Resources

About Us

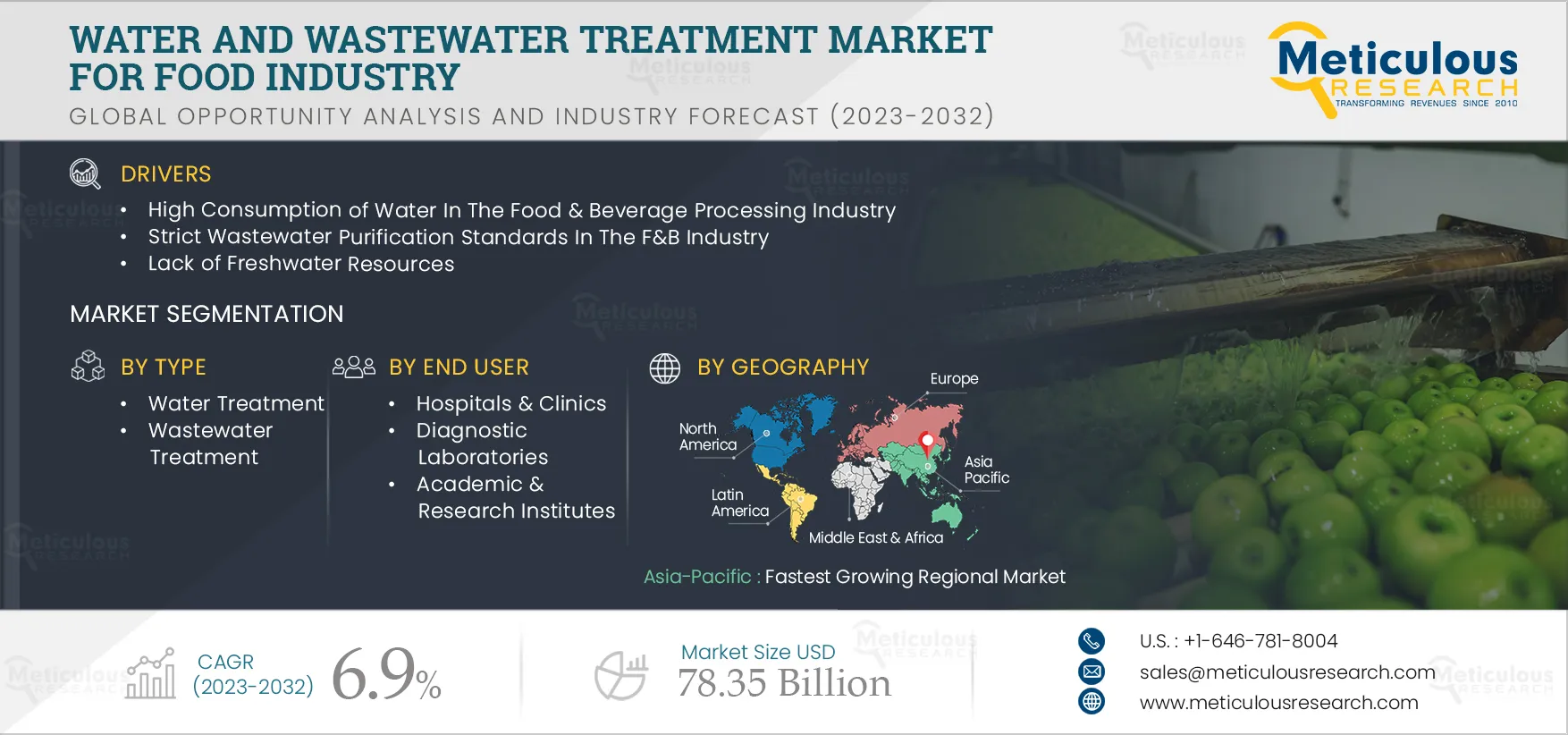

Water and Wastewater Treatment Market for Food & Beverage Industry by Type (Water Treatment, Wastewater Treatment), Offering, Cluster (Dairy, Cheese, Ice-cream, Non-alcoholic Beverages, Prepared Foods, Powdered Foods, Alcoholic Beverages), and Geography - Global Forecast to 2032

Report ID: MRCHM - 104572 Pages: 331 Feb-2023 Formats*: PDF Category: Chemicals and Materials Delivery: 2 to 4 Hours Download Free Sample ReportThe Water and Wastewater Treatment Market for Food & Beverage Industry is projected to reach $78.35 billion by 2032, at a CAGR of 6.9% during the forecast period of 2023–2032. Some of the major factors driving the growth of this market include the high consumption of water in the food & beverage industry, the high concentration of organic and inorganic substances in F&B wastewater, strict wastewater purification standards in the F&B industry, and the lack of freshwater resources. However, high installation, maintenance, and operating costs restrain the growth of this market. The growing demand for energy-efficient and advanced water treatment technologies is expected to create market growth opportunities. However, upgrading and repairing aging water infrastructure are major challenges for the players operating in this market.

The COVID-19 pandemic adversely impacted most economies around the globe. Governments imposed nationwide lockdowns to curb the spread of the infection, impacting multiple industries, including the water and wastewater treatment industry. The pandemic lowered the demand for food & beverage products as people reduced their spending due to economic uncertainty and loss of employment. Supply chain disruptions led to raw material shortages, impacting F&B production. Also, the pandemic highlighted the importance of cleanliness and hygiene in the F&B industry, increasing the demand for water and wastewater treatment technologies that ensure the safety and quality of food and beverages. The COVID-19 pandemic disrupted the water sector supply chain. Several water and wastewater treatment technologies, including membrane separation and filtration, gained traction in the F&B industry.

The COVID-19 pandemic also slowed down investments in installing new water and wastewater treatment plants in the F&B industry due to the decline in revenues. In addition, operations were also affected due to the increased risk of infection among utility staff. Operational continuity and flexibility are key to keeping essential water and sanitation services running. Hence, many governments recognized people working in the water and sewerage industry as essential workers, enabling utilities to maintain continuity of service. However, social distancing protocols meant that utilities could only retain operationally critical staff onsite. Supply chain and logistic disruptions were also observed. Although installations of water and wastewater systems were delayed due to social distancing and lockdown measures, the increased focus on health and hygiene helped sustain the demand for water and wastewater treatment technologies in the F&B industry. Overall, the COVID-19 pandemic had a mixed impact on this market.

Click here to: Get a Free Sample Copy of this report

High Consumption of Water in the Food & Beverage Processing Industry is Expected to Drive the Growth of the Market

Water is crucial in many stages of food processing, including washing and cleaning, preparation, cooking, and cooling. The food & beverage industry is one of the largest water consumers globally. Food production requires large quantities of water, leading to high levels of wastewater generation. The high water consumption in the food & beverage industry significantly impacts the environment, leading to water scarcity and pollution. Hence, there is increased regulatory pressure on the F&B industry to adopt sustainable water management practices. As a result, there is a growing demand for water treatment solutions in the F&B industry as it uses them to remove impurities, bacteria, and other contaminants from water, maintain water quality, and meet regulatory requirements.

To meet stringent regulations and maintain water quality, the food & beverage industry is turning to water and wastewater treatment technologies. These technologies provide physical, chemical, and biological methods to remove impurities, bacteria, and other contaminants from water. Common water treatment processes used in the food & beverage industry include reverse osmosis, ultrafiltration, nanofiltration membranes (NF), chlorination, and sludge management. Thus, the high water consumption in the food & beverage processing industry drives the growth of this market.

In 2023, the Wastewater Treatment Segment is Expected to Dominate the Water and Wastewater Treatment Market for Food & Beverage Industry

Based on type, the water and wastewater treatment market for food & beverage industry is segmented into o water treatment and wastewater treatment. In 2023, the wastewater treatment segment is expected to account for the largest share of the global water and wastewater treatment market for food & beverage industry. The demand for wastewater treatment in the food & beverage industry is expected to increase due to increasing industrialization & urbanization, declining freshwater resources, growing energy demand across the globe, and a rising focus on water quality and public health. Moreover, the increasing prevalence of water-borne diseases and stringent governmental regulations on treating industrial wastewater also support the growth of this market

In 2023, the Design, Engineering, & Construction Services Segment is Expected to Dominate the Water and Wastewater Treatment Market for Food & Beverage Industry

Based on offering, the global water and wastewater treatment market for the food & beverage industry is segmented into treatment technologies; treatment chemicals; process control & automation; design, engineering, & construction services; and operation & maintenance services. In 2023, the design, engineering, & construction services segment is expected to account for the largest share of the global water and wastewater treatment market for the food & beverage industry. The large market share of this segment is attributed to the growing investments in water and wastewater treatment-related infrastructure in the food & beverages industry.

Asia-Pacific to be the Fastest-growing Regional Market

Based on geography, the water and wastewater treatment market for food & beverage industry is segmented into North America, Asia-Pacific, Europe, Latin America, and the Middle East & Africa. In 2023, Asia-Pacific is expected to account for the largest share of the water and wastewater treatment market for food & beverage industry market.

Asia has 13 of the world’s 22 megacities, which is expected to reach 20 megacities by 2025 (Source: UNESCAP). Most Asian cities do not have effective wastewater treatment systems. For instance, in the Philippines, only 10% of wastewater is treated, while in Indonesia, the figure is 14%, in Vietnam, 4%, and in India, 13.5% (Source: CPCB, National Inventory of Sewage Treatment Plants, 2021). According to the Asia-Pacific Water Forum, more than 90% of people in APAC do not have water security. Water and wastewater management is a critical part of the manufacturing process for food and beverage. Therefore, the growing concerns over water purity and increasing awareness regarding the benefits of water treatment in the F&B industry are expected to accelerate the adoption of advanced water treatment systems in Asia-Pacific during the forecast period.

Key Players:

The key players operating in the water and wastewater treatment market for food & beverage industry are Suez Environnement S.A. (France), Veolia Environnement SA. (France), Xylem, Inc. (U.S.), DuPont de Nemours, Inc. (U.S.), 3M Company, Inc. (U.S.), Pentair plc (U.K.), United Utilities Group PLC (U.K.), Kingspan Group Plc (U.K.), The Dow Chemical Company (U.S.), BASF SE (Germany), Kurita Water Industries Ltd. (Japan), Bio-Microbics, Inc. (U.S.), Calgon Carbon Corporation (U.S.), Trojan Technologies Inc. (Canada), Kemira Oyj (Finland), Thermax Limited (India), Wog Technologies (India), Golder Associates, Inc. (Canada), SWA Water Technologies PTY LTD. (Australia), Burns & McDonnell (U.S.), Adroit Associates Private Limited (India), Sauber Environmental Solutions Pvt. Ltd. (India), SPEC Limited (India), Ecolab, Inc. (U.S.), GFL Environmental Inc. (U.S.), and Clean TeQ Water Limited (Australia).

Scope of the report:

Water and Wastewater Treatment Market for Food & Beverage Industry, by Type

Water and Wastewater Treatment Market for Food & Beverage Industry, by Offering

Water and Wastewater Treatment Market for Food & Beverage Industry, by Cluster

Water and Wastewater Treatment Market for Food & Beverage Industry, by Geography

Key questions answered in the report:

The global water and wastewater treatment market for food & beverage industry is projected to reach $78.35 billion by 2032 at a CAGR of 6.9% during the forecast period.

The growth of this market is mainly driven by the factors such as the high consumption of water in the food & beverage industry, the high concentration of organic and inorganic substances in F&B wastewater, strict wastewater purification standards in the F&B industry, and the lack of freshwater resources.

The key players operating in the water and wastewater treatment market for food & beverage industry are Suez Environnement S.A. (France), Veolia Environnement SA. (France), Xylem, Inc. (U.S.), DuPont de Nemours, Inc. (U.S.), 3M Company, Inc. (U.S.), Pentair plc (U.K.), United Utilities Group PLC (U.K.), Kingspan Group Plc (U.K.), The Dow Chemical Company (U.S.), BASF SE (Germany), Kurita Water Industries Ltd. (Japan), Bio-Microbics, Inc. (U.S.), Calgon Carbon Corporation (U.S.), Trojan Technologies Inc. (Canada), Kemira Oyj (Finland), Thermax Limited (India), Wog Technologies (India), Golder Associates, Inc. (Canada), SWA Water Technologies PTY LTD. (Australia), Burns & McDonnell (U.S.), Adroit Associates Private Limited (India), Sauber Environmental Solutions Pvt. Ltd. (India), SPEC Limited (India), Ecolab, Inc. (U.S.), GFL Environmental Inc. (U.S.), and Clean TeQ Water Limited (Australia).

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates