body segment orientation and movement without requiring cameras or a fixed capture volume, offer compelling portability and flexibility advantages for on-location sports science, industrial ergonomics, and location-based virtual production. Movella's Xsens MVN Animate platform and Noitom's Perception Neuron series are prominent examples of inertial systems designed to support professional-grade capture in unrestricted outdoor and industrial environments.

Why Does the Media & Entertainment Segment Lead the Market?

The media and entertainment segment commands the largest share of the global 3D motion capture system market in 2026. This leadership stems from the entertainment industry's long-established reliance on motion capture for character animation in major film productions, AAA video game development, and virtual production workflows that combine live performance with real-time digital environments. Major studios continue to invest in high-density optical camera rigs and large capture volumes to achieve the standard of physical performance fidelity expected in premium content. The rapid growth of live-service games, streaming platform original content, and real-time virtual production pipelines — driven by the widespread adoption of Unreal Engine's LED volume stage infrastructure — continues to sustain strong hardware and software spending across both Hollywood and global entertainment markets.

The healthcare and rehabilitation segment is positioned for the fastest growth through 2036, fueled by expanding clinical applications including gait disorder assessment, post-surgical rehabilitation monitoring, neurological movement analysis, and the emerging use of markerless capture platforms in tele-rehabilitation environments. As remote physiotherapy programs scale globally and clinical institutions seek validated motion analysis tools that integrate with electronic health records and diagnostic workflows, purpose-built healthcare motion capture solutions from providers such as Qualisys AB, Motion Analysis Corporation, and Noraxon USA are seeing accelerating procurement activity.

How is North America Maintaining Dominance in the Global 3D Motion Capture System Market?

North America holds the largest share of the global 3D motion capture system market in 2026. This leadership is primarily driven by the region's dense concentration of major film studios, AAA game development companies, animation houses, and visual effects firms that represent the world's highest-volume consumers of professional optical and hybrid motion capture systems. The United States alone is home to the majority of global premium content production activity, with studios in Los Angeles, Vancouver, and New York maintaining large-scale, multi-system motion capture infrastructure as a core part of their production workflows. The region also benefits from a well-developed ecosystem of motion capture service companies, middleware developers, and academic research centers that drive continuous innovation in capture methodology, software processing, and cross-platform data integration.

North America's position is further reinforced by robust demand across healthcare, defense, and sports science verticals. Clinical research hospitals and rehabilitation networks are investing in validated motion analysis platforms to support remote diagnostics and evidence-based physical therapy. The U.S. Department of Defense and allied military programs continue to use motion capture for soldier training simulation, human performance research, and the development of exoskeleton and autonomous platform technologies.

Which Factors Support Asia-Pacific's Rapid Growth?

Asia-Pacific is expected to register the fastest growth in the global 3D motion capture system market during the forecast period. China, Japan, South Korea, and India are the primary growth engines, supported by rapidly expanding gaming, animation, and digital media industries that are investing heavily in content quality and production technology. South Korea's growing e-sports and game development ecosystem, Japan's globally recognized animation and visual effects industry, and China's rapidly scaling digital entertainment market are collectively creating strong regional demand for both optical and inertial motion capture platforms. Government-backed initiatives in digital content development, robotics, and advanced manufacturing in several Asia-Pacific economies are further accelerating procurement of motion capture systems across industrial and research applications.

Which Factors Support Europe and Other Regional Markets?

Europe accounts for a significant share of the global 3D motion capture system market, supported by a strong tradition of innovation in motion capture technology, with companies such as Vicon Motion Systems Ltd. and Qualisys AB headquartered in the UK and Sweden respectively. The UK's thriving film and animation industry — anchored by studios such as Pinewood and Framestore — along with robust academic and clinical research infrastructure across Germany, France, and the Netherlands, supports consistent regional demand. Europe's leadership in sports science research and its advanced clinical healthcare systems further contribute to procurement of biomechanics-focused motion capture platforms. Government incentives for digital creative industries and the broader push toward sustainable smart manufacturing are expected to support steady market growth across the region through 2036.

Companies such as Vicon Motion Systems Ltd., NaturalPoint, Inc. (OptiTrack), and Movella Inc. (formerly Xsens Technologies B.V.) lead the global 3D motion capture system market with comprehensive hardware and software platforms serving the full range of professional capture applications. Meanwhile, players including Qualisys AB, Motion Analysis Corporation, PhaseSpace, Inc., and Northern Digital Inc. (NDI) focus on precision optical systems for clinical, biomechanical, and industrial research applications. Emerging and specialized manufacturers such as Noitom Ltd., Rokoko Electronics ApS, Move AI Ltd., Noraxon USA, Inc., Codamotion (Charnwood Dynamics Ltd.), BTS Bioengineering S.r.l., and SIMI Reality Motion Systems GmbH are strengthening the market through innovations in inertial wearable systems, AI-powered markerless capture, and integrated sports and clinical analytics platforms.

The global 3D motion capture system market is expected to grow from USD 218.8 million in 2026 to USD 702.7 million by 2036.

The global 3D motion capture system market is projected to grow at a CAGR of 12.4% from 2026 to 2036.

Hardware is expected to dominate the market in 2026 due to the essential role of cameras, IMU suits, and sensor infrastructure in enabling motion data recording. However, the software segment is projected to be the fastest-growing component segment, driven by subscription-based software licensing, the growth of AI-powered processing tools, and the adoption of cloud-based motion data platforms.

AI-based markerless capture and real-time motion processing are transforming the market by eliminating traditional setup complexity, reducing the need for dedicated studio infrastructure, and enabling high-quality motion data acquisition in uncontrolled environments. These technologies are expanding the addressable market beyond professional studios to include sports facilities, clinical settings, and industrial environments where marker-based systems are impractical.

The optical segment holds the largest share of the global 3D motion capture system market in 2026, driven by its long-standing adoption in high-end film and game production, its superior tracking accuracy, and its broad compatibility with industry-standard animation and rendering pipelines.

North America holds the largest share of the global 3D motion capture system market in 2026, primarily attributed to its high concentration of film and game studios, advanced healthcare and defense technology ecosystems, and a mature infrastructure of motion capture service and technology providers.

The leading companies include Vicon Motion Systems Ltd., NaturalPoint, Inc. (OptiTrack), Movella Inc. (Xsens), Qualisys AB, Motion Analysis Corporation, PhaseSpace, Inc., Noitom Ltd., and Rokoko Electronics ApS.

Published Date: Jan-2024

Published Date: Jul-2022

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates