Resources

About Us

Industrial Wastewater Treatment Market by Offering (Treatment Technologies, Treatment Chemicals, Process Control & Automation, Design, Engineering, and Construction Services, Operation & Maintenance services), End User, and Geography - Global Forecast to 2031

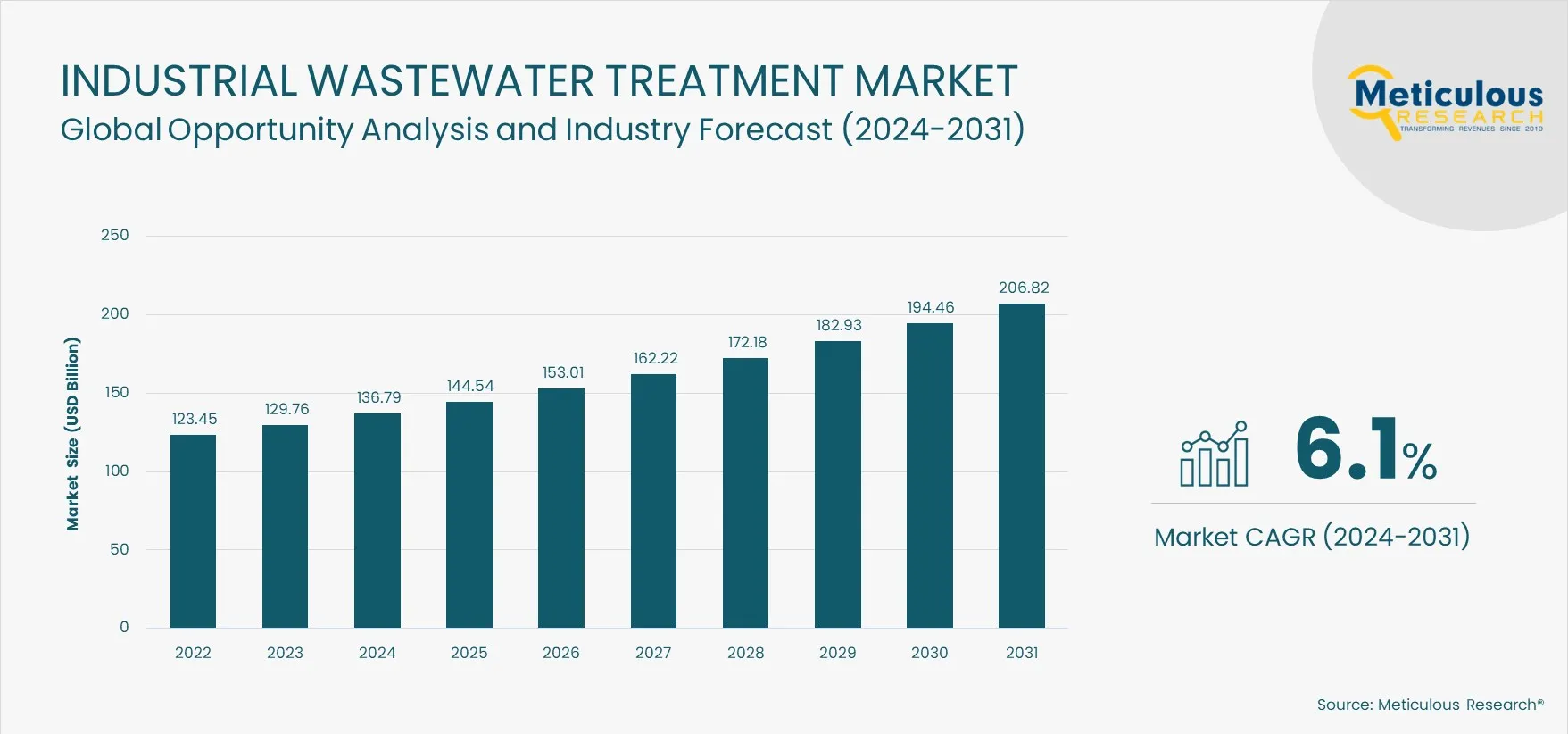

Report ID: MRCHM - 104476 Pages: 384 Feb-2024 Formats*: PDF Category: Chemicals and Materials Delivery: 2 to 4 Hours Download Free Sample ReportThe Industrial Wastewater Treatment Market is expected to reach $206.81 billion by 2031, at a CAGR of 6.1% from 2024 to 2031. The growth of the global industrial wastewater treatment market is driven by factors such as lack of freshwater resources, government encouragement and the growing emphasis on corporate social responsibility, and the need for critical resource recovery from wastewater. However, the high installation, maintenance, and operating costs of wastewater treatment infrastructure may restrain the growth of this market.

Furthermore, the growing demand for energy-efficient and advanced wastewater treatment technologies and the generation of green hydrogen from industrial wastewater are expected to provide growth opportunities for the players operating in this market. However, high energy consumption and expenditure due to excess sludge production pose a major challenge impacting market growth.

Water and energy have always been crucial for social and economic growth; their supply and use must be sustainable. Water provision and use require energy in all phases. Water gets treated to drinking water through various processes, including filtration, sedimentation, and disinfection, which require energy. According to Festo Didactic, a global provider of equipment and solutions for technical education, water and wastewater treatment plants are energy-intensive and account for up to 35% of municipal energy consumption. Pumps and aeration in water and wastewater treatment plants consume significant energy, which calls for attention.

Proper maintenance and operation help ensure the nameplate efficiencies of motors, pumps, and overall pump systems. Pump optimization with SCADA systems or pump optimization software is a secondary consideration. Furthermore, supplying energy-efficient ballasts for plant fluorescent fixtures and ultraviolet disinfection or pretreatment systems can reduce energy consumption. The growing need for advanced and energy-efficient wastewater treatment technologies is expected to encourage market players to develop innovative offerings and augment their market shares.

Based on offering, the global industrial wastewater treatment market is segmented into operation & maintenance services, process control & automation, design, engineering, and construction services, treatment technologies, and treatment chemicals. The process control & automation segment is expected to grow at the highest CAGR during the forecast period. The growth of this segment is attributed to the rising technological complexities in industrial wastewater treatment facilities, the increasing need for operational automation, the rising number of investments in process control systems, and the companies’ growing focus on achieving cost & energy-saving targets.

Based on end user, the global industrial wastewater treatment market is segmented into power generation, semiconductor manufacturing, data centers, green hydrogen generation, chemical manufacturing, refining & petrochemicals, oil & gas, pulp & paper, food & beverage, pharmaceutical manufacturing, industrial manufacturing, and other end users. The food & beverage segment is expected to register the highest CAGR during the forecast period. The food & beverage industry is one of the major contributors to economic growth globally. Food production is expected to intensify in the coming years due to the global population explosion. The food industry requires large volumes of water for production and cleaning. As a result, the industry typically generates a tremendous amount of wastewater with relatively high concentrations of total suspended solids (TSS) and is a major source of environmental pollution. Food & beverage companies are adopting industrial wastewater treatment techniques, including proper screening of waste streams to increase discharge dryness, resulting in lower hauling and waste disposal costs.

Click here to: Get Free Sample Pages of this Report

Based on geography, the global industrial wastewater treatment market is segmented into Asia–Pacific, Europe, North America, Latin America, and Middle East & Africa. Asia-Pacific is expected to become the fastest-growing region in the global industrial wastewater treatment market by 2031. The market in Asia-Pacific is experiencing growth due to the increasing demand for sustainable and advanced solutions in response to significant water stress and environmental pollution. The dairy and beverage sector, particularly in China and India, is generating substantial investment opportunities in the region, driving the demand for industrial wastewater treatment solutions.

The market growth in Asia-Pacific is further propelled by the rapid industrial expansion in developing countries, including South Korea, Indonesia, and Vietnam. China and India are poised to take the lead in adopting membrane filtration technology for wastewater treatment in the industrial sector. Some of the factors contributing to the rising demand for industrial wastewater treatment in the region are as follows:

The key players operating in the global industrial wastewater treatment market are Xylem Inc. (U.S.), SUEZ S.A. (France), Pentair plc (U.K.), Dow Inc. (U.S.), Veolia Environnement S.A. (France), BASF SE (Germany), PPU Umwelttechnik GmbH (Germany), DuPont de Nemours, Inc. (U.S.), Bio-Microbics (U.S.), Thermax Limited (India), Ecolab Inc. (U.S.), Kurita Water Industries, Ltd. (Japan), Kemira Oyj (Finland), GFL Environmental (Canada), 3M Company (U.S.), Kingspan Group plc (U.K.), Calgon Carbon Corporation (U.S.), Trojan Technologies (Canada), Clean TeQ Water Limited (Australia), SWA Water Australia Pty Limited (Australia), Adroit Associates Private Limited (India), Sauber Environmental Solutions (India), SEPC Limited (India), Golder Associates Inc. (Canada), Burns & McDonnell (U.S.), and WOG Technologies (India).

|

Particular |

Details |

|

Number of Pages |

384 |

|

Format |

|

|

Forecast Period |

2024–2031 |

|

Base Year |

2023 |

|

CAGR (Value) |

6.1% |

|

Estimated Market Size (Value) |

$206.81 billion by 2031 |

|

Segments Covered |

By Offering

By End User

By Geography

|

|

Countries Covered |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy, Spain, Poland, Belgium, Switzerland, Denmark, Sweden, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Indonesia, Australia, Malaysia, Thailand, Vietnam, Philippines, Singapore, New Zealand, Taiwan, and Rest of Asia-Pacific), Latin America (Brazil, Mexico, Chile, Argentina, Rest of Latin America), and Middle East & Africa (Saudi Arabia, UAE, Kuwait, South Africa, Iran, Rest of Middle East & Africa) |

|

Key Companies |

Xylem Inc. (U.S.), SUEZ S.A. (France), Pentair plc (U.K.), Dow Inc. (U.S.), Veolia Environnement S.A. (France), BASF SE (Germany), PPU Umwelttechnik GmbH (Germany), DuPont de Nemours, Inc. (U.S.), Bio-Microbics (U.S.), Thermax Limited (India), Ecolab Inc. (U.S.), Kurita Water Industries, Ltd. (Japan), Kemira Oyj (Finland), GFL Environmental (Canada), 3M Company (U.S.), Kingspan Group plc (U.K.), Calgon Carbon Corporation (U.S.), Trojan Technologies (Canada), Clean TeQ Water Limited (Australia), SWA Water Australia Pty Limited (Australia), Adroit Associates Private Limited (India), Sauber Environmental Solutions (India), SEPC Limited (India), Golder Associates Inc. (Canada), Burns & McDonnell (U.S.), and WOG Technologies (India) |

The global industrial wastewater treatment market is segmented based on offering, end user, and geography. The study also evaluates industry competitors and analyses the country-level markets.

The global industrial wastewater treatment market is projected to reach $206.81 billion by 2031, at a CAGR of 6.1% from 2024 to 2031.

Based on offering, in 2024, the operation & maintenance services segment is expected to account for the largest share of the global industrial wastewater treatment market.

Based on end user, in 2024, the food & beverage segment is expected to account for the largest share of the global industrial wastewater treatment market.

The growth of the global industrial wastewater treatment market is driven by factors such as lack of freshwater resources, government encouragement and the growing emphasis on corporate social responsibility, and the need for critical resource recovery from wastewater. However, the high installation, maintenance, and operating costs of wastewater treatment infrastructure restrain the growth of this market.

Furthermore, the growing demand for energy-efficient and advanced wastewater treatment technologies and the generation of green hydrogen from industrial wastewater are expected to provide growth opportunities for the players operating in this market. However, high energy consumption and expenditure due to excess sludge production pose a major challenge impacting market growth.

The key players operating in the global industrial wastewater treatment market are Xylem Inc. (U.S.), SUEZ S.A. (France), Pentair plc (U.K.), Dow Inc. (U.S.), Veolia Environnement S.A. (France), BASF SE (Germany), PPU Umwelttechnik GmbH (Germany), DuPont de Nemours, Inc. (U.S.), Bio-Microbics (U.S.), Thermax Limited (India), Ecolab Inc. (U.S.), Kurita Water Industries, Ltd. (Japan), Kemira Oyj (Finland), GFL Environmental (Canada), 3M Company (U.S.), Kingspan Group plc (U.K.), Calgon Carbon Corporation (U.S.), Trojan Technologies (Canada), Clean TeQ Water Limited (Australia), SWA Water Australia Pty Limited (Australia), Adroit Associates Private Limited (India), Sauber Environmental Solutions (India), SEPC Limited (India), Golder Associates Inc. (Canada), Burns & McDonnell (U.S.), and WOG Technologies (India).

Asia-Pacific is expected to become the fastest-growing region in the global industrial wastewater treatment market by 2031. The fast growth of this region is attributed to the rising demand for sustainable and advanced solutions due to significant water stress and environmental pollution. The key food & beverage sectors creating the highest investment opportunities in the region include dairy and beverages, especially in China and India.

Published Date: Jun-2024

Published Date: May-2024

Published Date: Nov-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates