Resources

About Us

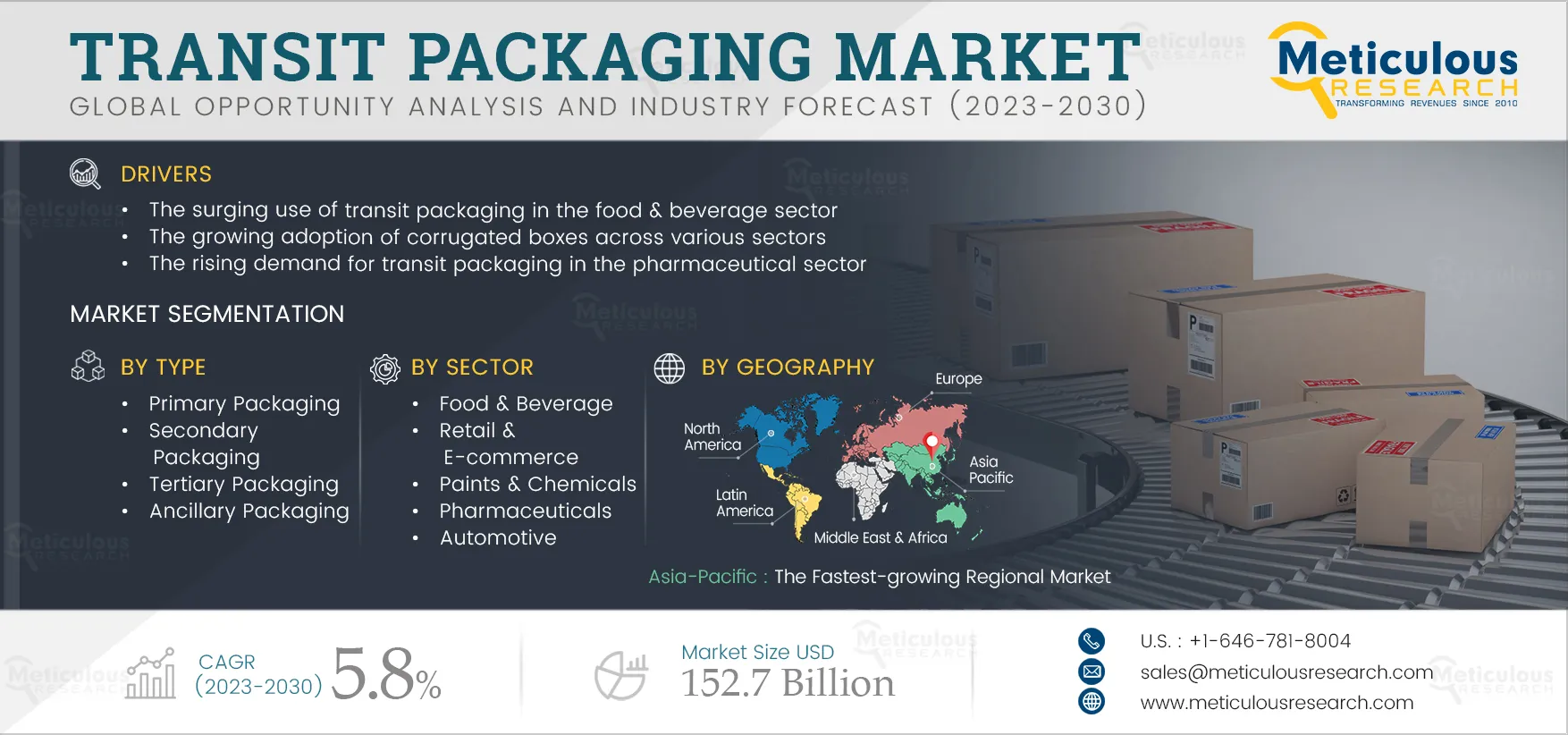

Transit Packaging Market by Type (Primary Packaging, Secondary Packaging, Tertiary Packaging, Ancillary Packaging), Sector (Food & Beverage, Pharmaceuticals, Retail & E-Commerce), and Geography - Global Forecast to 2030

Report ID: MRICT - 104795 Pages: 268 Apr-2023 Formats*: PDF Category: Information and Communications Technology Delivery: 2 to 4 Hours Download Free Sample ReportThe Transit Packaging Market is Expected to reach $152.7 billion by 2030, at a CAGR of 5.8% from 2023–2030. The growth of the transit packaging market is driven by the surging use of transit packaging in the food & beverage sector, the growing adoption of corrugated boxes across various sectors, the rising demand for transit packaging in the pharmaceutical sector, and the rapidly growing e-commerce sector. However, the increasing overall packaging costs due to dynamic regulatory policies may restrain the market’s growth.

The growing demand for eco-friendly packaging solutions and customized packaging is expected to create market growth opportunities. However, additional distribution channel costs are a major challenge for the players operating in this market. The internet of packaging and digital printing are the latest trends in the transit packaging market.

Click here to: Get a Free Sample Copy of this report

Rapid Growth in E-Commerce to Drive the Transit Packaging Market

The e-commerce sector has become extremely competitive due to rising technological advancements and growth in online retailing. The rapid growth in e-commerce sales and distribution channels is revolutionizing the retail marketplace. Leading e-commerce giants, such as Amazon.com, Inc. (U.S.) and Walmart. Inc. (U.S.) have attracted large customer bases due to the benefits of online shopping. E-commerce provides customers with a large variety of options to buy from and also the convenience of buying from their homes. These benefits are encouraging more and more people to shop online, making the e-commerce industry the fastest-growing industry across the globe. For instance, according to Alibaba Group Holding Limited (China), the global e-commerce market was valued at $16.6 trillion in 2022, and the industry is expected to grow significantly in the coming years at a CAGR of 27.43%. Also, according to data published by Kinsta, Inc. (U.S.), it is estimated that almost 90% of all purchases will be done through online portals by 2040. Thus, the consistent growth in e-commerce has boosted the demand for transit packaging, driving the transit packaging market.

E-commerce companies and platforms are exploring the potential of transit packaging beyond its basic function of protecting products during transit. With the growing popularity of e-commerce, companies in the industry are exploring new avenues to provide consumers with a seamless and memorable unboxing experience, which was earlier limited to only luxury and physical stores. This has boosted the significance and demand for better transit packaging in the e-commerce sector. Transit packaging solutions provide containment and protection to goods during handling, storage, and transportation.

TABLE 1 LIST OF THE TOP 10 LARGEST E-COMMERCE MARKETS IN THE WORLD AND THEIR KEY SPENDING AREAS (2022)

|

Country |

Revenue |

Fashion & Apparel |

Books/Music/Stationery |

Consumer Electronics |

Beauty & Personal Care |

Household Products |

Packaged Groceries |

Fresh Groceries |

||

|

China |

USD 672 Bn |

68% |

- |

- |

52% |

45% |

47% |

22% |

||

|

U.S. |

USD 340 Bn |

- |

64% |

- |

- |

- |

- |

- |

||

|

U.K. |

USD 99 Bn |

67% |

66% |

48% |

- |

37% |

37% |

37% |

||

|

Japan |

USD 79 Bn |

- |

79% |

- |

- |

33% |

33% |

23% |

||

|

Germany |

USD 73 Bn |

76% |

75% |

52% |

47% |

- |

21% |

- |

||

|

France |

USD 43 Bn |

- |

64% |

- |

- |

- |

- |

- |

||

|

South Korea |

USD 37 Bn |

77% |

72% |

- |

65% |

52% |

51% |

37% |

||

|

Canada |

USD 30 Bn |

- |

- |

- |

- |

- |

- |

- |

||

|

Russia |

USD 20 Bn |

- |

- |

50% |

- |

- |

- |

- |

||

|

Brazil |

USD 19 Bn |

- |

- |

57% |

- |

- |

- |

- |

||

Key Findings in the Global Transit Packaging Market Study:

In 2023, the Primary Packaging Segment is Expected to Account for the Largest Share of 37.9% of the Global Transit Packaging Market

Based on type, the global transit packaging market is segmented into primary packaging, secondary packaging, tertiary packaging, and ancillary packaging. In 2023, the primary packaging segment is expected to account for the largest share of 37.9% of the global transit packaging market. The large market share of this segment is attributed to the rising demand to protect and preserve the finished products, the growing e-commerce sector, and the rising demand for primary packaging in the food & beverage and pharmaceutical sectors. In addition, the benefits offered by primary packaging, such as convenience, easy handling, proper display, safety, and stacking, further boost the growth of this segment.

In 2023, the Food & Beverage Segment is Expected to Account for the Largest Share of 18.9% of the Global Transit Packaging Market

Based on sector, the global transit packaging market is segmented into food & beverage, retail & e-commerce, paints & chemicals, building & construction, pharmaceuticals, electrical & electronics, automotive, industrial machinery & equipment, and other sectors. In 2023, the food & beverage segment is expected to account for the largest share of 18.9% of the global transit packaging market. The large market share of this segment is attributed to the rising demand for convenient and sustainable packaging solutions, the increasing demand for shelf-life extension of foods, the growth of the packaged food industry in emerging economies, and the increasing demand for hygienic food packaging.

Asia-Pacific to be the Fastest-growing Regional Market

Based on geography, the global transit packaging market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific is projected to register the highest CAGR of 6.5% during the forecast period. The large share and high growth of this regional segment can be attributed to the presence of prominent players offering advanced transit packaging solutions across different sectors in the region. In addition, the surging usage of transit packaging in the food and beverage sector, growing demand for eco-friendly packaging solutions, supportive government initiatives, and growing adoption of contact packaging in the pharmaceutical sector are anticipated to propel the demand for transit packaging over the forecast period.

Key Growth Strategies

Product launches were the most preferred key growth strategies adopted by leading market players, accounting for a share of 40.0% of the total strategic developments by leading market players between 2020 and 2023. These strategies enabled companies to strengthen their product portfolios and expand their geographic reach in the transit packaging market. WestRock Company (U.S.), Sonoco Products Company (U.S.), DS Smith Plc (U.K.), Nefab Group AB (Sweden), and Corplex (France).

Partnerships, agreements, and collaborations accounted for a share of 33.3% of the total strategic developments by leading market players between 2020 and 2023. These strategies help companies broaden their product portfolios, advance the capabilities of their existing products, cater to users' changing demands, and ensure a competitive edge in the global transit packaging market. The leading players that followed these strategies were WestRock Company (U.S.), Sonoco Products Company (U.S.), Mondi Group plc (U.K.), and DS Smith Plc (U.K.).

Acquisitions accounted for a share of 20.0% of the total strategic developments by leading market players between 2020 and 2023. Smurfit Kappa Group plc (Ireland) and Nefab Group AB (Sweden) were the leading players that focused on acquisitions.

Expansions accounted for a share of 6.7% of the total strategic developments by leading market players between 2020 and 2023. The leading player that adopted this strategy was Mondi Group plc (U.K.).

Key Players

The report includes a competitive landscape based on an extensive assessment of the key growth strategies adopted by leading market participants in the last 3–4 years. The key players operating in the transit packaging market are WestRock Company (U.S.), International Paper (U.S.) Greif, Inc. (U.S.), Sonoco Products Company (U.S.), Mondi Group plc (U.K.), Smurfit Kappa Group plc (Ireland), DS Smith Plc (U.K.), Packaging Corporation of America (U.S.), Crown Holdings, Inc. (U.S.), Nefab Group AB (Sweden), Corplex (France), Smithpack Limited (U.K.), STI-Gustav Stabernack GmbH (Germany), GWP Group (U.K.), and Eltete TPM Ltd (Finland).

Report Summary:

|

Particular |

Details |

|

Number of Pages |

268 |

|

Format |

|

|

Forecast Period |

2023–2030 |

|

Base Year |

2022 |

|

CAGR (Value) |

5.8% |

|

Estimated Market Size (Value) |

$152.7 billion by 2030 |

|

Segments Covered |

By Type

By Sector

By Geography

|

Key questions answered in the report

The transit packaging market is projected to reach $152.7 billion by 2030, at a CAGR of 5.8% during the forecast period.

In 2023, the food & beverage segment is estimated to account for the largest share of the transit packaging market. The large market share of this segment is attributed to the rising demand for convenient and sustainable packaging solutions, the growth of the packaged food industry in emerging economies, and the increasing need to extend the shelf-life of food & beverage products.

The growth of the transit packaging market is driven by the surging use of transit packaging in the food & beverage sector, the growing adoption of corrugated boxes across various sectors, the rising demand for transit packaging in the pharmaceuticals sector, and the rapidly growing e-commerce sector. Furthermore, the growing need for eco-friendly packaging solutions and the rising demand for customized packaging are expected to offer significant growth opportunities for the players in this market.

The key players operating in the transit packaging market include WestRock Company (U.S.), International Paper (U.S.) Greif, Inc. (U.S.), Sonoco Products Company (U.S.), Mondi Group plc (U.K.), Smurfit Kappa Group plc (Ireland), DS Smith Plc (U.K.), Packaging Corporation of America (U.S.), Crown Holdings, Inc. (U.S.), Nefab Group AB (Sweden), Corplex (France), Smithpack Limited (U.K.), STI-Gustav Stabernack GmbH (Germany), GWP Group (U.K.), and Eltete TPM Ltd (Finland).

At present, Asia-Pacific dominates the transit packaging market. However, Germany, Japan, China, India, South Korea, and the U.K. are expected to witness strong growth in demand for transit packaging in the coming years.

Published Date: Jan-2024

Please enter your corporate email id here to view sample report.

Subscribe to get the latest industry updates